1/4

Yes, a very good start with the key message that,

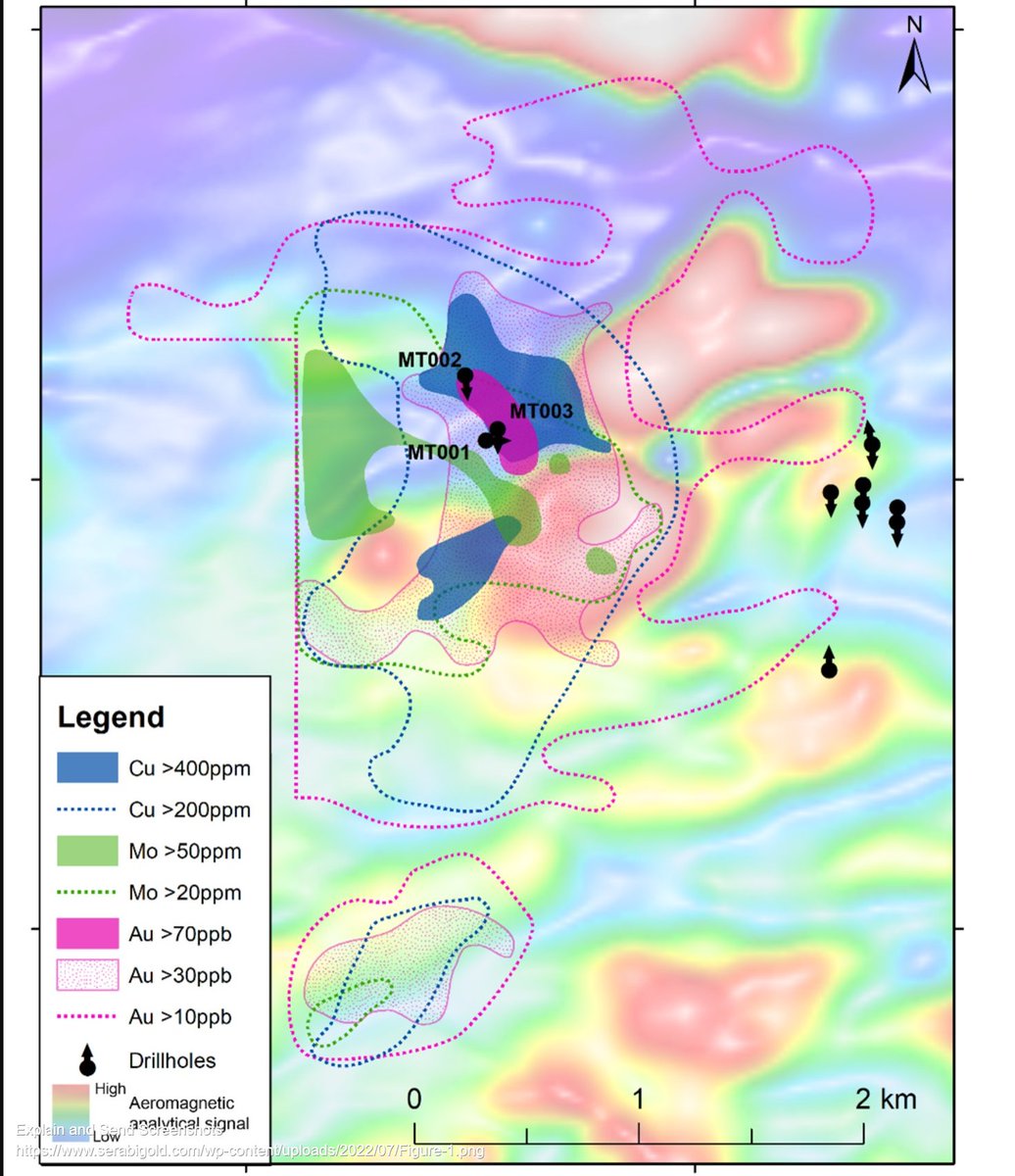

"Significantly, the three holes completed to date targeted the geochemical high, but the core of the magnetic high has yet to be tested."

The direction of the #SRB drill holes clearly demonstrates this.

Yes, a very good start with the key message that,

"Significantly, the three holes completed to date targeted the geochemical high, but the core of the magnetic high has yet to be tested."

The direction of the #SRB drill holes clearly demonstrates this.

https://twitter.com/man94_con/status/1544201093533646849

2/

“This is a very promising time for Serabi and between this discovery, the excellent progress with the development of Coringa, improved production from the Palito Complex, and advancing all our high priority regional targets, we look forward to updating all our stakeholders.”

“This is a very promising time for Serabi and between this discovery, the excellent progress with the development of Coringa, improved production from the Palito Complex, and advancing all our high priority regional targets, we look forward to updating all our stakeholders.”

3/

I agree and such words about Palito help support the belief that June was another strong month. Meaning Q2 should have delivered levels of gold production that are in line with the guidance set at the start of the year.

I agree and such words about Palito help support the belief that June was another strong month. Meaning Q2 should have delivered levels of gold production that are in line with the guidance set at the start of the year.

4/

Finally,

"Matilda represents one of five compelling, zoned multi-element, soil geochemical anomalies defined by the exploration team in recent years along the margins of a 40km magnetic high."

With Coringa also in development, there's now a lot in SRB for just £31m MC.

Finally,

"Matilda represents one of five compelling, zoned multi-element, soil geochemical anomalies defined by the exploration team in recent years along the margins of a 40km magnetic high."

With Coringa also in development, there's now a lot in SRB for just £31m MC.

• • •

Missing some Tweet in this thread? You can try to

force a refresh