For the record, I supported Demonetization when I was NOT YET CEA. I've always formed my views using empirical evidence even if it meant standing alone based on my courage of conviction. So, to help evidence-based assessments, putting out a #Thread on #EvidenceOnDemon 1/12

https://twitter.com/bijaysinghjnu/status/1548329927975440393

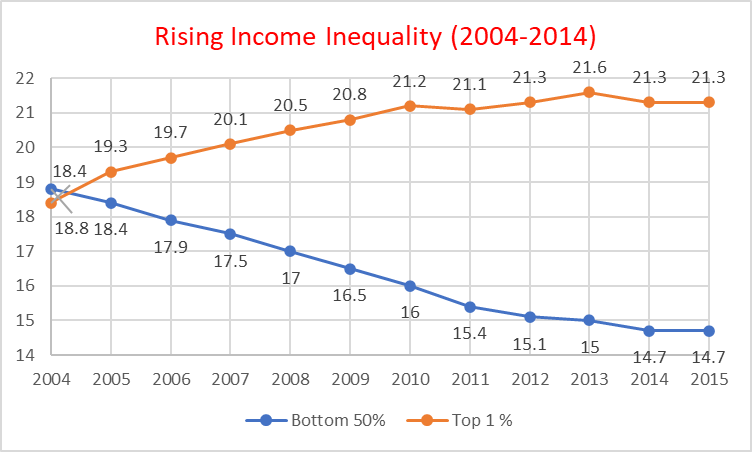

Data from World Inequality Database shows inequality ↑ in India from 2004-14, when share of wealthy top 1% in national income ↑ from 18.4% to 21.3% but share of bottom 50% ↓ from 18.8% to 14.7%. Why? ↑ in cronyism & corruption from 2004-14. See indiabudget.gov.in/budget2020-21/… 2/12

Unlike the ↑ in inequality from 2004-14, demon had the effect of redistributing wealth from the rich to the poor. See sciencedirect.com/science/articl…. These findings, which carefully control for various confounding factors, suggest that demon would have helped to ↓ inequality. 3/12

During demon, non-profit organizations & non-corporates were 2nd largest category of entities in avg. cash deposited. While they account for only 4.6% of PAN nos, cash deposited by them accounted for a disproportionate 16.2%. 4/12

Large cash deposited by non-profit organizations & non-corporates crucial bcos they maybe vehicles for unholy trinity of tax evasion, wilful default & money laundering. See evidence related party transactions r used by wilful defaulters (Fig 21-23 in indiabudget.gov.in/budget2020-21/…) 5/12

Following demon, 3.8lakh companies & 4.5lakh directors related to shell entities have been struck off under Sec 248(1)(c) & 248(1)(c) of the Companies Act. Cumulatively, surveys conducted by tax authorities in 63691 cases revealed undisclosed income of about Rs. 85K cr 6/12

As shown in tables in slides 45-50 in the deck in linkedin.com/feed/update/ur… , formalization of economy helped in bringing crores of workers into formal sector. 7/12

BOTH Direct tax/GDP ratio & actual direct tax collection ↑ following Demon. See charts below that show clearly the same - the vertical line is for the year of Demon 8/12

Volume of digital transactions ↑ sharply while traditional transactions maintained similar growth. See chart below that shows this clearly 9/12

In a pair of NUS working papers, Prof. Sumit Agarwal shows that demon led to a permanent ↑ in use of digital transactions, especially among the young. Even 2 yrs after demon, those who switched to digital txns didn't return to cash txns. See scholar.google.com/scholar?hl=en&… 10/12

In a Harvard Univ working paper, Bandi et al. (2019) find that post demon customers that switched to digital payments on e-commerce platforms – instead of cash-on-delivery – spend more per transaction and are less likely to return their purchases. hbs.edu/faculty/Pages/… 11/12

In a Northwestern University working paper, Crouzet et al. (2020) find a 60% permanent increase in fintech payments after demonetization kellogg.northwestern.edu/faculty/crouze… 12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh