How to Read Stock Charts

A Step by Step Guide🧵

Drop 👏 if you want a detailed 32 page pdf

A Step by Step Guide🧵

Drop 👏 if you want a detailed 32 page pdf

Before we begine Like and Retweet to show support

It takes a lot of time and effort :)

1/n

It takes a lot of time and effort :)

1/n

Learning how to trade the stock market successfully can come with a lot of challenges.

Something that can help you create an edge over the market is reading and accurately analyzing stock charts

In this thread, we go through everything you need to know about stock charts

2/n

Something that can help you create an edge over the market is reading and accurately analyzing stock charts

In this thread, we go through everything you need to know about stock charts

2/n

What Exactly is a Stock Chart?

A stock chart shows you a visual representation of what price has done in history and what it could do in the future

For example, a 15 minute chart shows what the price is doing every 15 minutes,

3/n

A stock chart shows you a visual representation of what price has done in history and what it could do in the future

For example, a 15 minute chart shows what the price is doing every 15 minutes,

3/n

Choosing the Best Stock Chart

1. Line Chart

This is the simplest of all the stock market charts. This chart also has the least amount of information and is just one long line moving higher and lower.

It doesnt show the high or low price and reduces noise

4/n

1. Line Chart

This is the simplest of all the stock market charts. This chart also has the least amount of information and is just one long line moving higher and lower.

It doesnt show the high or low price and reduces noise

4/n

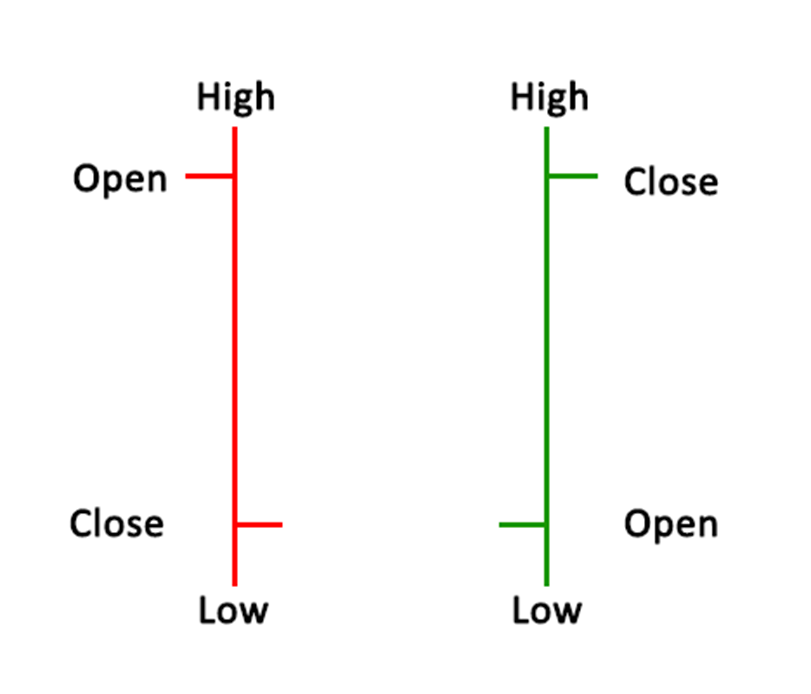

2. Bar Charts

The bar chart and candlestick chart are similar.

The bar chart shows you more information than a line chart as it also shows you the open, close, high, and low that price made for each session.

5/n

The bar chart and candlestick chart are similar.

The bar chart shows you more information than a line chart as it also shows you the open, close, high, and low that price made for each session.

5/n

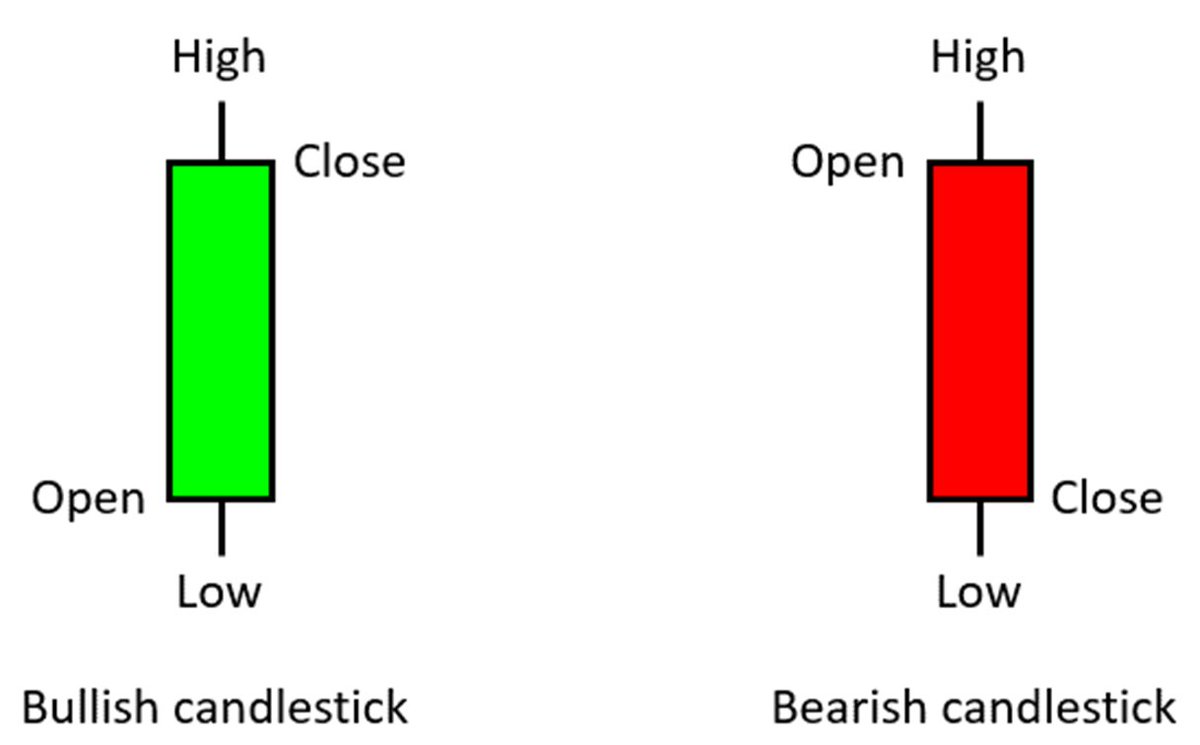

3. Japanese Candlestick Charts

Whilst the candlestick chart shows you the same information as the bar chart, it also includes a body. You can normally change the color of the candle body to suit your own needs.

Green : Bullish , Red: Bearish

6/n

Whilst the candlestick chart shows you the same information as the bar chart, it also includes a body. You can normally change the color of the candle body to suit your own needs.

Green : Bullish , Red: Bearish

6/n

How to Read Stock Charts

Some of the most popular strategies for reading stock charts include;

Look for a obvious Trend

Use Support and Resistance

Add important Indicators

Follow Volume Information

Youtube Video of the same:

7/n

Some of the most popular strategies for reading stock charts include;

Look for a obvious Trend

Use Support and Resistance

Add important Indicators

Follow Volume Information

Youtube Video of the same:

7/n

Before I proceed Ahead ,

Mentorship Progran

✅Mentorship starting on JULY 9 on weekends only with recording

✅Covering Pure Price Action , Relative Strength, Stage Analysis, How to find Super Stocks

Link for Payment :

tagmango.app/4efa5b90c1

8/n

Mentorship Progran

✅Mentorship starting on JULY 9 on weekends only with recording

✅Covering Pure Price Action , Relative Strength, Stage Analysis, How to find Super Stocks

Link for Payment :

tagmango.app/4efa5b90c1

8/n

Look for the Obvious Trend

Obvious trends will tend to run for long periods. Whilst every trend has pullbacks where price makes a move against the trend until the trend fails, it can offer high probability trades

9/n

Obvious trends will tend to run for long periods. Whilst every trend has pullbacks where price makes a move against the trend until the trend fails, it can offer high probability trades

9/n

In the example chart below price is on a trend higher. Price makes regular moves and swings lower against the trend, but the trend overall continues moving higher.

These swings lower against the trend can often be the best spots to look for trend trading entries

10/n

These swings lower against the trend can often be the best spots to look for trend trading entries

10/n

Using Support and Resistance

When using support and resistance in your trading, you can either look for the support or resistance to bounce or for a breakout

Support and resistance are some of the most common forms of trading across all different markets and time frames.

11/n

When using support and resistance in your trading, you can either look for the support or resistance to bounce or for a breakout

Support and resistance are some of the most common forms of trading across all different markets and time frames.

11/n

In the example below, price moves into an important area of support. This could be a high probability area to look for long trades before the price rejects the support level and then moves back higher.

12/n

12/n

Adding Important Indicators

One of the most popular indicators in the stock market is the moving average and, in particular, the longer-term 200 ema

The 200 ema can give you a quick indication of the overall price trend, and it can also be used as dynamic support and resistance.

One of the most popular indicators in the stock market is the moving average and, in particular, the longer-term 200 ema

The 200 ema can give you a quick indication of the overall price trend, and it can also be used as dynamic support and resistance.

In the example chart below, we can see that price continually stays below the 200 period moving average.

We can also see that each time price moves higher to test this moving average, it rejects it as resistance and moves lower.

14/n

We can also see that each time price moves higher to test this moving average, it rejects it as resistance and moves lower.

14/n

In the example chart below, we can see that price continually stays above the 200 period moving average.

We can also see that each time price moves lower to test this moving average, it rejects it as Support and moves higher.

15/n

We can also see that each time price moves lower to test this moving average, it rejects it as Support and moves higher.

15/n

Following the Volume Information

When the price is moving higher with increased volume, it is normally seen as a good sign that the stock is strong and healthy. The opposite is also true when the price starts falling, and the volume is increasing.

16/n

When the price is moving higher with increased volume, it is normally seen as a good sign that the stock is strong and healthy. The opposite is also true when the price starts falling, and the volume is increasing.

16/n

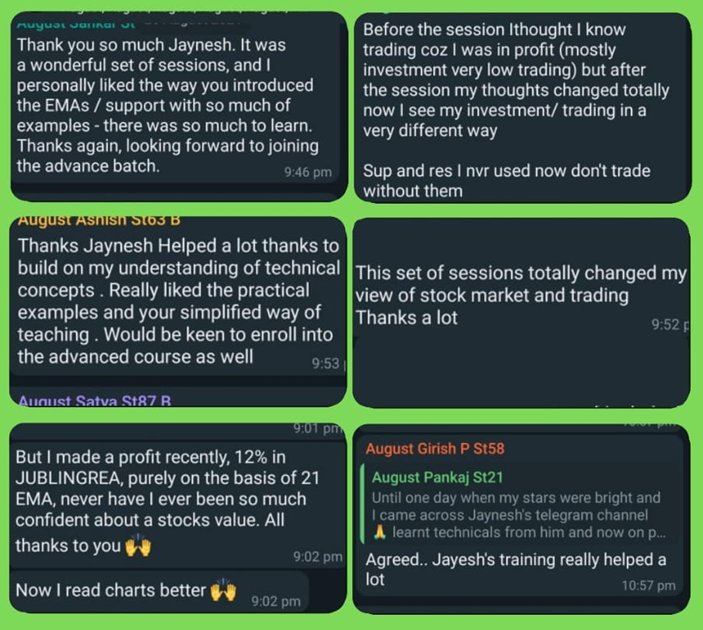

What Mentees have to say :

#Feedback

LINK FOR ENQUIRY:

wa.link/si4jn4

Payment Link :tagmango.app/4efa5b90c1

17/n

#Feedback

LINK FOR ENQUIRY:

wa.link/si4jn4

Payment Link :tagmango.app/4efa5b90c1

17/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh