PERSONAL INCOME & SPENDING DEEP DIVE

1/ Income and spending are two sides of the same coin, with one person’s spending powering another person’s income.This relationship isn’t necessarily 1:1, as consumers can save income. Nonetheless, the pass-through is large:

1/ Income and spending are two sides of the same coin, with one person’s spending powering another person’s income.This relationship isn’t necessarily 1:1, as consumers can save income. Nonetheless, the pass-through is large:

2/ Currently, aggregate income remains supported by a high level of nominal wages and heightened employment. We see this in today’s economic data, where nominal personal income grew primarily as a function of increasing employee compensation:

3/ Employee compensation accounted for 51% of monthly income growth, which remains in line with its one-year trend. On an annual basis, employee compensation continues to power nominal income growth, and the drop-off in government benefits continues to drag on growth:

4/ However, these marginal increases in income were not allocated to spending but rather saved. We show the composition of the monthly change in income and its uses:

5/ In May, 51% of income increases were saved by consumers, effectively canceling out the growth in employee compensation. The impact of these increased savings was a decline in monthly outlays, i.e., a drag on personal spending, with 60% of sub-categories turning lower in May.

6/ Over the last year, Real Consumption has been in a downtrend though the latest print breaks this trend. This sequential acceleration was due to the drop-off of last May’s data, which showed a decline of -0.5%. We offer the monthly trend:

7/ This print disappointed expectations with a monthly change of -0.4% versus expectations of -0.3%. Motor Vehicles & Parts has been the most significant driver of these moves with a weighted year-over-year growth of -8.3%.

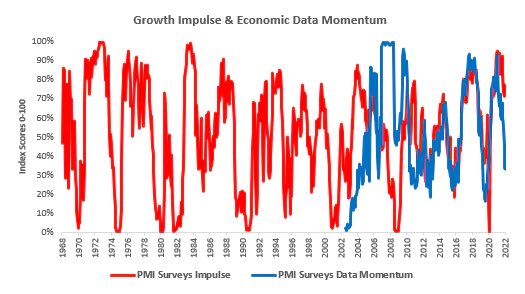

8/These weak areas of the economy tend to be highly responsive to the business cycle, i.e., they swing ahead of major inflections in the business cycle. They bode I’ll for the business cycle. We use these components to get a sense of the direction of GDP growth to come:

9/ You could have insights like these delivered to your inbox regularly, along with actionable signals and portfolios coming from a systematic, rule-based process-

All for free. Why wouldn’t you #subscribe?

prometheusresearch.substack.com

All for free. Why wouldn’t you #subscribe?

prometheusresearch.substack.com

@MacroAlf @AndreasSteno @JackFarley96 @Macronomics1 @Credit_Junk @options_insight @42macroDDale @Jesse_Livermore

• • •

Missing some Tweet in this thread? You can try to

force a refresh