1/14 Tesla USA Doubled Sales in First Half of 2022 via

@YouTube

$TSLA #tesla #electriccars $VW $F #ford #VW

@YouTube

$TSLA #tesla #electriccars $VW $F #ford #VW

4/14

Tesla USA Doubled Sales in First Half of 2022 via

@YouTube

$TSLA #tesla #electriccars $VW $F #ford #VW

Tesla USA Doubled Sales in First Half of 2022 via

@YouTube

$TSLA #tesla #electriccars $VW $F #ford #VW

5/15 Comparing monthly Tesla US sales from goodcarbadcar.net. I determined Tesla USA doubled sales in the first half of 2022 vs first half of 2021.

$TSLA #tesla #electriccars $VW $F #ford #VW

$TSLA #tesla #electriccars $VW $F #ford #VW

8/15 Volkswagen lost ground and now Tesla USA had 63 times as many EVs sold in the first half of 2022 versus VW USA. $TSLA $VW

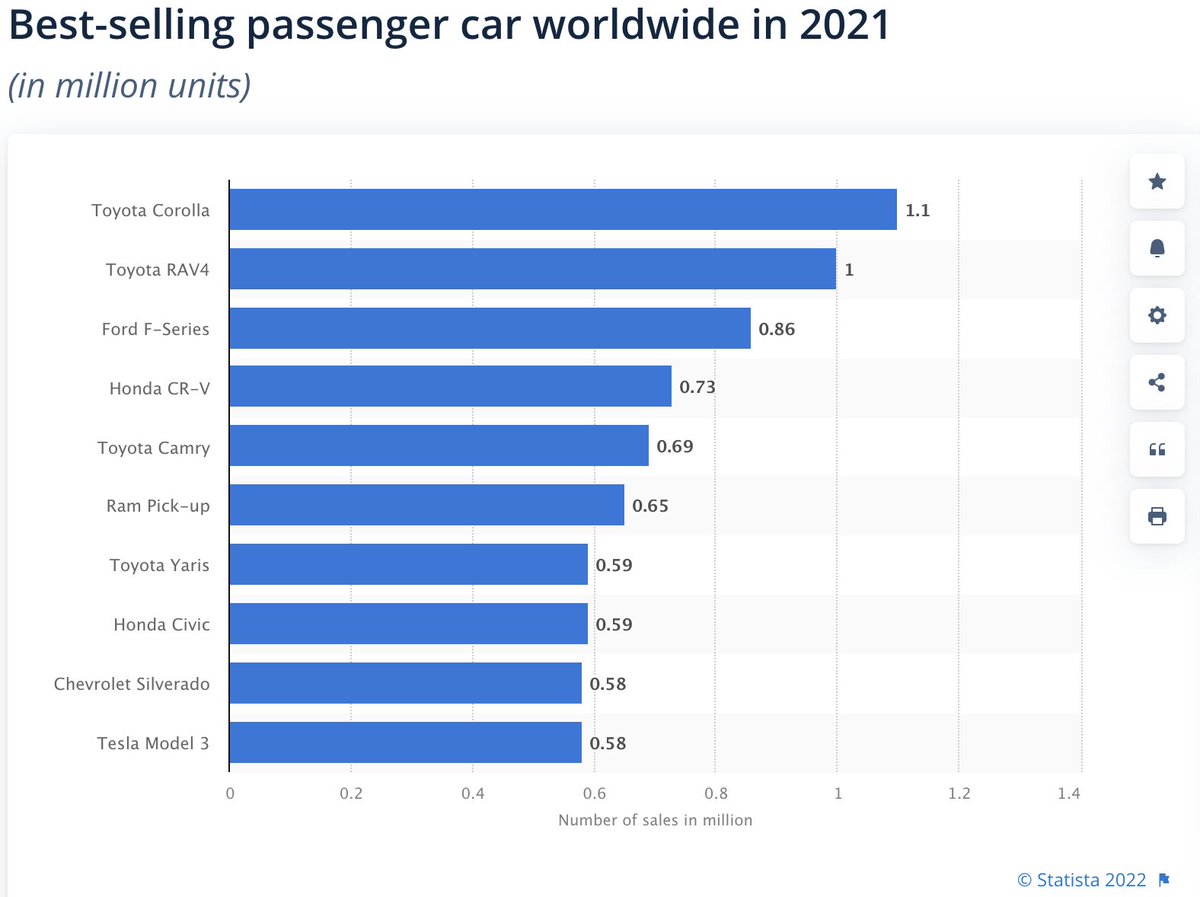

9/15 VW also sold fewer EVs in the first half of 2022 versus their own US EV sales in 2021. 4,415 in 2022H1 versus 6,230 for VW in 2021H1. Tesla sold 282,071 EV in 2022H1 and 139,301 in 2021H1. $TSLA $VW

12/15 Tesla USA sold 16 times more EVs than Ford USA in the first half of 2022 $TSLA $F

Tesla USA increased its lead over Ford in US EV sales from 11 times in 2021H1 to 16 times in 2022H1

Tesla USA increased its lead over Ford in US EV sales from 11 times in 2021H1 to 16 times in 2022H1

13/15 Volkswagen is starting mass production of EVs in the US at a new Chattanooga factory. VW is targeting 10k per month production. This will take years to achieve that ramp-up. Tesla is selling over 4 times that VW USA monthly production target. Tesla Austin open.

15/15 Tesla will likely triple US sales when the Tesla Austin factory is ramped in 2024 or late 2023. $TSLA $F $VW #electricars

• • •

Missing some Tweet in this thread? You can try to

force a refresh