Sheffield Wednesday’s 2020/21 accounts cover a season when they finished 24th in the Championship and were thus relegated to League One (after a 6-point FFP penalty). Manager Garry Monk replaced by Tony Pulis, then succeeded by Darren Moore. Some thoughts follow #SWFC

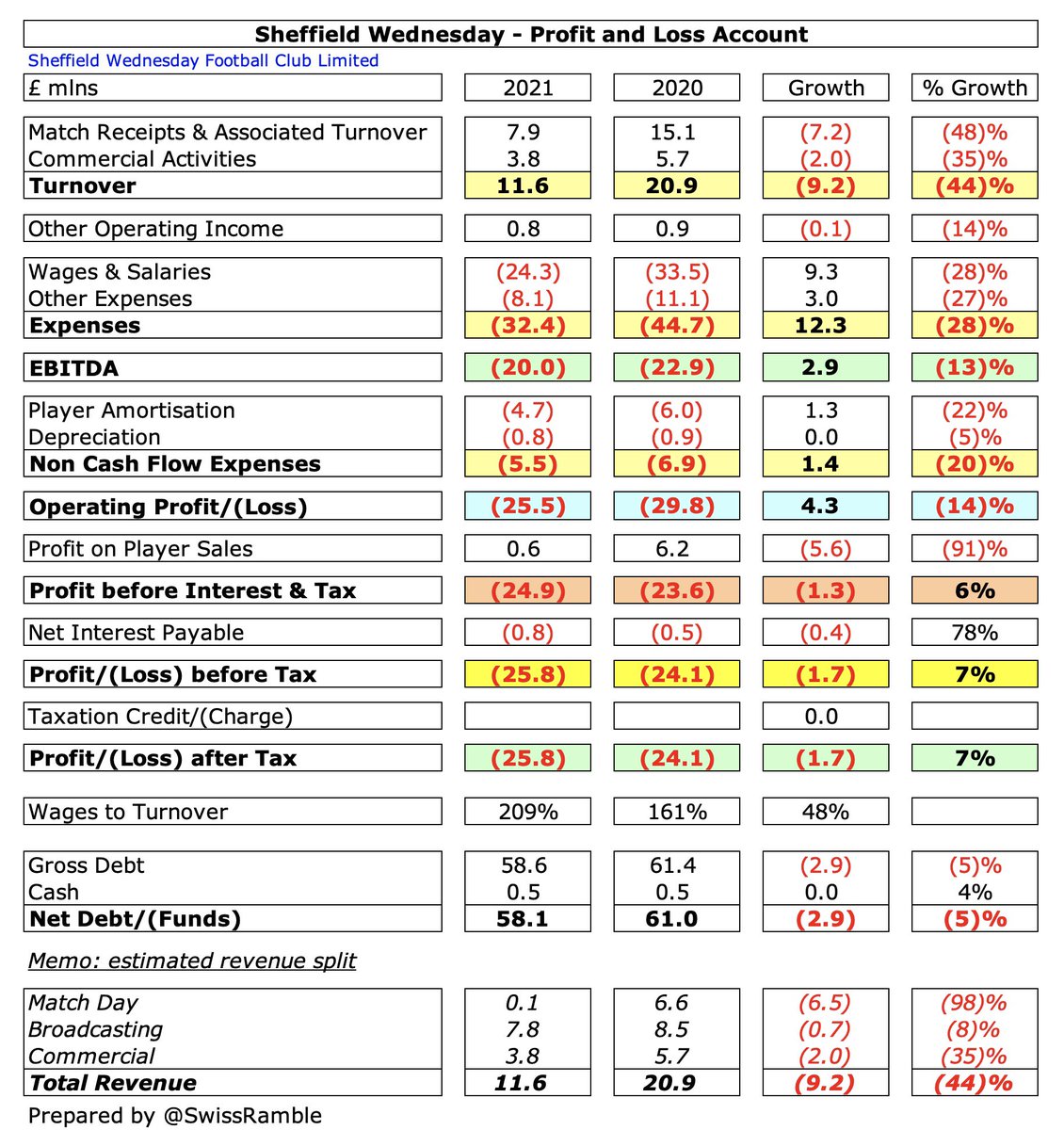

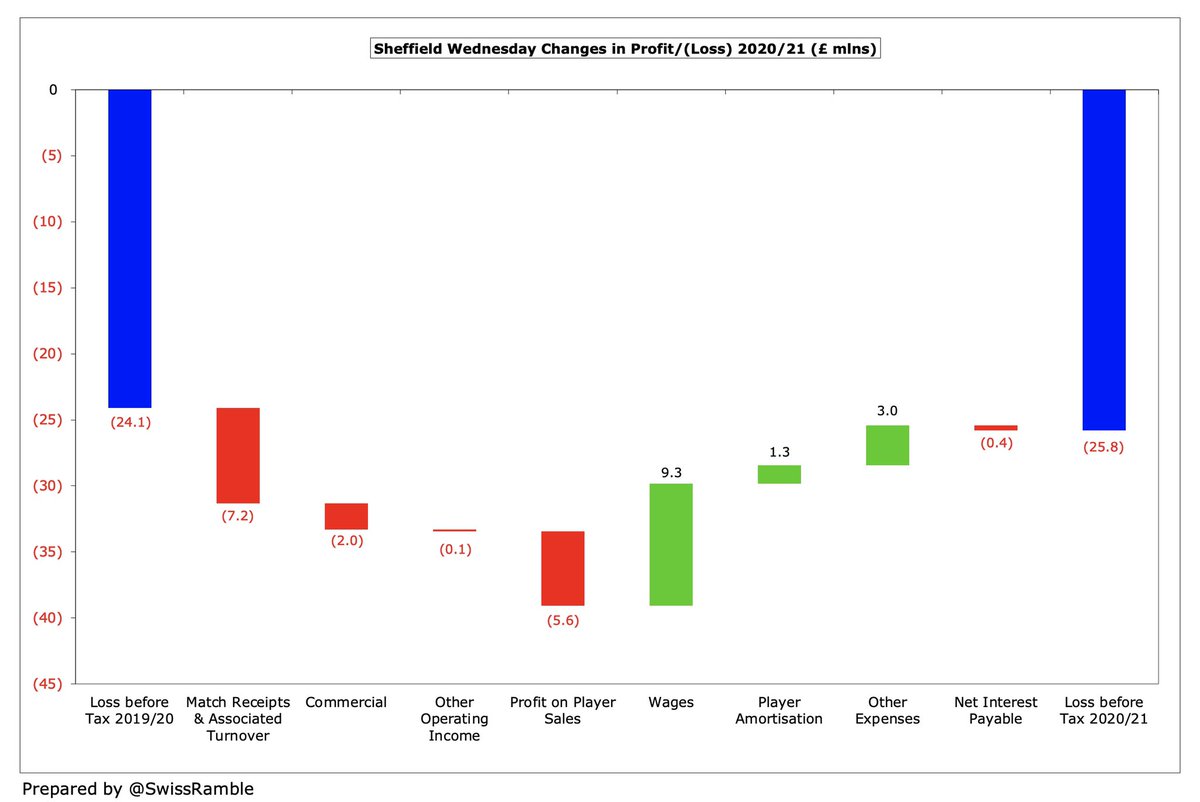

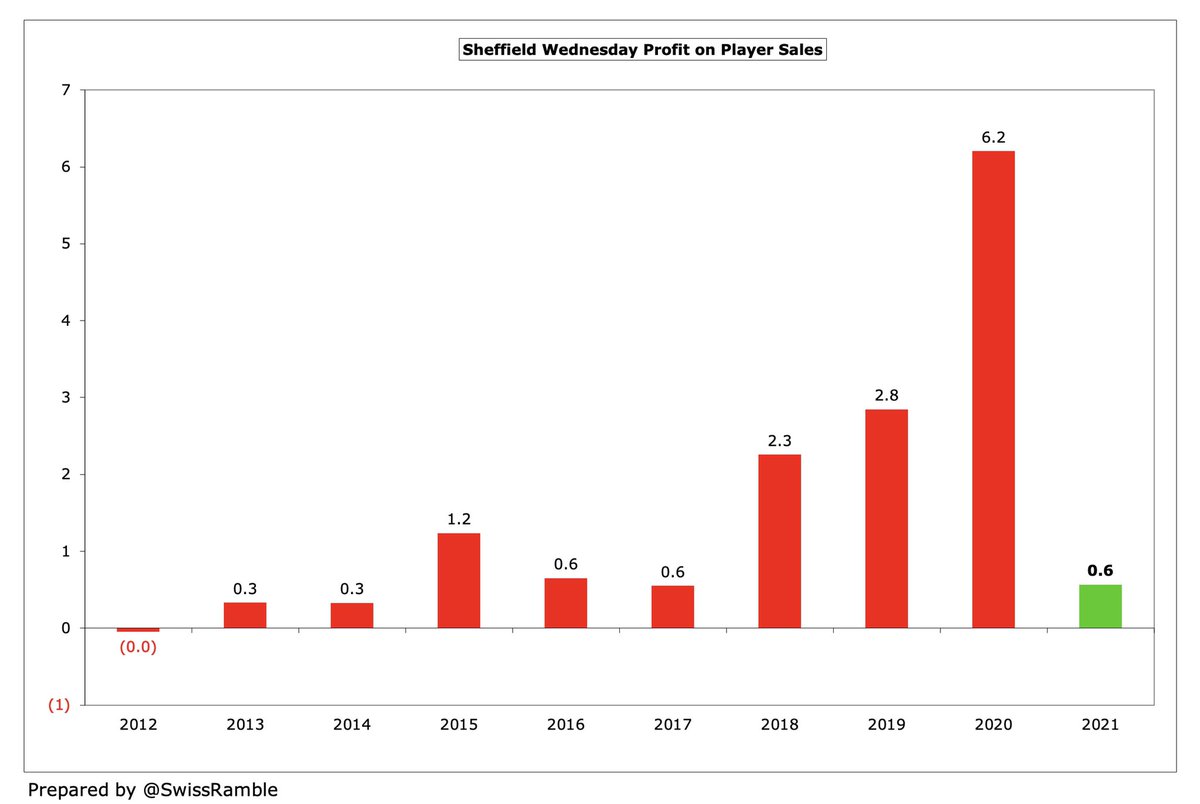

#SWFC loss slightly increased from £24m to £26m, as revenue nearly halved from £20.9m to £11.6m and profit from player sales fell from £6.2m to £0.6m, though these decreases were largely offset by a significant £14m (26%) reduction in expenses.

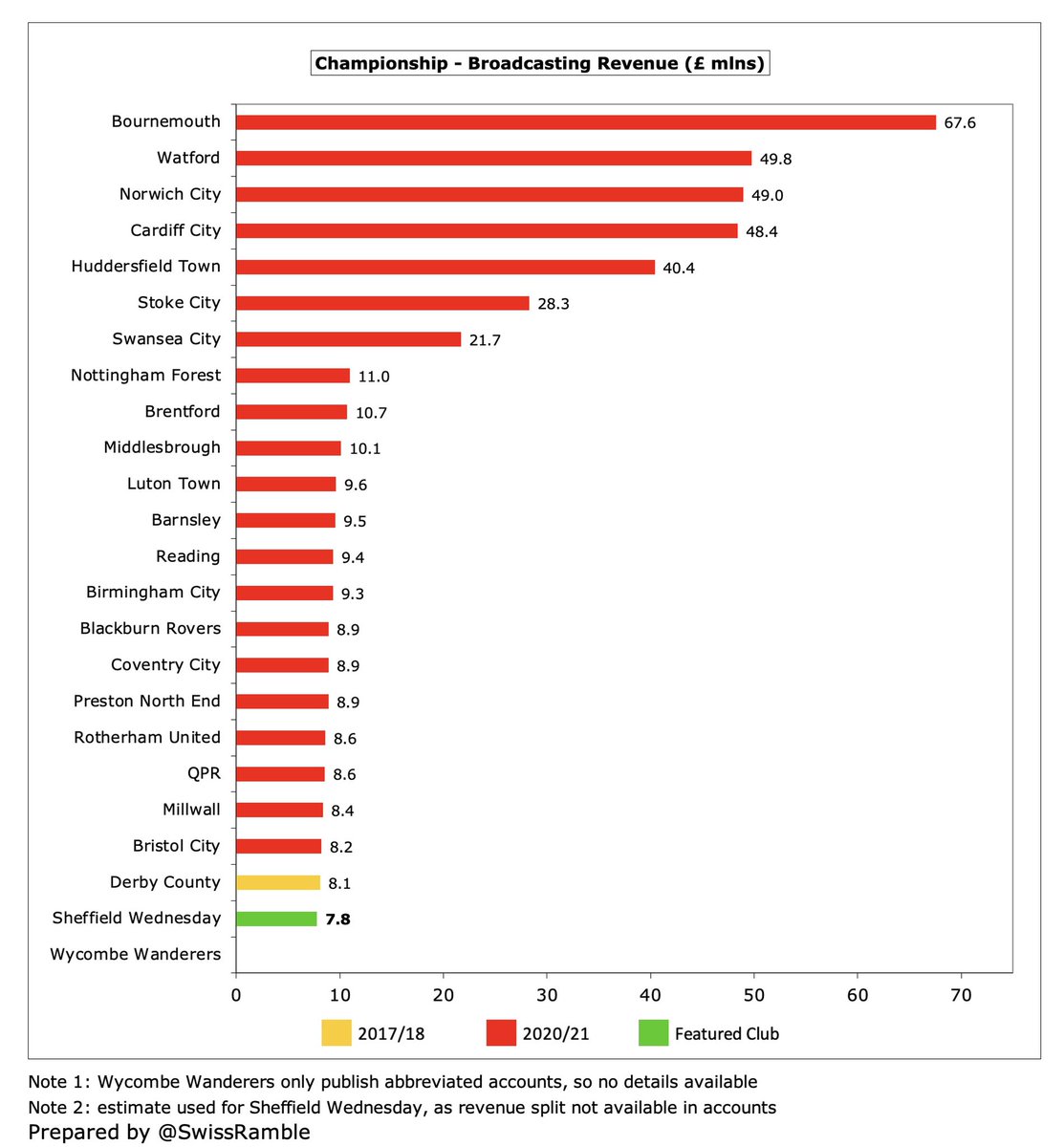

Due to COVID, #SWFC match day decreased 98% from £6.6m to £0.1m and commercial was down a third from £5.7m to £3.8m, while broadcasting fell £0.7m (8%) to £7.8m. Note: match day and broadcasting not separated in accounts, so I have estimated these based on similar sized clubs.

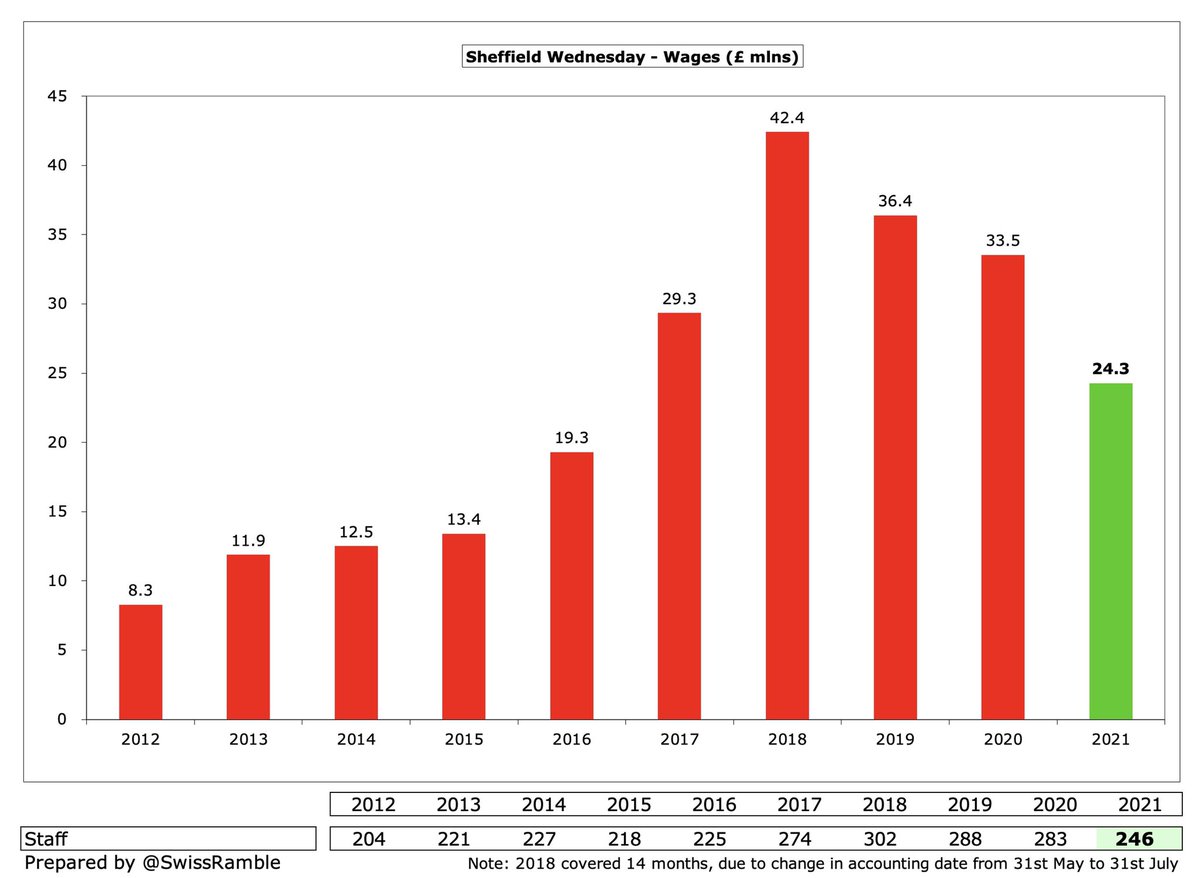

There was a sizeable cut in #SWFC staff costs: wage bill fell £9.3m (28%) from £33.5m to £24.3m, while player amortisation decreased £1.3m (30%) from £6.0m to £4.7m. Other expenses also dropped £3.0m (27%) to £8.1. However, net interest payable almost doubled to £0.8m.

Very few clubs manage to make money in the Championship, but #SWFC £25m loss was the fourth worst, only surpassed by Bristol City £38m, Reading £36m and #Boro £31m. Just four clubs were profitable, led by two that were recently relegated from the Premier League.

#SWFC did not quantify the adverse impact of COVID-19, though this obviously significantly impacted gate receipts, retail and hospitality revenue with all games played behind closed doors, only partly mitigated by a government grant.

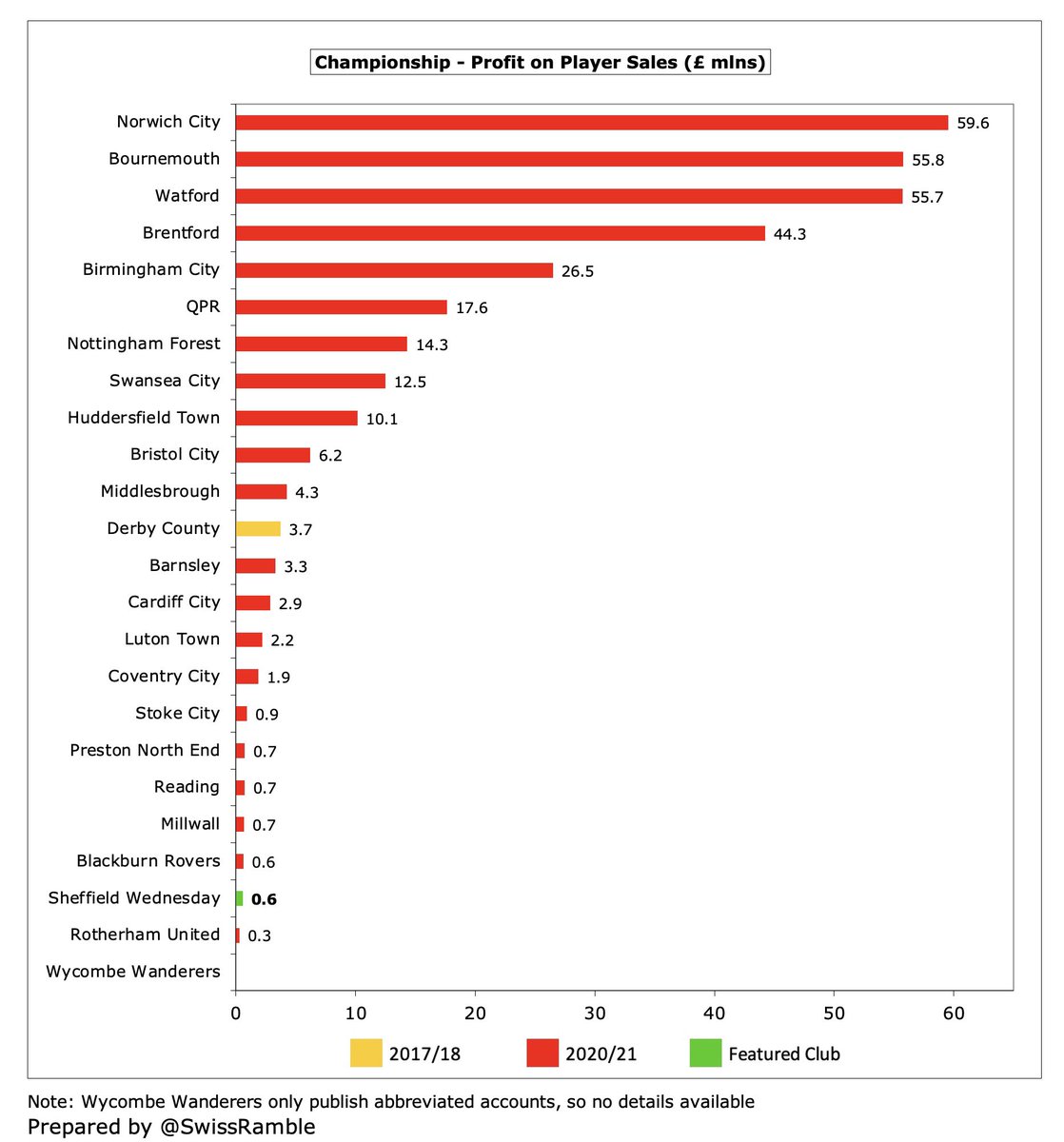

#SWFC profit on player sales fell from £6.2m to just £0.6m, as many players were released on free transfers. That was miles below the player trading profits at the three clubs relegated from the Premier League the previous season: #NCFC, #AFCB and Watford (£56m to £60m).

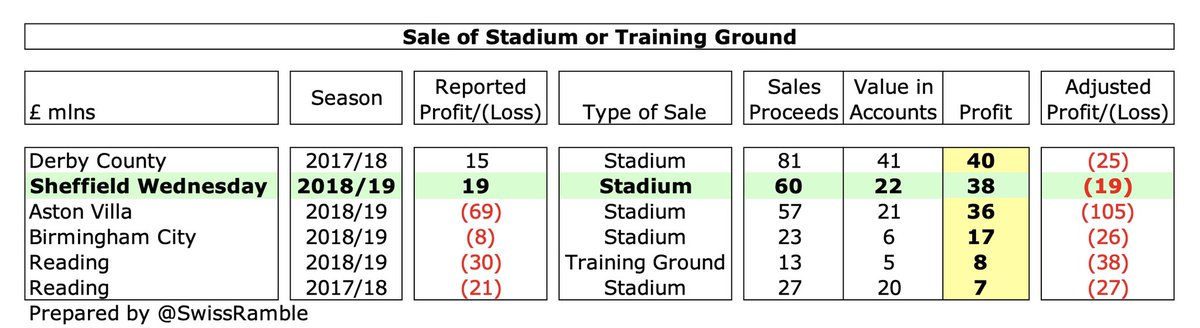

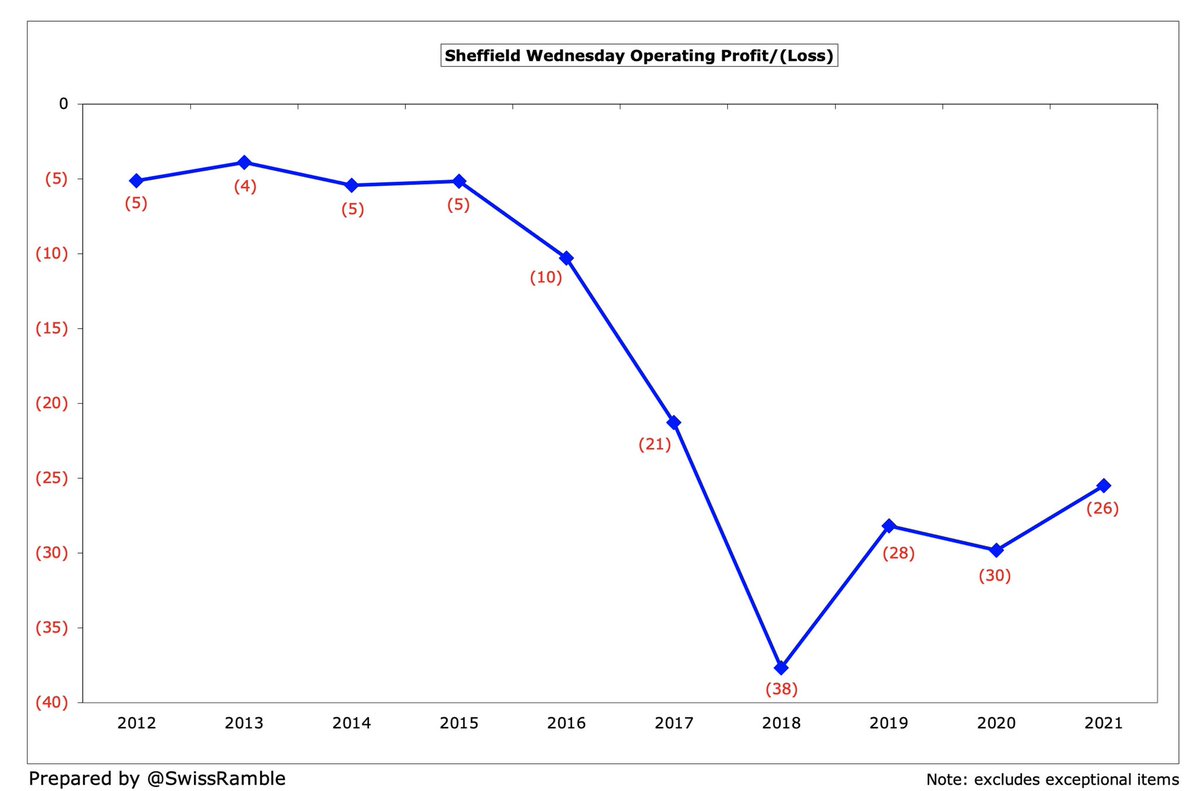

#SWFC have consistently lost money, only reporting a profit once in the last decade, and that was only due to one-offs in 2019 (stadium sale £38m plus £6.5m settlement agreement). The club has lost £87m in the last 5 years (£125m excluding the stadium sale).

As a reminder, #SWFC sold their stadium for £60m, which gave them a £38m profit after deducting the £22m book value. This was an attempt to try to meet FFP targets, though other clubs did the same thing, some even more egregiously, e.g. #DCFC sold their stadium for £81m.

Profit on player sales can also improve the bottom line, but this has not really been a big money-spinner at #SWFC. While the 2020 profit of £6.2m was decent, they have made less than £15m profit from this activity in the last 10 years, which is very low.

#SWFC operating loss (i.e. excluding player sales and interest) narrowed from £30m to £26m. Though still not great, this was actually only mid-table in the Championship, where many clubs post substantial operating losses. In fact, ten of them were above £30m.

#SWFC revenue has fallen by £11.1m (49%) in the last two years from the pre-pandemic level of £22.8m to £11.6m. The 2018 peak of £25.2m was inflated by the accounting period being extended to 14 months, as the club attempted to include the stadium sale.

Following the steep decrease, #SWFC £11.6m revenue was the lowest in the Championship in 2020/21 (though Wycombe did not publish revenue figures in their accounts). This was only around a fifth of those clubs in receipt of the largest parachute payments,

As Chansiri once said, “The Championship is incredibly competitive and gets stronger and stronger each year with parachute money.” This makes it very difficult for clubs like #SWFC, e.g. in 2019/20 a relegated club received £42m in year one, £34m in year two & £15m in year three.

Following relegation, #SWFC revenue will have fallen a further £6m, due to the lower TV deal in League One, though this should be offset by higher match day and commercial income, as fans returned to the stadium.

#SWFC (estimated) broadcasting income fell £0.7m (8%) from £8.5m to £7.8m. Most Championship clubs earn £8-10m TV money, but there is a huge gap to clubs with parachutes. As Wednesday’s accounts close on 31st July, they did not defer any income to 2020/21, unlike other clubs.

#SWFC (estimated) match day income dropped £6.5m to £0.1m, as all home games were played behind closed doors. This revenue stream was one of the highest in the Championship before the pandemic in 2019 with £8.6m, although that was down from the £10.5m peak in 2018.

#SWFC average attendance (for games played with fans) of 23,752 was fifth highest in the 2019/20 Championship, albeit down 13% from the recent 27,306 peak in 2017. Ticket prices were significantly cut following relegation, as club averaged an impressive 22,470 in the third tier.

#SWFC commercial income fell £2.0m (35%) to £3.8m, the club’s lowest since 2012, though obviously adversely impacted by the pandemic. This was firmly in the bottom half of the Championship, far below the likes of Stoke City £12m, #NCFC £8m and Bristol City £8m.

#SWFC owner Dejphon Chansiri provided £1.0m sponsorship”, down from £1.6m the previous season. Wednesday manufactured their own kits under Chansiri’s ‘Elev8’ brand up to June 2021, but the club now have a long-term deal with Macron.

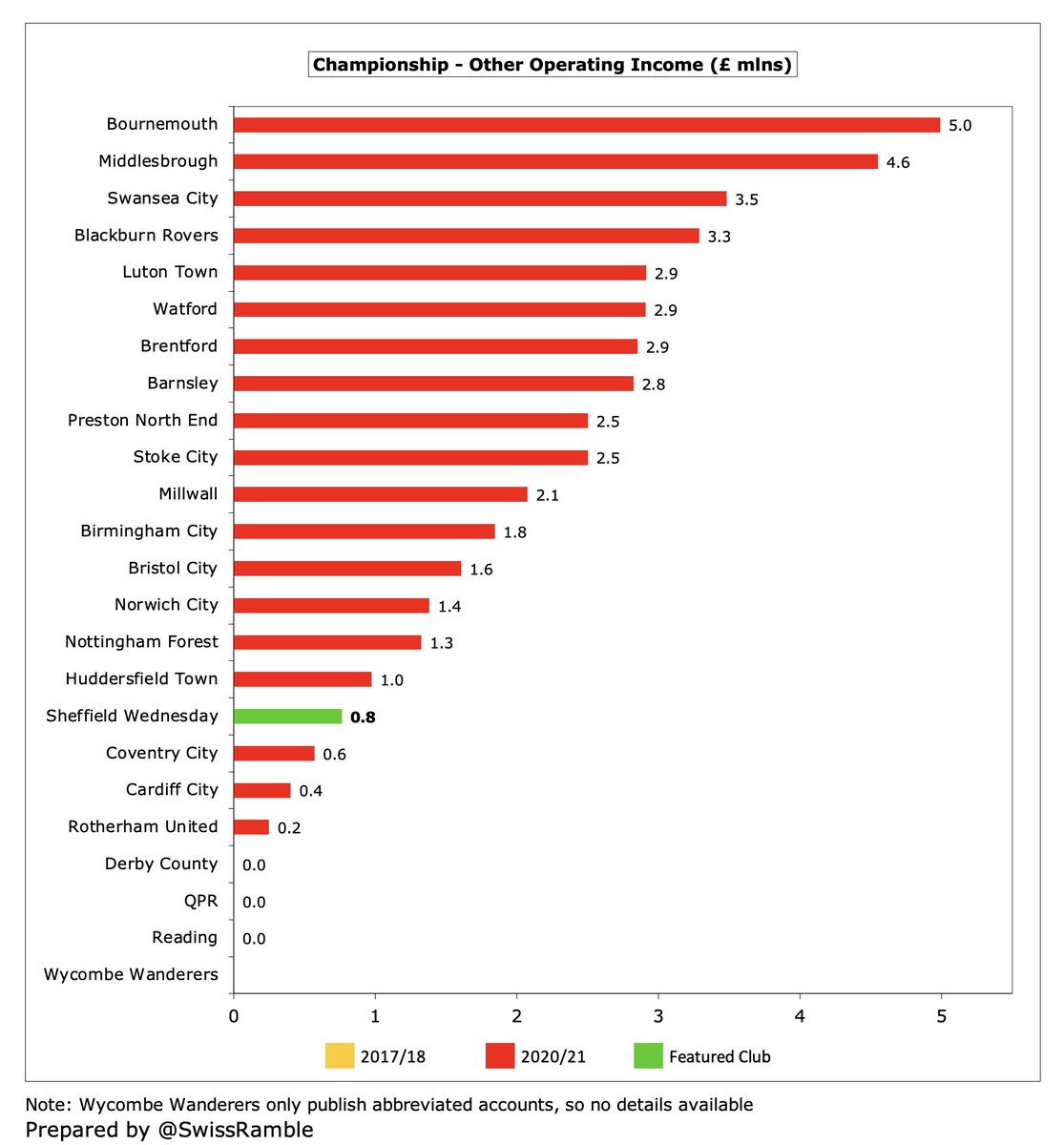

#SWFC had £0.8m other operating income, made up of government grants. Other Championship clubs also reported business interruption insurance claims for COVID losses here, while #AFCB £5.0m included £1.8m player loans.

#SWFC wage bill fell £9.3m (28%) from £33.5m to £24.3m, as headcount reduced from 283 to 246. This is £18m less than the 2018 £42m peak (14 months), though wages had previously tripled from £13m in 2015. Since these accounts, more high earners have left, so will further drop.

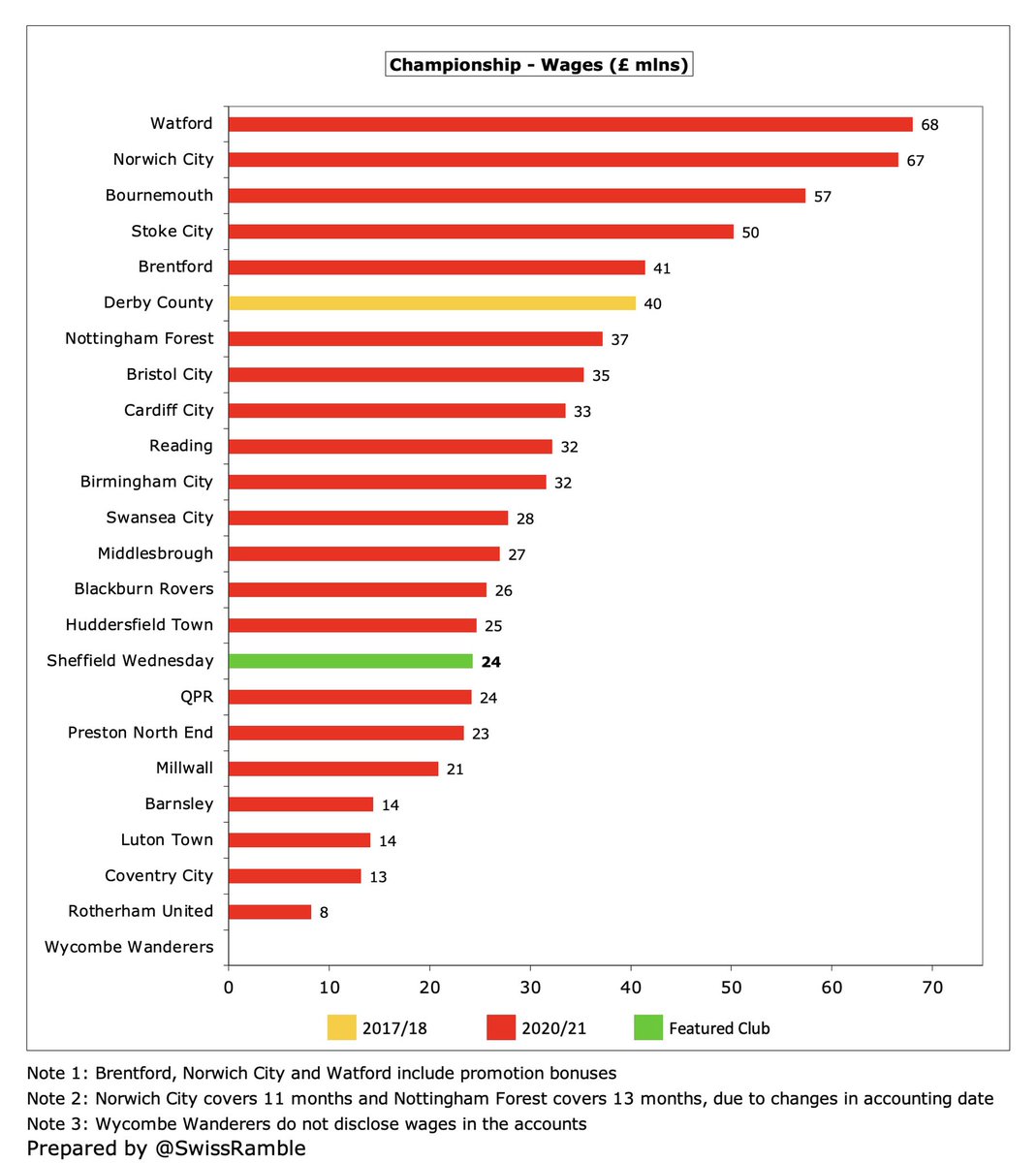

Following the decrease, #SWFC £24m wage bill was in the bottom half of the Championship, miles below the likes of Watford £68m, #NCFC £67m and #AFCB £57m (though the first two did include hefty promotion bonuses).

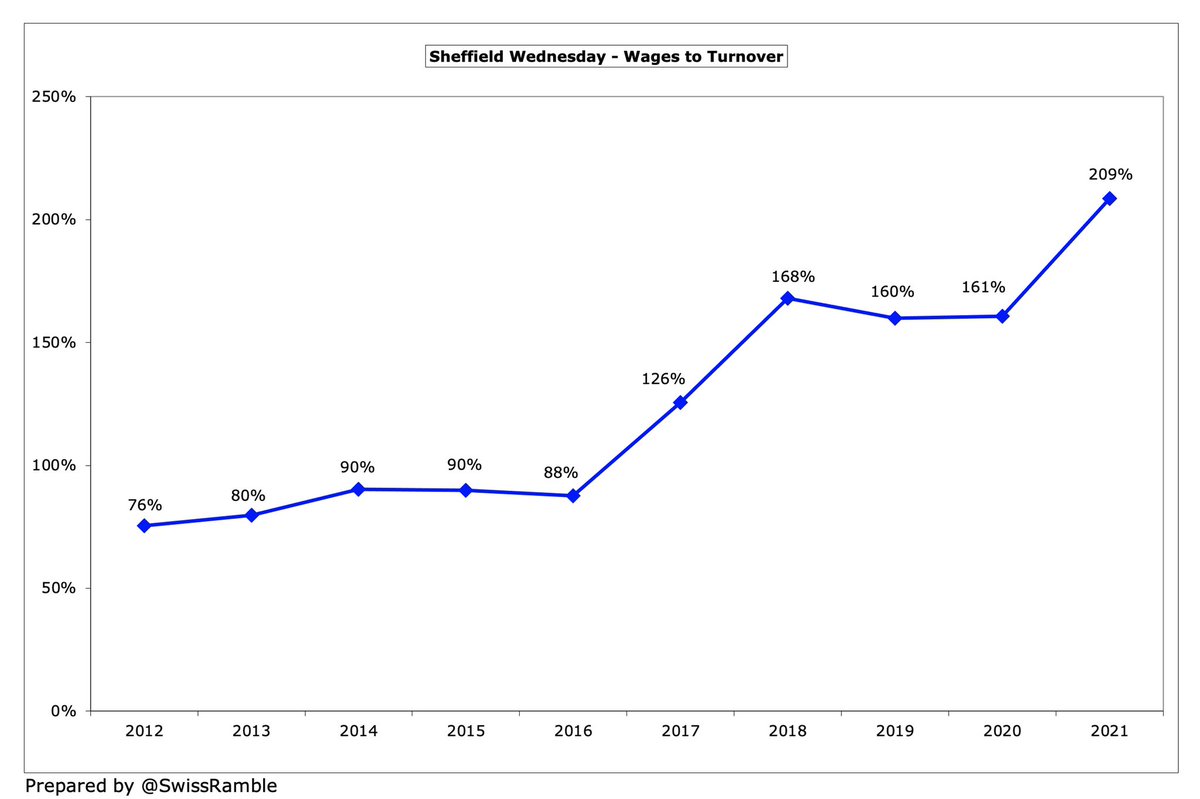

#SWFC wages to turnover ratio increased from 161% to 209%, badly impacted by COVID revenue reductions. In fairness, the vast majority of clubs in the Championship have unsustainable ratios well above 100% (with six over 200%), but Wednesday were fifth highest (worst).

#SWFC have not paid any directors’ remuneration for the past two years, in contrast to #AFCB £2.1m and Watford £934m. The last time that Wednesday paid a director was £137k in 2019/20, presumably for former chief executive, Katrien Meire.

#SWFC other expenses fell from £11.1m to £8.1m, mainly due to lower costs for games without fans. Club now has to pay rent for use of the stadium (averaging £1.75m over next 5 years). Accounts note £3.1m paid to Chansiri, but not clear what else is included besides the rent.

#SWFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £1.3m (30%) from £6.0m to £4.7m, so less than half £10.9m in 2018. Far below big spenders relegated from the Premier League, e.g. #AFCB £36m and Watford £33m.

#SWFC only spent £1.4m on new players in 2021, mainly Josh Windass and Callum Paterson, a similar amount to the previous two seasons, partly due to a soft transfer embargo imposed by EFL for breach of rules. A long way below the likes of Brentford, #NCFC and Watford (£21-22m).

Initially, Chansiri funded a relatively large outlay in the transfer market, amounting to £37m in three years between 2016 and 2018, though the taps have been turned off since those heady days with less than £4m spent in the last three years.

As a result, #SWFC squad cost has slumped from £35m in 2018 to around £2m in 2021, which means, among other things, that there is likely to be little realisable value from the club’s playing assets.

#SWFC gross debt decreased by £2m from £61m to £59m, almost all (£58m) owed to Chansiri with “no set repayment or interest terms”. The debt would have been much higher if Chansiri had not converted £44m into share capital and the former owner had not waived £21m loans.

#SWFC £59m debt was only 13th highest in the Championship, a long way below the likes of Stoke City £212m, #AFCB £165m and #BRFC £152m, though it has shot up from less than £5m in 2015.

In fairness, the debt is not an issue – so long as Chansiri continues to provide financial support. The owner has not charged any interest, though #SWFC had a (lease) interest payment of £64k. Only four clubs in the Championship paid more than £1m interest in 2020/21.

#SWFC don’t separately report transfer debt, but assuming this is 90% of Trade Creditors, it is down from £11m in 2017 to less than £2m, reflecting the limited transfer spend. Miles below the clubs recently relegated from the PL: Watford £62m, #AFCB £45m & #NCFC £23m.

#SWFC £26m operating loss became £10m negative cash flow after adding back non-cash movements, but then spent £1m on players (purchases £1.4m, sales £0.4m) and repaid £4m loans. Funded by £15m proceeds from the stadium sale.

#SWFC cash balance was unchanged at £0.5m. This is on the low side, but most clubs in the Championship held less than £3m cash in the bank, emphasising the clubs’ reliance on their owners’ money.

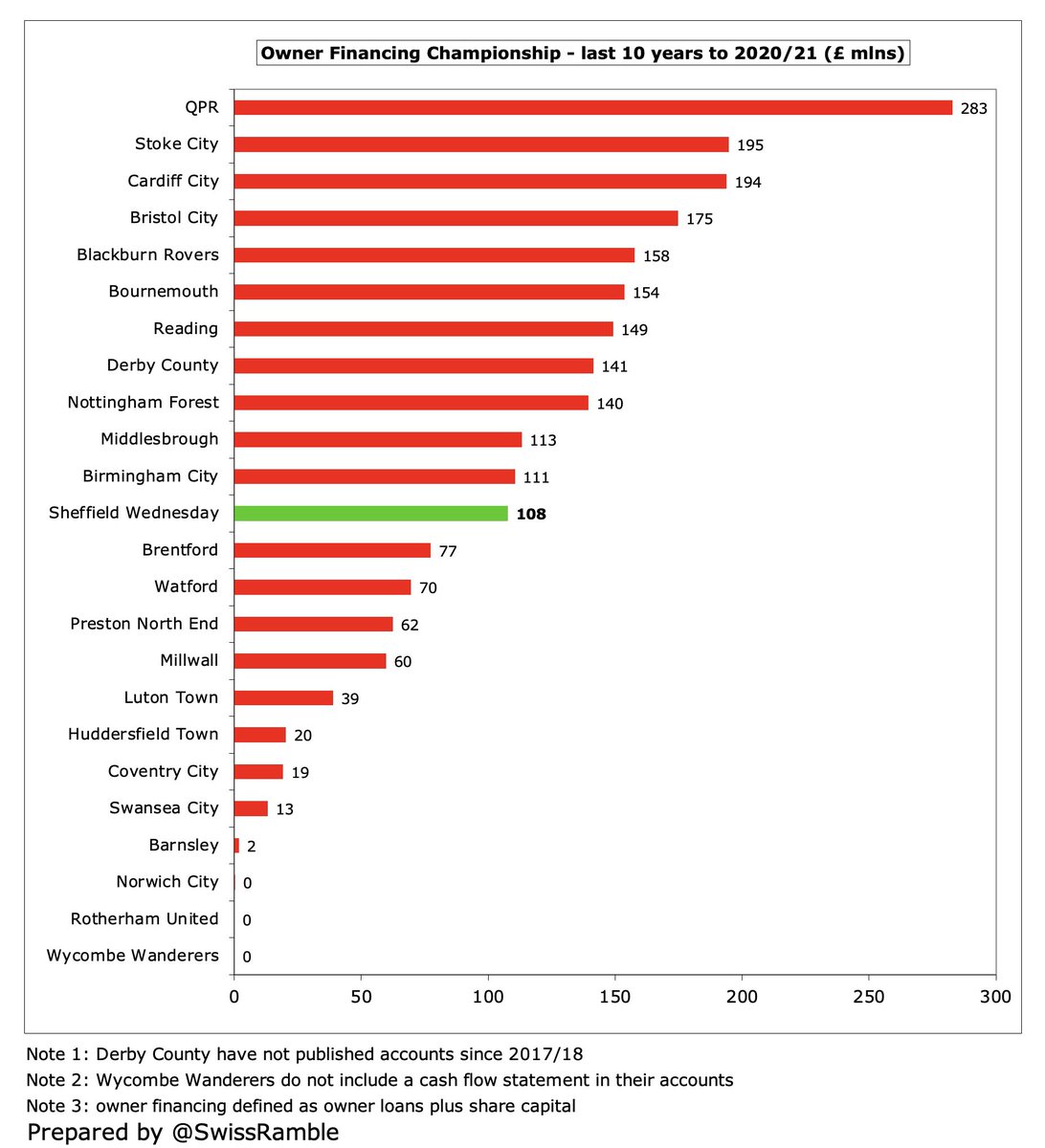

Since Chansiri bought #SWFC from Milan Mandaric in February 2015, he has provided £133m funding. This has been mainly used to cover £87m operating losses, while £20m was spent on players (net), £18m paid off old loans, £5m invested in infrastructure and £1m interest.

So Chansiri has pumped £133m into #SWFC, comprising loans £77m, share capital £25m and £30m payments for the stadium sale (as part of his total £60m commitment).

Excluding the stadium sale proceeds, #SWFC owners (very largely Chansiri) have put in £108m of funding in last 10 years. That’s a lot of money, but much lower than some clubs, e.g. QPR £283m, Stoke £195m & Cardiff £194m, though this has clearly not been a guarantee of success.

#SWFC FFP situation looks OK, though only after including £38m profit from the stadium sale (EFL loophole since closed). As a result, their £41m loss in the 3-year monitoring period is close to the £39m limit even before allowable deductions (including COVID impact).

#SWFC auditors noted material uncertainty about club’s ability to continue as going concern, though Chansiri has confirmed financial support for at least next 12 months. This is a “red flag”, but worth noting that Wednesday’s accounts have included similar comments since 2013.

#SWFC relegation to League One was due to a six-point deduction applied by the EFL (reduced from 12 points). This was because the club submitted paperwork late, as opposed to the stadium sale itself, so very avoidable. Without the penalty, they would have stayed up.

More positively, #SWFC transfer embargo has now been lifted, but the club also had to accept a suspended six-point deduction for not paying player wages between March and June 2021, though it has been reported that these arrears have now been paid.

So, while Chansiri has kept #SWFC “in operational existence” (to quote the auditors), he is also responsible for the club’s relegation. Wednesday were close to bouncing back at the first attempt after reaching the play-offs, but it will be difficult after the recent budget cuts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh