About -

EKI Energy Services Ltd. is an Indian company founded in May 2011 provides climate change advisory & support to companies in the country & across the world. Its services include climate change advisory, carbon offsetting, business excellence advisory & training Svcs.

EKI Energy Services Ltd. is an Indian company founded in May 2011 provides climate change advisory & support to companies in the country & across the world. Its services include climate change advisory, carbon offsetting, business excellence advisory & training Svcs.

Global Presence -

EKI has been earning 52% from Europe, 27% from USA, 12% from India, 7% from Australia & 2% from rest of the world.

EKI is working with leading brands & leaders

across the world.

EKI has been earning 52% from Europe, 27% from USA, 12% from India, 7% from Australia & 2% from rest of the world.

EKI is working with leading brands & leaders

across the world.

Company is constantly identifying projects within India & outside to reduce carbon

emissions, protect biodiversity & deliver measurable benefits aligned with the aims of the Kyoto

Protocol, Paris Agreement & the UN Sustainable Development Goals.

emissions, protect biodiversity & deliver measurable benefits aligned with the aims of the Kyoto

Protocol, Paris Agreement & the UN Sustainable Development Goals.

Financial Summary -

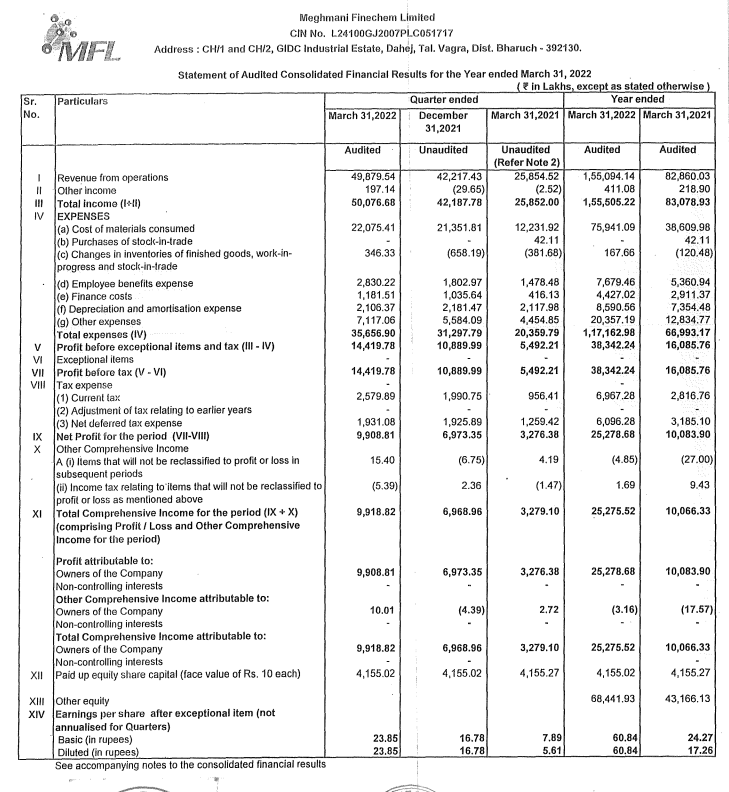

Q4 FY22 (YoY)

Revenue were at Rs.1800 Cr.⬆️844%

PAT at Rs.383 Cr.⬆️1951%

EBITDA at Rs.515 Cr.⬆️1937%

EPS at Rs.558 ⬆️ 1406%

Q4 FY22 (YoY)

Revenue were at Rs.1800 Cr.⬆️844%

PAT at Rs.383 Cr.⬆️1951%

EBITDA at Rs.515 Cr.⬆️1937%

EPS at Rs.558 ⬆️ 1406%

Revenue Breakup -

EKI earns 99.5% of it's revenue form Climate Change & Sustainability Advisory and Carbon Offsetting

0.4% from Business Excellence Advisory & Training Services

0.1% from Electricity Safety Audits.

EKI earns 99.5% of it's revenue form Climate Change & Sustainability Advisory and Carbon Offsetting

0.4% from Business Excellence Advisory & Training Services

0.1% from Electricity Safety Audits.

Clients -

EKI has strong standing relationships with most of it's customers, their customers includes GAIL, Adani, ReNew power, NTPC and many others.

They also provide services to international customers like The World Bank, Siemens, etc.

EKI has strong standing relationships with most of it's customers, their customers includes GAIL, Adani, ReNew power, NTPC and many others.

They also provide services to international customers like The World Bank, Siemens, etc.

Industry Oppertunity -

✅ 137 countries have

committed to work toward

net zero emissions by 2050

& to enhance their

international climate pledges under the Paris

Agreement.

✅ Companies are increasingly

using internal carbon pricing

to reduce emissions.

✅ 137 countries have

committed to work toward

net zero emissions by 2050

& to enhance their

international climate pledges under the Paris

Agreement.

✅ Companies are increasingly

using internal carbon pricing

to reduce emissions.

✅ Stringent regulations & implementation of carbon

pricing (emissions trading systems (ETS) & carbon

taxes) around the World are

expected to drive demand

for carbon credits in the

near term.

✅ Corporates all around the

World are aiming for carbon

neutrality.

pricing (emissions trading systems (ETS) & carbon

taxes) around the World are

expected to drive demand

for carbon credits in the

near term.

✅ Corporates all around the

World are aiming for carbon

neutrality.

Industry Outlook -

India is the world’s 3rd largest GHG emitter & 2nd most populous country. Farming sustains half of India’s 1.4 bill population but is also a major contributor of GHG. The Govt is pushing for a uniform carbon trading market through policy changes & legislation.

India is the world’s 3rd largest GHG emitter & 2nd most populous country. Farming sustains half of India’s 1.4 bill population but is also a major contributor of GHG. The Govt is pushing for a uniform carbon trading market through policy changes & legislation.

The proposed legislation is aimed at creating a robust domestic market for clean certificates. India is also well placed to pioneer agriculture-related carbon credit trading.

India's International climate commitments include a reduction goal in GHG emission intensity of GDP by 33-35% until 2030 & target to increase the

share of non-fossil fuel energy sources to 40% by

2030. India is pledged to achieve net zero carbon

emissions by 2070.

share of non-fossil fuel energy sources to 40% by

2030. India is pledged to achieve net zero carbon

emissions by 2070.

The Global carbon credit market was valued at US$ 211.5 Bn in 2019 and is expected to reach US$ 2,407.8 Bn by 2027 at a CAGR of 30.7% between 2020 and 2027.

Business Expansion Strategies -

✅ With the acquisition of new talent pool & development of existing

human capital, Co is aiming to enter into new geographies across

the Globe where it see huge potential for climate & acquisition of carbon credits projects.

✅ With the acquisition of new talent pool & development of existing

human capital, Co is aiming to enter into new geographies across

the Globe where it see huge potential for climate & acquisition of carbon credits projects.

✅ EKI will further strengthen the backward integration of the carbon credit

supply chain through environment friendly projects that also enable

community upliftment i.e., cookstove, biogas, tree plantation, etc.

supply chain through environment friendly projects that also enable

community upliftment i.e., cookstove, biogas, tree plantation, etc.

✅ Company intends to continue to expand its end-user client base in the

developed countries such as Germany, U.S.A, Australia etc. Its strategy to

supply carbon offsets directly to the end-users will result in higher profit

margins.

developed countries such as Germany, U.S.A, Australia etc. Its strategy to

supply carbon offsets directly to the end-users will result in higher profit

margins.

Joint Venture -

EKI Energy Services & Shell Overseas Investments B.V. floated a JV company for nature-based solutions in India to reduce GHG emissions.

They will work on conserving,enhancing & restoring natural ecosystems such as forests, agriculture, grasslands, blue carb, etc

EKI Energy Services & Shell Overseas Investments B.V. floated a JV company for nature-based solutions in India to reduce GHG emissions.

They will work on conserving,enhancing & restoring natural ecosystems such as forests, agriculture, grasslands, blue carb, etc

Risks -

🛑 Carbon pricing is dependent on the supply & demand of carbon credits majorly from developing nations

to developed nations. Any increase in the supply of carbon credits in these developing markets would

reduce the carbon credit rates as well as our operating margins.

🛑 Carbon pricing is dependent on the supply & demand of carbon credits majorly from developing nations

to developed nations. Any increase in the supply of carbon credits in these developing markets would

reduce the carbon credit rates as well as our operating margins.

🛑 EKI has not entered into any long-term contracts with its customers & they typically operate on

the basis of orders. Inability to maintain regular order flow would adversely impact revenues & profitability.

the basis of orders. Inability to maintain regular order flow would adversely impact revenues & profitability.

🛑 Fluctuation in foreign currency exchange rates could affect financial condition & results of

operations.

operations.

Conclusion -

With +13 yrs of advisory experience,well established network of 1000+ greenhouse gas efficient projects.

The Co is constantly looking for new growth avenues including acquisitions/partnerships to play a bigger role in global carbon asset management.

With +13 yrs of advisory experience,well established network of 1000+ greenhouse gas efficient projects.

The Co is constantly looking for new growth avenues including acquisitions/partnerships to play a bigger role in global carbon asset management.

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

And follow us on @LnprCapital for more information like this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh