How to Invest in IPPs (Power Sector) 💰💰💰

1)Understand the PPA (Power Purchase Agreement)

2)Never Ever Look at GP Margins %%

3)Build Late Payments into your Valuation

4)Keep an Eye on Disputes between IPPs and Power Purchaser

🧶🧶 Thread 🧶🧶

#PSX #KSE100 #IPPs

1)Understand the PPA (Power Purchase Agreement)

2)Never Ever Look at GP Margins %%

3)Build Late Payments into your Valuation

4)Keep an Eye on Disputes between IPPs and Power Purchaser

🧶🧶 Thread 🧶🧶

#PSX #KSE100 #IPPs

PPA is the Holy Grail to value an IPP. Most Important aspects include

➡️Total Project Cost

➡️%age of Equity in Total Cost

➡️ Return on Equity

1/20

➡️Total Project Cost

➡️%age of Equity in Total Cost

➡️ Return on Equity

1/20

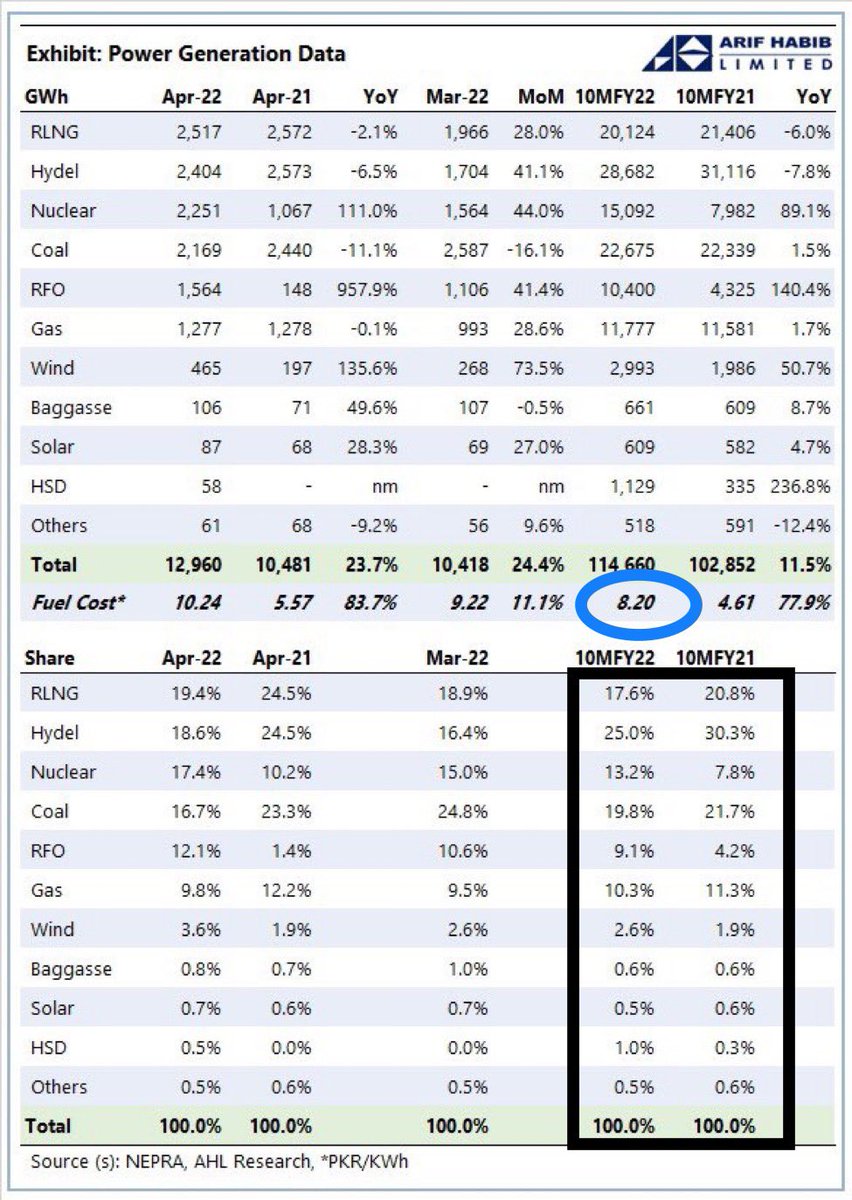

There are two main components in payments to an IPP

Capacity Payments 👉🏼 Majorly includes Return on Equity and Repayment of Debt

Variable Costs 👉🏼 Majorly include Fuel Costs (Coal, Gas etc) and Maintenance costs

2/20

Capacity Payments 👉🏼 Majorly includes Return on Equity and Repayment of Debt

Variable Costs 👉🏼 Majorly include Fuel Costs (Coal, Gas etc) and Maintenance costs

2/20

These Power plants are not allowed to sell to anyone but the Power Purchasing Company of Pakistan (CPPA)

Hence to cover for Debt Repayments etc, IPPs ask for Fixed Capacity Payments whether the Plant operates for 1 month or 11 months in a year

3/20

Hence to cover for Debt Repayments etc, IPPs ask for Fixed Capacity Payments whether the Plant operates for 1 month or 11 months in a year

3/20

Capacity Payments are fixed, CPPA operates Power Plants according to lowest Variable Cost (Merit Order)

Variable Cost mostly depends on the type of Fuel and the average Buying price of Fuel. There is an agreed formula in PPA to determine Variable cost per KWh

4/20

Variable Cost mostly depends on the type of Fuel and the average Buying price of Fuel. There is an agreed formula in PPA to determine Variable cost per KWh

4/20

Why GP Margins are deceiving‼️

There is marginal difference between Revenue an IPP gets from CPPA per unit and the variable cost it incurs in producing it

Example👇🏼

Lets say a plant has Rs100 Capacity payment/year and can produce max 1000 units at Rs1/Kwh annually

5/20

There is marginal difference between Revenue an IPP gets from CPPA per unit and the variable cost it incurs in producing it

Example👇🏼

Lets say a plant has Rs100 Capacity payment/year and can produce max 1000 units at Rs1/Kwh annually

5/20

The Plant produces 200 units in a year, its total revenue will be Rs300 and costs of Rs200. GP Margin 33%

Same plant produces 900 units next year, has total Total Revenue of Rs 1000 and costs of Rs900. GP Margin comes down to 10%

GP Margin is irrelevant in this industry‼️

6/20

Same plant produces 900 units next year, has total Total Revenue of Rs 1000 and costs of Rs900. GP Margin comes down to 10%

GP Margin is irrelevant in this industry‼️

6/20

Confusion on Returns offered to IPPs 👀👀

People quote returns from a range of 15% all the way upto 30%. There is one big misunderstanding for such claims

Simple Explanation below🔽

Imagine you have Rs100 in a Bank Account & the Bank offers you 15% return for 30 years

7/20

People quote returns from a range of 15% all the way upto 30%. There is one big misunderstanding for such claims

Simple Explanation below🔽

Imagine you have Rs100 in a Bank Account & the Bank offers you 15% return for 30 years

7/20

You will get Rs15/year & get Rs100 at the end. Now the Banks says I cannot pay Rs100 at the end, but I will keep paying more each year to compensate

In such a case to earn 15% return, Bank will have to pay Rs27 per year for next 30 years. This is ROEDC in IPPs language

8/20

In such a case to earn 15% return, Bank will have to pay Rs27 per year for next 30 years. This is ROEDC in IPPs language

8/20

For projects with 17% Return, ROEDC is close to 27%

For projects which have 20% Return (Thar Coal), ROEDC is close to 29-30%

Anyone saying IPPs are earning 30% return is either Misinformed or is trying to Misguide/Sensationalise the issue. Beware‼️

9/20

For projects which have 20% Return (Thar Coal), ROEDC is close to 29-30%

Anyone saying IPPs are earning 30% return is either Misinformed or is trying to Misguide/Sensationalise the issue. Beware‼️

9/20

Due to Circular Debt in Power Sector, payments are made very late to IPPs especially the ROE Component. CPPA usually keeps paying the Variable cost and Debt Repayments to keep the Plant operational

Since these payments are Guaranteed by GoP……

10/20

Since these payments are Guaranteed by GoP……

10/20

IPPs finance these shortfalls from Local Banks paying them back when payments are received

Late payment penalties are slightly different for Plants under different Policies. For instance KIBOR+4.5% for 2002 IPPs.

Exact rates can be found in a Company’s Annual Report

11/20

Late payment penalties are slightly different for Plants under different Policies. For instance KIBOR+4.5% for 2002 IPPs.

Exact rates can be found in a Company’s Annual Report

11/20

After a few years these payments accumulate and Govt has to pay them in one go in order to avoid Default/Shutdown of Power Supply.

In return, Govt asks for some concessions like in 2020 Negotiations with 1994 & 2002 IPPs

12/20

In return, Govt asks for some concessions like in 2020 Negotiations with 1994 & 2002 IPPs

12/20

Investing in IPPs is like investing in a Savings Account in which returns are largely Fixed but there is uncertainty over when the Profits will be paid.

This uncertainty drives Investors away and creates Good investment opportunities for Investors willing to wait it out

13/20

This uncertainty drives Investors away and creates Good investment opportunities for Investors willing to wait it out

13/20

A rough estimate of Fair Value is using ROEDC as the Profit of the Company, using 4-6 PE & Adding Net Receivables from Prior years

For more than 15 years remaining in PPA, 6-7 PE multiple is appropriate, for plants with 7-8 years left 4 PE is more suitable

14/20

For more than 15 years remaining in PPA, 6-7 PE multiple is appropriate, for plants with 7-8 years left 4 PE is more suitable

14/20

To account for Govt Receivables accumulated in Prior years use Trade Debts - Total liabilities excluding Debt component of the Power Plant.

Debt is usually paid back in the first 10-12 years of operations

To build Margin of Safety, Value Net Receivables at 70%

15/20

Debt is usually paid back in the first 10-12 years of operations

To build Margin of Safety, Value Net Receivables at 70%

15/20

Some plants at the later stages of their Plant life loose efficiency and produce Electricity at a higher cost than the agreed formula for Variable Price.

Examples include Pakgen & Lalpir Power. These plants Earnings decrease the more Electricity they produce

16/20

Examples include Pakgen & Lalpir Power. These plants Earnings decrease the more Electricity they produce

16/20

Disputes between IPPs and CPPA are common & mostly originate from Fuel Shortages.

Whenever there is Gas/FO shortage, both Parties blame each other for Plant not being able to produce Electricity

17/20

Whenever there is Gas/FO shortage, both Parties blame each other for Plant not being able to produce Electricity

17/20

Resolutions can take years and usually end up in IPPs comprising in return for payment of overdue receivables

This is the major Reason IPPs prefer investing in Plants based on Imported Fuels. It can be Imported with ease

PRICE DOES NOT MATTER AS IT IS A PASS THROUGH ITEM

18/20

This is the major Reason IPPs prefer investing in Plants based on Imported Fuels. It can be Imported with ease

PRICE DOES NOT MATTER AS IT IS A PASS THROUGH ITEM

18/20

This sector is unpopular due to its cashflow uncertainties and heavy involvement of Govt, but if one looks closely there is minimal risk apart from timing of receivables.

Hence building a decent Margin of Safety is key. Take advantage of this Sector being out of Favour

19/20

Hence building a decent Margin of Safety is key. Take advantage of this Sector being out of Favour

19/20

Invest with a 5 year Time Horizon. Wait for Prices to be at least 40-50% of Fair Value to compensate for 2-3 years of waiting for receiving payments from Govt which are paid as Dividends.

Dividend Tax is 7.5% on IPPs instead of 15%

Share & RT

Thank you 😊

20/20

Dividend Tax is 7.5% on IPPs instead of 15%

Share & RT

Thank you 😊

20/20

@Sabbandkardo

@PseudoEconomist

@arafayzafar

@FaizanKamran1

@AzamAKhan2

@ahfazmustaf

@rogueonomist

@samigodil

What do you guys think about this Sector ??

@PseudoEconomist

@arafayzafar

@FaizanKamran1

@AzamAKhan2

@ahfazmustaf

@rogueonomist

@samigodil

What do you guys think about this Sector ??

• • •

Missing some Tweet in this thread? You can try to

force a refresh