Paras Defence and Space Technologies Analysis!!

#Parasdefence

A detailed thread 🪡🧵

#StockMarket #Investing

#Parasdefence

A detailed thread 🪡🧵

#StockMarket #Investing

About -

Paras Defence & Space Technologies is into designing, developing, manufacturing & testing a wide range of defence & space engineering products and solutions. It has 2 mfg. facilities in Maharashtra. It's main vertical is optics that services the military & space sectors.

Paras Defence & Space Technologies is into designing, developing, manufacturing & testing a wide range of defence & space engineering products and solutions. It has 2 mfg. facilities in Maharashtra. It's main vertical is optics that services the military & space sectors.

They are one of the leading Indigenously Designed Developed & Manufactured company in India which caters to 4 major segments of Indian defence

sector i.e. defence and space optics, defence electronics, electro-magnetic pulse “EMP” protection solution & heavy

engineerin.

sector i.e. defence and space optics, defence electronics, electro-magnetic pulse “EMP” protection solution & heavy

engineerin.

Location wise breakup -

Paras Defence earns 87.5% of their revenue from India, 12.5% from other countries.

Paras Defence earns 87.5% of their revenue from India, 12.5% from other countries.

Revenue breakup -

Paras earns 43.6% of it's revenue form Heavy Engeneering, 34.6% from Defence & Space Optics, 21.6% from Defence Electronics & EMP protection solution.

Paras earns 43.6% of it's revenue form Heavy Engeneering, 34.6% from Defence & Space Optics, 21.6% from Defence Electronics & EMP protection solution.

▪️ Heavy Engeneering

Under heavy engineering for defence operations category, they provide mechanical manufacturing support to other verticals

of their business. In addition, under this vertical, they provide heavy engineering products & solutions such as:

Under heavy engineering for defence operations category, they provide mechanical manufacturing support to other verticals

of their business. In addition, under this vertical, they provide heavy engineering products & solutions such as:

▪️ Defence & Space Optics

They manufacture high end optics for defence and space applications such as:

They manufacture high end optics for defence and space applications such as:

▪️ Defence Electronics

Company provide a wide array of computing and electronic systems for defence

applications such as:

Company provide a wide array of computing and electronic systems for defence

applications such as:

▪️EMP Protection Solutions

EMP protection solutions include designing, developing, manufacturing & commissioning various solutions for EMP

protection, such as:

EMP protection solutions include designing, developing, manufacturing & commissioning various solutions for EMP

protection, such as:

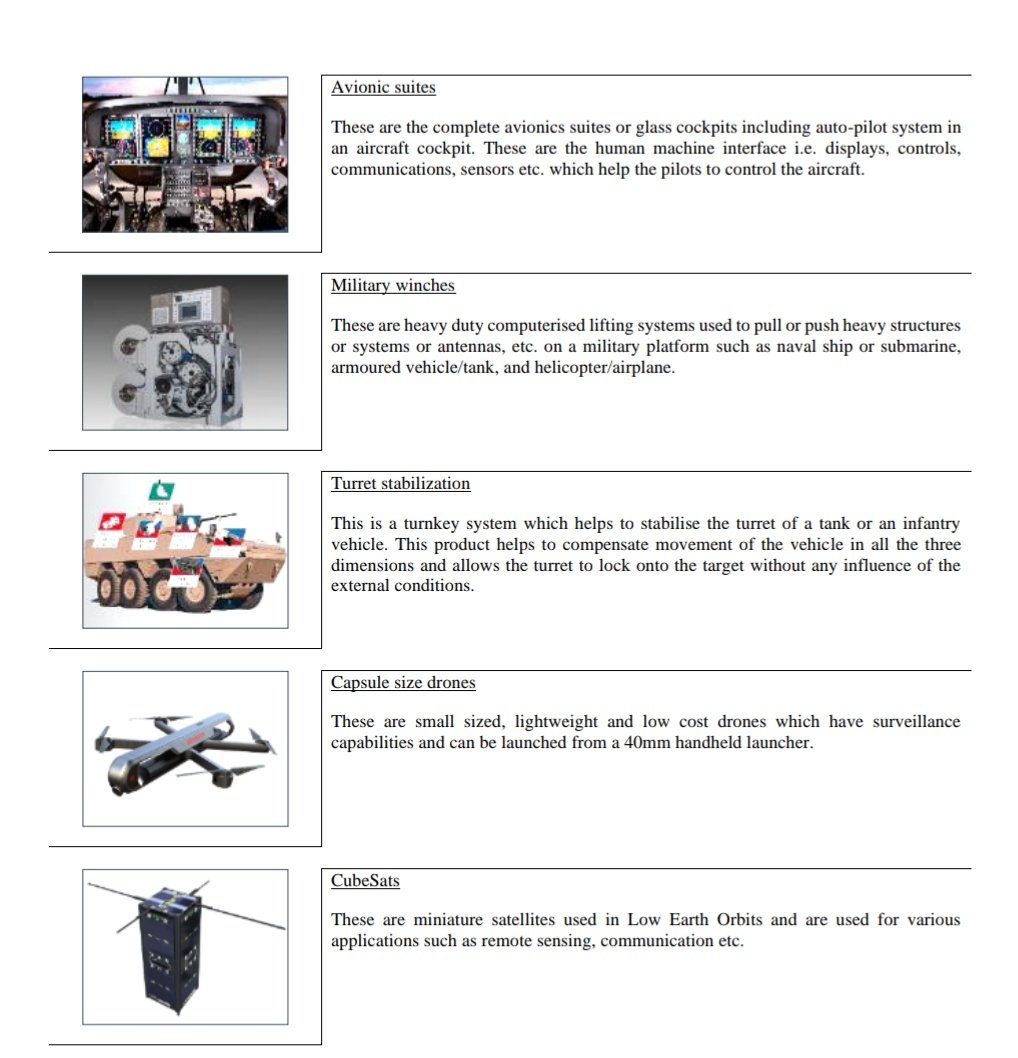

▪️Niche Technologies

As part of this vertical, company aim to source technologies from their exclusive partners in various countries & manufacture products

for clients in India & abroad. Some of the current products we offer are:

As part of this vertical, company aim to source technologies from their exclusive partners in various countries & manufacture products

for clients in India & abroad. Some of the current products we offer are:

Customers -

They have long standing relationships with most of their customers, their customers includes Hindustan Aeronautics, Bharat Electronics, TCS, Solar Industries, & many others. They also service international customers Green Optics (South Korea), Chaban (Israel), etc.

They have long standing relationships with most of their customers, their customers includes Hindustan Aeronautics, Bharat Electronics, TCS, Solar Industries, & many others. They also service international customers Green Optics (South Korea), Chaban (Israel), etc.

Manufacturing Facilities -

They have 2 manufacturing facilities located at Ambernath in Thane, Maharashtra & Nerul in Navi

Mumbai, Maharashtra each facilities have the ability to manufacture a wide range of products.

They have 2 manufacturing facilities located at Ambernath in Thane, Maharashtra & Nerul in Navi

Mumbai, Maharashtra each facilities have the ability to manufacture a wide range of products.

It provides the company the necessary flexibility to cater to changing demands in the market, thereby avoiding dependence on any one product category.

R&D Infrastructure -

Co has two R&D centres in Maharashtra & Karnataka employing

30 engineers & officers, to undertake research, develop and experiment new designs,technologies and equipment.

Co has two R&D centres in Maharashtra & Karnataka employing

30 engineers & officers, to undertake research, develop and experiment new designs,technologies and equipment.

They are also constantly exploring opportunities to collaborate with leading overseas technology companies around the world,

which among others benefits allows them to enhance R&D.

which among others benefits allows them to enhance R&D.

Industry Outlook -

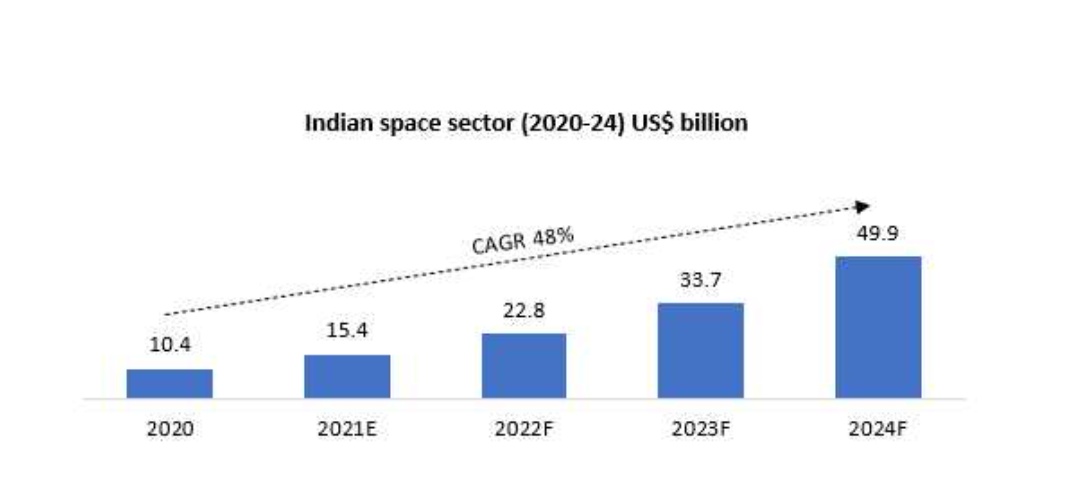

Indian Space Industry:

The Indian space sector has been globally recognised for building cost-effective satellites, launching lunar probes & taking foreign satellites to space.

Indian Space Industry:

The Indian space sector has been globally recognised for building cost-effective satellites, launching lunar probes & taking foreign satellites to space.

The global space economy is estimated at ~US$ 423 billion. Currently, India constitutes 2-3% of the global space economy and is expected to enhance its share to >10% by 2030 at a CAGR of 48%.

Indian Defence Industry:

India’s defence manufacturing sector has been witnessing a CAGR of 3.9% between 2016-20. The Indian Govt. has set defence production target at US$ 25 billion by 2025 (including US$ 5 billion from exports by 2025).

India’s defence manufacturing sector has been witnessing a CAGR of 3.9% between 2016-20. The Indian Govt. has set defence production target at US$ 25 billion by 2025 (including US$ 5 billion from exports by 2025).

India ranked 19th in the list of top defence exporters in the world by exporting defence products to 42 countries.

Strength -

• Paras provides wide range of products & solutions for both defence & space applications.

• They're one of the few players in high precision optics manufacturing for space and defence application in India.

• Strong R&D capabilities with a focus on innovation.

• Paras provides wide range of products & solutions for both defence & space applications.

• They're one of the few players in high precision optics manufacturing for space and defence application in India.

• Strong R&D capabilities with a focus on innovation.

• They're well positioned to benefit from the Government’s "Atmanirbhar Bharat" & "Make in India" initiatives.

• Strengthening foothold in India’s expanding market.

• Diversify our products and solutions range, with focus on growth by expansion into opportunistic areas.

• Strengthening foothold in India’s expanding market.

• Diversify our products and solutions range, with focus on growth by expansion into opportunistic areas.

Risks -

• Decline or reprioritisation of the Indian defence or space budget, changes

in GoI entities defence/space requirements, reduction in orders will have a material adverse impact on

its business.

• Fixed price contracts may result in cost overruns.

• Decline or reprioritisation of the Indian defence or space budget, changes

in GoI entities defence/space requirements, reduction in orders will have a material adverse impact on

its business.

• Fixed price contracts may result in cost overruns.

• Any failure to comply with the provisions of the contracts entered with customers, especially the GoI Entities,

could have an adverse effect on business operations & financial conditions.

could have an adverse effect on business operations & financial conditions.

Conclusion -

Modernization of Indian Defence sector & ISRO’s efforts to enable domestic participants to outsource

space systems manufacturing may set to be a major growth driver for Paras Defence.

Please 🙏 like 👍,comment & retweet ♻️ if you find this useful.

Modernization of Indian Defence sector & ISRO’s efforts to enable domestic participants to outsource

space systems manufacturing may set to be a major growth driver for Paras Defence.

Please 🙏 like 👍,comment & retweet ♻️ if you find this useful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh