NEW Bruegel Publication on Joint Gas Purchasing

[with great co-authors]

1. Focus on concrete tool for 2022/23

2. There are good reasons

3. Devil=detail

4. It can be done!

5. Keep borders open

🧵

bruegel.org/2022/06/how-to…

[with great co-authors]

1. Focus on concrete tool for 2022/23

2. There are good reasons

3. Devil=detail

4. It can be done!

5. Keep borders open

🧵

bruegel.org/2022/06/how-to…

1. Focus : 2022/23

•COM and Council agree to develop an #EU_EnergyPlatform for gas purchase

•Expectations are high but mandate and setup are vague

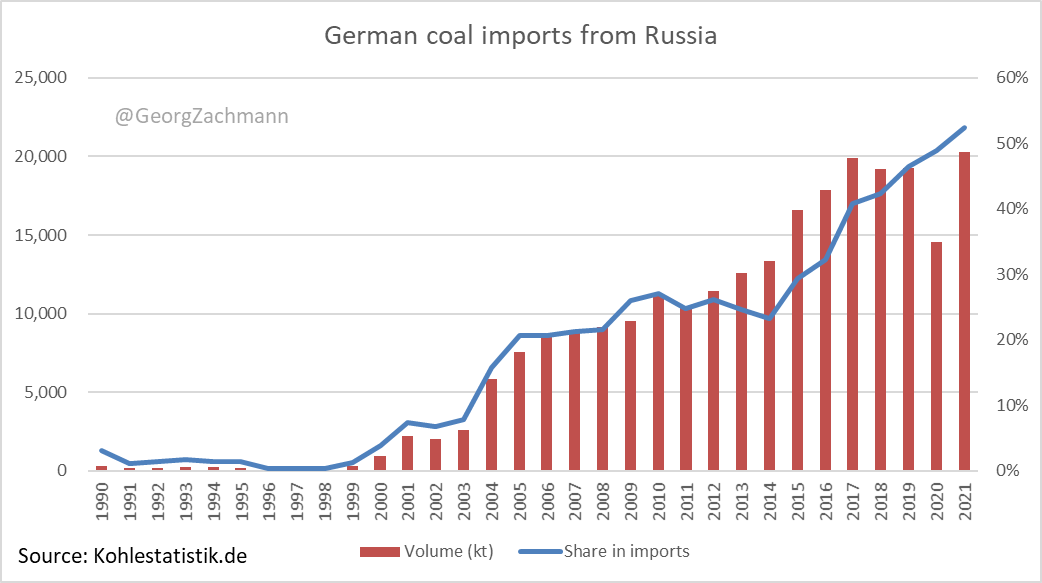

•Getting gas to replace RU and filling all storages should be priority

•COM and Council agree to develop an #EU_EnergyPlatform for gas purchase

•Expectations are high but mandate and setup are vague

•Getting gas to replace RU and filling all storages should be priority

2. Good reasons

•Synchronise storage filling [optimise schedule and prevent overbidding w. national tools]

•Prevent free-riding of MS/Comp

•Reduce gas costs

•Pool admin capability

•Ensure solidarity & internal market integrity

•Synchronise storage filling [optimise schedule and prevent overbidding w. national tools]

•Prevent free-riding of MS/Comp

•Reduce gas costs

•Pool admin capability

•Ensure solidarity & internal market integrity

3. Devilish-details

• Avoid crowding out private

• Not undermine market

• Proper incentives to participate

• Deliver gas to where needed

• Overcome lack of expertise in public admin

• Protect legacy contracts

• Prevent market power abuse

• Compatibility w legal framework

• Avoid crowding out private

• Not undermine market

• Proper incentives to participate

• Deliver gas to where needed

• Overcome lack of expertise in public admin

• Protect legacy contracts

• Prevent market power abuse

• Compatibility w legal framework

4a. It can be done !

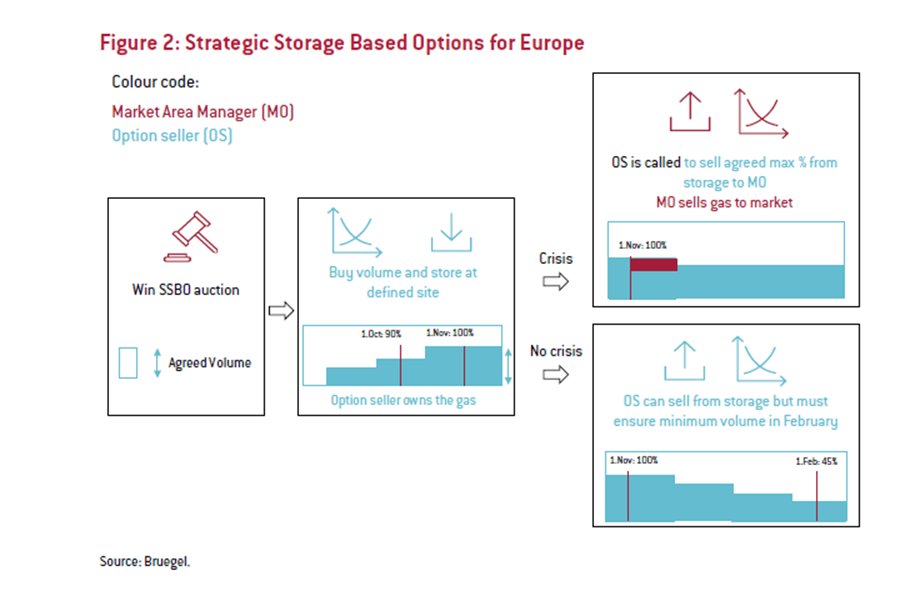

Proposal 1 : EU Strategic Storage Based Options

•Auction remuneration for companies to fill specific EU storages

•Allows higher remuneration for difficult to reach storages

•Proven tool that can work alongside market

Proposal 1 : EU Strategic Storage Based Options

•Auction remuneration for companies to fill specific EU storages

•Allows higher remuneration for difficult to reach storages

•Proven tool that can work alongside market

4b. It can be done !

Proposal 2 : EU two-sided auction for LNG deliveries

•New exchange-platform for additional LNG volumes

•Diplomatically-unlocked volumes can be allocated here

•Subsidisation is possible to match volume-targets

Proposal 2 : EU two-sided auction for LNG deliveries

•New exchange-platform for additional LNG volumes

•Diplomatically-unlocked volumes can be allocated here

•Subsidisation is possible to match volume-targets

5. Keep borders open

•Solidarity promise rings hollow w/o concrete tools

•Concrete tools are possible

•Linking platform-benefit to keep borders open for commercial flows can ensure efficient X-border/X-sector allocation in crisis

•Only with solidarity, we can withstand Putin

•Solidarity promise rings hollow w/o concrete tools

•Concrete tools are possible

•Linking platform-benefit to keep borders open for commercial flows can ensure efficient X-border/X-sector allocation in crisis

•Only with solidarity, we can withstand Putin

• • •

Missing some Tweet in this thread? You can try to

force a refresh