Stoke City’s 2020/21 accounts covered a season when they finished 14th in the Championship under manager Michael O’Neill, one place better than the previous season, but the third year in a row they have finished in the bottom half of the table. Some thoughts follow #SCFC

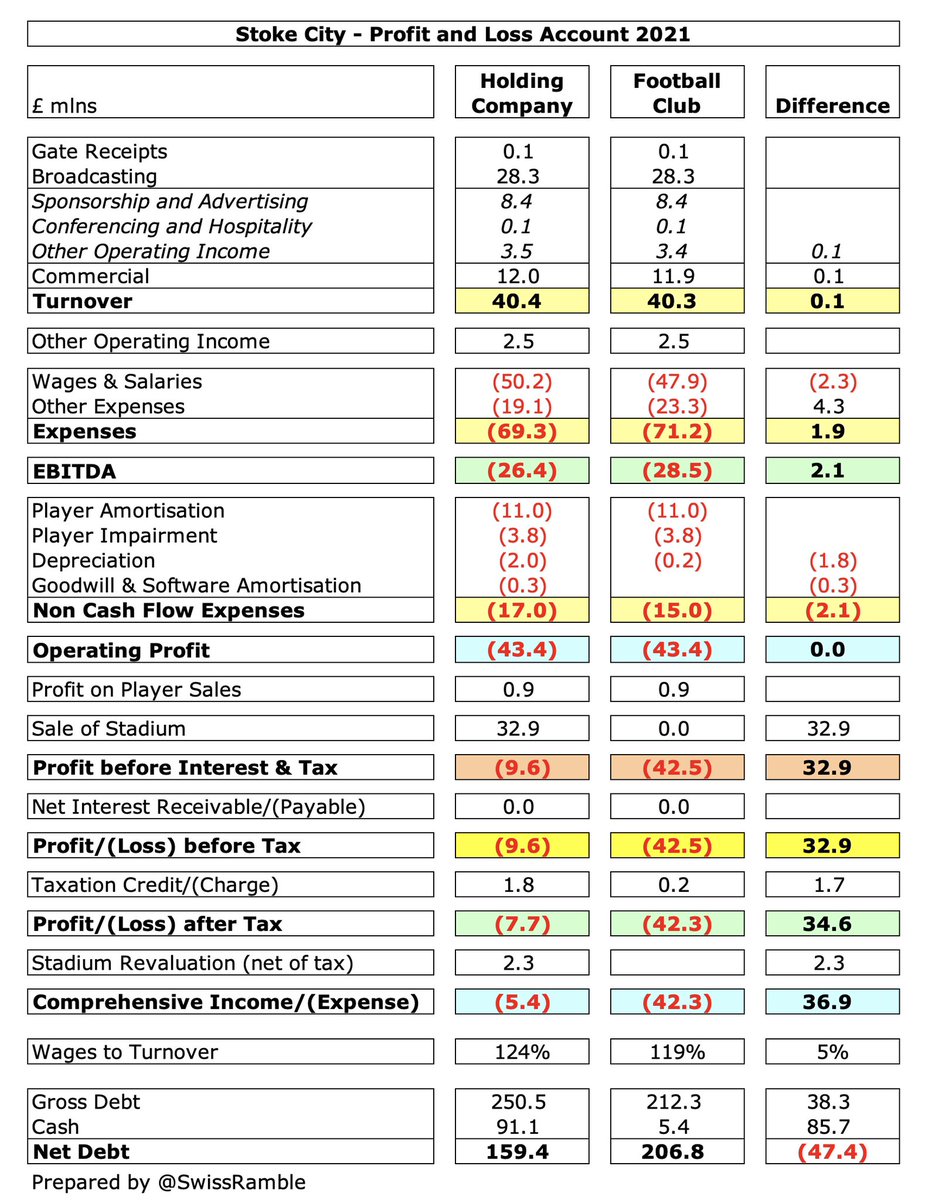

#SCFC pre-tax loss narrowed from £88m to £10m, despite revenue falling £10m (19%) from £50m to £40m and profit on player sales decreasing £2m to £1m, as they made £33m profit on the sale of stadium and training ground. Operating expenses down £55m (39%). Loss after tax was £8m.

As a technical aside, these figures relate to Stoke City Holdings Ltd. The pre-tax loss in the football club was much higher at £43m, mainly because those accounts do not include the £33m profit from the sale of the stadium and training ground.

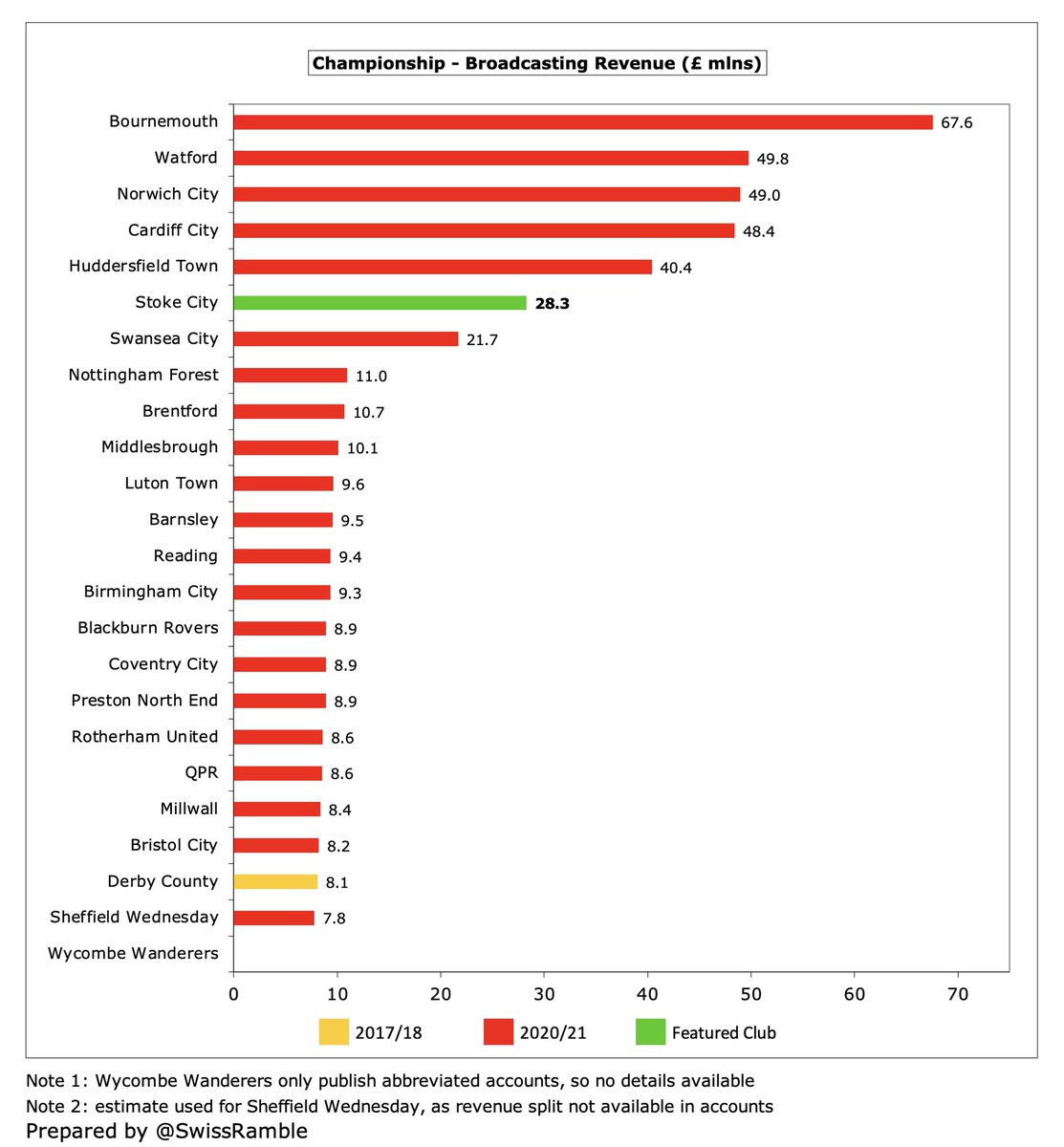

Main reason for #SCFC £10m revenue decrease was COVID, which drove reductions in match day, down £4.7m (97%) to just £121k, and commercial, down £1.9m (14%) to £12.0m. Broadcasting fell £2.9m (9%) to £28.3m, as lower parachute payment partly offset by deferred 2019/20 revenue.

#SCFC only cut the wage bill by £5m (8%) from £55m to £50m, but there were huge reductions in player amortisation, down £19m (64%) from £30m to £11m, and player impairment, down £39m (91%) from £43m to £4m. However, other expenses rose £7m (62%) to £19m.

Thanks to the asset sales, #SCFC “only” reported a £10m loss, but that was still in the bottom half of the Championship. Five clubs had losses above £20m, led by Bristol City £38m, but Stoke would have had the worst deficit in the division (i.e. £43m) without the property sales.

#SCFC figures were significantly hit by the COVID pandemic, which has resulted in money lost from matches played behind closed doors, partly offset by revenue for games played after the 31st May 2019/20 accounting close being deferred to 2020/21 accounts.

#SCFC COVID impact in 2002/21 was £19m (revenue loss £9m, cost savings £2m & missed player sales due to depressed transfer market £11m). Total loss over last 2 years was £57m, including £30m player impairment and £4m extra costs in 2019/20 (e.g. not utilising furlough scheme).

#SCFC profit from player sales fell from £3.1m to just £0.9m, mainly Jack Butland to #CPFC. Miles below the player trading profits at the three clubs relegated from the Premier League the previous season: #NCFC, #AFCB and Watford (£56m to £60m).

Following four consecutive years of (small) profits between 2014 and 2017, #SCFC have now posted losses four years in a row, adding up to a hefty £143m in total (£176m excluding the stadium/training ground sale). The £88m loss in 2019/20 was the highest ever in the Championship.

#SCFC made £33m from selling assets to parent bet365 in advance of 1 July 2021 deadline before such transactions are excluded from FFP: stadium (proceeds £70m, profit £28m) and training ground (proceeds £15m, profit £5m). Other clubs had already done similar, e.g. #DCFC & #SWFC.

#SCFC only made £4m profit from player sales in the last two years, a tenth of the £40m they generated in the preceding two-year period. However, this season will be around £12m, thanks to Nathan Collins to Burnley and Sam Surridge to #NFFC, though many left on free transfers.

#SCFC operating loss (excluding player sales & stadium sale) fell from £92m to £43m, thanks to lower player impairment, though still one of the worst performances in the Championship. That said, most clubs in this division posts substantial operating losses with ten above £30m.

Since relegation from the Premier League, #SCFC revenue has dropped by £87m (68%) from £127m in 2018 to £40m, very largely due to less TV money in the Championship (£73m decrease), though gate receipts and commercial are also down £8m and £7m respectively.

#SCFC revenue decline has been cushioned by Premier League parachute payments, though these have fallen in each of the three years since relegation: 2019 £43m, 2020 £34m and £2021 £15m. Last season was the final tranche, so 2021/22 revenue will be even lower.

Even after the decrease, #SCFC £40m revenue was still 6th highest in the 2020/21 Championship, though a fair way below the clubs receiving the largest parachute payments (#AFCB £72m, #NCFC £57m and Watford £57m).

#SCFC broadcasting income fell £3m (9%) from £31m to £28m, as the lower parachute payment was partly offset by revenue deferred from 2019/20 for games played after 31 May close. Most Championship clubs receive £8-10m TV money, but a huge gap to clubs benefiting from parachutes.

#SCFC commercial revenue fell £2m (14%) from £14m to £12m, as decrease in conference & hospitality (due to COVID) was offset by higher sponsorship. Highest in the Championship in 2020/21 by some distance, well ahead of #NCFC and Bristol City (both around £8m).

Of course, #SCFC benefit from a good commercial agreement with their owner bet365 (shirt sponsorship and stadium naming rights). In addition, the Macron kit supplier deal has been extended to 2024.

#SCFC gate receipts fell £4.7m (97%) to just £121k, as all home games were played behind closed doors. Revenue was 9th highest in the Championship before the pandemic in 2019 with £6.4m, although that was down from the £8.4m peak in 2016 (in the Premier League).

#SCFC average attendance (for games played with fans) was 22,824 in 2019/20, so had dropped 6,500 since relegation, but was still 6th highest in the Championship. Ticket prices for 2022/23 were frozen, so they have been held at the same level for an incredible 15 years.

#SCFC had £2.5m other operating income, thanks to a business interruption claim. The highest in the Championship were #AFCB £5.0m (including £1.8m player loans) and #Boro £4.6m.

#SCFC wage bill fell £5m (8%) from £55m to £50m, which means wages have almost halved from £94m in the three years since relegation. This is the club’s lowest wage bill since £47m in 2011. Will further fall after departure of some high earners last summer.

Despite the decrease #SCFC £50m wage bill was still 4th highest in the Championship, only surpassed by the three clubs most recently relegated from the Premier League. Stoke have enjoyed three of the top 20 wages ever in this division, so have clearly underperformed.

#SCFC wages to turnover ratio increased from 110% to 124%, though this was still only mid-table in the Championship, where the vast majority of clubs have unsustainable ratios well above 100% (with six of them over 200%). Stoke’s ratio was as low as 62% in the Premier League.

#SCFC directors’ remuneration fell 21% from £834k to £662k, which was 6th highest in the Championship. This was all for one director, almost certainly chief executive Tony Scholes, though other directors are paid via bet365 Group Ltd and Hillside (Shared Services 2018) Ltd.

#SCFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell significantly by two-thirds from £30m to £11m, the club’s lowest since 2009, but still 8th highest in the Championship. Reduction largely due to previous player impairment.

#SCFC player impairment fell from £43m to £4m, but they have booked £77m of impairment in last 4 years, including £30m attributed to the pandemic. Stoke said this was in line with EFL guidelines, but no other club in the Championship has had more than £6m in last two years.

#SCFC spent £5m on player purchases, mainly Jacob Brown from Barnsley. This was less than half the previous season and Stoke’s lowest outlay since 2015. Still in the Championship’s top ten, but less than a quarter of Brentford, #NCFC and Watford (all between £21m and £22m).

#SCFC have spent relatively little on new players in the last two seasons (and only £5m in 2021/22), which is in stark contrast to the four years between 2016 and 2019, when their gross spend averaged a chunky £58m, including an incredible £67m in the first year after relegation.

#SCFC gross debt in the football club increased by £25m from £187m to £212m, all ultimately owed to the Coates family. The good news is that Stoke have no bank debt, but this “friendly” debt with their owners has shot up by £153m in the past five years.

#SCFC gross debt of £212m is by far the highest in the Championship, far above #AFCB £165m, #BRFC £152m and Watford £139m. In fact, in Stoke City’s holding company, the gross debt was even higher at a cool quarter of a billion.

However, since these accounts #SCFC have reduced holding company debt by £160m after writing-off £120m of shareholder loans and converting £40m of loans to equity “in order to comply with the Secure Funding requirement of the EFL’s Profitability & Sustainability rules”.

In fairness, the #SCFC debt picture is a little misleading, so long as the Coates family continues to provide support. The fact that their loans are interest-free gives Stoke a competitive advantage against a number of their rivals, who have to pay interest on their loans.

#SCFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this was reduced from £6m to just £2m, down from £39m just two years ago. Miles below the clubs recently relegated from the PL: Watford £62m, #AFCB £45m & #NCFC £23m.

#SCFC £43m operating loss became £17m negative cash flow after adding back non-cash movements, but club then spent £10m on players (purchases £11m, sales £1m) and £1m on infrastructure. Funded provided by £86m proceeds from sale of stadium & training ground plus £25m owner loan.

As a result, #SCFC cash balance increased by £83m to £91m in the holding company (though only £5m in the football club). Most clubs in this division have less than £3m cash in the bank, so this was a pretty good buffer in the current economic climate.

Since 2011 #SCFC have had available cash of £303m: (a) £195m from owners’ loans; (b) £86m from property sales; (c) £22m operating activities (negative in last 4 years). The majority was spent on the squad (£223m), albeit with mixed results, with £74m increasing the cash balance.

#SCFC have spent very little on infrastructure, but they have recently announced a £20m five-year redevelopment programme at the stadium and training ground. More than £4m will be invested this summer, including the installation of 8,400 seats.

I reckon that the Coates family have pumped £338m into #SCFC since regaining control of the club in 2006, comprising loans £251m, share capital £2m and £86m payment for the sale of the stadium and training ground.

Excluding the property sale proceeds, the Coates family have put in £195m of funding in last 10 years. That’s a lot of money, only surpassed by QPR £283m in the Championship, though fans will note that this great commitment has not always produced results on the pitch.

#SCFC were “there or thereabouts” in terms of meeting FFP, though only thanks to the sale of the stadium and training ground. The club can exclude academy, community & infrastructure costs plus COVID losses, while averaging the two seasons impacted by the pandemic (19/20 & 20/21)

The FFP result is OK even if we restrict the COVID losses to only £5m in each of 2019/20 and 2020/21, as per the EFL’s rule changes announced in February 2022. Note that this is considerably lower than the COVID losses reported by #SCFC “in accordance with EFL guidance”.

However, #SCFC are likely to be facing bigger FFP challenges now, as the 2022 three-year monitoring period will drop the last season in the Premier League, so the allowable loss will fall from £61m to £39m (the £42m loss for 2019 and 2020/21 average is already higher than this).

#SCFC owners can be praised for their financial support, but the other side of the coin is sporting success, and mistakes have clearly been made. As John Coates said, “On the field, the last four or five years have not proved to be as successful as any of us would have hoped.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh