I don't have blind faith oil will stay strong, and I acknowlede the oil market is rightly considered as somewhat opaque. There are two factors giving me confidence:

1) Crack spreads (record highs)

2) VLCC rates (near record lows)

#OOTT #COM #EFT $XLE $XOP $OIH $CL_F

1) Crack spreads (record highs)

2) VLCC rates (near record lows)

#OOTT #COM #EFT $XLE $XOP $OIH $CL_F

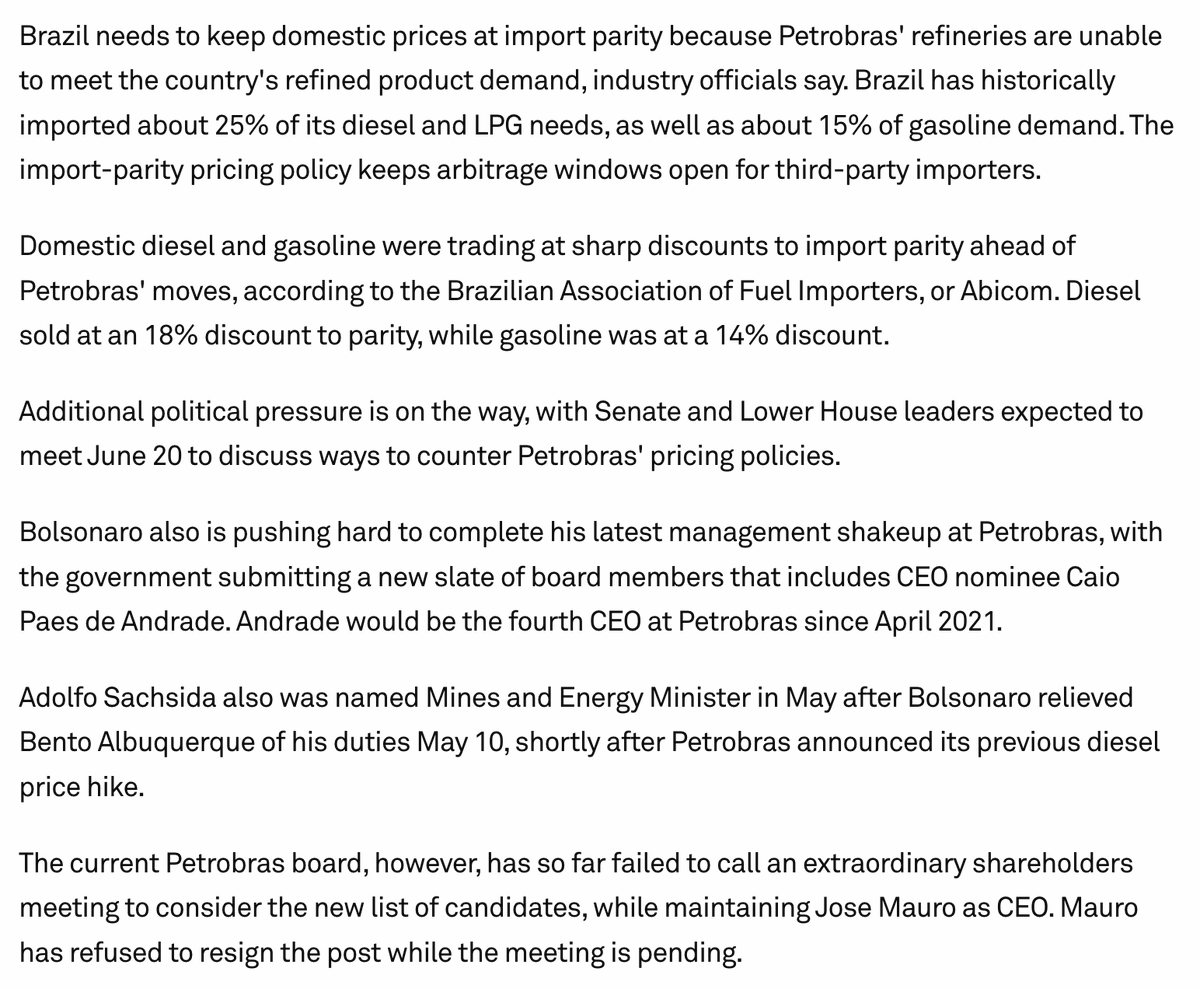

So first on crack spreads. This is your sanity check on "is demand destruction occurring". The crack spread is the difference between the price of crude and the price of products like gasoline and diesel. At incredible, historic, world beating levels.

What does this imply?

What does this imply?

Basically, that refineries have zero incentive to slow down. They cannot meet consumer demand. So fuel margins are at record highs. As long as this persists, refiners, the main buyer of crude, have a historic incentive to not only buy, but to bring more capacity online. Anything.

The other factor, low VLCC rates, combined with big backwardation in the futures structure, shows that floating storage is low and supply of crudd is insufficient.

Usually, VLCCs do best in an over supplied market, especially a contango structure, where on shore storage fills.

Usually, VLCCs do best in an over supplied market, especially a contango structure, where on shore storage fills.

Best years in recent memory for VLCCs were 2020 (super contango), 2019 (floating storage build up for #IMO2020 transition), and 2015 (contango). You might notice two of these years coincide with materially lower oil prices.

I've said often don't sell oil till VLCC rates good.

I've said often don't sell oil till VLCC rates good.

Which brings up another point: VLCCs are paradoxically a great hedge to a weakening oil macro. When market moves into contango, VLCC earnings improve as tonnage is taken out of the trading fleet for storage.

Anyway, of course there are other factors, but these are two things you can look at which are easy to verify and impossible to manipulate, both representing a hyper competitive, global, and mostly physical market, as opposed to oil futures or equities which are largely financial.

Btw sorry for typos...phone

Here are some charts which illustrate oil market dynamics well.

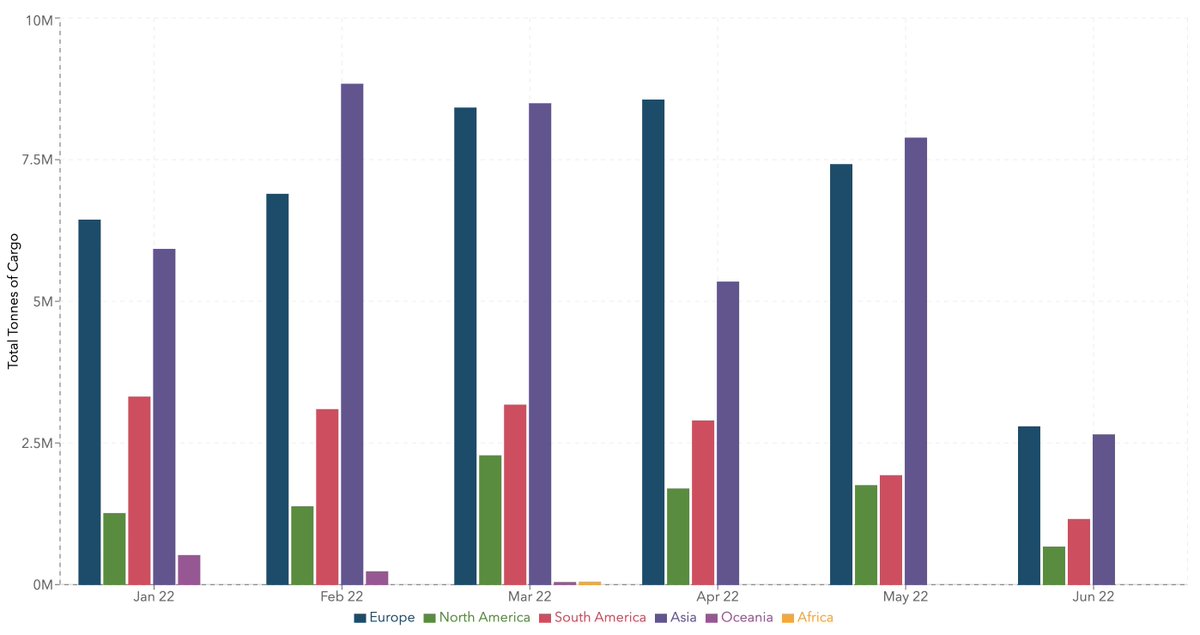

Tonne miles for VLCCs are still closw to the lows - this means supply crashed during covid and still hasn't recovered.

Fleet has grown, but this has nothing to do with export activity.

Tonne miles for VLCCs are still closw to the lows - this means supply crashed during covid and still hasn't recovered.

Fleet has grown, but this has nothing to do with export activity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh