1. With the June Acreage report up on Thursday, good time to review what we know about revisions to USDA planted acreage estimates. My latest #FDD article.

https://twitter.com/FarmPolicy/status/1541748593379393540

2. Important first finding. Revisions to USDA March Prospective Plantings estimates are unbiased for major crops and total principal crops. Average revisions from March-January very, very close to zero. In other words, statistically unbiased.

3. Unbiased does not mean unchanging. Not unusual for corn planted acreage revisions to be up or down as much as 2 million acres. That matters to the market. Key is that ups and downs tend to offset over time.

4. Here is the weirdest finding. One of the bigger puzzles I know about for any USDA estimate. March acreage estimates should NOT be unbiased after considering prevented plant acres, but they are. In other words, Mar - Jan = PP (on average). But this is not the way it works.

5. All else constant, if PP is 4 million acres, then final Jan estimate for corn should be less than Mar by 4 million. Historically, Jan only falls by 1.2 million acres. What gives? Its as if farmers include some PP in March acreage intentions but don't tell the USDA.

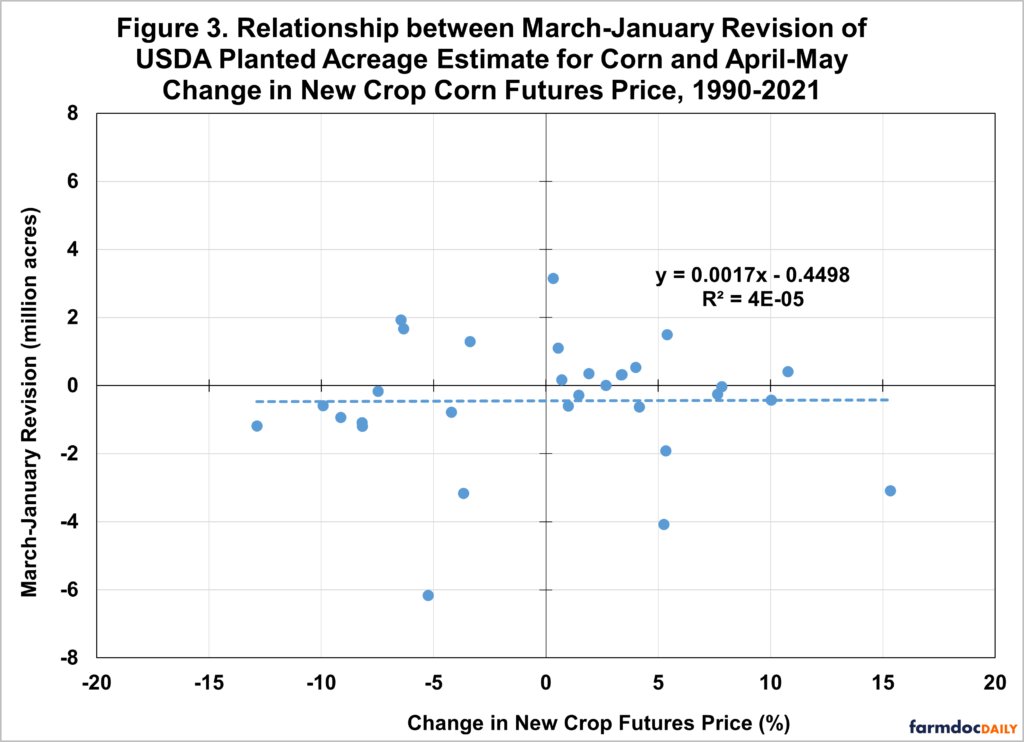

6. Always talk every year about the market buying this or that crop acres after the March Prospective plantings report. I have tried many price variables and I cannot find any useful relationships that match the market chatter.

7. Its possible that price relationships are more subtle than I what I tested. Still have to conclude it is very hard to predict USDA planted acreage revisions based on market data.

8. Last but not least, Mar-Jun acreage revision dominates later revisions to estimates. Roughly 80-90% of total Mar-Jan revision explained by Mar-Jun revision. Implication: June Acreage report is the big show in terms of revisions to USDA planted acreage estimates.

9. So, what will it be this Thursday? My research says the only responsible answer is I don't know the direction or magnitude of revisions coming up, but I do know they will likely be market moving. Buckle up. farmdocdaily.illinois.edu/2022/06/what-d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh