Seeing a lot of misconceptions and confusion around $stETH (@LidoFinance liquid staked Ether)

Thought I’d write a short thread on my perspective

Thought I’d write a short thread on my perspective

$stETH is a fully collateralized representation of $ETH staked on the Ethereum PoS beacon chain

1 $stETH = 1 staked $ETH

When withdraws are enabled on beacon chain, 1 $stETH can be redeemed for 1 ETH

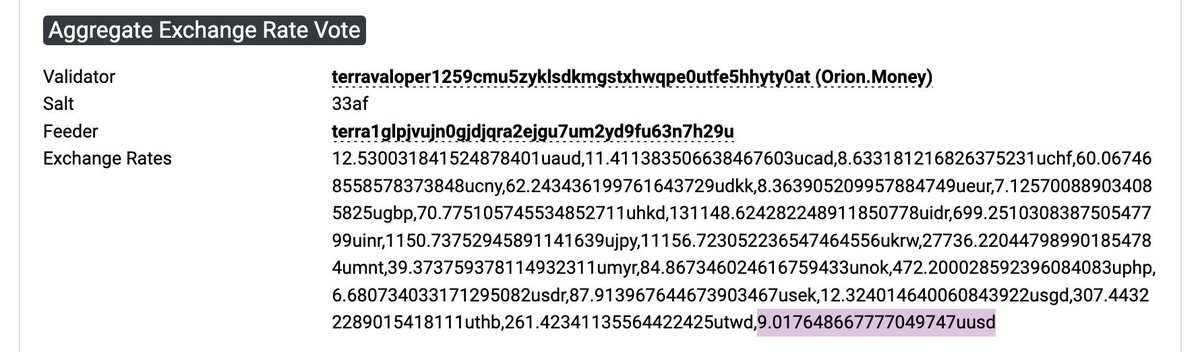

Any comparisons to an undercollateralized stablecoin like $UST are misguided

1 $stETH = 1 staked $ETH

When withdraws are enabled on beacon chain, 1 $stETH can be redeemed for 1 ETH

Any comparisons to an undercollateralized stablecoin like $UST are misguided

I think any comparisons of $stETH to $GBTC are misguided as well

$stETH is an ERC20 token that has utility within a growing DeFi ecosystem

It also have a native yield attached which you cannot get by having liquid $ETH alone

There are many who will take the carry risk

$stETH is an ERC20 token that has utility within a growing DeFi ecosystem

It also have a native yield attached which you cannot get by having liquid $ETH alone

There are many who will take the carry risk

$stETH doesn’t have a target peg, it continues to be collateralized regardless of what the secondary market values it at

Being able to exchange your $stETH on the secondary market for $ETH is simply for convenience, but you’ll get what the market values it at

Being able to exchange your $stETH on the secondary market for $ETH is simply for convenience, but you’ll get what the market values it at

Generally $stETH won’t trade at a value above 1 ETH as long as deposits is uncapped

This is because of arbitrage

If $stETH trades at 1.05 ETH

I can deposit 1 $ETH to Lido, get 1 $stETH, sell it on a secondary market for 1.05 $ETH, profit 0.05 $ETH and push price of $stETH down

This is because of arbitrage

If $stETH trades at 1.05 ETH

I can deposit 1 $ETH to Lido, get 1 $stETH, sell it on a secondary market for 1.05 $ETH, profit 0.05 $ETH and push price of $stETH down

Currently this arbitrage only works one direction

$stETH can’t be redeemed *yet* but once it can, reverse arbitrage is simple

If $stETH trades at 0.95 ETH, I can buy 1 $stETH for 0.95 $ETH, then redeem it for 1 $ETH, for a profit of 0.05 $ETH and pushing the price of $stETH up

$stETH can’t be redeemed *yet* but once it can, reverse arbitrage is simple

If $stETH trades at 0.95 ETH, I can buy 1 $stETH for 0.95 $ETH, then redeem it for 1 $ETH, for a profit of 0.05 $ETH and pushing the price of $stETH up

Important to note that withdraws of $ETH from the beacon chain will not be enabled once the merge happens

It will be the first hard fork 6-12 months after the merge

Hence, $stETH may not be redeemable for a while

Also there is a withdraw queue on the beacon chain

It will be the first hard fork 6-12 months after the merge

Hence, $stETH may not be redeemable for a while

Also there is a withdraw queue on the beacon chain

There’s various reasons $stETH may temporarily trade above/below its collateral value

- Liquidity premium

- SC bug risk discount

- Beacon chain risk discount

- Forced sellers from leverage

etc etc

- Liquidity premium

- SC bug risk discount

- Beacon chain risk discount

- Forced sellers from leverage

etc etc

That last one is what most of the current fud around $stETH is coming from

$stETH is an ERC20 which can be used in the DeFi ecosystem as collateral

People have deposited $stETH as collateral on Aave, borrowed $ETH, deposited into Lido for $stETH, and repeat

$stETH is an ERC20 which can be used in the DeFi ecosystem as collateral

People have deposited $stETH as collateral on Aave, borrowed $ETH, deposited into Lido for $stETH, and repeat

Thus if people continue to sell $stETH on the secondary market, there may be a liquidation cascade from these leveraged positions being flushed out

Larger market makers/manipulators have already exited, but some still remain

Larger market makers/manipulators have already exited, but some still remain

Celsius may or may not be running into liquidity issues, but they hold a significant amount of $stETH which is being used as collateral to borrow stablecoins

If sold, this would definitely cause stETH’s secondary market value to decrease, at least temporarily

If sold, this would definitely cause stETH’s secondary market value to decrease, at least temporarily

The flip side to all of this, is that regardless of how the secondary market values $stETH

$stETH is still backed 1:1 by staked $ETH

Depending on your time preference and risk tolerance, buying $stETH below its treasury value is boosted yield

$stETH is still backed 1:1 by staked $ETH

Depending on your time preference and risk tolerance, buying $stETH below its treasury value is boosted yield

If 1 $stETH is trading at a value of 0.70 $ETH (30% discount) and Ethereum staking yield remains 4% APR

Then in two years, your aggregate yield will have been 38% APR, rather than 8% as a normal staker

(Ethereum staking doesn’t auto-compound yield)

Then in two years, your aggregate yield will have been 38% APR, rather than 8% as a normal staker

(Ethereum staking doesn’t auto-compound yield)

Is that worth two yield of illiquidity and Lido risk exposure?

Not for everyone, but definitely for some

So while a liquidation cascade won’t be pretty, and secondary market price for $stETH probably won’t be 1:1 $ETH for a while

It’s no death spiral situation

Not for everyone, but definitely for some

So while a liquidation cascade won’t be pretty, and secondary market price for $stETH probably won’t be 1:1 $ETH for a while

It’s no death spiral situation

I think after the event passes, $stETH will probably trade at a discount to its collateral value

3-5% seems likely but it depends largely on market sentiment

Regardless, the beacon chain will keep working, so will DeFi, and so will Lido for that matter as well

3-5% seems likely but it depends largely on market sentiment

Regardless, the beacon chain will keep working, so will DeFi, and so will Lido for that matter as well

This is a decent thread on the situation, but read it with the above context in mind

https://twitter.com/crypto_joe10/status/1535291197119352832

Like and retweet the first tweet in this thread if you found it insightful and so the twitter algo gods provide their blessing

https://twitter.com/chainlinkgod/status/1535486859219902464

• • •

Missing some Tweet in this thread? You can try to

force a refresh