#Blinkit & #Zomato – Long thread:

1/n

Blurred to Opaque to Muddy

How to leverage a listed company to recover losses from failed ventures/adventures?

Danny DeVito famously said in namesake movie – There is only one thing I love more than my money -

"other people’s money"

1/n

Blurred to Opaque to Muddy

How to leverage a listed company to recover losses from failed ventures/adventures?

Danny DeVito famously said in namesake movie – There is only one thing I love more than my money -

"other people’s money"

2/n

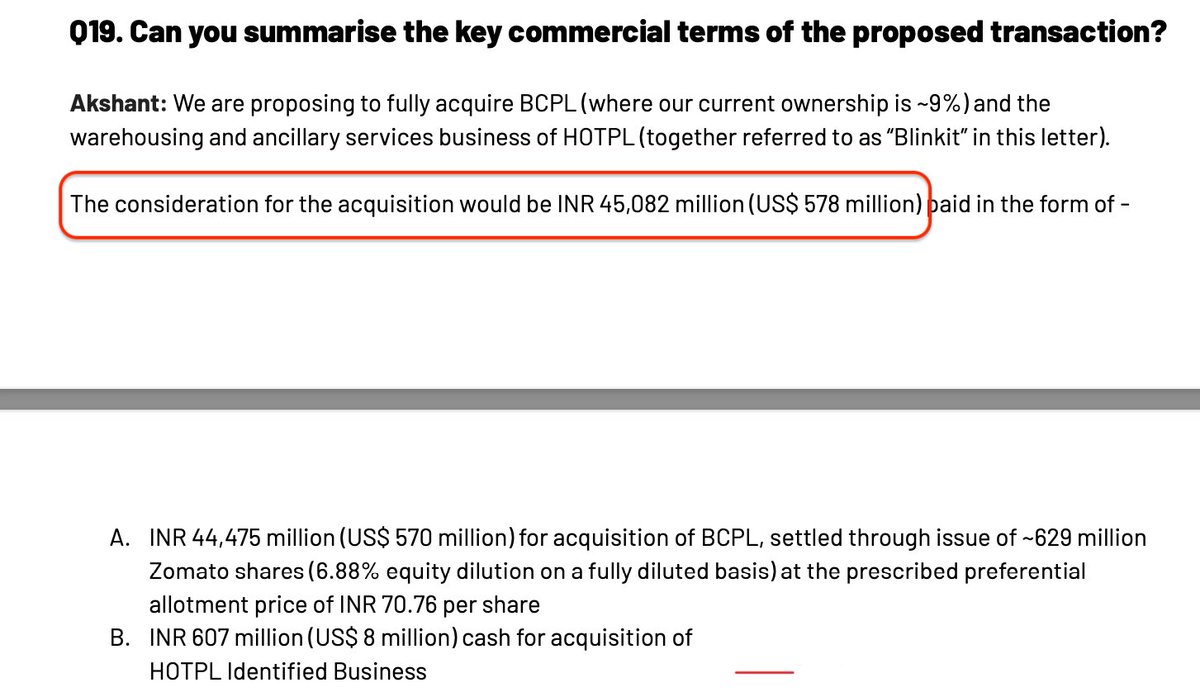

Zomato announced that it plans to acquire Blinkit for a “consideration” of $ 578 Mn. We will revisit valuation later. Below is the snapshot of financials.

Who pays $578 Mn on unaudited financials of just 2 mths ? Not even even 1 quarter nos are provided.

@SEBI listening?

Zomato announced that it plans to acquire Blinkit for a “consideration” of $ 578 Mn. We will revisit valuation later. Below is the snapshot of financials.

Who pays $578 Mn on unaudited financials of just 2 mths ? Not even even 1 quarter nos are provided.

@SEBI listening?

3/n

Is the company really growing topline at 162% as claimed ? This invites some curiosity. Where are the past YoY nos ?

I tried to dig out what I could with public reported info. Here is what the past looks like for #Blinkit .Revenues touched Rs 177 Cr in FY 2020 before covid

Is the company really growing topline at 162% as claimed ? This invites some curiosity. Where are the past YoY nos ?

I tried to dig out what I could with public reported info. Here is what the past looks like for #Blinkit .Revenues touched Rs 177 Cr in FY 2020 before covid

4/n

As quoted by the founders, pandemic “accelerated path to profitability” for Grofers & it was planning a listing by FY 2021.

No surprise the Rev. grew in FY’20, never mind the loss of Rs 637 Cr to “earn” a revenue of Rs 177 Cr.

As quoted by the founders, pandemic “accelerated path to profitability” for Grofers & it was planning a listing by FY 2021.

No surprise the Rev. grew in FY’20, never mind the loss of Rs 637 Cr to “earn” a revenue of Rs 177 Cr.

5/n

Building narratives is a part of startup playbook. Delivering on guidance…. not important. After all who’s tracking ?

Have a glimpse of the narratives built for planned listing:

2019 – “We’re on track to deliver GMV of Rs 5000 Cr in FY’20”

Actual number ? Try searching !

Building narratives is a part of startup playbook. Delivering on guidance…. not important. After all who’s tracking ?

Have a glimpse of the narratives built for planned listing:

2019 – “We’re on track to deliver GMV of Rs 5000 Cr in FY’20”

Actual number ? Try searching !

6/n

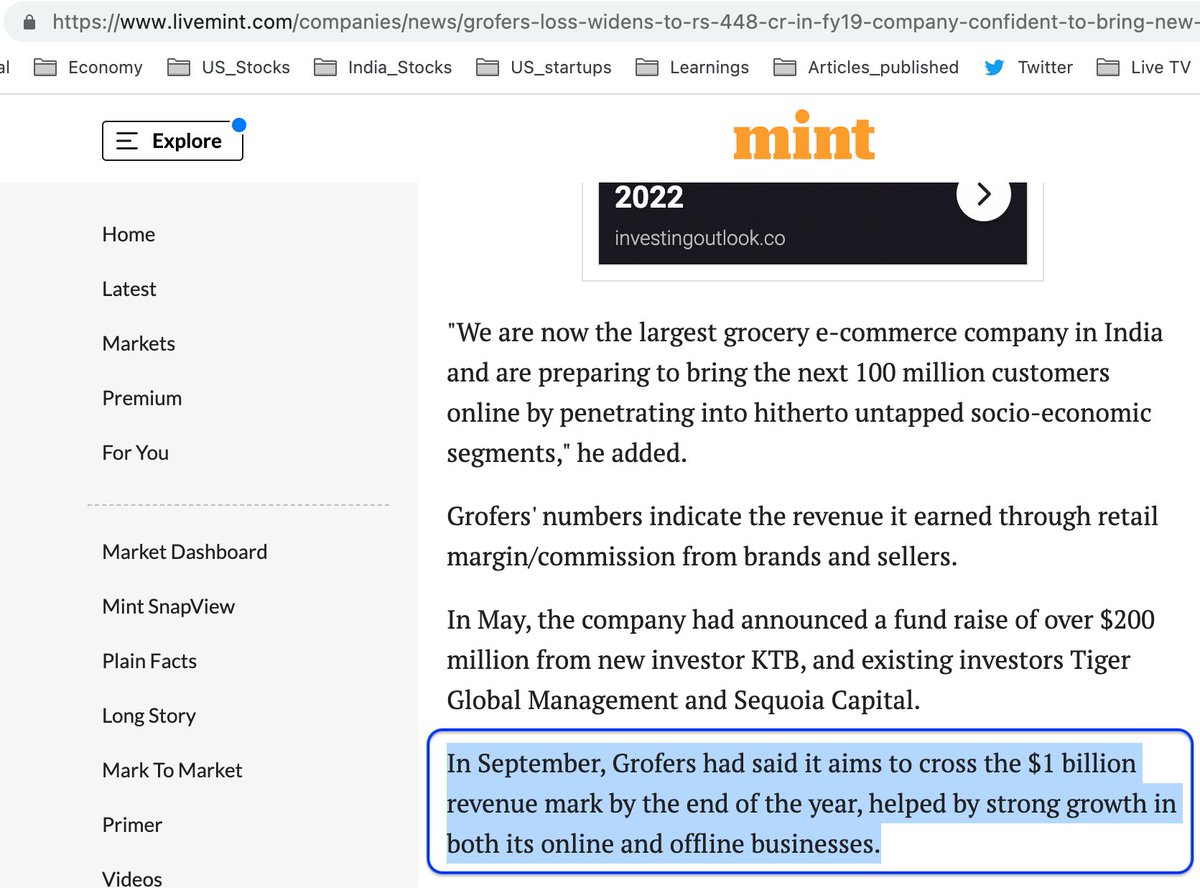

2020 – Another bullish guidance:

“Grofers aims to reach $ 1 BN (Rs 7800 Cr) GOV by end of 2020”.

Actual achievement ? Try searching !

They haven’t achieved even half of this in latest reported numbers for 2022.

2020 – Another bullish guidance:

“Grofers aims to reach $ 1 BN (Rs 7800 Cr) GOV by end of 2020”.

Actual achievement ? Try searching !

They haven’t achieved even half of this in latest reported numbers for 2022.

7/n

2021 – Another year, another guidance.

“Grofers is expecting to touch Rs 10,000 Cr by March 2021 as covid accelerated shift to e-commerce”.

Actual numbers ? Try searching !

Who's tracking?

2021 – Another year, another guidance.

“Grofers is expecting to touch Rs 10,000 Cr by March 2021 as covid accelerated shift to e-commerce”.

Actual numbers ? Try searching !

Who's tracking?

8/n

2022 – the bull takes a breather. So it scaled down to its earlier projection of $ 1 BN GMV.

Dec 2021 – “Current GMV run rate is $ 600 Mn(Rs 4680 Cr) & aiming to hit annualized GMV of $ 1 BN for FY'22”

Notice that it is “monthly run rate”, not actual sales for the year.

2022 – the bull takes a breather. So it scaled down to its earlier projection of $ 1 BN GMV.

Dec 2021 – “Current GMV run rate is $ 600 Mn(Rs 4680 Cr) & aiming to hit annualized GMV of $ 1 BN for FY'22”

Notice that it is “monthly run rate”, not actual sales for the year.

9/n

Enter June 2022.

May be it was time to disclose something in “actual numbers” since Blinkit is getting acquired by a listed company. What does the company disclose ? Jan & May’22 nos only.

Why do you need anything more for "just" $ 578 Mn acquisition?

Enter June 2022.

May be it was time to disclose something in “actual numbers” since Blinkit is getting acquired by a listed company. What does the company disclose ? Jan & May’22 nos only.

Why do you need anything more for "just" $ 578 Mn acquisition?

10/n

Let’s save that trouble for #Zomato. Here is how the YoY financial snapshot looks like:

Extrapolating Jan 2022 financials for the year, we see:

Revenues grew 50% in FY’22 after years since FY’20

#Blinkit is spending Rs 2713 Cr (Jan nos. x12) to "sell" orders of Rs 3546 Cr

Let’s save that trouble for #Zomato. Here is how the YoY financial snapshot looks like:

Extrapolating Jan 2022 financials for the year, we see:

Revenues grew 50% in FY’22 after years since FY’20

#Blinkit is spending Rs 2713 Cr (Jan nos. x12) to "sell" orders of Rs 3546 Cr

11/n

More importantly, Blinkit is spending Rs 2448 Cr to “earn” a revenue of Rs 265 Cr. This for a company started in 2015.

2020 – Grofers says “it turned operationally profitable in 27 cities” with 2.6 Mn new customers.

2022 Jan - Blinkit has just 1.6 Mn active users

More importantly, Blinkit is spending Rs 2448 Cr to “earn” a revenue of Rs 265 Cr. This for a company started in 2015.

2020 – Grofers says “it turned operationally profitable in 27 cities” with 2.6 Mn new customers.

2022 Jan - Blinkit has just 1.6 Mn active users

12/n

2021: Grofers now says “it plans to achieve profitability in 2021”. Roadmap to list in 2021 is intact, so of course are the stories that need to go along.

Actual profitability numbers for FY 21 ? Not disclosed

2021: Grofers now says “it plans to achieve profitability in 2021”. Roadmap to list in 2021 is intact, so of course are the stories that need to go along.

Actual profitability numbers for FY 21 ? Not disclosed

13/n

2022 June: Post acquisition plan, the tone is much subtle.

#Zomato CFO says “Given the early stage of business, it is very hard to commit a timeline for profitability……..it is possible in next 3 yrs, but it is an educated guess, not a guidance”.

Bravo !

2022 June: Post acquisition plan, the tone is much subtle.

#Zomato CFO says “Given the early stage of business, it is very hard to commit a timeline for profitability……..it is possible in next 3 yrs, but it is an educated guess, not a guidance”.

Bravo !

14/n

Where does this brazen confidence come from ? This is where it turns from opaque to muddy.

#Zomato says the acquisition price is $ 578 Mn. Really ?

Zomato already had 9% stake. So valuation of Blinkit is higher.

Add to this another $ 150 Mn “loan” given in March 2020.

Where does this brazen confidence come from ? This is where it turns from opaque to muddy.

#Zomato says the acquisition price is $ 578 Mn. Really ?

Zomato already had 9% stake. So valuation of Blinkit is higher.

Add to this another $ 150 Mn “loan” given in March 2020.

15/n

So what does the valuation of Blinkit add up to?

$578 Mn +57 Mn +150 Mn – cash on B/S)

Total = $ 720 Mn.

This is the actual price paid by Zomato for Blinkit.

Do you now how much money has been raised & spent by Grofers & Blinkit since 2015 ?

You guessed it : $ 700 Mn.

So what does the valuation of Blinkit add up to?

$578 Mn +57 Mn +150 Mn – cash on B/S)

Total = $ 720 Mn.

This is the actual price paid by Zomato for Blinkit.

Do you now how much money has been raised & spent by Grofers & Blinkit since 2015 ?

You guessed it : $ 700 Mn.

16/n

So how was the valuation of Blinkit arrived at ?

$ 700 Mn has been sunk in Grofers/Blinkit since inception. All that money has to be recovered by VCs. Since listing plans got derailed, plan B is to take money out from one of their own listed entities.

Welcome #Zomato

So how was the valuation of Blinkit arrived at ?

$ 700 Mn has been sunk in Grofers/Blinkit since inception. All that money has to be recovered by VCs. Since listing plans got derailed, plan B is to take money out from one of their own listed entities.

Welcome #Zomato

17/n

You don't even need hard cash. Bonus shares of Zomato are issued with share dilution of ~8%.

$ 700 Mn of losses in a failed venture Grofers (#Blinkit) is recovered in one shot in form of shares of the listed entity #Zomato.

Well played !!

You don't even need hard cash. Bonus shares of Zomato are issued with share dilution of ~8%.

$ 700 Mn of losses in a failed venture Grofers (#Blinkit) is recovered in one shot in form of shares of the listed entity #Zomato.

Well played !!

18/n

Conclusion:

My concern is not with the promotors or VCs of #Zomato. After all they are in the business to make money & recover losses where they can.

My question is to the mutual funds who are investing retail money in such muddy ventures.

Conclusion:

My concern is not with the promotors or VCs of #Zomato. After all they are in the business to make money & recover losses where they can.

My question is to the mutual funds who are investing retail money in such muddy ventures.

19/n

#DoorDash in US is valued at $ 28 BN in a $ 25 TN economy. An Indian replica venture with much poor metrics can’t be worth $ 8 BN. Zomato looks overpriced by 3x.

See comparison below:

#DoorDash in US is valued at $ 28 BN in a $ 25 TN economy. An Indian replica venture with much poor metrics can’t be worth $ 8 BN. Zomato looks overpriced by 3x.

See comparison below:

n/n

Mutual funds who bought #Zomato are saying out loud –

We love to play with “Other people’s money”

I said this about #Paytm IPO in Nov'21. And it is worth repeating here:

If your mutual fund is still holding #Zomato

STOP that #SIP

Mutual funds who bought #Zomato are saying out loud –

We love to play with “Other people’s money”

I said this about #Paytm IPO in Nov'21. And it is worth repeating here:

If your mutual fund is still holding #Zomato

STOP that #SIP

• • •

Missing some Tweet in this thread? You can try to

force a refresh