Thread: a collection of concrete cases of substitution & demand reduction in the energy crisis.

Economic theory predicts that, as prices rise, households & firms reduce demand and substitute. We're starting to see more and more such cases

I'll collect these here as we go along.

Economic theory predicts that, as prices rise, households & firms reduce demand and substitute. We're starting to see more and more such cases

I'll collect these here as we go along.

Background: EU countries must cut gas demand by substantial amounts, e.g. Germany by around 29%, to withstand a Russian gas cut-off. Other energy is getting scarcer as well.

Where might such demand reduction come from? And how costly will it be?

Where might such demand reduction come from? And how costly will it be?

https://twitter.com/GuntramWolff/status/1546436433837170689?s=20&t=yZkHwHO3jTSUH91c1uPBYQ

In our import stop paper we emphasize that it makes a big difference how much substitution occurs.

Importantly, this is not just about substitution of gas itself. Downstream substitution of gas-intensive products, e.g. via imports, also does the trick.

Importantly, this is not just about substitution of gas itself. Downstream substitution of gas-intensive products, e.g. via imports, also does the trick.

https://twitter.com/kuhnmo/status/1500937765814517774?s=20&t=NZD_ZuG9vpjYl9QiBnBSww

We also collected a number of concrete examples of how firms were able to substitute in other contexts.

https://twitter.com/ben_moll/status/1505958846505930756?s=20&t=7g15hzKbT1Ios9QbvHtJsQ

Many people, especially industry lobbyists, claimed "substitution is impossible"

Remarkably, prices usually weren't mentioned. So it's really "no substitution even when prices skyrocket."

Of course, this then conveniently implies that subsidies to industry aren't all that bad😉

Remarkably, prices usually weren't mentioned. So it's really "no substitution even when prices skyrocket."

Of course, this then conveniently implies that subsidies to industry aren't all that bad😉

But how much do firms and households actually respond as prices are rising?

Let's get started. How long will the list grow? I'm unsure and curious.

If you know of a case of substitution that's not part of this thread, please send it my way.

Let's get started. How long will the list grow? I'm unsure and curious.

If you know of a case of substitution that's not part of this thread, please send it my way.

0. (= actually one where everyone agrees) Substitution of gas in electricity generation: switching on coal-fired power plants.

This is big, e.g. in 🇩🇪 electricity accounts for ~12% of gas consumption.

EU countries are now preparing this. But this should have happened long ago!

This is big, e.g. in 🇩🇪 electricity accounts for ~12% of gas consumption.

EU countries are now preparing this. But this should have happened long ago!

1. Screw manufacturer Würth is converting some of the ovens it uses to make screws from gas to electricity.

faz.net/aktuell/wirtsc…

faz.net/aktuell/wirtsc…

This could take up to a year.

@makro_philip is furious: if Würth had started doing this in March, the ovens may have been just about ready by late winter. Now they will likely be ready too late.

There should have been less lobbying and more substituting

@makro_philip is furious: if Würth had started doing this in March, the ovens may have been just about ready by late winter. Now they will likely be ready too late.

There should have been less lobbying and more substituting

https://twitter.com/makro_philip/status/1547582464922529792?s=20&t=byyHt0kBandR7l4IFqO37w

2. @BASF can apparently substitute by producing ammonia (which is used in fertilizer production) in the U.S. rather than in Germany.

So the substitution via imports can even happen *within* the same firm.

icis.com/explore/resour…

So the substitution via imports can even happen *within* the same firm.

icis.com/explore/resour…

3. This study looks at German fertilizer production and shows "that increased ammonia imports have allowed domestic fertilizer production to remain remarkably stable."

https://twitter.com/OliverRuhnau/status/1518871345504919552?s=20&t=7M0cPEvm1Sx-V82eJVPWCQ

4. Consistent with these stories, what looks like substitution via imports is starting to show up in aggregate trade data:

https://twitter.com/OliverRakau/status/1546774406197874688

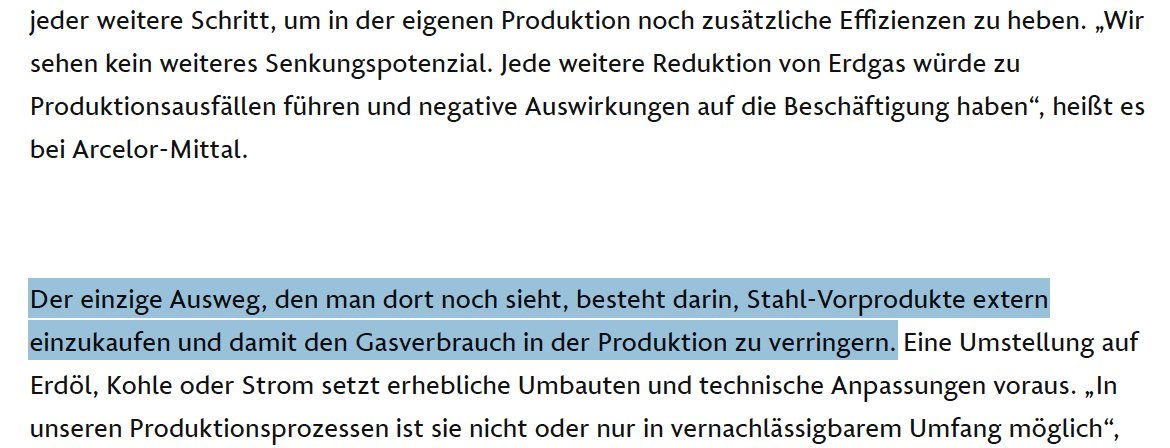

5. This article cites an Arcelor-Mittal manager essentially saying: we could, of course, import inputs for steel production from abroad. But we'd rather not bc it's expensive. Also, saving additional gas would result in lower production.

Shocking I know.

faz.net/aktuell/wirtsc…

Shocking I know.

faz.net/aktuell/wirtsc…

6. Households and firms have already reduced their gas demand: according to this study for Germany, household demand is down 6% and industrial demand down 11% relative to early 2021.

https://twitter.com/LionHirth/status/1544260511465889792?s=20&t=7M0cPEvm1Sx-V82eJVPWCQ

One thing to note about households: prices are passed through to a much smaller extent due to long-term contracts, "only" between a 50% and 140% increase.

https://twitter.com/OliverRuhnau/status/1544990379111489537?s=20&t=OvHVE6WhjzF7K4nzMYT92A

One can use these price increases and the 6% demand reduction to compute back-of-envelope elasticities.

These are between 0.07 to 0.15. As expected, small but very much not equal to zero. In our paper we used 0.1

(Math: log(0.94)/log(2.4) = -0.07 and log(0.94)/log(1.5) = -0.15)

These are between 0.07 to 0.15. As expected, small but very much not equal to zero. In our paper we used 0.1

(Math: log(0.94)/log(2.4) = -0.07 and log(0.94)/log(1.5) = -0.15)

That's my list for now. I'll append this thread as new cases come in.

#Econtwitter are you aware of other cases? Perhaps some from countries other than Germany for a change? I'd love to hear about them!

#Econtwitter are you aware of other cases? Perhaps some from countries other than Germany for a change? I'd love to hear about them!

New additions:

7. Some German dairy producers will switch from gas to oil in case gas deliveries get cut.

tagesschau.de/wirtschaft/unt… HT @resilietas

7. Some German dairy producers will switch from gas to oil in case gas deliveries get cut.

tagesschau.de/wirtschaft/unt… HT @resilietas

8. Munich's energy supplier @SWM_Muenchen

- is postponing the conversion of a heating plant from coal to gas

- will convert two heating plants from gas back to oil

zeitung.faz.net/fas/wirtschaft…

- is postponing the conversion of a heating plant from coal to gas

- will convert two heating plants from gas back to oil

zeitung.faz.net/fas/wirtschaft…

9. CEO of German chemicals producer H&R tells the @FT they "could only replace about 25% of its gas consumption with coal and oil"

@MSchularick: 25% is a hell of a difference from the "no substitution possible" typically claimed by the chemicals lobby.

@MSchularick: 25% is a hell of a difference from the "no substitution possible" typically claimed by the chemicals lobby.

https://twitter.com/MSchularick/status/1549366199628201985?s=20&t=tAObVMprQpYIZq4YbJcF7w

10. Related to point 6 above, industrial gas consumption in the Netherlands is

- down 25% (!) since Jan 2022

- down 40.5% (!!) since Jan 2019

HT @Mariekeconomie cc @LionHirth @OliverRuhnau

Data: Statistics Netherlands (CBS) & gas network operator (GTS)

cbs.nl/nl-nl/visualis…

- down 25% (!) since Jan 2022

- down 40.5% (!!) since Jan 2019

HT @Mariekeconomie cc @LionHirth @OliverRuhnau

Data: Statistics Netherlands (CBS) & gas network operator (GTS)

cbs.nl/nl-nl/visualis…

As a reminder: zero substitution --> production falls 1-for-1 with gas.

So if you think substitutability of gas along entire supply chain =0 (Leontief "cascade effects") you must also think 🇳🇱 production should be down 25% since Jan 2022.

Clearly not: fred.stlouisfed.org/series/NLDPROI…

So if you think substitutability of gas along entire supply chain =0 (Leontief "cascade effects") you must also think 🇳🇱 production should be down 25% since Jan 2022.

Clearly not: fred.stlouisfed.org/series/NLDPROI…

11. Car manufacturer Audi says it can substitute 20% of its gas consumption in the near term, e.g. by turning down the heating in offices. Only 10% of gas is irreplaceable (paint shop, ovens) and "the minimum amount of gas needed".

n-tv.de/wirtschaft/Aud… HT @GeorgZachmann

n-tv.de/wirtschaft/Aud… HT @GeorgZachmann

12. Car manufacturer Mercedes says it can reduce its Germany-wide gas consumption by a whopping 50% "if regional pooling is made possible." For example, the paint shop in its Sindelfingen factory can be operated without any gas whatsoever.

mbpassion.de/2022/07/merced… HT @OliverRakau

mbpassion.de/2022/07/merced… HT @OliverRakau

.@marceldirsus take on this case:

https://twitter.com/marceldirsus/status/1552257764935745537?s=20&t=R6O60KxjEXzCHS1kWpsFfQ

... and an article in English about it:

https://twitter.com/marceldirsus/status/1552258818318499840?s=20&t=R6O60KxjEXzCHS1kWpsFfQ

13. Remember the lobbyists' favorite example of "substitution is impossible": the glass industry. Surprise surprise:

Glas manufacturer Wiegand Glass "will be able to heat its melting tanks [...] with light fuel oil instead of natural gas"

zeit.de/news/2022-07/2… HT @Bajuwandres

Glas manufacturer Wiegand Glass "will be able to heat its melting tanks [...] with light fuel oil instead of natural gas"

zeit.de/news/2022-07/2… HT @Bajuwandres

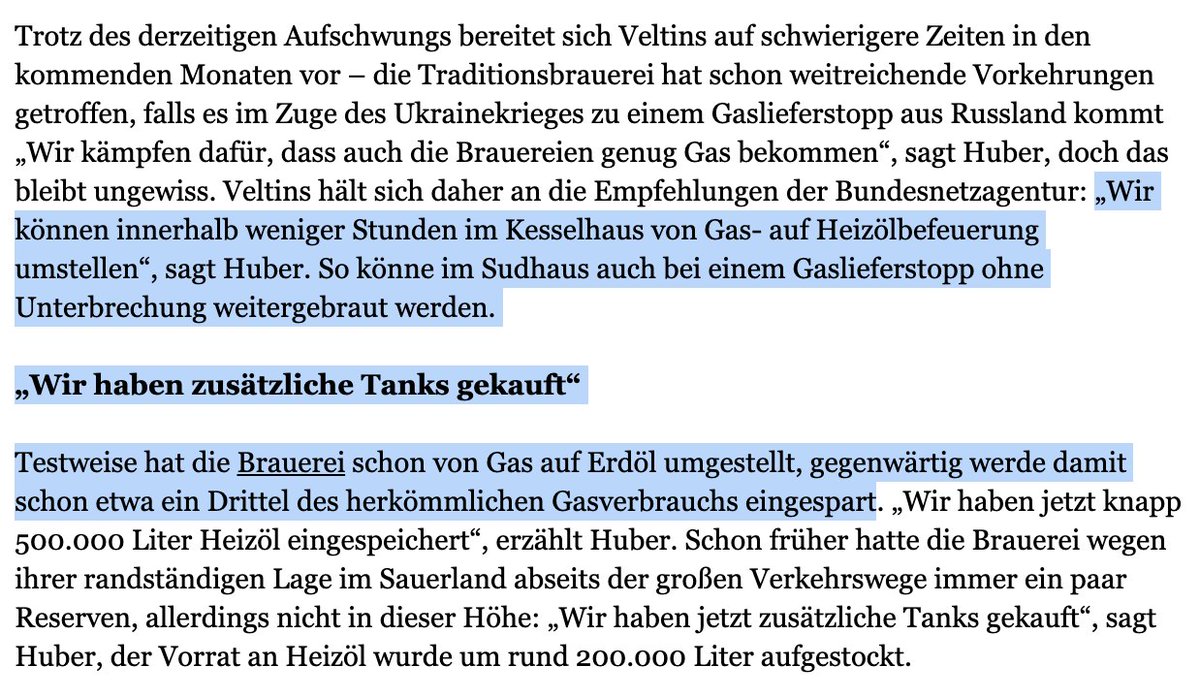

14. Veltins brewery says that brewing can continue in the brewhouse without interruption even if gas supply stops: "We can switch from gas to fuel oil firing in the boiler house within a few hours."

Plus they've cut gas by 1/3 to date.

faz.net/aktuell/wirtsc… HT @embargo_energy

Plus they've cut gas by 1/3 to date.

faz.net/aktuell/wirtsc… HT @embargo_energy

15. @BASF (same amount of gas as🇨🇭)

- can substitute 15% of gas used for heat & steam (=50% of total) with oil

- can easily substitute ammonia by importing

- can operate as long as gas >50%

- just revised profit expectations for 2022 UPWARDS

nzz.ch/wirtschaft/che… HT @LionHirth

- can substitute 15% of gas used for heat & steam (=50% of total) with oil

- can easily substitute ammonia by importing

- can operate as long as gas >50%

- just revised profit expectations for 2022 UPWARDS

nzz.ch/wirtschaft/che… HT @LionHirth

For comparison here's @BASF CEO Brudermüller back in March: a cut-off from Russian gas would mean the "destruction of the entire German economy" and the "worst crisis since the end of the Second World War"

Lobbyism at its best.

spiegel.de/wirtschaft/unt…

Lobbyism at its best.

spiegel.de/wirtschaft/unt…

It’s also always good to remember how @BASF got to be so reliant on Russian gas. For German speakers, this @ZDF video summarizes it nicely. See in particular the timeline around minute 1:00.

amp.zdf.de/nachrichten/wi…

amp.zdf.de/nachrichten/wi…

16. Paper manufacturer Schoellershammer will substitute 50% of gas until early January by converting its gas-fired boiler to oil. Even without this measure, it can save 15% of gas while operating its machines at somewhat reduced capacity.

aachener-nachrichten.de/lokales/dueren… HT @ThWittlinger

aachener-nachrichten.de/lokales/dueren… HT @ThWittlinger

17. Sugar manufacturer Pfeifer & Langen expects to cut Germany-wide gas consumption by 50%. Important part of plan: reshuffle gas across factories. Eg the factories in Appeldorn & Euskirchen can switch to oil which frees up gas for Jülich

aachener-nachrichten.de/lokales/juelic… HT @ThWittlinger

aachener-nachrichten.de/lokales/juelic… HT @ThWittlinger

Interesting aspect of cases 16 & 17: due to Germany's announced 2030 phase-out of lignite, both the paper manufacturer in 16 & sugar manufacturer in 17 switched everything from lignite to gas only a year ago

After all, gas was green, cheap, and secure. How times have changed!

After all, gas was green, cheap, and secure. How times have changed!

18. (follow up on 15.)

@BASF now even advertise their substitution prowess in their analyst conference calls:

- “preparations to substitute natural gas are progressing well”

- “Continued operation at Ludwigshafen site is ensured down to 50% of BASF’s maximum natural gas demand”

@BASF now even advertise their substitution prowess in their analyst conference calls:

- “preparations to substitute natural gas are progressing well”

- “Continued operation at Ludwigshafen site is ensured down to 50% of BASF’s maximum natural gas demand”

https://twitter.com/PhilippaSigl/status/1553667057052426240

19. (Follow-up on 5.)

Remember that poor @ArcelorMittal manager who essentially said “we could of course substitute by importing metal inputs, but it really wouldn’t be good for our bottom line”? Guess what they ended up doing:

nytimes.com/2022/07/30/bus… HT @SteveCicala

Remember that poor @ArcelorMittal manager who essentially said “we could of course substitute by importing metal inputs, but it really wouldn’t be good for our bottom line”? Guess what they ended up doing:

nytimes.com/2022/07/30/bus… HT @SteveCicala

https://twitter.com/ben_moll/status/1548004174419206147

Importantly, just like @BASF in case 2, @ArcelorMittal is yet another case of substitution via imports even happening *within* the same firm.

https://twitter.com/ben_moll/status/1548004164252213249

An important clarification because people often ask: doesn't substitution via imports destroy some production in importing country (🇩🇪)?

Answer: of course it does. But it kills the notorious "cascading effects" = one of main arguments of industry lobby.

Answer: of course it does. But it kills the notorious "cascading effects" = one of main arguments of industry lobby.

https://twitter.com/fabolange/status/1548021451197784065?s=20&t=O-vOSf8zLX2_mbDcpeCGDA

More generally people sometimes ask: if a firm is cutting production doesn't that show it can't substitute?

The answer is: no, of course substitution is costly. The question is not WHETHER production falls but by HOW MUCH it falls?

The answer is: no, of course substitution is costly. The question is not WHETHER production falls but by HOW MUCH it falls?

No substitutability means production falls one-for-one with gas.

Some substitutability means production does fall but it falls by potentially much less than gas.

That's what we're seeing now.

Some substitutability means production does fall but it falls by potentially much less than gas.

That's what we're seeing now.

Here’s a chart by @OliverRakau that shows this beautifully: German industrial gas use falls of a cliff (~40%) but manufacturing output & even chemical output fall by much less (~1% &10%)

The world is not Leontief!

*as @OliverRakau says the ENTSOG data may overstate the gas drop

The world is not Leontief!

*as @OliverRakau says the ENTSOG data may overstate the gas drop

https://twitter.com/OliverRakau/status/1555847089661280256

The next four cases are due to excellent reporting by @IlkaKopplin @bfreytag @MaxosTaxos @GustavTheile in @FAZ_Wirtschaft and @c_endt @JurikIser in @zeitonline_wir

zeit.de/wirtschaft/202…

zeit.de/wirtschaft/202…

https://twitter.com/JoPennekamp/status/1554905107220910085?s=20&t=rg-mmrEZ9xUzIv984sMBRA

20. Automotive supplier ZF says it should be able to reduce gas consumption by 20% by:

- turning down heating

- switching some production processes to electricity

- switching others to oil

- importing some parts from regions with lower energy prices

- turning down heating

- switching some production processes to electricity

- switching others to oil

- importing some parts from regions with lower energy prices

21. Semiconductor manufacturer @Infineon aims to save two thirds (!) of its gas consumption by the end of 2022. One main measure is switching the energy source for the air conditioning systems cooling the rooms where their microchips are manufactured from gas to oil.

22. Yet another glass industry example, just like case 13:

Special glass manufacturer Schott can switch its melting furnaces from natural gas to propane gas if necessary. To this end, it has already stocked up on large quantities of propane gas.

Special glass manufacturer Schott can switch its melting furnaces from natural gas to propane gas if necessary. To this end, it has already stocked up on large quantities of propane gas.

23. German pharma and chemicals manufacturer Merck says it can switch its production processes from gas to oil and that it is "very well prepared" for any potential gas shortage.

See zeit.de/wirtschaft/202… and faz.net/aktuell/wirtsc…

See zeit.de/wirtschaft/202… and faz.net/aktuell/wirtsc…

24. Oil giant @ExxonMobil_EU say they have reduced natural gas consumption in their European refineries "by 65%, that's the equivalent gas used for powering about 2 million homes in Europe."

From their Q2 earnings call on July 29 corporate.exxonmobil.com/-/media/Global… HT @manuel66972261

From their Q2 earnings call on July 29 corporate.exxonmobil.com/-/media/Global… HT @manuel66972261

25. You may also remember @eni, the Italian energy giant that was extremely keen to pay for its gas in rubles back in May.

Just like @ExxonMobil_EU, they have also reduced gas consumption in their refineries by 70%.

seekingalpha.com/article/452812… HT @manuel66972261

Just like @ExxonMobil_EU, they have also reduced gas consumption in their refineries by 70%.

seekingalpha.com/article/452812… HT @manuel66972261

Here's an article from May on the ruble saga starring @eni.

Note: the ruble payments were probably economically irrelevant to a certain extent, see e.g. @PHonohan piie.com/blogs/realtime…, but it's still worth pointing out this is the same company.

ft.com/content/7b416e…

Note: the ruble payments were probably economically irrelevant to a certain extent, see e.g. @PHonohan piie.com/blogs/realtime…, but it's still worth pointing out this is the same company.

ft.com/content/7b416e…

26. Also BP @bp_plc have reduced natural gas by almost 50% in their 🇩🇪🇪🇸 & 🇳🇱 refineries.

Strikingly, they say this "has not impacted output in any way"!

In economics lingo: not only is production not Leontief -- instead (close to) perfect substitutes!

bp.com/content/dam/bp…

Strikingly, they say this "has not impacted output in any way"!

In economics lingo: not only is production not Leontief -- instead (close to) perfect substitutes!

bp.com/content/dam/bp…

27. Here we go with yet another example from the Chemicals industry: specialty chemicals group Evonik say they can reduce their natural gas consumption by up to 40%.

How? They can substitute it with liquefied petroleum gas (LPG).

How? They can substitute it with liquefied petroleum gas (LPG).

https://twitter.com/jakluge/status/1556683597746212866?s=20&t=9UKt3xiauAon0JtLplH7Gw

28. A case from the heavily gas-dependent aluminum industry.

German engineers are smart and inventive. Unfortunately the lobbyists pretended that they are not.

(Video in German, English video in next tweet)

German engineers are smart and inventive. Unfortunately the lobbyists pretended that they are not.

(Video in German, English video in next tweet)

https://twitter.com/jakluge/status/1557260388575633408

Here’s an English version of the video. HT @GeorgZachmann

https://twitter.com/Reuters/status/1557025157381758977

29. According to @ICISOfficial data, German industrial gas demand is now 26%(!) below normal (= average in previous 5 years). The chart also shows the decline really picking up in recent months.

https://twitter.com/tmarzecmanser/status/1560149526748561408?s=20&t=C9bqcVED4eyqj0-CTot-Ew

Also consistent with this: overall gas consumption (i.e. not just industry) is down 15% in the first half of 2022 according to the power industry lobbyists @bdew_ev.

reuters.com/markets/commod…

reuters.com/markets/commod…

30. Sugar industry again, like case 17: sugar giant Nordzucker says that over 80% (!!!) of its German sugar production capacity has been converted back to oil.

Thanks @jakluge who is essentially a co-author by now!

Source: euronews.com/next/2022/08/2…

Thanks @jakluge who is essentially a co-author by now!

Source: euronews.com/next/2022/08/2…

https://twitter.com/jakluge/status/1562796758266445831?s=20&t=FjBSH0Hjl0MD67UgBGhEBw

31. Zurich airport says it can switch its heating from gas to oil. "This is technically possible, but comes with a negative impact on our CO2 emissions."

Source: news.yahoo.com/edited-transcr…

Source: news.yahoo.com/edited-transcr…

https://twitter.com/JavierBlas/status/1562073242952769537?s=20&t=o0ILAWVPH8VYxav1_d8tDg

32. German PPE and sportswear manufacturer Uvex is planning on substituting 80% (!!!) of its gas consumption with propane gas (LPG). HT @exergetiker

(Video in German )

(Video in German )

33. Yet another lobbyist favorite where "substitution is impossible": the steel industry. (Chemicals and glass were even more popular but we've already covered those).

Guess what happened? Doesn't exactly look like steel production is Leontief, does it?

Guess what happened? Doesn't exactly look like steel production is Leontief, does it?

https://twitter.com/GeorgZachmann/status/1564147623136829440?s=20&t=7MLY-5jOEwf_vDhGvRtzjg

34. I like this example because it's so unique: Berlin has the world's largest surviving gaslight network and will replace most of these with LED lights.

HT @DanielMDoine

reuters.com/markets/europe…

HT @DanielMDoine

reuters.com/markets/europe…

The article also illustrates nicely that substitution has costs:

- "Even the newest LEDs cannot fully imitate the colour of a tiny flame heating a rare-earth gas mantle causing it to shine brilliantly"

- "LEDs attract more insects than gas, killing hundreds of them a night"

- "Even the newest LEDs cannot fully imitate the colour of a tiny flame heating a rare-earth gas mantle causing it to shine brilliantly"

- "LEDs attract more insects than gas, killing hundreds of them a night"

35. EU industrial production continues to look very much non-Leontief (data til July 22).

I do expect *some* production cuts to show up in later data, just nowhere near one-for-one with gas usage...

I do expect *some* production cuts to show up in later data, just nowhere near one-for-one with gas usage...

https://twitter.com/LionHirth/status/1577231873423859712?s=20&t=1b4qJ-44yg63cEAA7g8C2A

This new paper about 🇩🇪 deserves an addition: controlling for temperature etc etc

- overall consumption⬇️30%

- industry⬇️19%

- small consumers⬇️36%

- power generation⬇️53%

and... no Armageddon

Great work @OliverRuhnau @ClemensStiewe @Jarusch1 @LionHirth!

- overall consumption⬇️30%

- industry⬇️19%

- small consumers⬇️36%

- power generation⬇️53%

and... no Armageddon

Great work @OliverRuhnau @ClemensStiewe @Jarusch1 @LionHirth!

https://twitter.com/LionHirth/status/1587547903614230530

I think perhaps I'm done making this thread's point. So let me conclude with three things:

First, some current slides summarizing much of this work.

benjaminmoll.com/RussianGas_sli…

First, some current slides summarizing much of this work.

benjaminmoll.com/RussianGas_sli…

Second, a pointer to this excellent recent @FT piece by @ChrisGiles_

https://twitter.com/GuntramWolff/status/1585899924138430467?s=20&t=cJXqgosam9mnsPArDshjjA

Third, a parting thought:

There's good economics in which households & firms reduce demand and substitute as prices rise, demand curves are downward sloping, and modern capitalist economies adapt.

If someone tells you otherwise, it's bad economics.

Simple as that.

There's good economics in which households & firms reduce demand and substitute as prices rise, demand curves are downward sloping, and modern capitalist economies adapt.

If someone tells you otherwise, it's bad economics.

Simple as that.

• • •

Missing some Tweet in this thread? You can try to

force a refresh