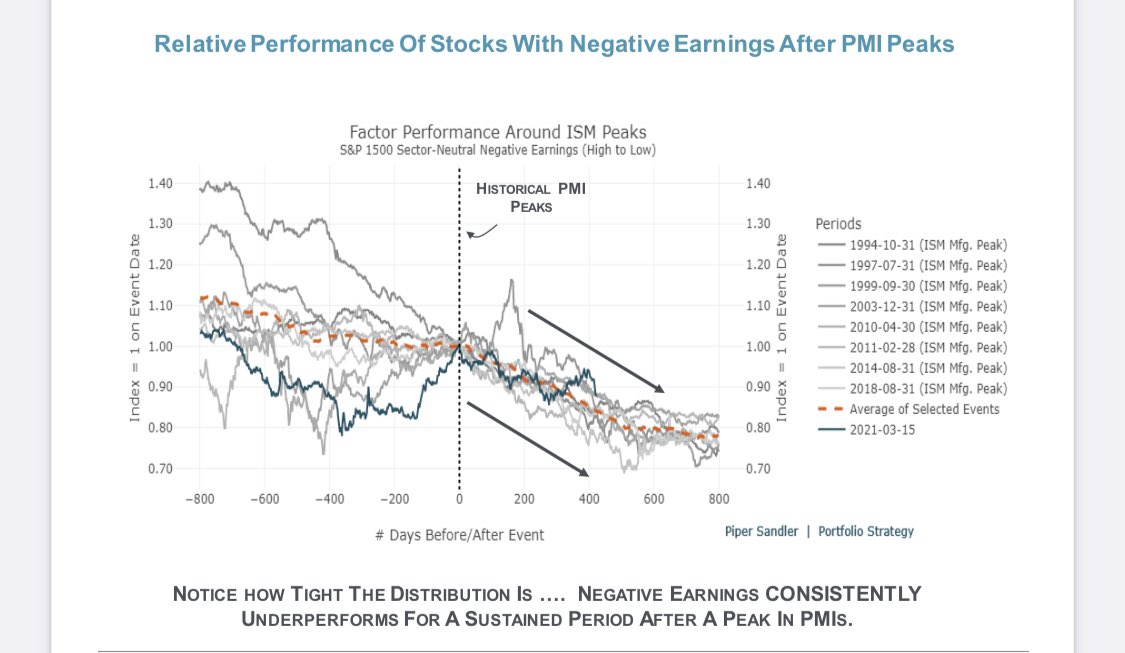

The rotation from value to growth since May was an early indication that investor fears were migrating from inflation to recession. We expect this to continue. Investors should avoid the unprofitable tails of style - “zombie value” and “pipe-dream growth.” 1/3

3/3 negative EPS stocks consistently underperform following a peak in PMIs (leading economic indicator). Below is a clear message from our event study factor dashboard. We’ve got data for days 😎🍭🍬🍫#macro #EPS

• • •

Missing some Tweet in this thread? You can try to

force a refresh