Updated the stablecoin depeg bingo for the month of June with #flexUSD from @CoinFLEXdotcom

PS if you want to be added to this prestigious leaderboard you need >50M circulating supply

PS if you want to be added to this prestigious leaderboard you need >50M circulating supply

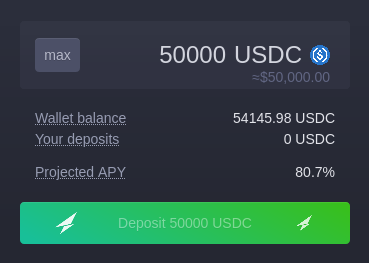

flexUSD is backed by USDC, they are used by users to trade on margin on the platforms (mostly perp swaps)

https://twitter.com/CoinFLEXdotcom/status/1538829726210330625

Few days ago, the platform blocked withdrawals citing problems with a counterparty ("not 3AC or any lending firm")

https://twitter.com/CoinFLEXdotcom/status/1540132881552781312

Could be a trading counterparty sitting on large unrealized negative pnl? so large the platform does not have enough liquid assets to meet withdrawals?

We need to wait for more details to find it out.

We need to wait for more details to find it out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh