CPI for May was ugly, up 8.6% from a year ago. There is no good in this, save that it wasn’t even uglier. The typical family must spend about $450 per month more to buy the same goods and services they did a year ago. They make about $70k a year. Ugh!

Primarily behind last month’s painfully high inflation is another spike in oil and gas prices. This goes to Europe’s decision to sanction Russian oil, which has left a hole in global oil supplies. While a laudable rebuke of Russia, it is a significant hit to the global economy.

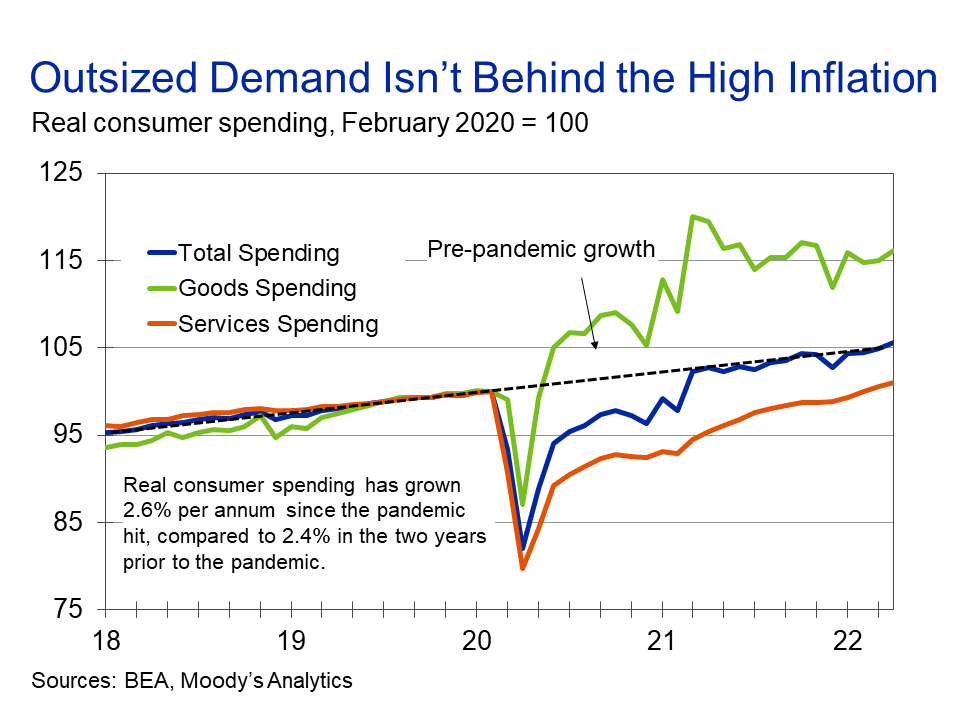

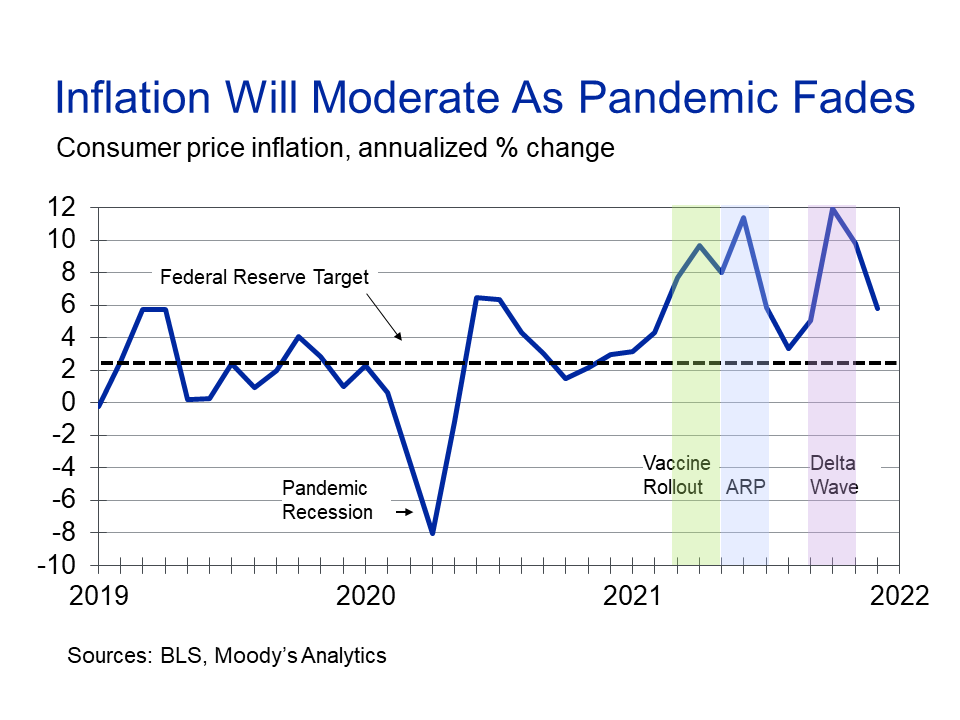

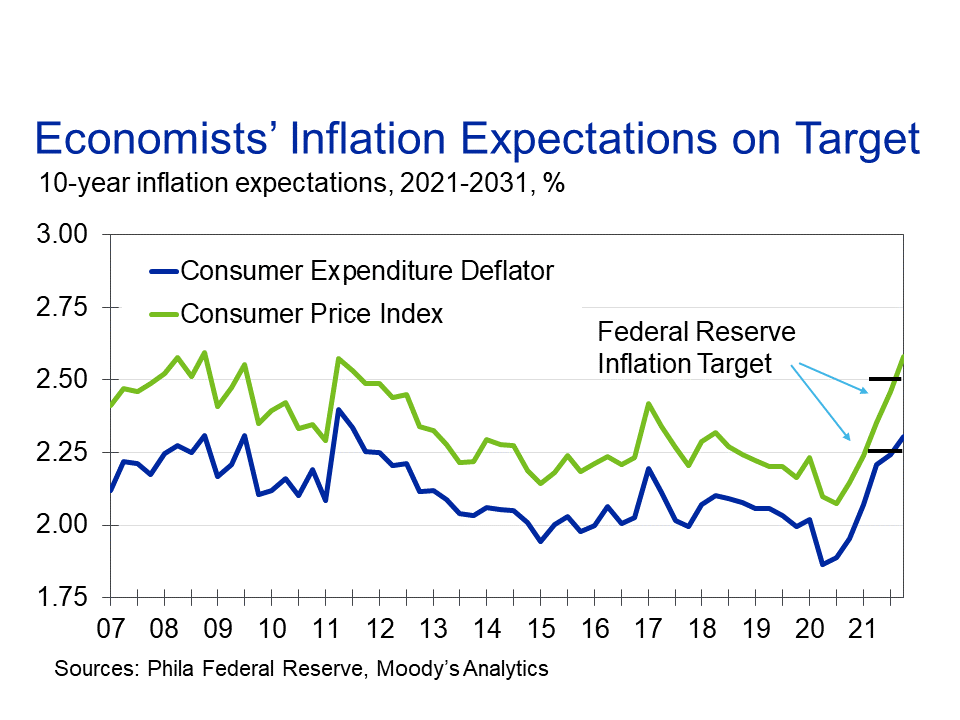

But there are reasons to think that once oil prices simply settle, even at these lofty prices, inflation will recede. Supply chain stresses are easing, inventories of goods are building, workers are getting back on the job, and inflation expectations are back down.

I suspect we are just a few months away from some #CPI reports that are much easier on the eyes and pocketbook.

• • •

Missing some Tweet in this thread? You can try to

force a refresh