US inflation came in at 9.1% y-o-y yesterday, a 40 year record. Inflation has been a key area of concern for investors lately.

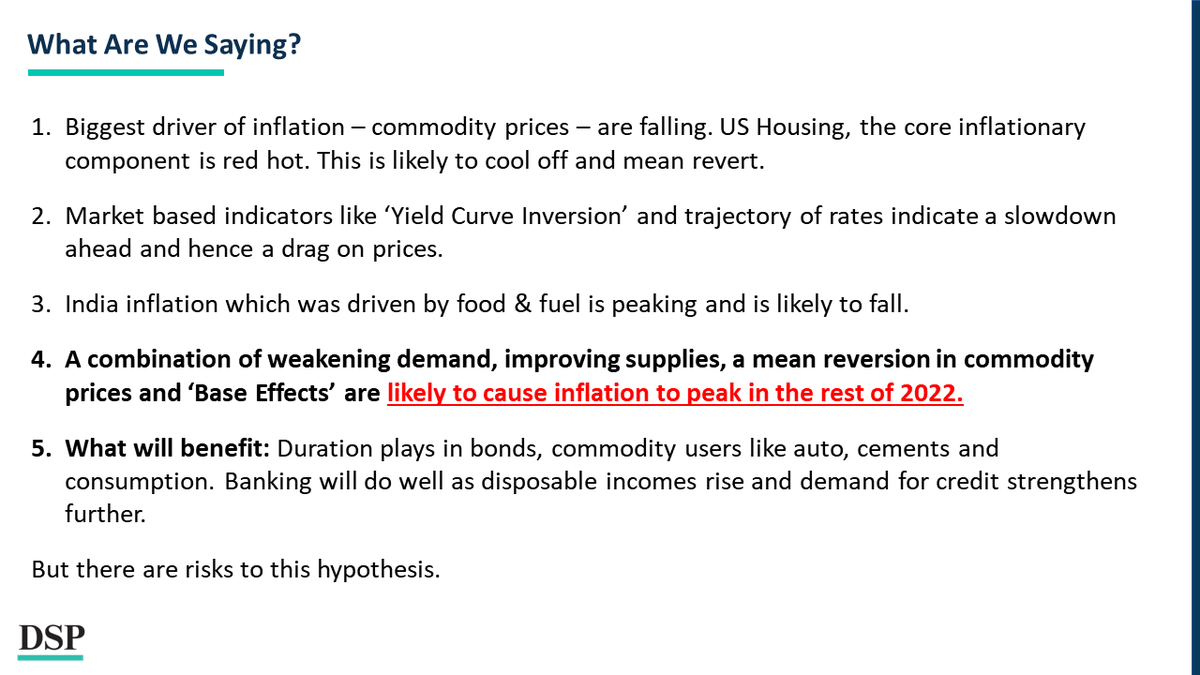

In this (long) thread, we highlight trends which indicate a likely ‘𝗰𝗼𝗼𝗹𝗶𝗻𝗴-𝗼𝗳𝗳’ 𝗼𝗳 𝗶𝗻𝗳𝗹𝗮𝘁𝗶𝗼𝗻𝗮𝗿𝘆 𝘁𝗿𝗲𝗻𝗱𝘀 𝗮𝗵𝗲𝗮𝗱.👇

In this (long) thread, we highlight trends which indicate a likely ‘𝗰𝗼𝗼𝗹𝗶𝗻𝗴-𝗼𝗳𝗳’ 𝗼𝗳 𝗶𝗻𝗳𝗹𝗮𝘁𝗶𝗼𝗻𝗮𝗿𝘆 𝘁𝗿𝗲𝗻𝗱𝘀 𝗮𝗵𝗲𝗮𝗱.👇

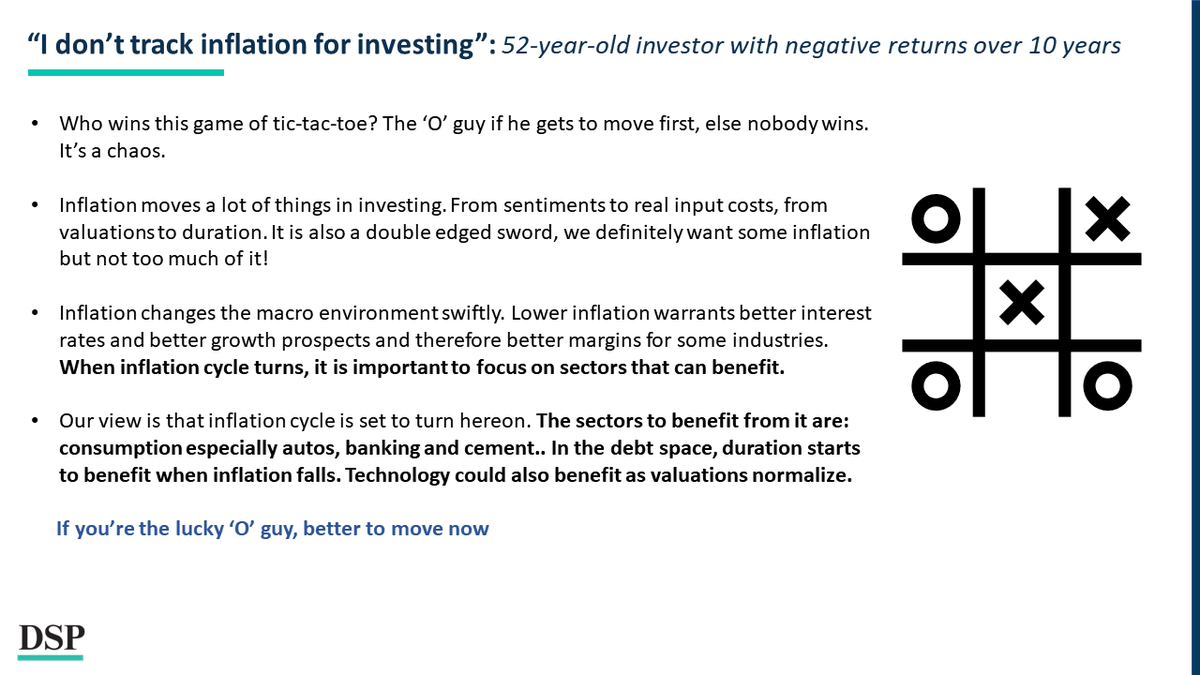

“I don’t track inflation for investing”: 52-𝘺𝘦𝘢𝘳-𝘰𝘭𝘥 𝘪𝘯𝘷𝘦𝘴𝘵𝘰𝘳 𝘸𝘪𝘵𝘩 𝘯𝘦𝘨𝘢𝘵𝘪𝘷𝘦 𝘳𝘦𝘵𝘶𝘳𝘯𝘴 𝘰𝘷𝘦𝘳 10 𝘺𝘦𝘢𝘳𝘴!

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

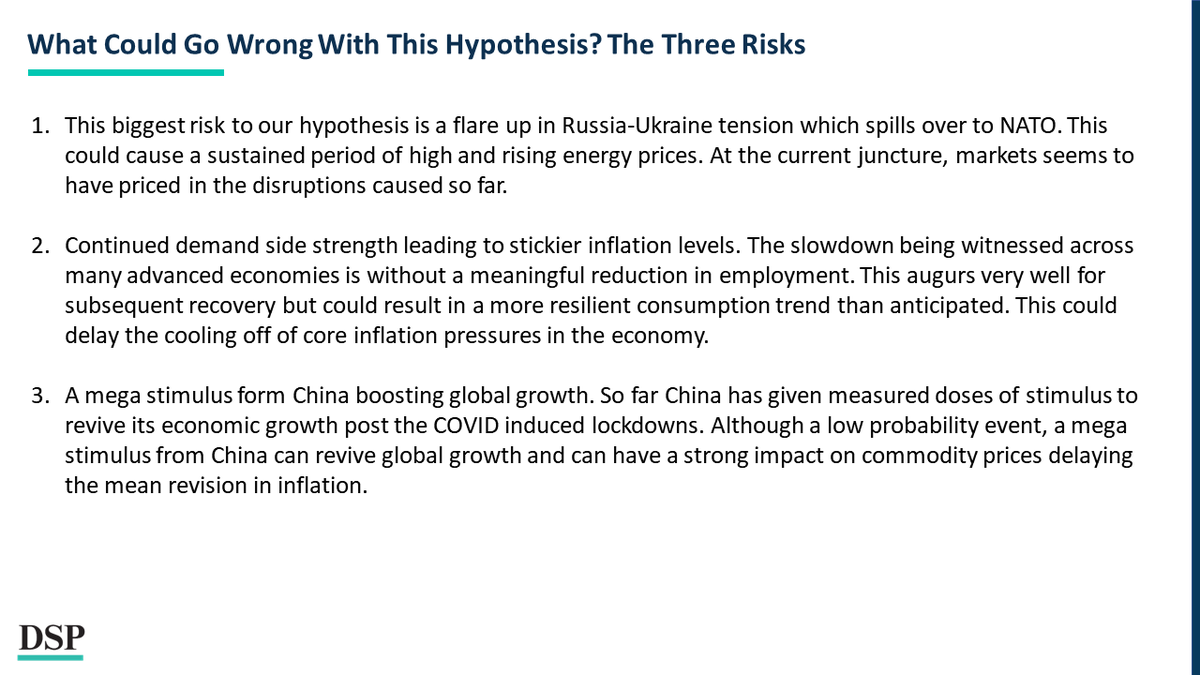

The 3 risks: What could go wrong with this hypothesis

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

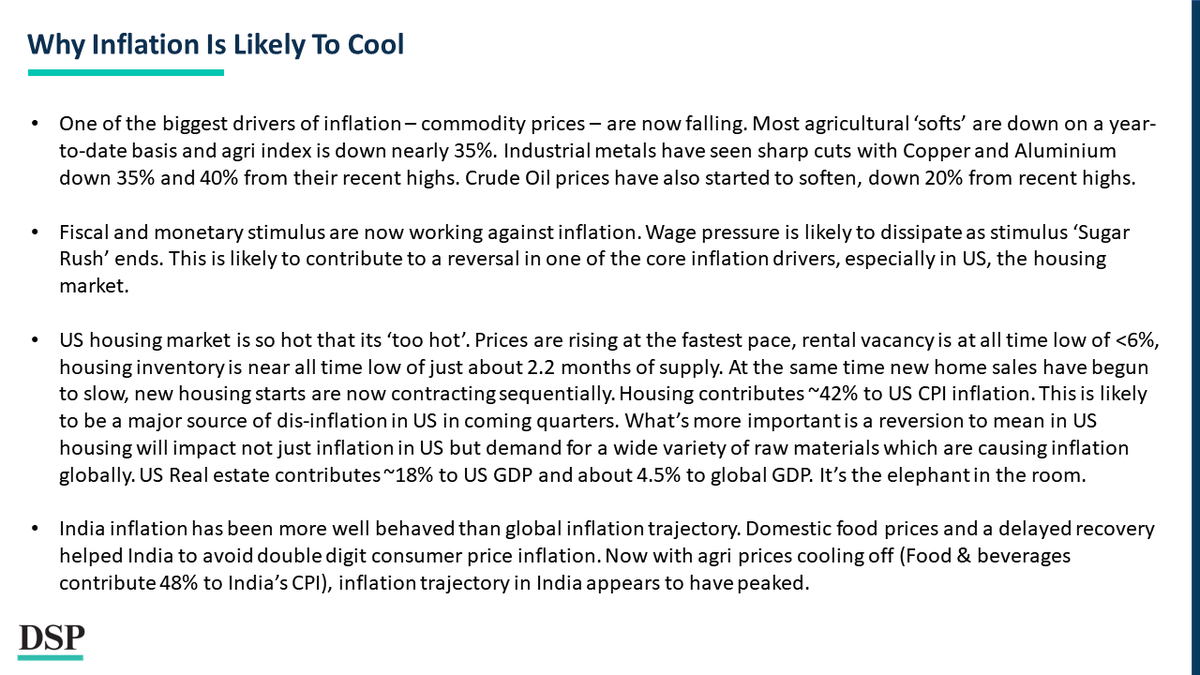

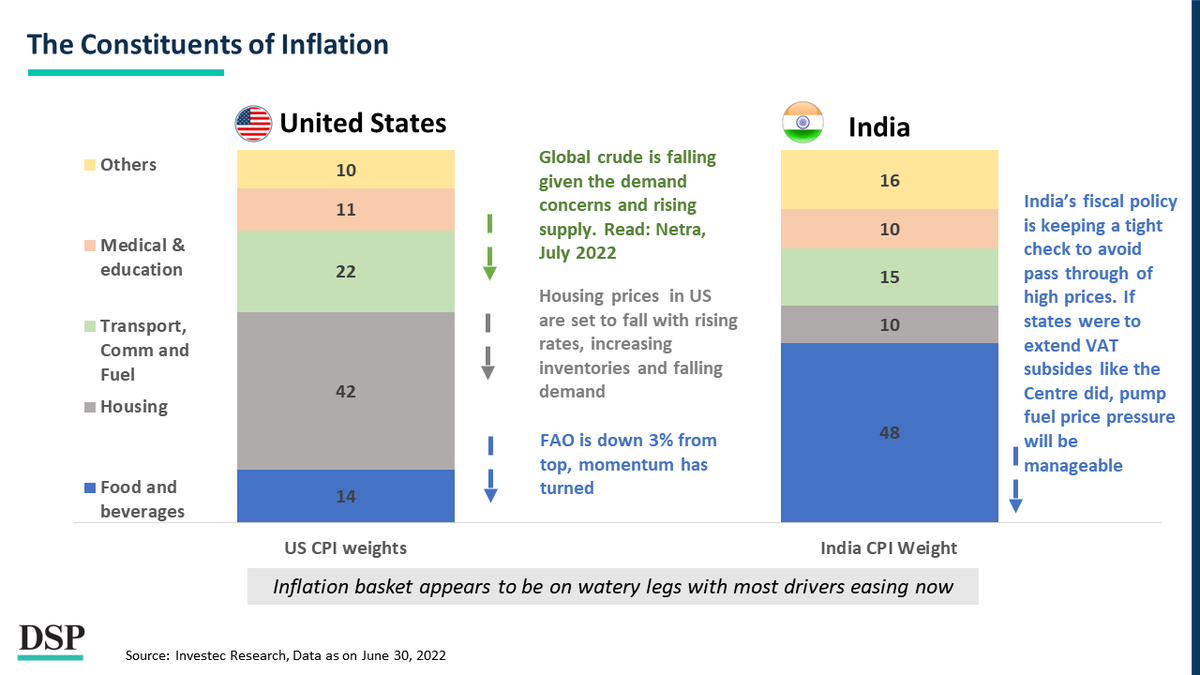

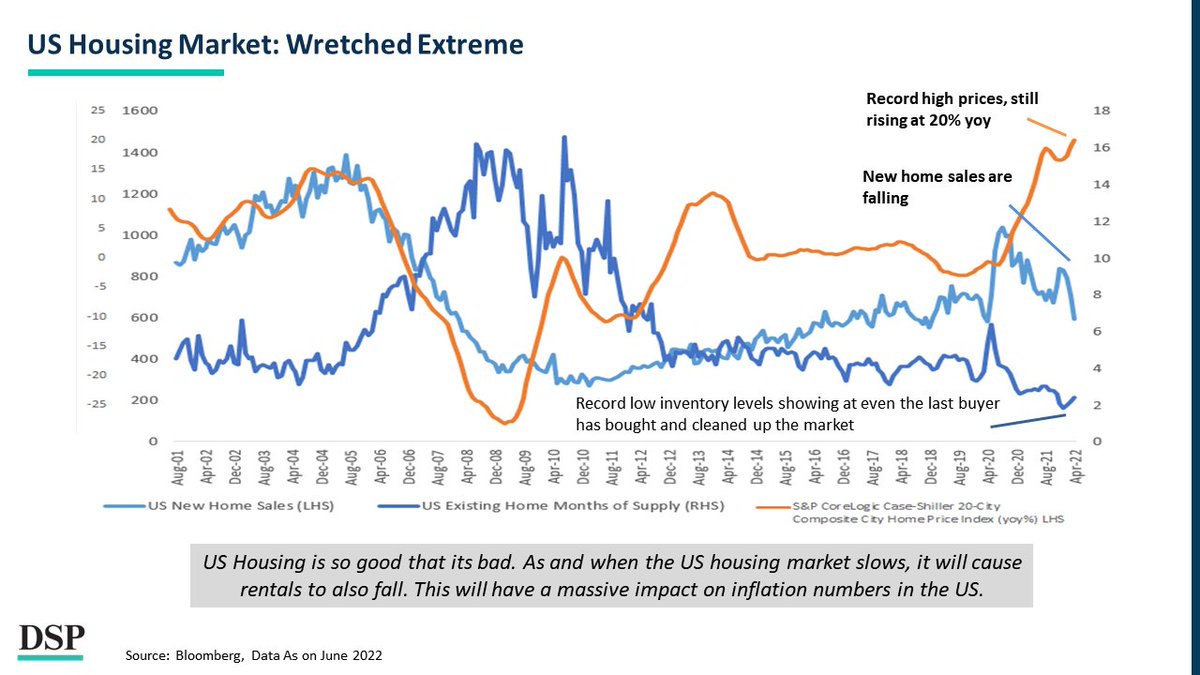

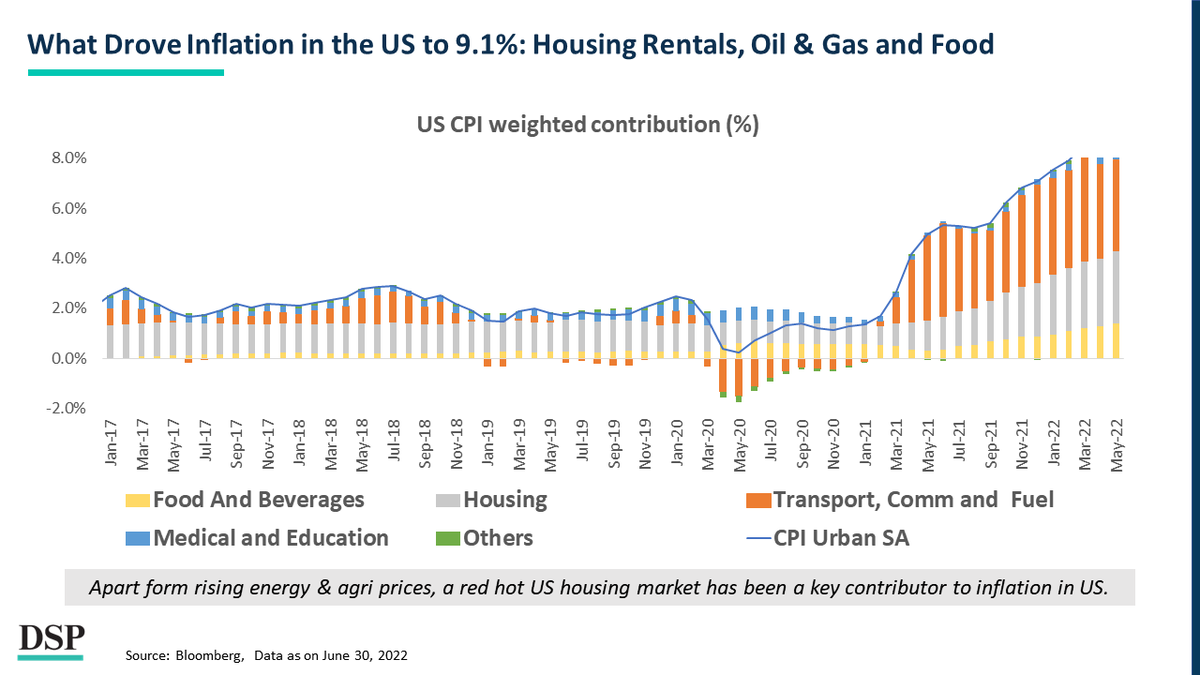

What drove inflation in the US to 9.1%: Housing rentals, Oil & Gas and Food

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

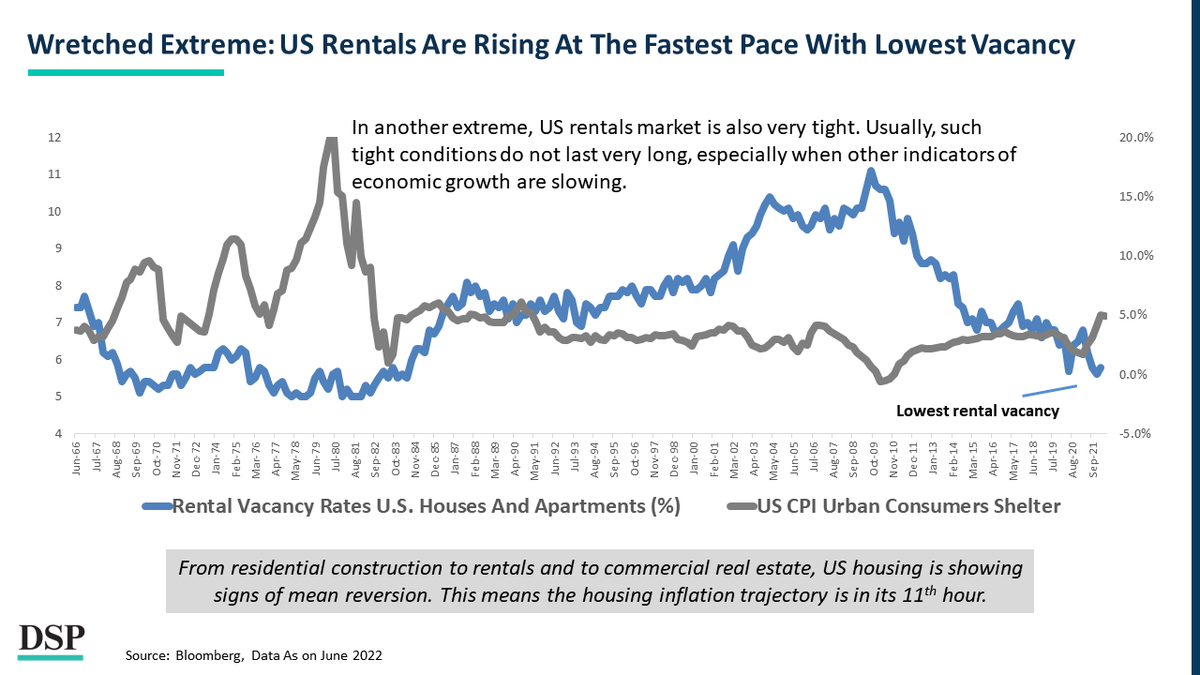

Wretched Extreme: US Rentals are rising at the fastest pace with lowest vacancy!

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

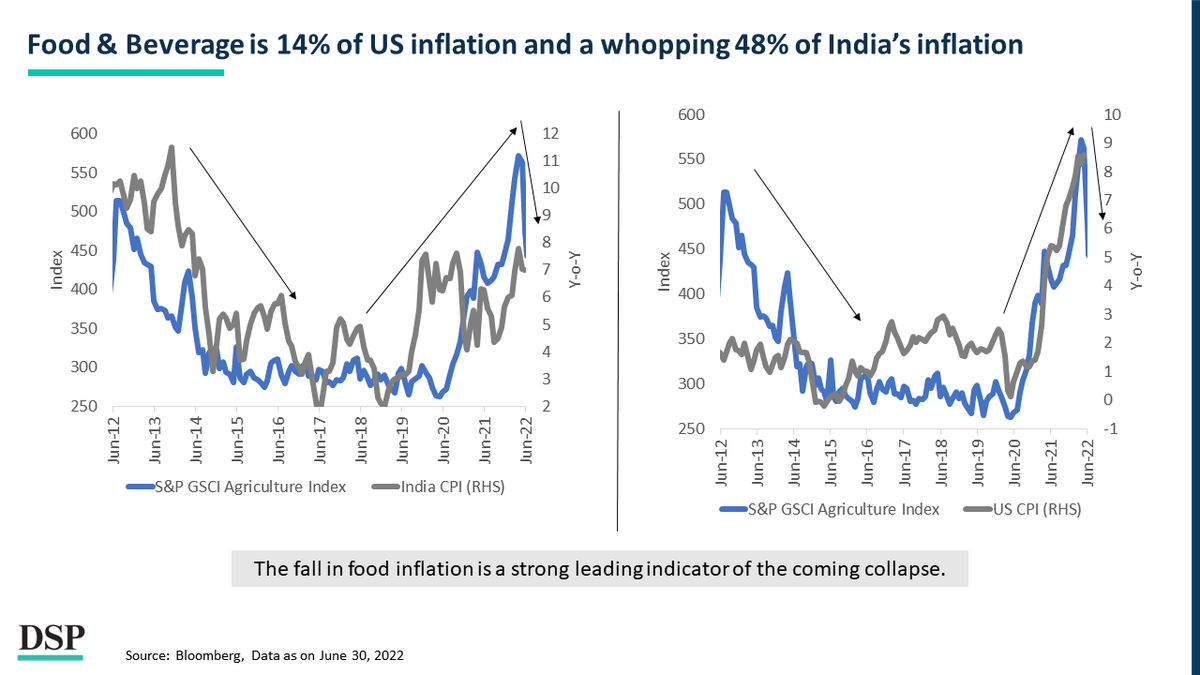

Food & Beverage is 14% of US inflation and a whopping 48% of India’s inflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

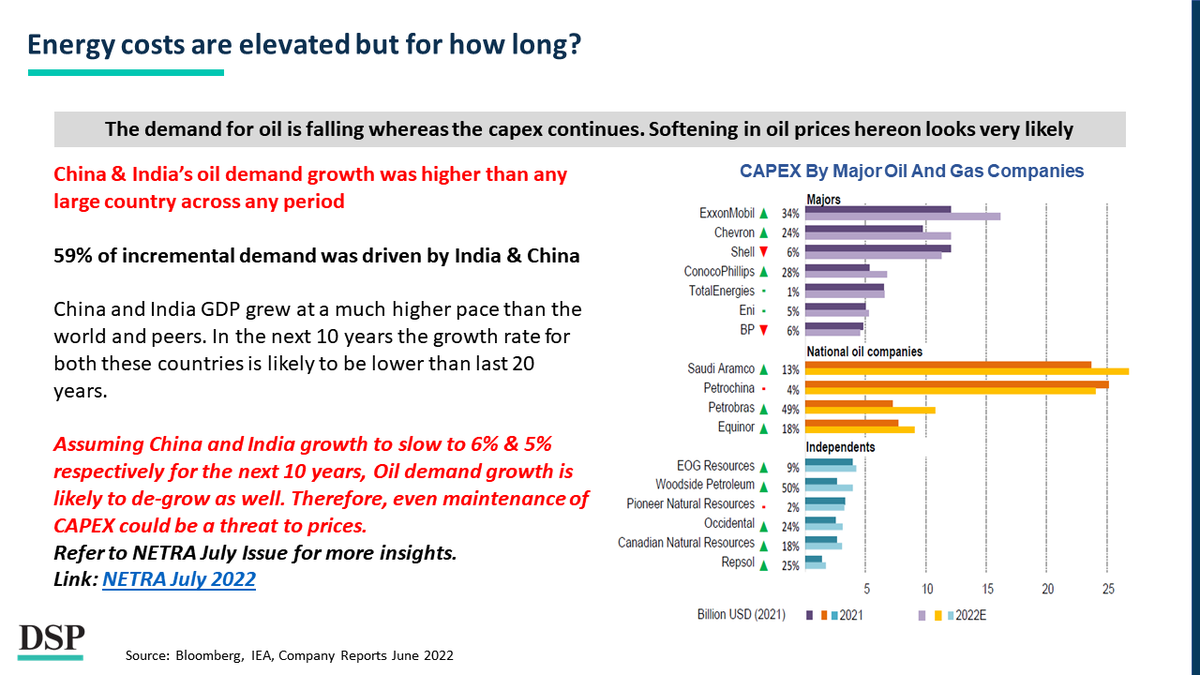

Energy costs are elevated but for how long?

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

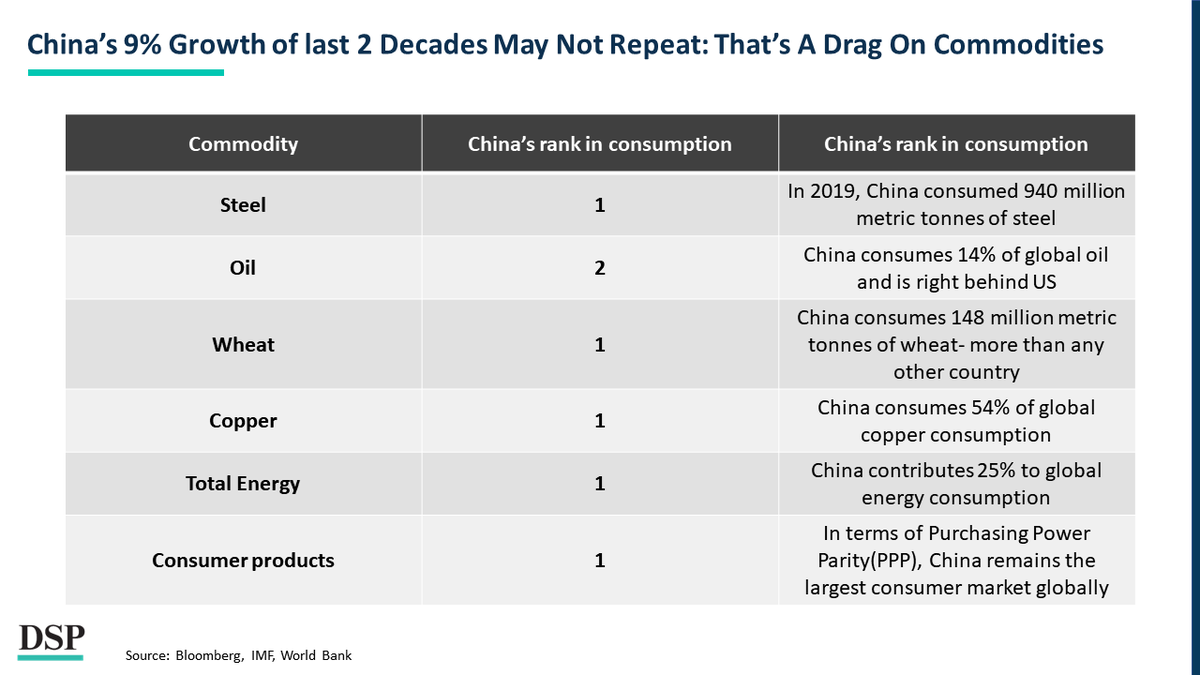

China’s 9% growth of last 2 decades may not repeat: That’s a drag on commodities!

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

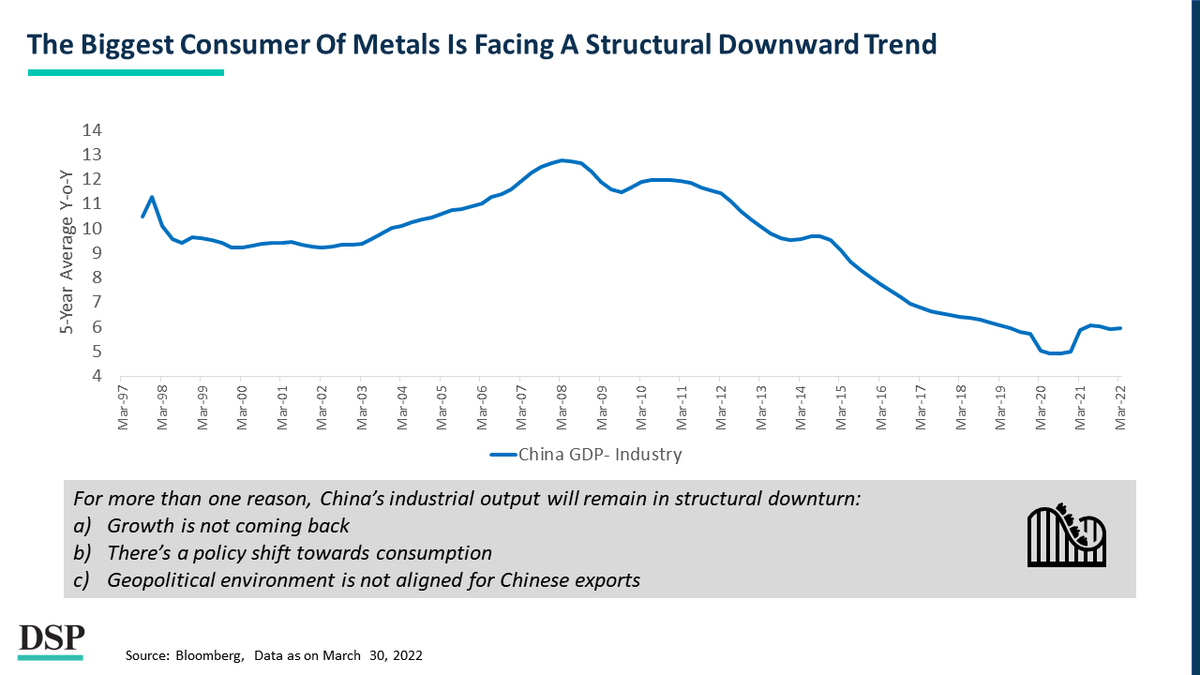

The biggest consumer of metals is facing a structural downward trend 👀

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

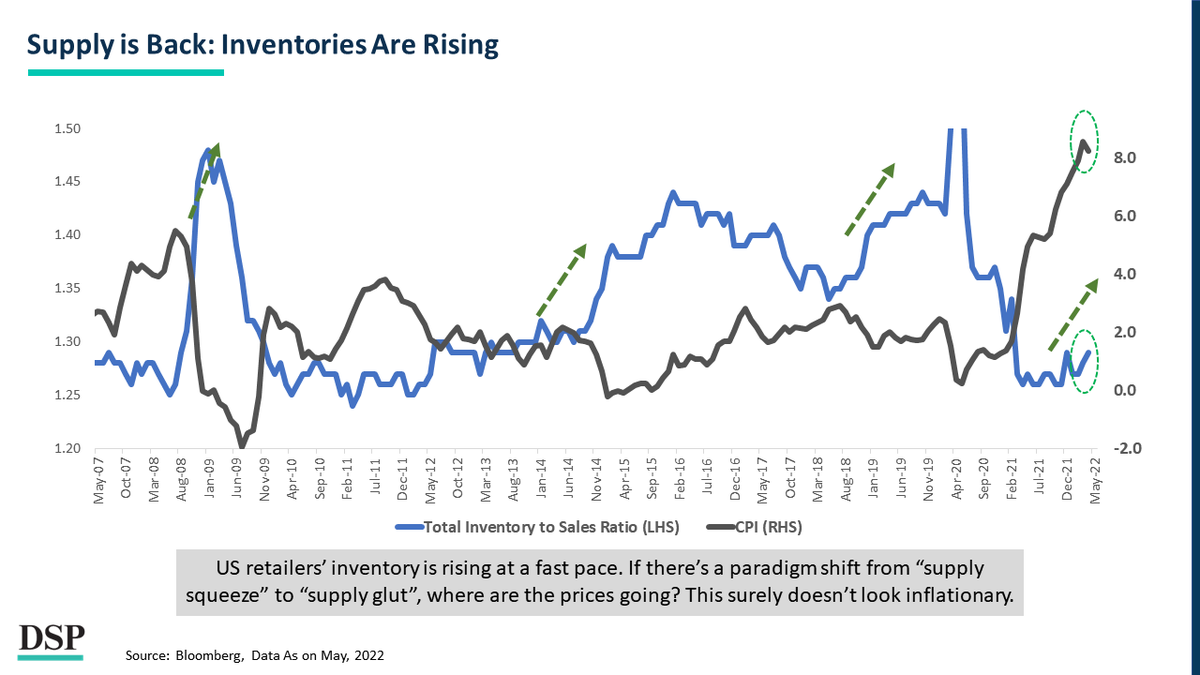

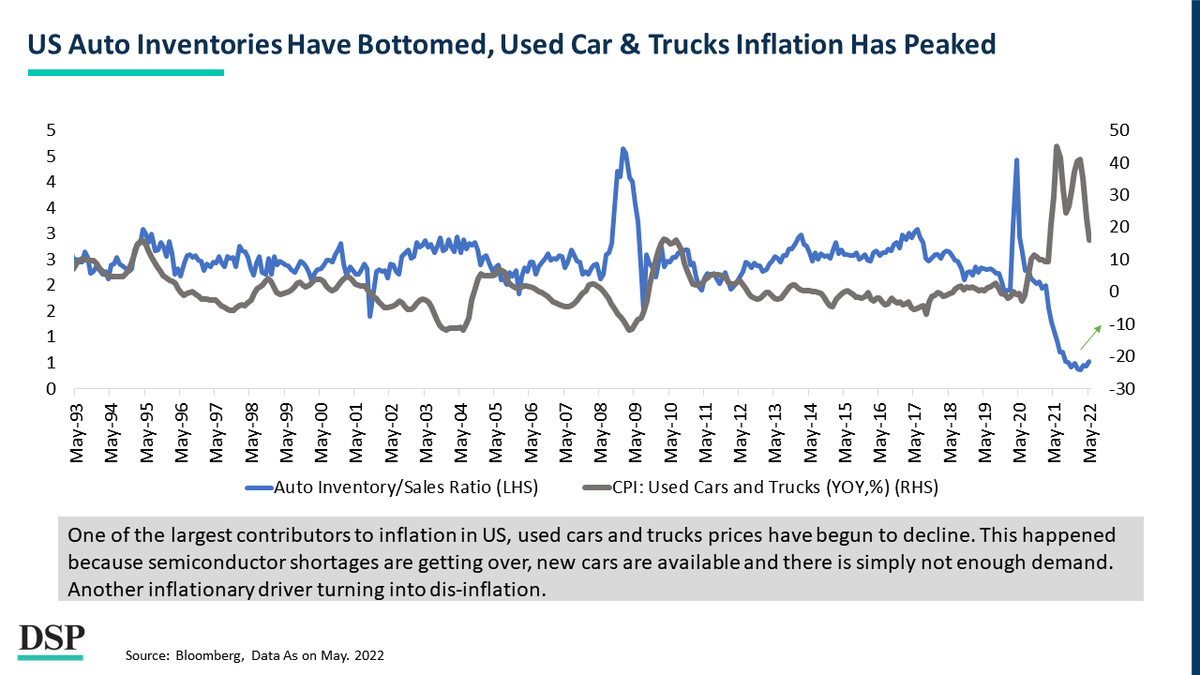

US Auto inventories have bottomed, used car & trucks inflation has peaked.

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

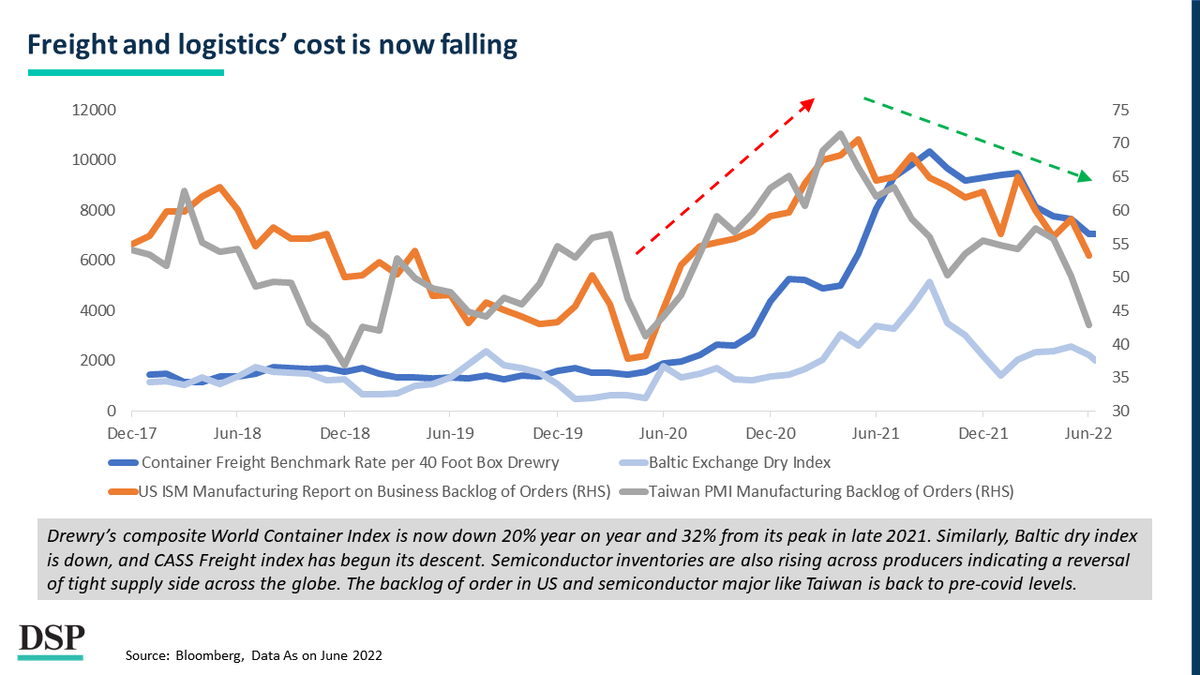

Freight and logistics’ cost is now falling 📉

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

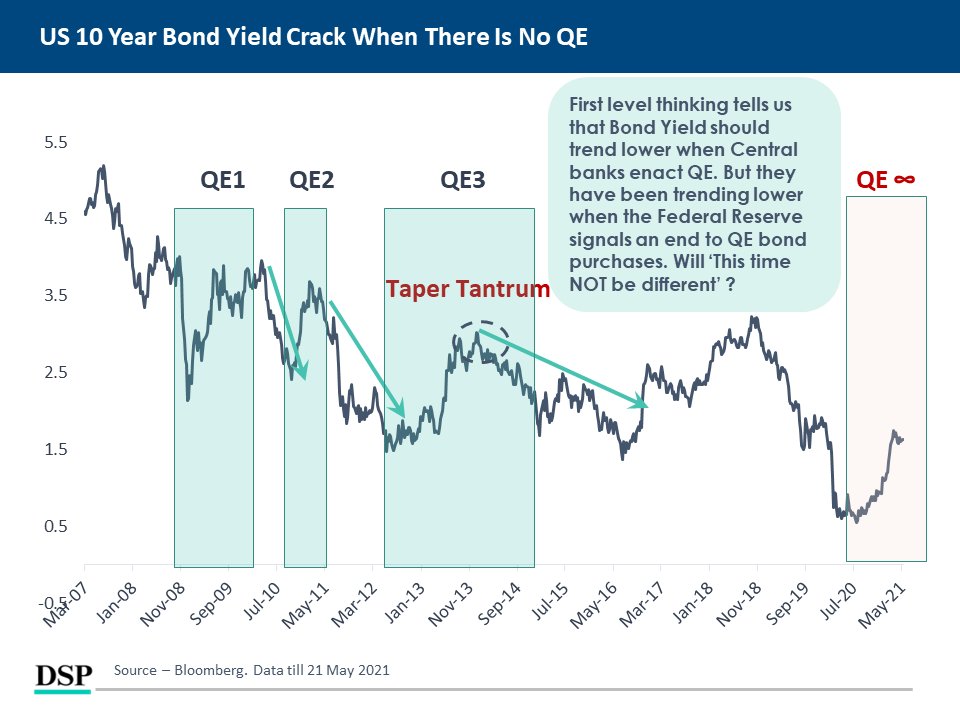

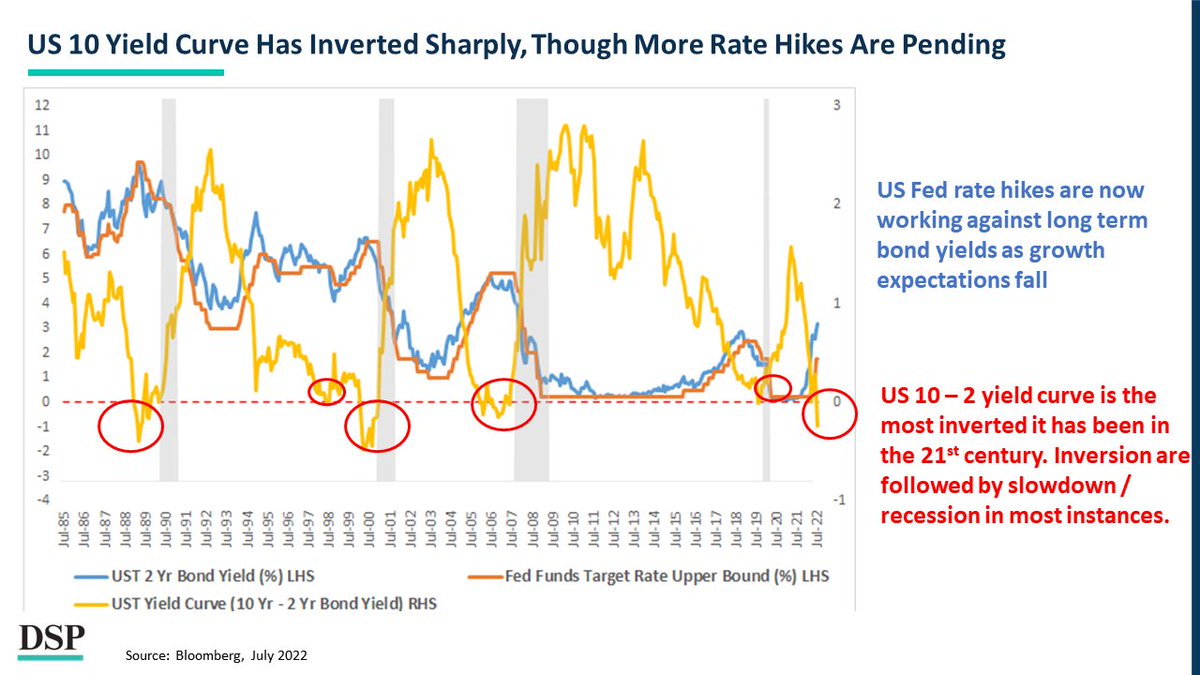

US 10 yield curve has inverted sharply, though more rate hikes are pending

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

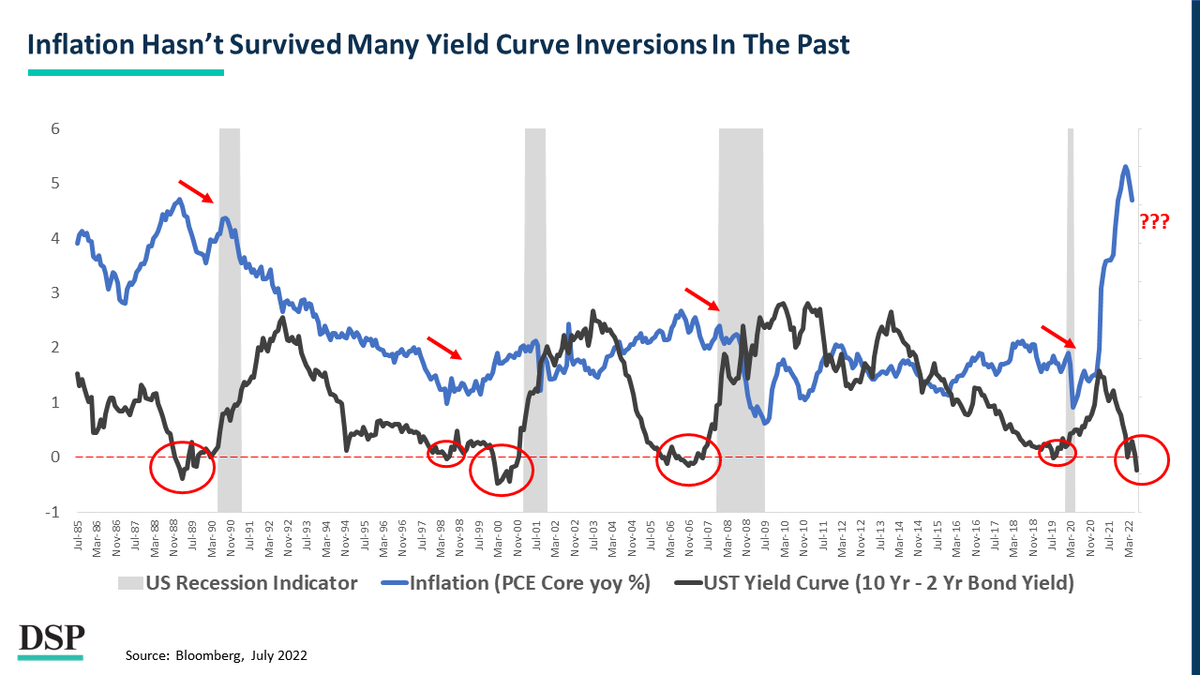

Inflation hasn’t survived many yield curve inversions in the past.

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

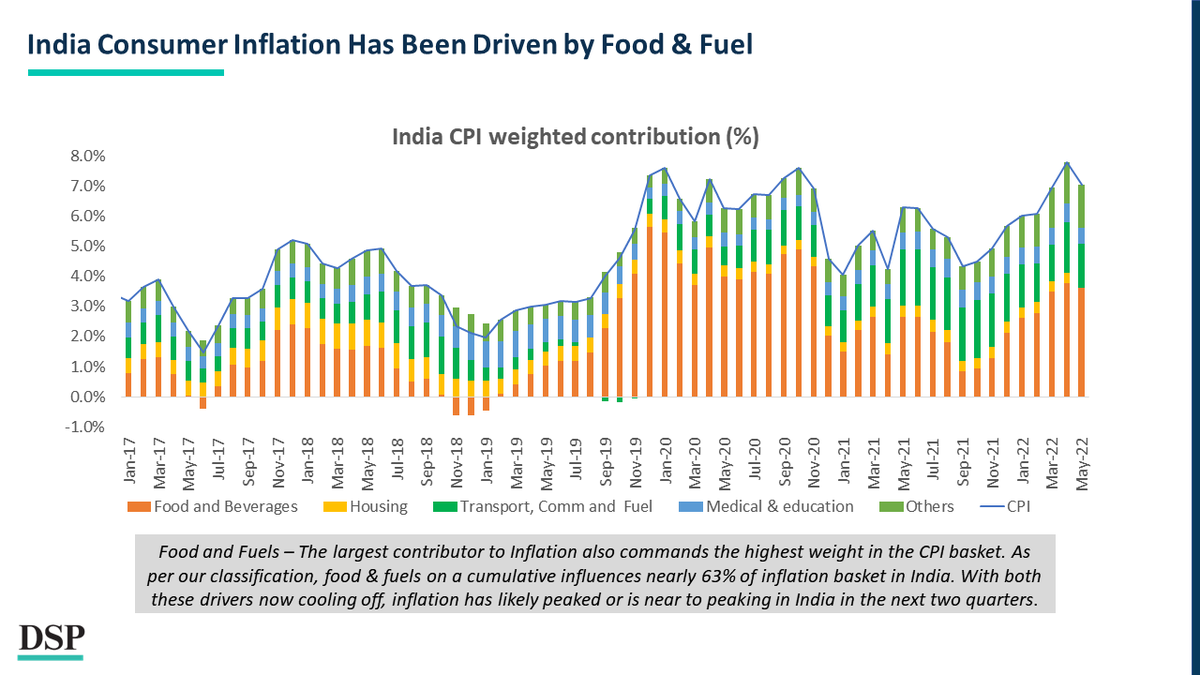

India consumer inflation has been driven by Food & Fuel🍲🛢️

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

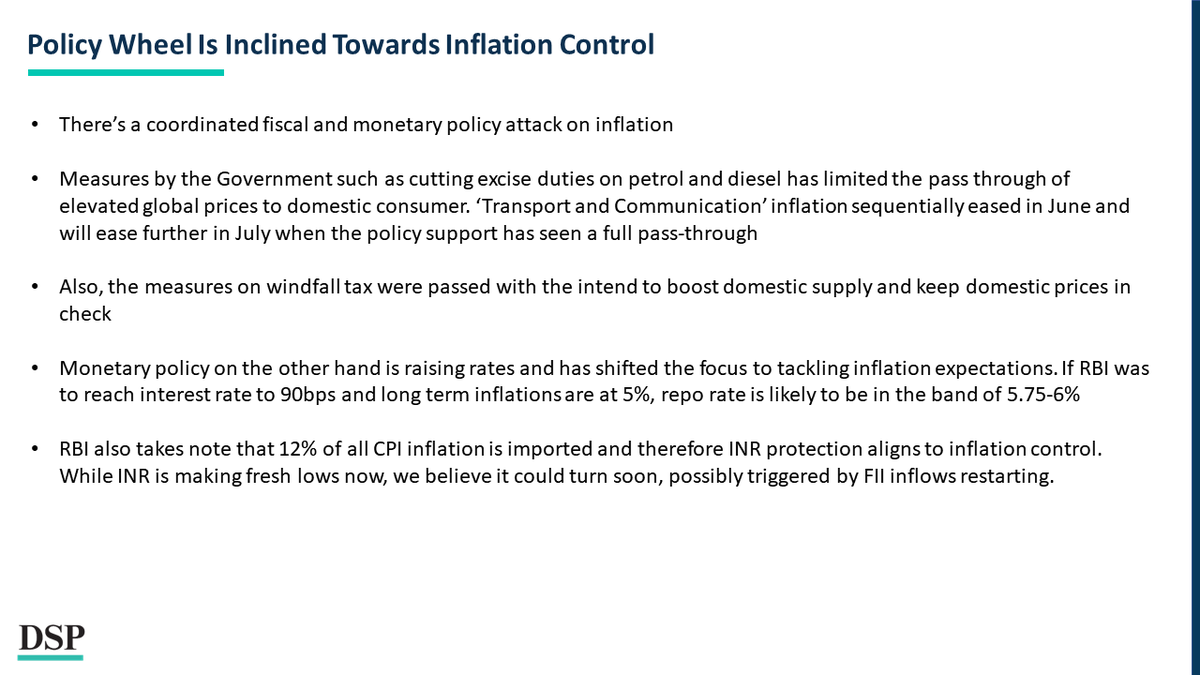

Policy wheel is inclined towards Inflation control.⏸️

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

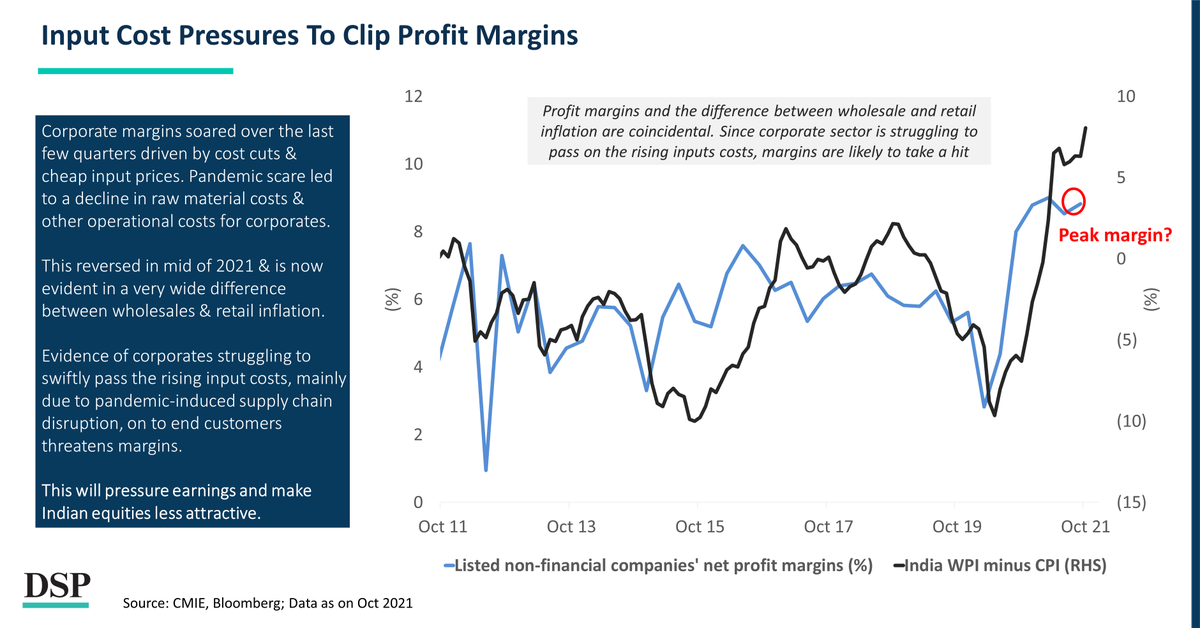

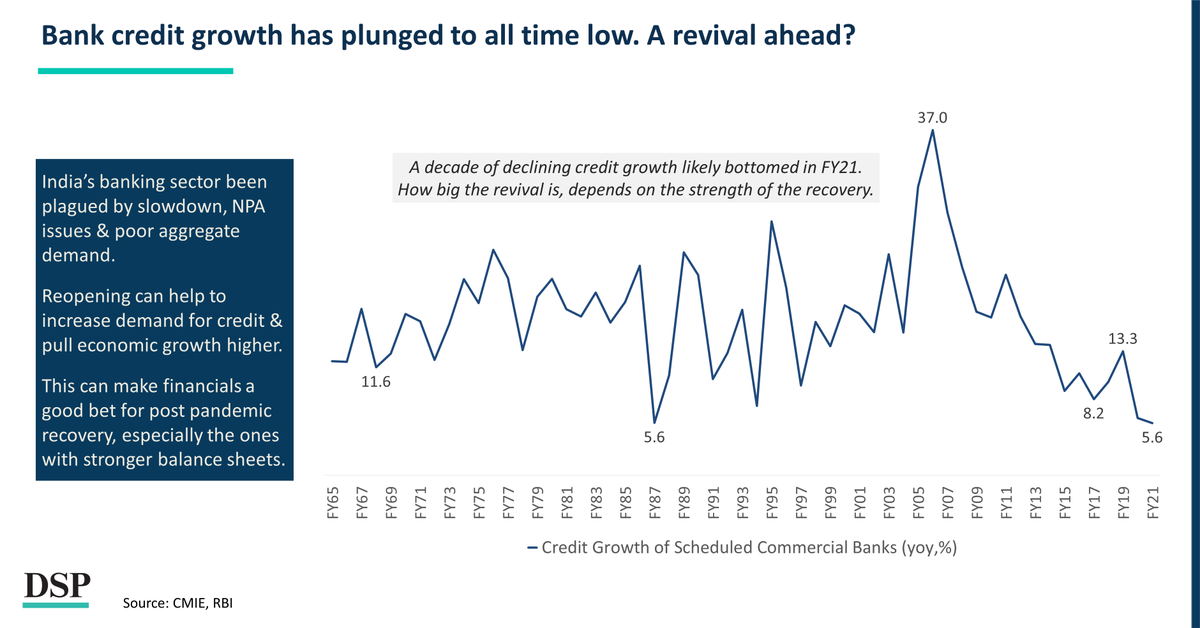

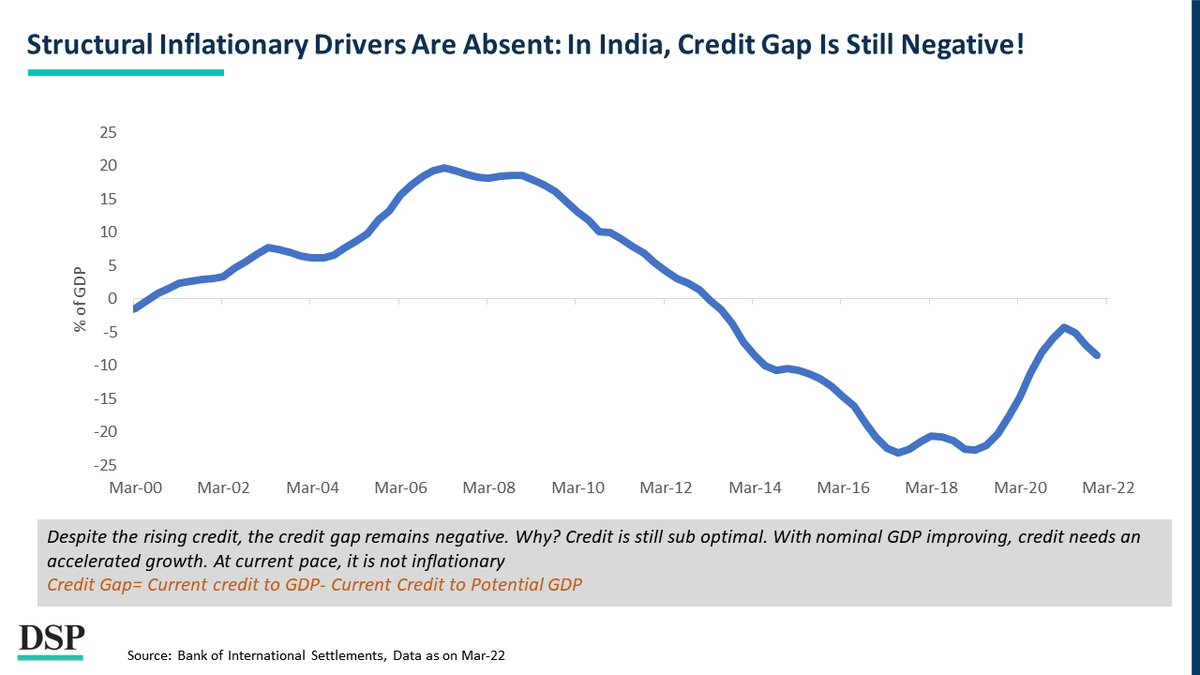

Structural inflationary drivers are absent: In India, credit gap is still negative!

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

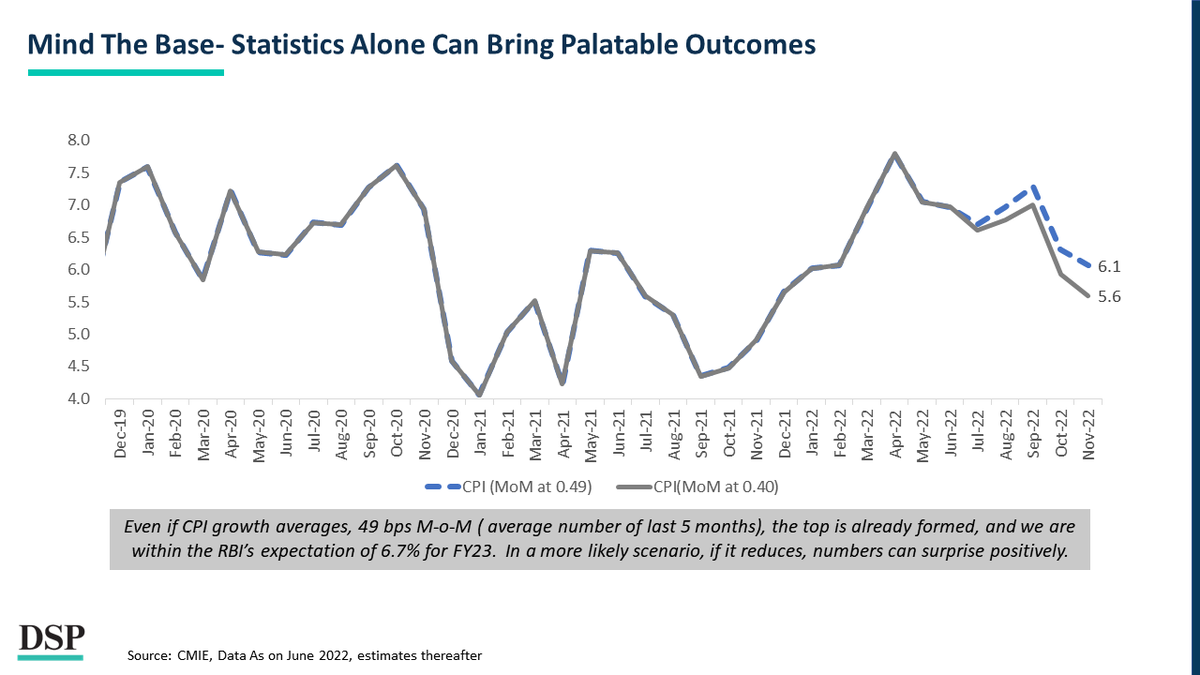

Mind the Base: Statistics alone can bring palatable outcomes!

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

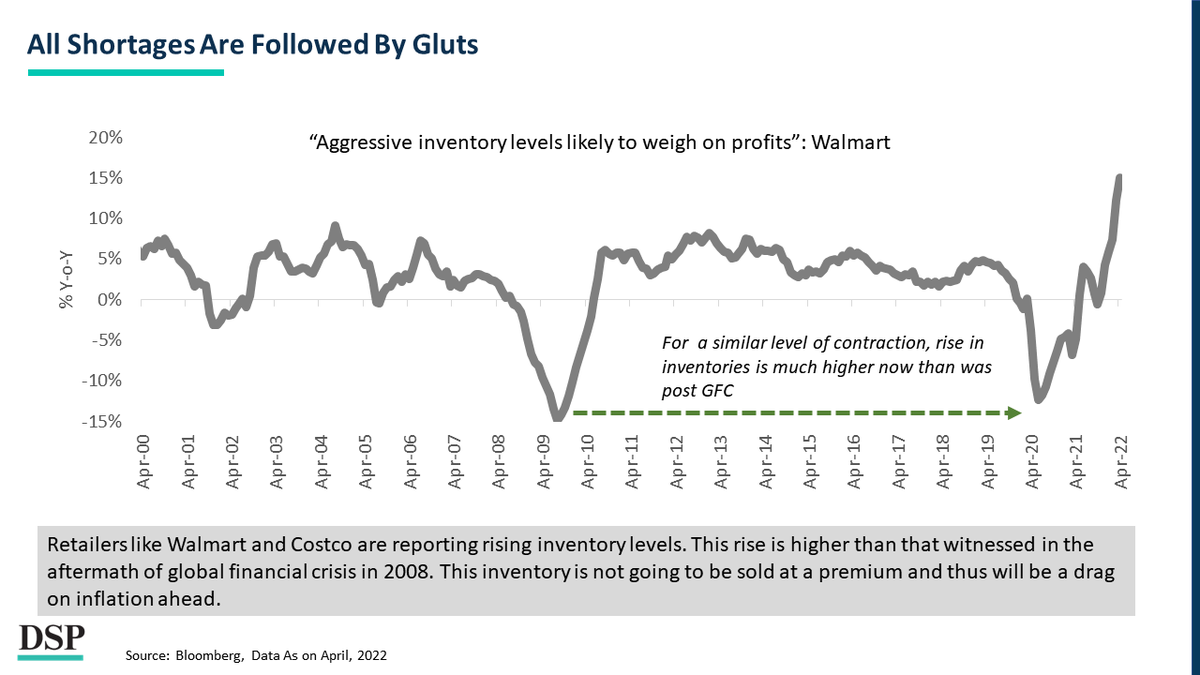

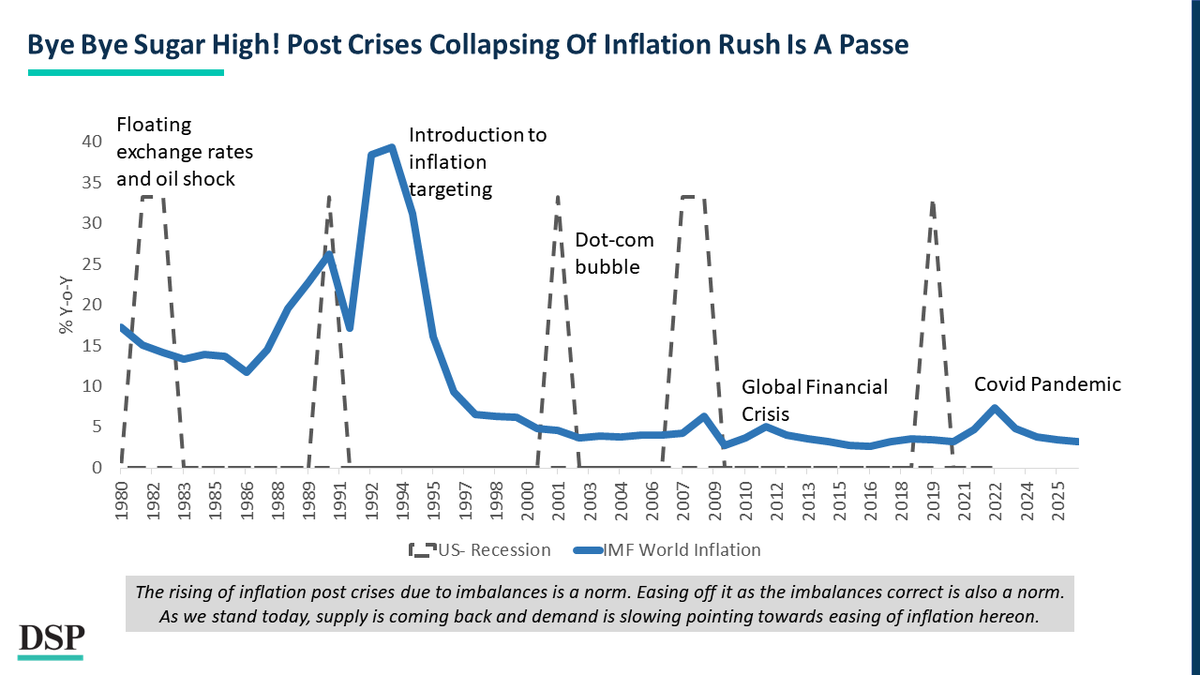

Bye bye Sugar high! Post crises collapsing of inflation rush is passé 👋

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

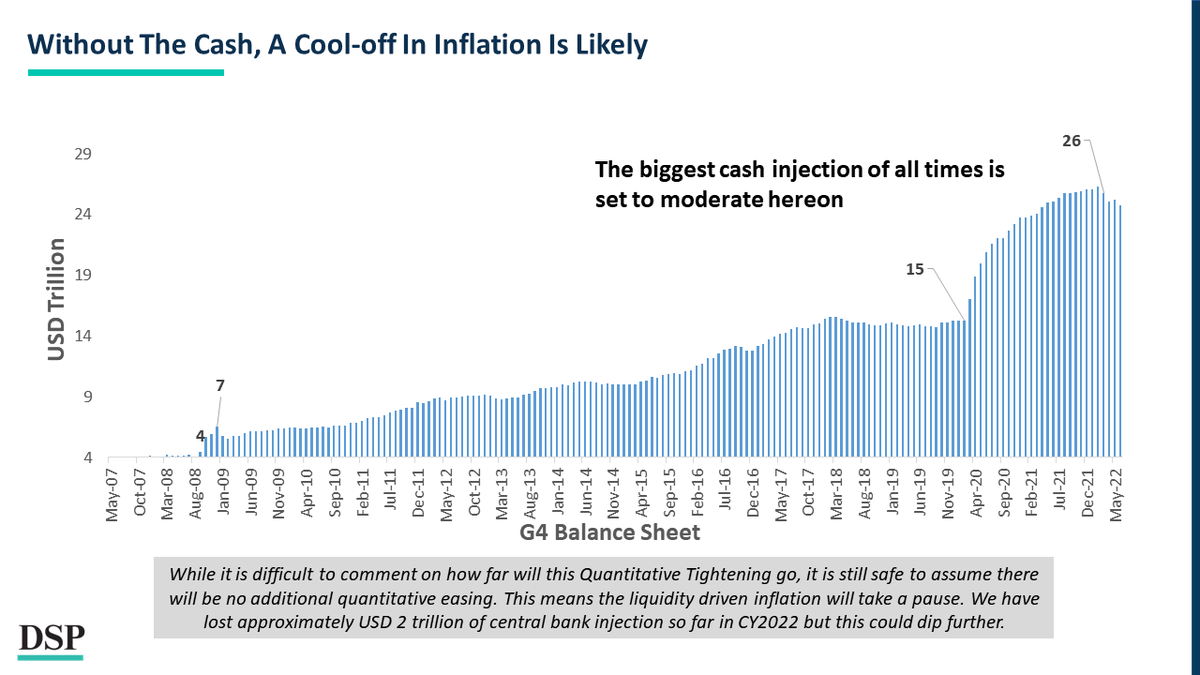

Without the cash, a cool-off in inflation is likely

Download report: dspim.co/InflationColla…

#DSPOnInflation

Download report: dspim.co/InflationColla…

#DSPOnInflation

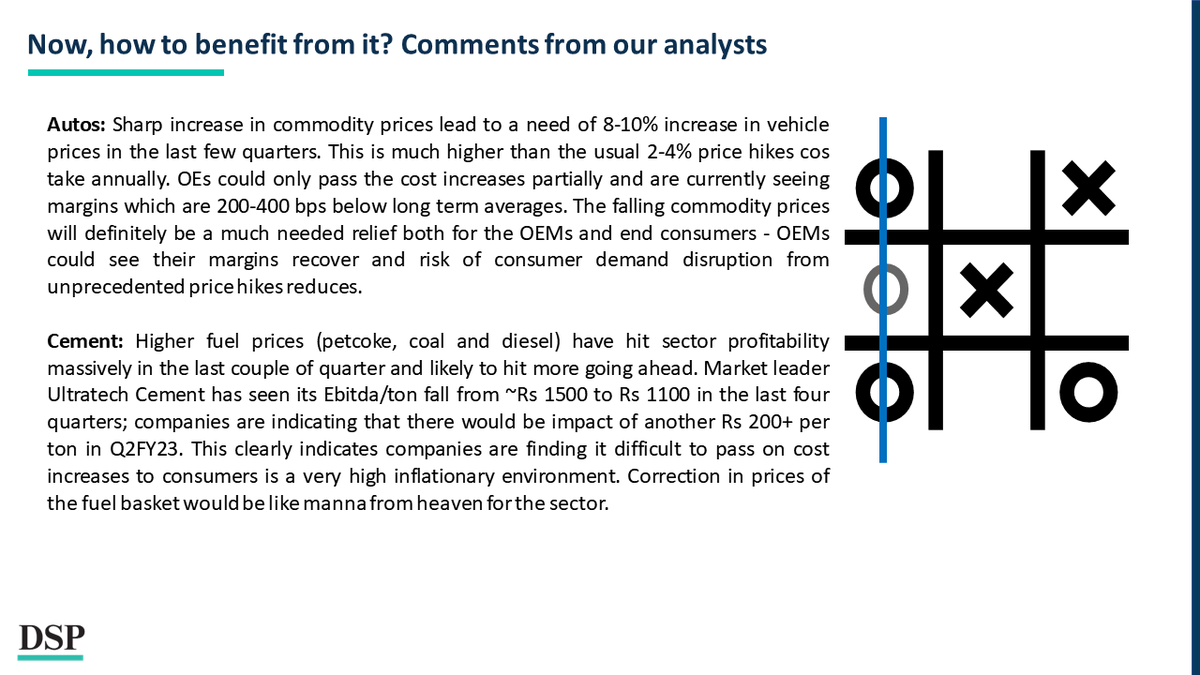

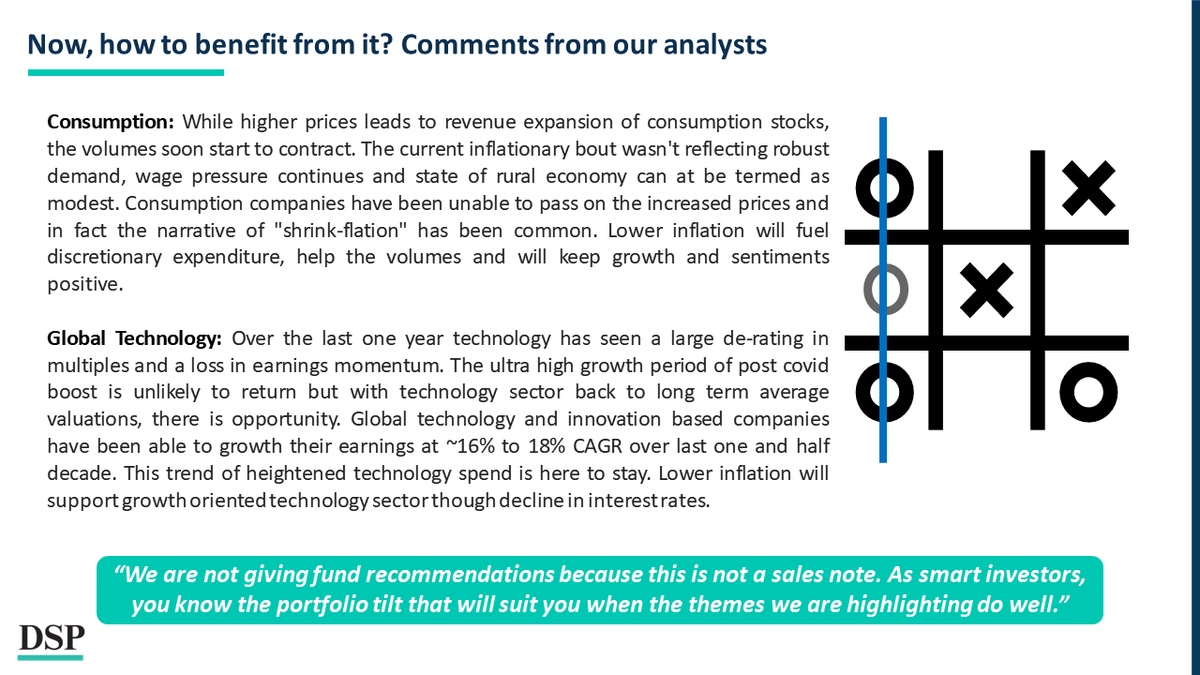

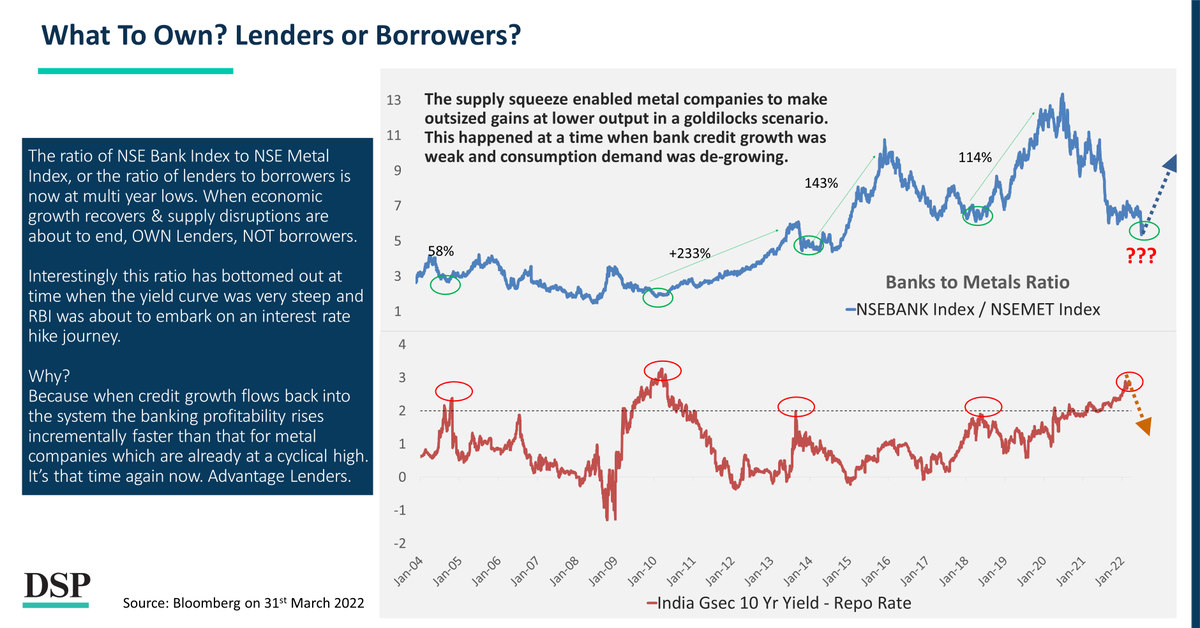

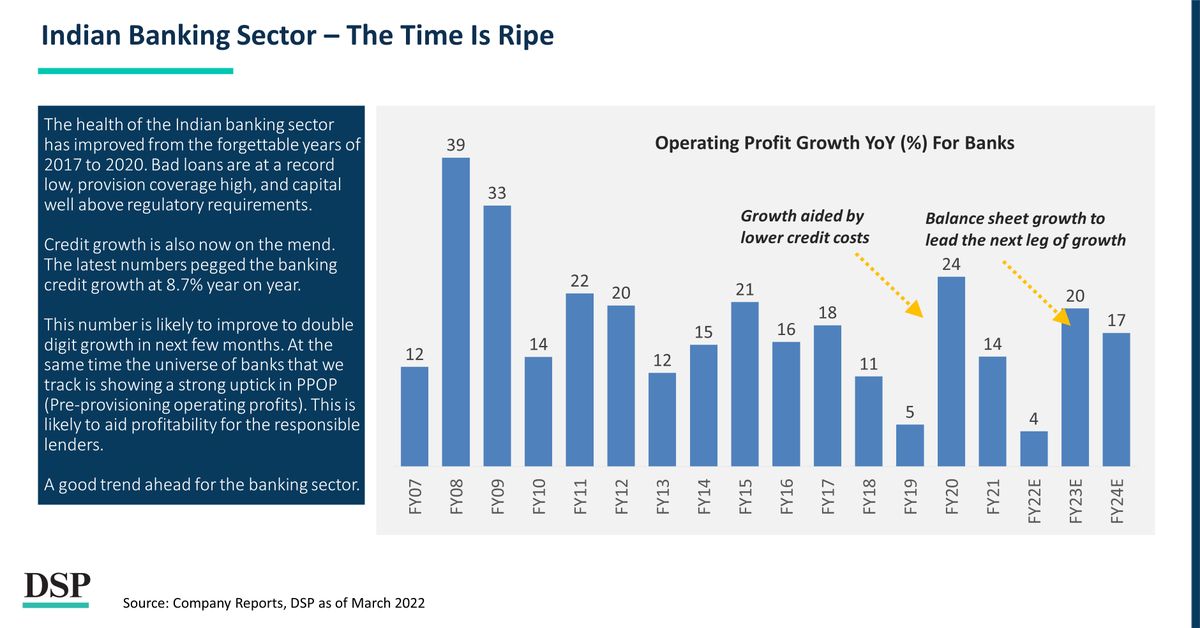

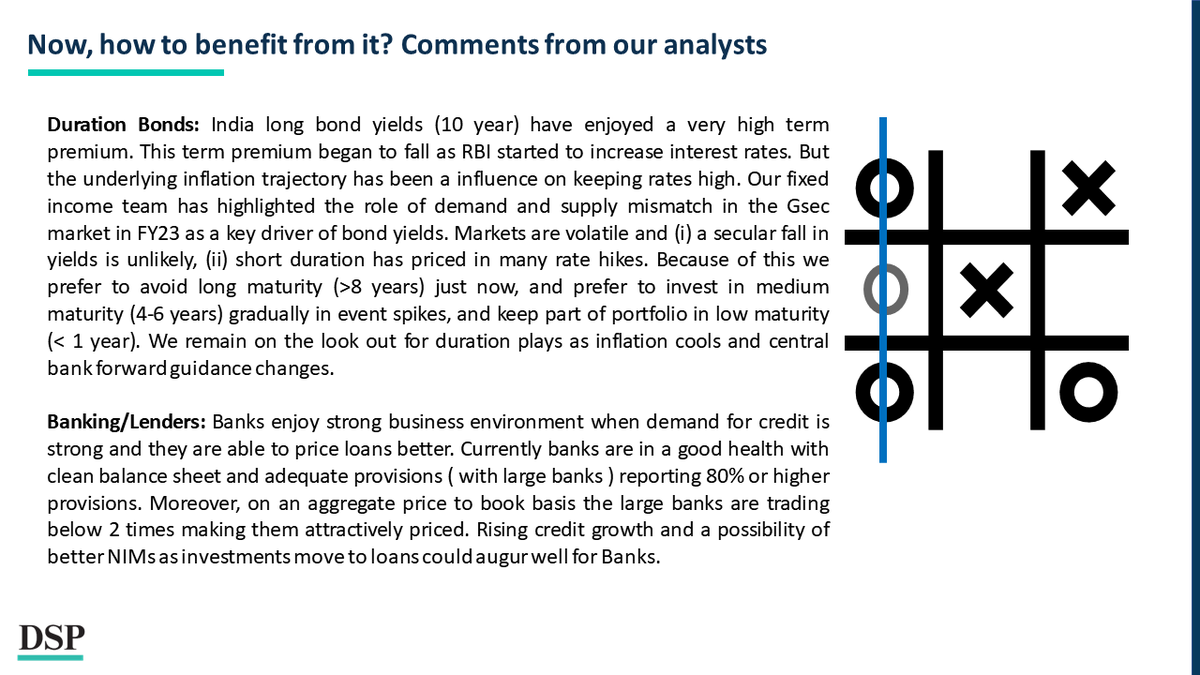

Now, how can you benefit from this?

Here are some comments from our analysts.🖋️👇

Download report: dspim.co/InflationColla…

#DSPOnInflation

Here are some comments from our analysts.🖋️👇

Download report: dspim.co/InflationColla…

#DSPOnInflation

• • •

Missing some Tweet in this thread? You can try to

force a refresh