7/13:

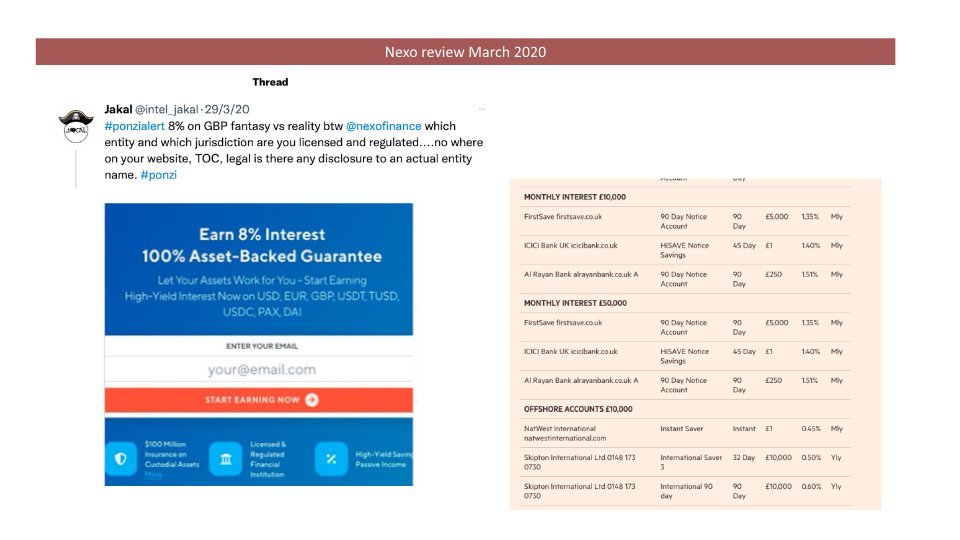

Nexo review March 2020 (cont.)

Next up ….

15-minute drill down into a couple of Nexo entities that I could easily source.

But wait….there’s more

Nexo review March 2020 (cont.)

Next up ….

15-minute drill down into a couple of Nexo entities that I could easily source.

But wait….there’s more

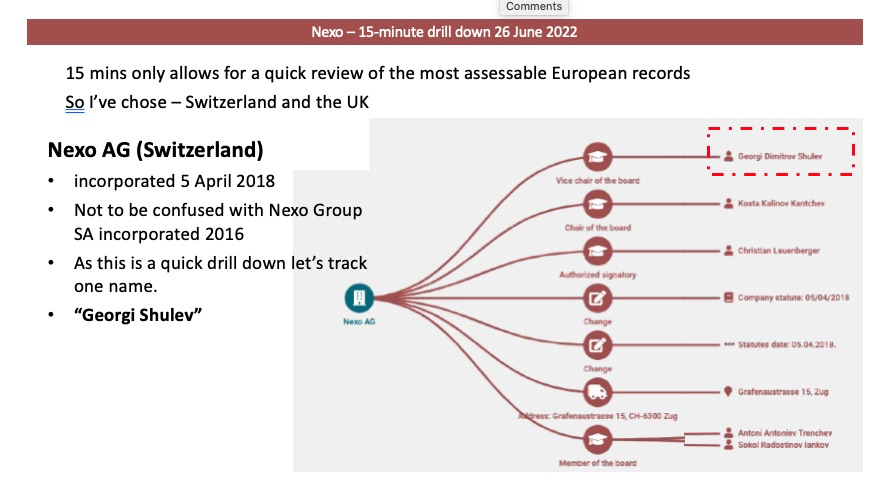

Let's review Nexo AG the Swiss company setup in 2018. As I only gave my self 15 mins to drill into Nexo..lets focus on one name "Georgi Shulev"

Lets flip over to Nexo's UK entities incorporated mid 2020 (note the timing....only a couple of months after ripping through their flimsy TOS).

Note: Shulev is not part of Nexo UK but there's this other entity NPEM Ltd

Note: Shulev is not part of Nexo UK but there's this other entity NPEM Ltd

Two Nexo Directors and a former are related to NPEM so what is it? Well essentially a UK shell with 5k in assets and a static web page built on Wix......

npemservices.com

Lets put that aside and see if we can find what Shulev is up to.

npemservices.com

Lets put that aside and see if we can find what Shulev is up to.

So looks like since beginning of 2021 he's been working on a company called #finblox .... I vaguely recognised the name.

#finblox is well and truely cooked @davidgerard has already stuck the fork in. I'm soo late to the party on this.

What does it mean for #nexo.....I'll have. another look tomorrow but its hard to see how they aren't exposed as every other participant in the perpetual motion rehypothetication shitshow.

Nexo AG, Defendant

Nexo Capital Inc., Defendant

Nexo Financial LLC, Defendant

Nexo Financial Services Ltd., Defendant

Nexo Services OU, Defendant

Worth a read.....

storage.courtlistener.com/recap/gov.usco…

Nexo Capital Inc., Defendant

Nexo Financial LLC, Defendant

Nexo Financial Services Ltd., Defendant

Nexo Services OU, Defendant

Worth a read.....

storage.courtlistener.com/recap/gov.usco…

Followed by this #nexo Jan 2022

ORDER GRANTING IN PART AND DENYING IN PART MOTION TO DISMISS

govinfo.gov/content/pkg/US…

ORDER GRANTING IN PART AND DENYING IN PART MOTION TO DISMISS

govinfo.gov/content/pkg/US…

• • •

Missing some Tweet in this thread? You can try to

force a refresh