About -

Meghmani Finechem Limited (MFL) is part of the Ahmedabad based Meghmani Group. It was incorporated in 2007 as a subsidiary of Meghmani Organics Ltd (MOL) but was demerged in April 2021. The co is primarily engaged in manufacturing & selling of Chlor Alkali & its

Meghmani Finechem Limited (MFL) is part of the Ahmedabad based Meghmani Group. It was incorporated in 2007 as a subsidiary of Meghmani Organics Ltd (MOL) but was demerged in April 2021. The co is primarily engaged in manufacturing & selling of Chlor Alkali & its

Derivatives with backward & forward integration facilities & also engaged in trading of Agrochemical products.

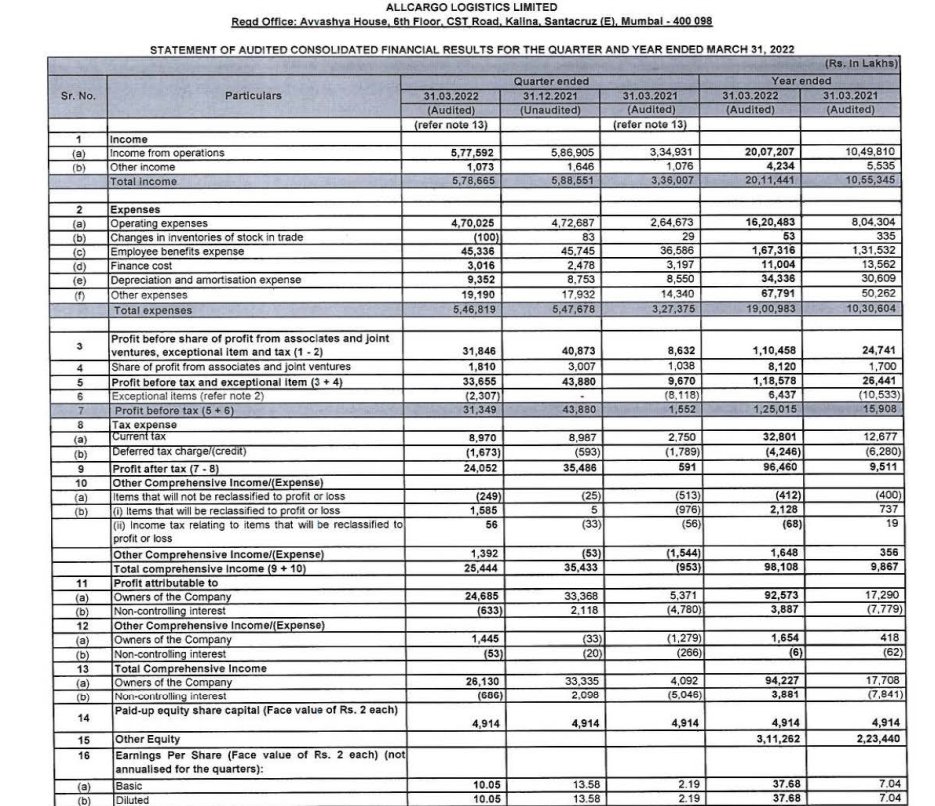

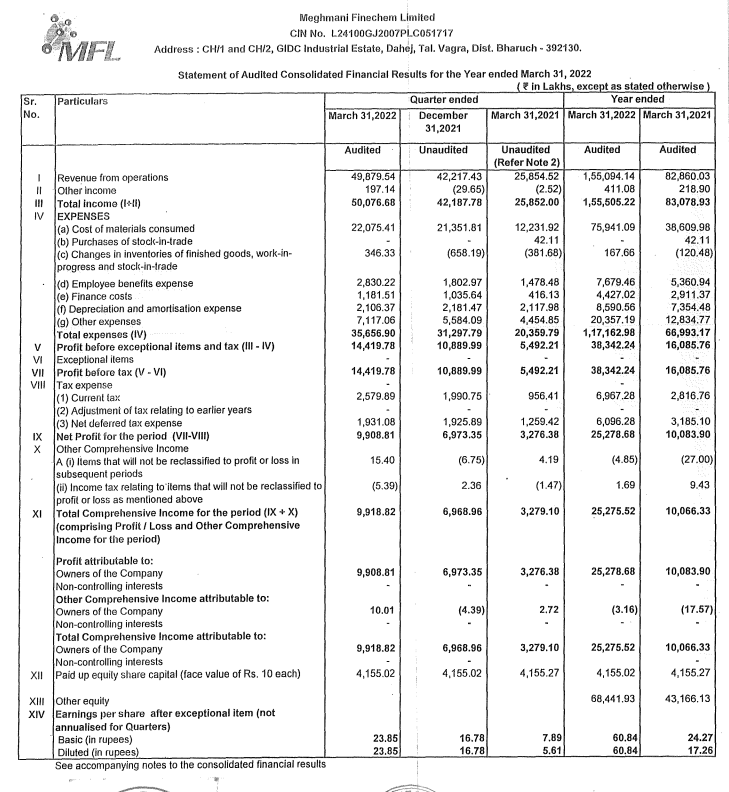

Financial Summary -

Q4FY22 (YoY)

Revenue at ₹ 501cr ⬆️94%

PAT at ₹99cr ⬆️202%

EPS at ₹23.85 ⬆️325%

Financial Summary -

Q4FY22 (YoY)

Revenue at ₹ 501cr ⬆️94%

PAT at ₹99cr ⬆️202%

EPS at ₹23.85 ⬆️325%

Product Portfolio :

▪️ Caustic Soda (NaOH) -

• Co is 4th largest producer in India

• Caustic Soda is basic raw material & caters to

many industries like alumina, textile, chemical etc

• Demand for Caustic Soda is expected to increase to

4.8 million ton by FY2025

▪️ Caustic Soda (NaOH) -

• Co is 4th largest producer in India

• Caustic Soda is basic raw material & caters to

many industries like alumina, textile, chemical etc

• Demand for Caustic Soda is expected to increase to

4.8 million ton by FY2025

• Co-products are key raw material for our value

added downstream products (CMS, H2O2, ECH

and CPVC)

▪️ Caustic Potash (KOH) -

• Co is 3rd largest producer in India

• Caustic Potash is majorly consumed in soap &

detergent, agrochemical & pharmaceutical

industry

added downstream products (CMS, H2O2, ECH

and CPVC)

▪️ Caustic Potash (KOH) -

• Co is 3rd largest producer in India

• Caustic Potash is majorly consumed in soap &

detergent, agrochemical & pharmaceutical

industry

• Co-products are key raw material for our value

added downstream products (CMS, H2O2, ECH and

CPVC)

▪️ Chloromethanes (CMS) -

• Co is 5th largest producer in India

• CMS plant produces 3 products, MDC, Chloroform

& CTC.

added downstream products (CMS, H2O2, ECH and

CPVC)

▪️ Chloromethanes (CMS) -

• Co is 5th largest producer in India

• CMS plant produces 3 products, MDC, Chloroform

& CTC.

• CMS is used majorly in pharmaceutical, refrigerant,

Tetrafluoroethylene (TFE), etc.

▪️ Hydrogen Peroxide (H2O2) -

• Co is 3rd largest producer in India

• H2O2 demand will grow driven by

diverse industrial uses – paper & pulp, textiles,

effluent treatment, chemicals, etc.

Tetrafluoroethylene (TFE), etc.

▪️ Hydrogen Peroxide (H2O2) -

• Co is 3rd largest producer in India

• H2O2 demand will grow driven by

diverse industrial uses – paper & pulp, textiles,

effluent treatment, chemicals, etc.

New Products – Specialty Chemicals :

▪️ CPVC Resin -

• Once commissioned, we will be largest producer

• Key raw material for heat resistant pipes

• Antidumping duty Imposition on Imports from China

and Korea creating opportunity for domestic Market.

▪️ CPVC Resin -

• Once commissioned, we will be largest producer

• Key raw material for heat resistant pipes

• Antidumping duty Imposition on Imports from China

and Korea creating opportunity for domestic Market.

• 95% of CPVC resin demand is served through import

▪️ Epichlorohydrin (ECH) -

• 1st co in India to produce sustainable bio based ECH

• Competitive advantage due to captive raw materials

• Estimated Capex ₹ 270 Cr, with a capatiy of 50

KTPA

▪️ Epichlorohydrin (ECH) -

• 1st co in India to produce sustainable bio based ECH

• Competitive advantage due to captive raw materials

• Estimated Capex ₹ 270 Cr, with a capatiy of 50

KTPA

Research & Development Centre -

Co building a R&D center in Ahmedabad. Capex for the project is ₹ 25 Cr. It will be used for creating further molecules for Chlorotoluene & other new

molecules, which will be intermediates for pharma & agrochemical active ingredients.

Co building a R&D center in Ahmedabad. Capex for the project is ₹ 25 Cr. It will be used for creating further molecules for Chlorotoluene & other new

molecules, which will be intermediates for pharma & agrochemical active ingredients.

Growth Strategy -

• Co explore opportunities in various High-growth sectors

• Co wants to scale up capacities in existing products

• Co wants to increase presence & improve market share

• Expand chemistry expertise to enter new value chains (specialty chemicals)

• Co explore opportunities in various High-growth sectors

• Co wants to scale up capacities in existing products

• Co wants to increase presence & improve market share

• Expand chemistry expertise to enter new value chains (specialty chemicals)

• Co expects to achieve revenue of ₹ 5,000 Cr by FY2027

Key Risks -

• High dependence on the intensely competitive chlor alkali industry dominated by large players such as Gujarat Alkalis, DCM Shriram, Grasim Industries & Reliance Industries Ltd

Key Risks -

• High dependence on the intensely competitive chlor alkali industry dominated by large players such as Gujarat Alkalis, DCM Shriram, Grasim Industries & Reliance Industries Ltd

• Vulnerability to fluctuations in caustic soda prices and regulatory risk

Conclusion -

Co's business risk profile will continue to benefit from diversification in product profile with increased proportion of revenues expected to come from chlorine derivatives. Further,

Conclusion -

Co's business risk profile will continue to benefit from diversification in product profile with increased proportion of revenues expected to come from chlorine derivatives. Further,

integrated nature of operations with healthy operating leverage should support operating efficiencies going forward.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful

• • •

Missing some Tweet in this thread? You can try to

force a refresh