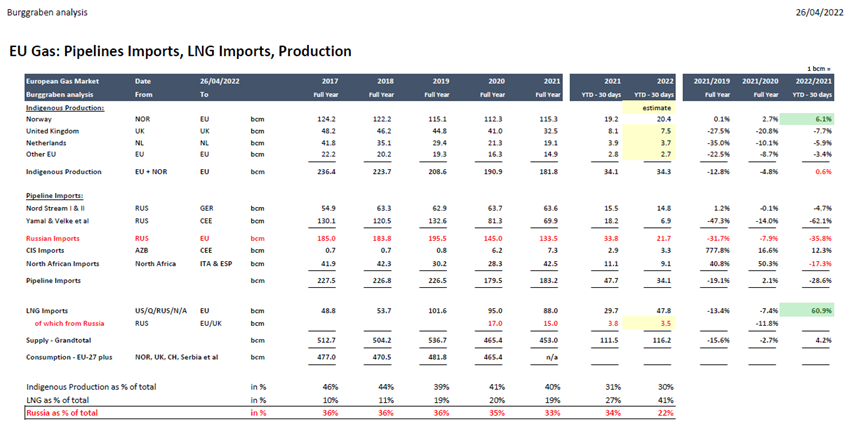

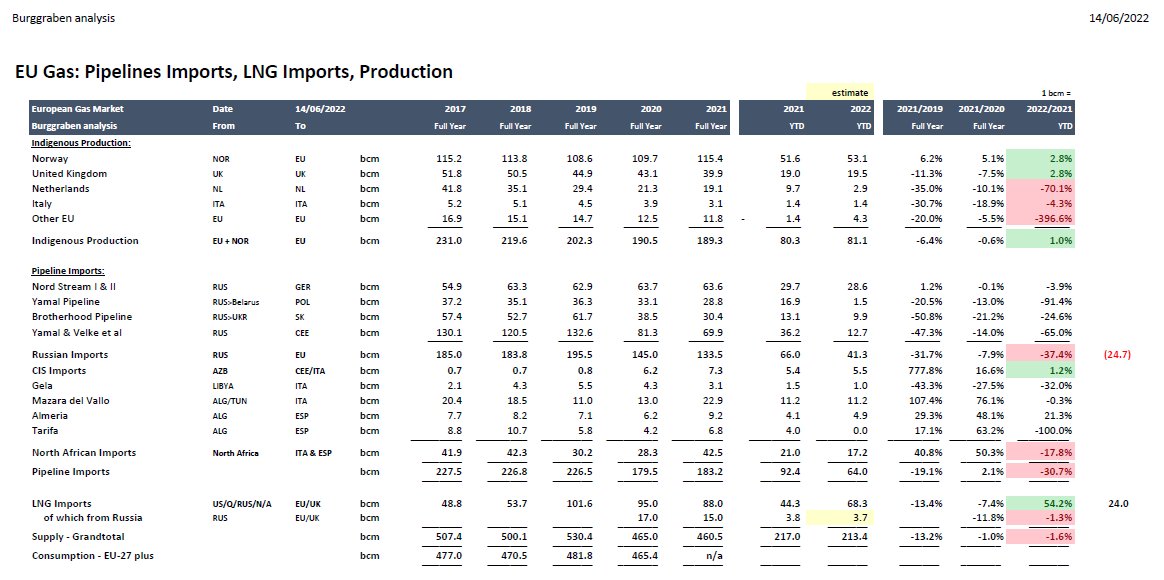

Not a believer in geopolitical coincidence. Take natgas. In 2022, flows reduced exactly by the amount the EU managed to increase LNG imp (24bcm). The better than expected storage fills in the EU may made the Kremlin decide to slow deliveries down by 12bcm (NS1).

#TTF @Alpen_R

#TTF @Alpen_R

Here is the EU storage fill in %. It's on track to be 80% filled by August which would likely reduce some risk premium for the winter of TTF. That is unlikely in the best interest of the Kremlin while the war continues.

#TTF

#TTF

@kittysquiddy @WifeyAlpha TTF will remain elevated now. That is what Gazprom wants and it will get its will.

• • •

Missing some Tweet in this thread? You can try to

force a refresh