#tradingtips Here’s my simple way of picking which stock to trade

This will help get you out of the “chop” and on the winning side of the move!

Let’s take a look at todays price action and show you how we nailed this amazing trade to start the week👇

$spy $qqq $iwm $nvda $amd

This will help get you out of the “chop” and on the winning side of the move!

Let’s take a look at todays price action and show you how we nailed this amazing trade to start the week👇

$spy $qqq $iwm $nvda $amd

I start with 4-8 familiar names.

Stay patient! watch for a decent trend to present itself. Without a trend there is no pullback/dip buy, so relax and wait for it. There’s no rush

Entering before a trend has formed means you are predicting price action rather than playing off it

Stay patient! watch for a decent trend to present itself. Without a trend there is no pullback/dip buy, so relax and wait for it. There’s no rush

Entering before a trend has formed means you are predicting price action rather than playing off it

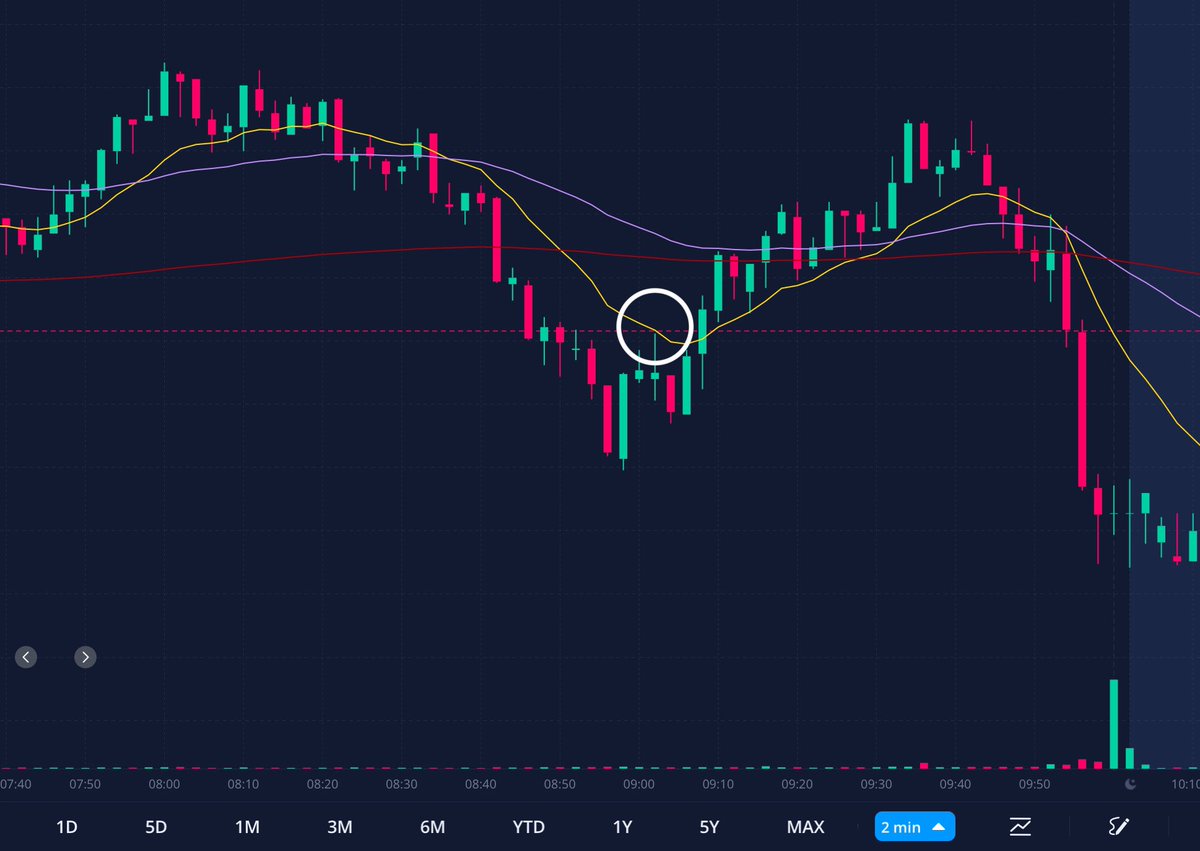

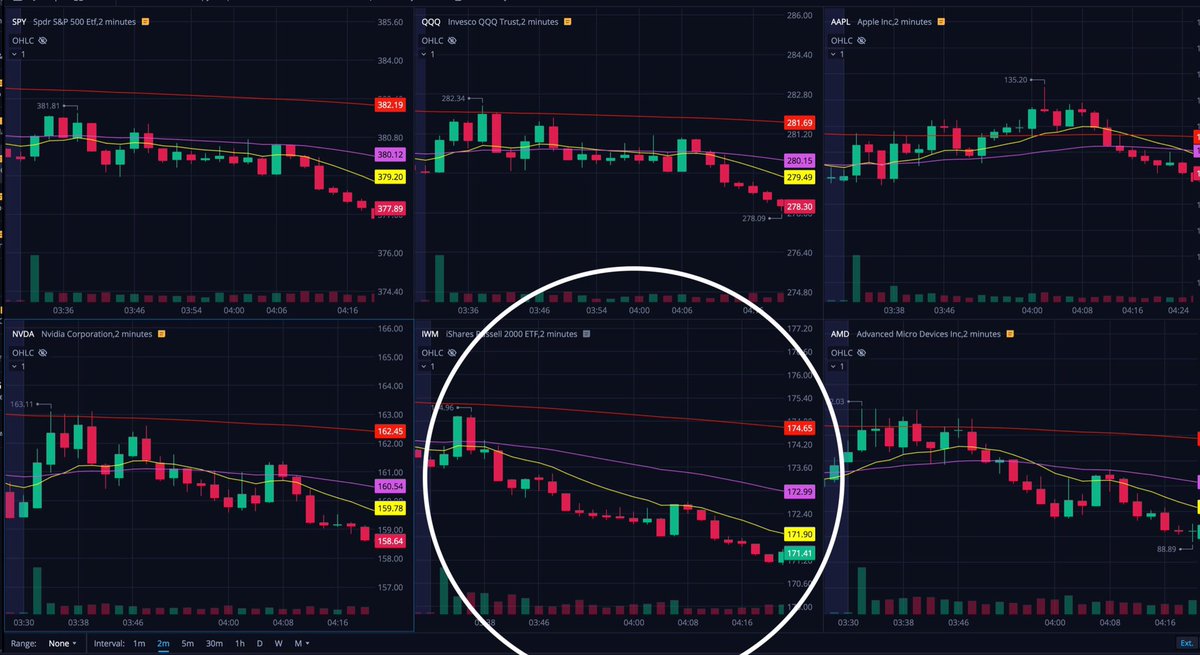

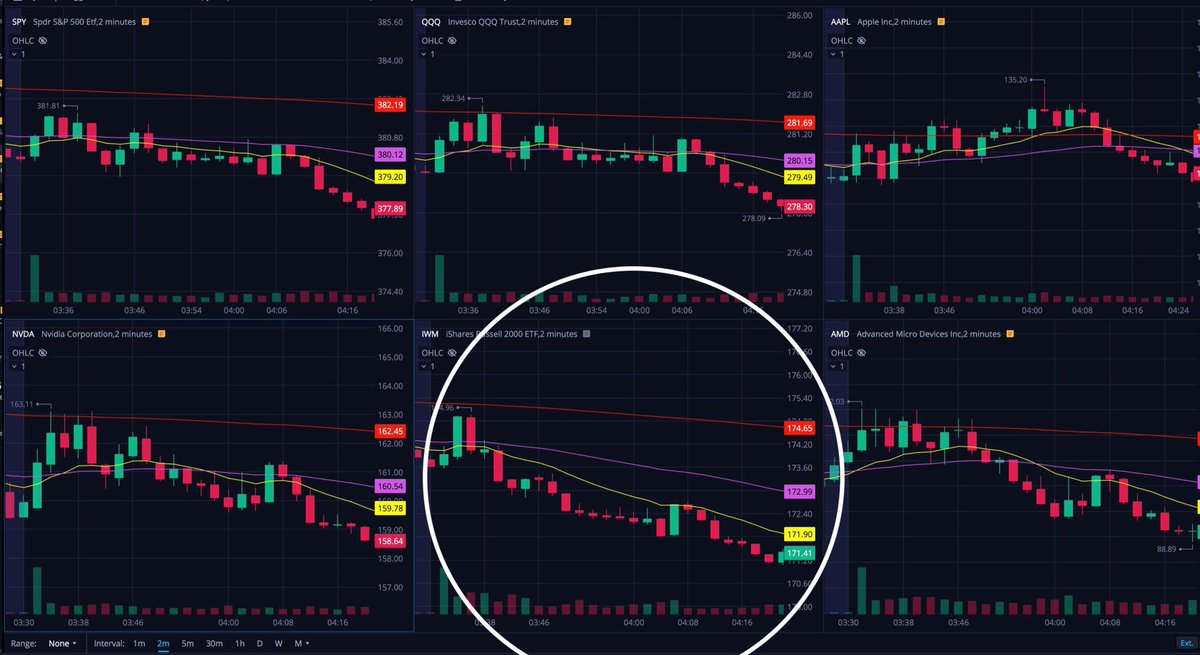

Look at the first 30 minutes of todays price action. Note the emas. $spy $qqq $nvda $amd all flat/choppy! There are no dip buys on flat price action.

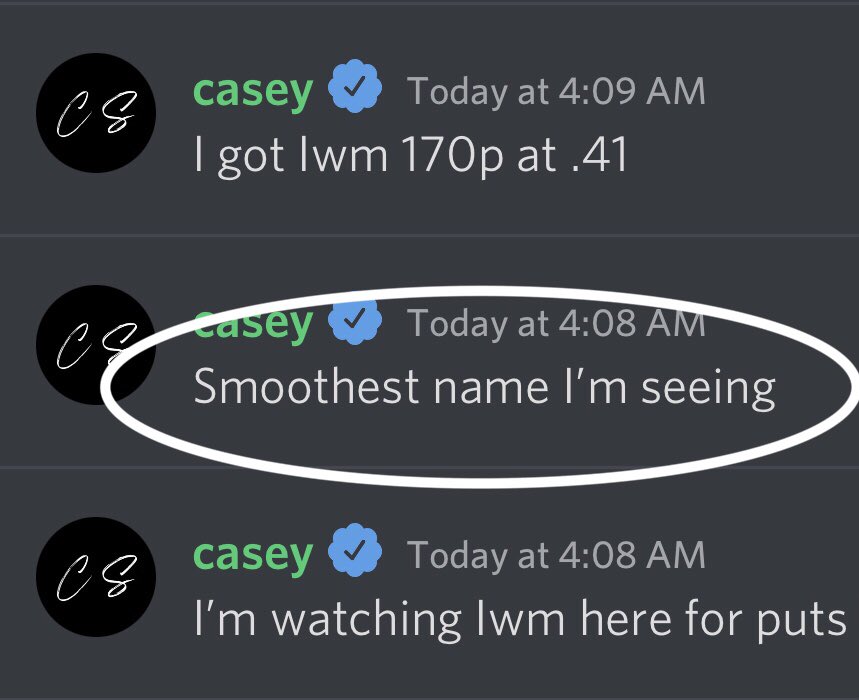

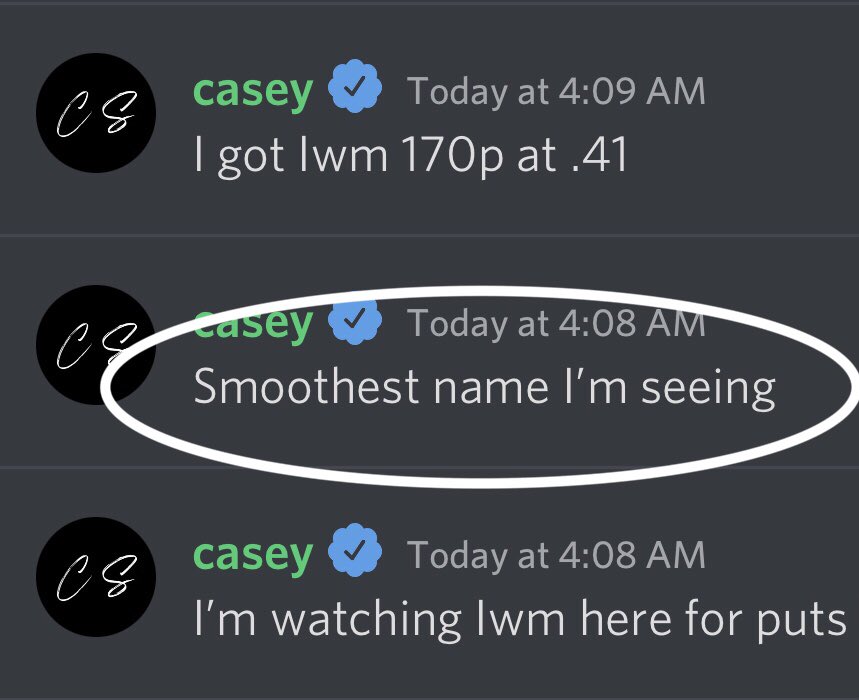

Now look at $iwm, the 13ema is drifting smoothly away from the 48. This is what the start of a nice trend looks like

Now look at $iwm, the 13ema is drifting smoothly away from the 48. This is what the start of a nice trend looks like

Now you have a stock with a decent trend to focus on, time to start focusing on your entry point. A pullback to the 13ema is that spot for me. Get in and ride the trend by trailing your stop

Watch a few of your favorite stocks✅

Focus on the one that has a decent trend✅

Buy the pullback✅

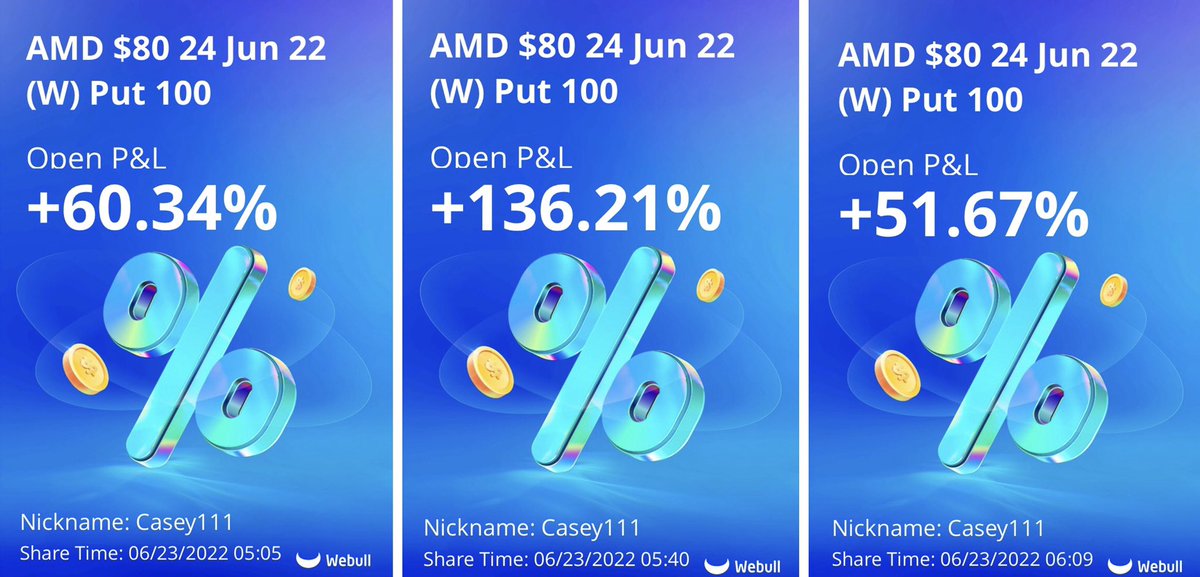

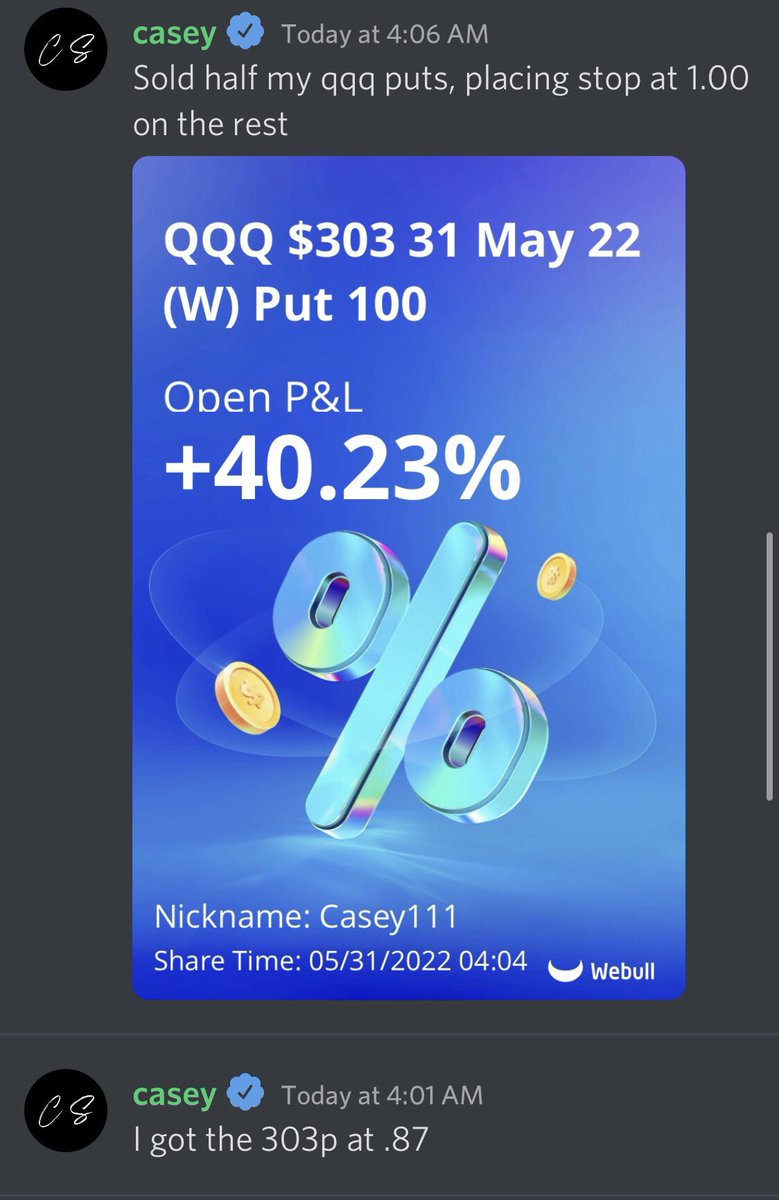

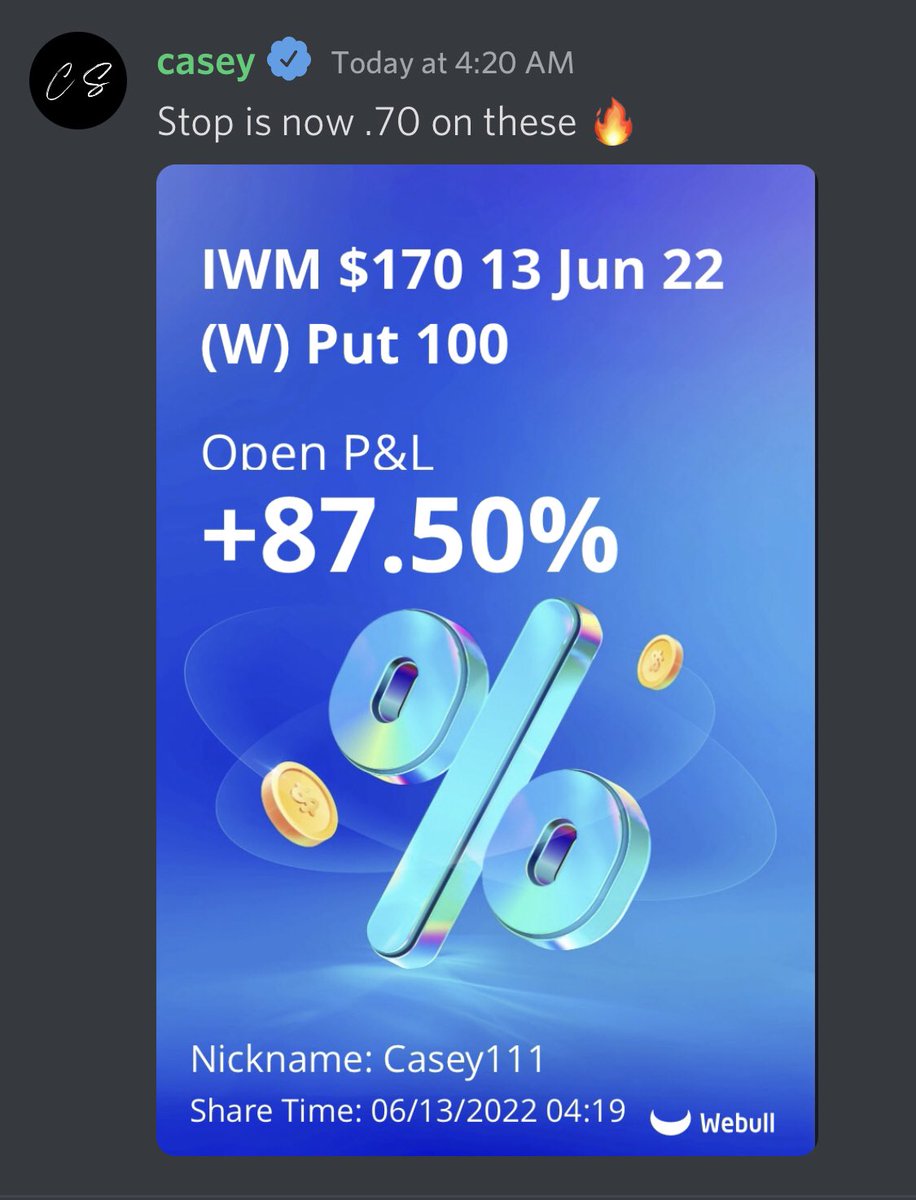

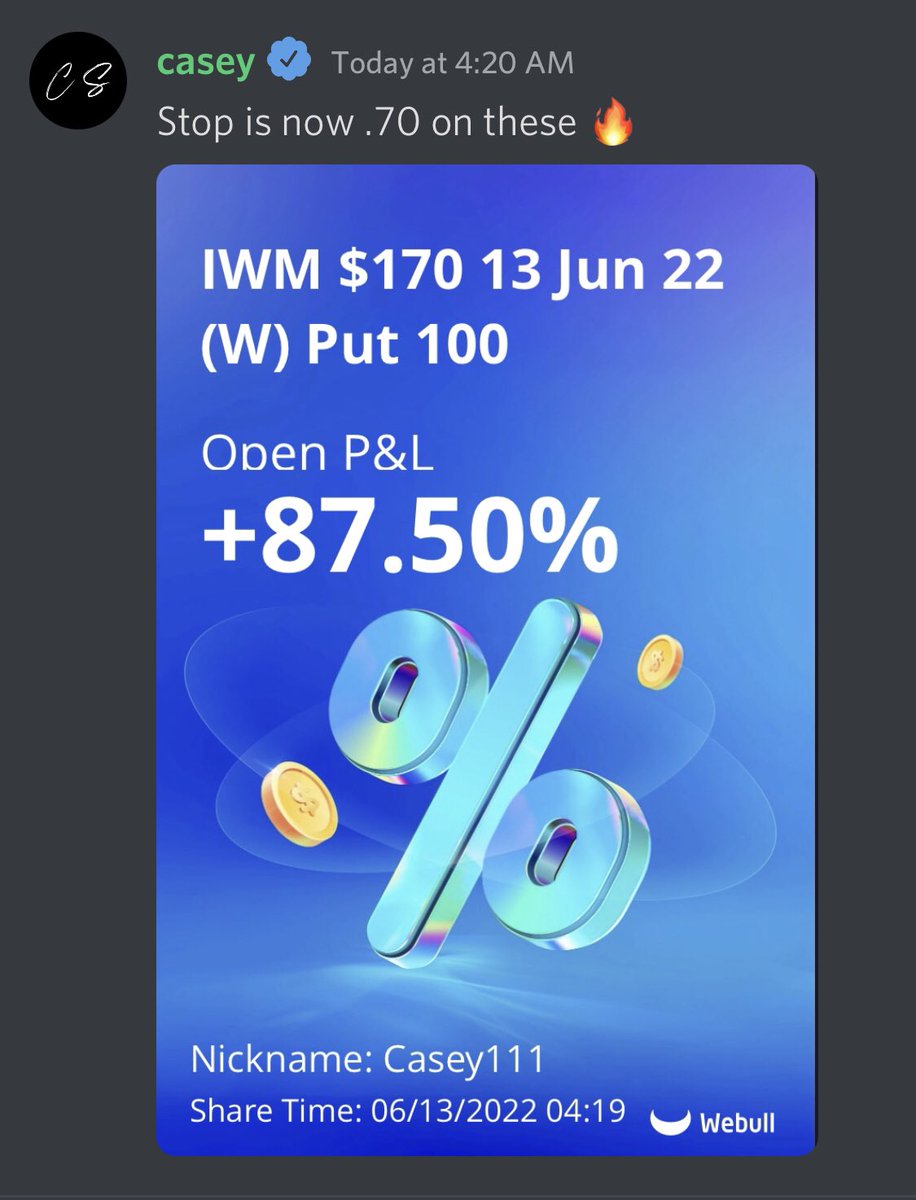

First trade on Monday morning and the team is already banking! That’s how you start the week 🔥

Focus on the one that has a decent trend✅

Buy the pullback✅

First trade on Monday morning and the team is already banking! That’s how you start the week 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh