Chief Investment Strategist @Piper_Sandler. Voted Wall Street's #1 Portfolio Strategist in '24 & '25. #HOPE. CFA. Girl dad. https://t.co/EBG0jU7WoE

8 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/AndreasSteno/status/1580438181643780096

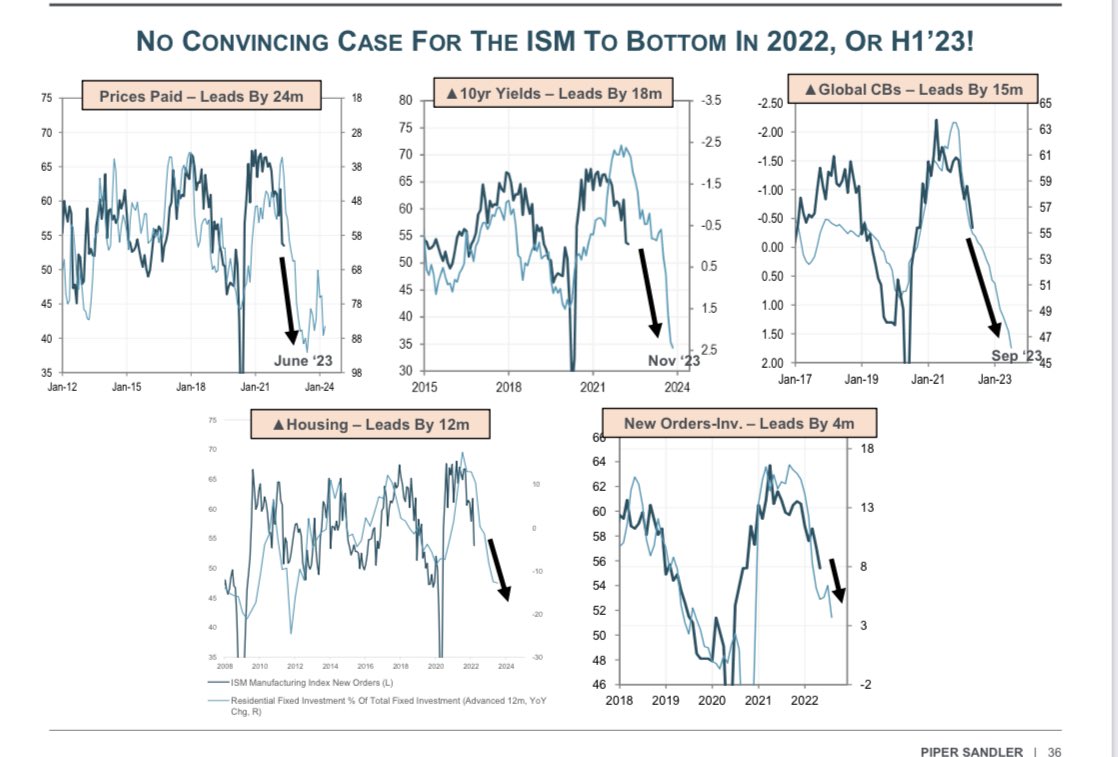

PMIs are only trending one direction for a while - same for housing. Same reasons we called BS on the market rally in August - wasn’t consistent with EVERY other market low

PMIs are only trending one direction for a while - same for housing. Same reasons we called BS on the market rally in August - wasn’t consistent with EVERY other market low

Respect the LAG of food and energy inflation ...

Respect the LAG of food and energy inflation ...

Who is feeling lucky?

Who is feeling lucky?