1/18

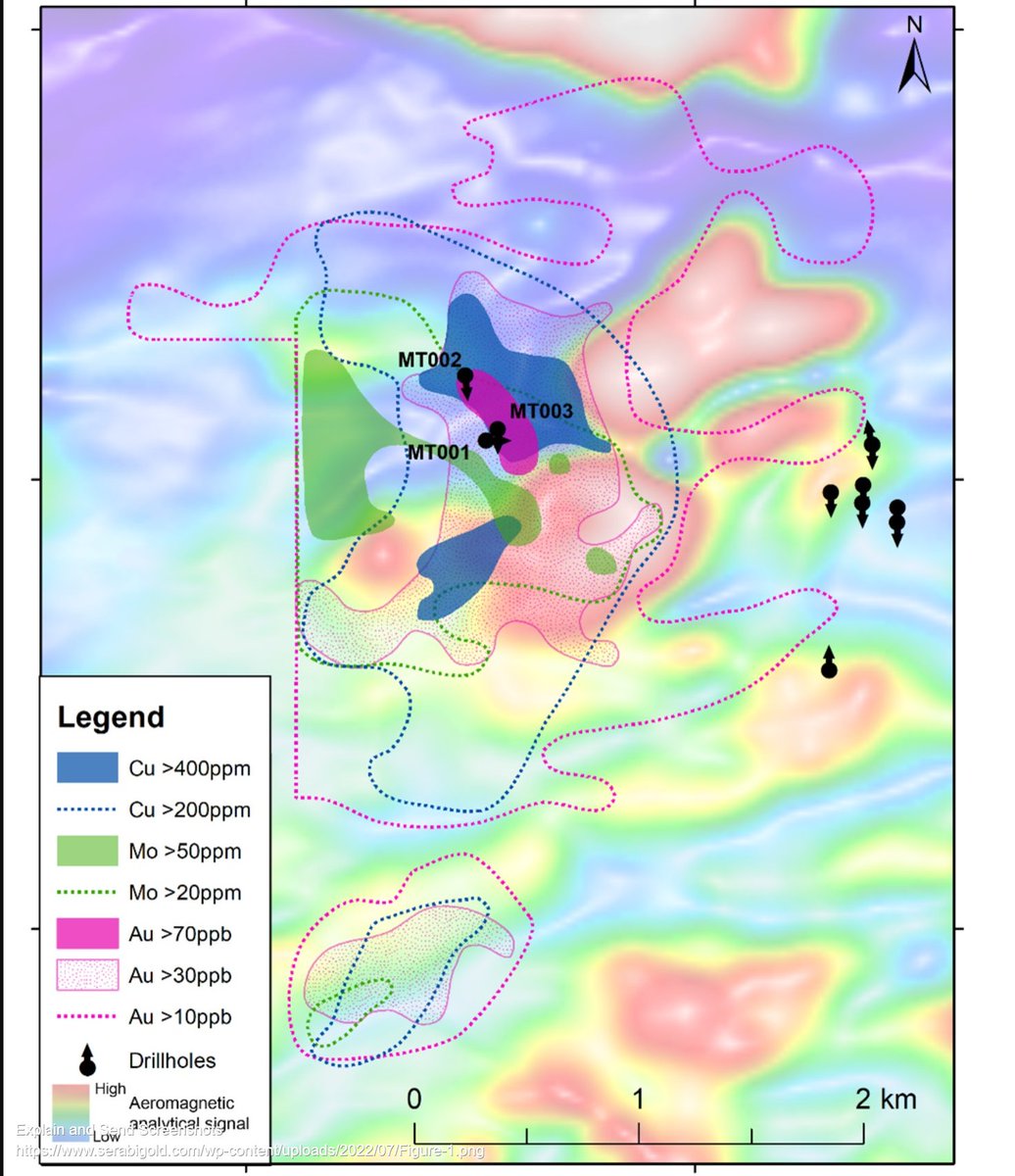

I've been running an extensive exercise on Verde Agritech also a relatively new but expanding fertiliser producer based just c. 70km from #HMI in Minas Gervais in Brazil. The results to date are rather fascinating and certainly worthy of review.

I've been running an extensive exercise on Verde Agritech also a relatively new but expanding fertiliser producer based just c. 70km from #HMI in Minas Gervais in Brazil. The results to date are rather fascinating and certainly worthy of review.

2/

Verde is a TSX-listed producer with a current plant capacity nearly double the size of HMI (0.6Mtpy) but with a phase 2 expansion due to come online in 2023 which would take output to 2.4Mtpy.

So a much bigger operation to come and soon.

Verde is a TSX-listed producer with a current plant capacity nearly double the size of HMI (0.6Mtpy) but with a phase 2 expansion due to come online in 2023 which would take output to 2.4Mtpy.

So a much bigger operation to come and soon.

3/

Those that remember my 5th July numbers on #HMI sales prices will perhaps remember that they demonstrated a $53.20/t average sale price for 2021.

At the average achieved AUD/BRL for 2021 of 4.054, this equated to an average price of BRL216.

Those that remember my 5th July numbers on #HMI sales prices will perhaps remember that they demonstrated a $53.20/t average sale price for 2021.

At the average achieved AUD/BRL for 2021 of 4.054, this equated to an average price of BRL216.

https://twitter.com/BigBiteNow/status/1544259568032792577?s=20&t=wFGk7_tFwwo8xD1Vn6V5HQ

4/

Verde through wonderfully detailed quarterly reports (something @harvestminerals could perhaps learn from) demonstrates an evolving price market in 2021.

By taking Verde's ex-freight average sales price and multiplying it by the average CAD/BRL in the period we get this,

Verde through wonderfully detailed quarterly reports (something @harvestminerals could perhaps learn from) demonstrates an evolving price market in 2021.

By taking Verde's ex-freight average sales price and multiplying it by the average CAD/BRL in the period we get this,

5/

2021

Q1 = (BRL) 155

Q2 = 168

Q3 = 199

Q4 = 235

Average = BRL 189 vs HMI 216.

= 12.5%

2021

Q1 = (BRL) 155

Q2 = 168

Q3 = 199

Q4 = 235

Average = BRL 189 vs HMI 216.

= 12.5%

6/

In terms of mineral resources Verde has a much greater K20 content (9.28% vs 4.4%) but clearly it's not that simple.

Verde commits a further c. 30% to freight prices indicating that a significant amount of product is shipped long distance.

In terms of mineral resources Verde has a much greater K20 content (9.28% vs 4.4%) but clearly it's not that simple.

Verde commits a further c. 30% to freight prices indicating that a significant amount of product is shipped long distance.

7/

Their main product Super Greensand is available on Amazon in Germany and the US to name but two. That's a big distance to travel in inflated times.

Whatever the reasoning the outcome doesn't lie. In 2021 HMI sold its product for 12.5% higher than Verde.

Their main product Super Greensand is available on Amazon in Germany and the US to name but two. That's a big distance to travel in inflated times.

Whatever the reasoning the outcome doesn't lie. In 2021 HMI sold its product for 12.5% higher than Verde.

8/

With that in mind let's now go one step further.

In Q1 2022 Verde achieved a price of BRL 311/t.

An increase of c. 65% on their FY2021 average. This was in part assisted by a 3.8% weakening of CAD/BRL.

With that in mind let's now go one step further.

In Q1 2022 Verde achieved a price of BRL 311/t.

An increase of c. 65% on their FY2021 average. This was in part assisted by a 3.8% weakening of CAD/BRL.

9/

An equivalent jump in HMI prices for Q1 would see its 2021 average of $53.20/t become $88/t.

However, the AUD weakened 6.5% (CAD 3.8%) which in theory should see the price increase for HMI push even higher.

An equivalent jump in HMI prices for Q1 would see its 2021 average of $53.20/t become $88/t.

However, the AUD weakened 6.5% (CAD 3.8%) which in theory should see the price increase for HMI push even higher.

10/

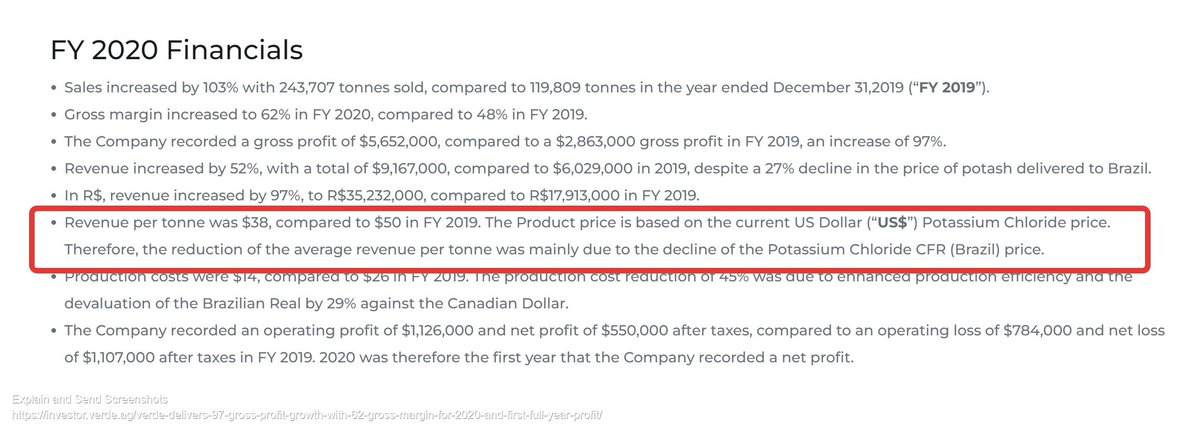

At this stage, it is important to appreciate that Verde isn't (in the main at least) driving these price changes.

Pricing variations are dependent on the potassium chloride CFR (Brazil) price. A price that Verde shares in each of its quarterly updates.

At this stage, it is important to appreciate that Verde isn't (in the main at least) driving these price changes.

Pricing variations are dependent on the potassium chloride CFR (Brazil) price. A price that Verde shares in each of its quarterly updates.

11/

Here is their chart for Q1 2022.

Note that prices were actually fairly consistent through Q4 2021 and Jan/Feb Q1 2022. It is March when prices pushed higher. Recording a minimum 25% increase in just one month.

Here is their chart for Q1 2022.

Note that prices were actually fairly consistent through Q4 2021 and Jan/Feb Q1 2022. It is March when prices pushed higher. Recording a minimum 25% increase in just one month.

12/

A quick return to Verde's prices (see post 5) tells us Verde achieved prices in Q1 2022 were c. 32% higher than Q4 2021.

One has to account for fluctuations because Verde sell more than one product and one of those was new in 2021. So bedding in like KP Fertil which...

A quick return to Verde's prices (see post 5) tells us Verde achieved prices in Q1 2022 were c. 32% higher than Q4 2021.

One has to account for fluctuations because Verde sell more than one product and one of those was new in 2021. So bedding in like KP Fertil which...

13/

in my view means discounts in order to gain traction.

However, despite this Verde achieved a significant uplift in achieved prices despite fertiliser prices being stable in Jan/Feb and the influence of the Ukraine invasion only kicking in March.

in my view means discounts in order to gain traction.

However, despite this Verde achieved a significant uplift in achieved prices despite fertiliser prices being stable in Jan/Feb and the influence of the Ukraine invasion only kicking in March.

14/

Again, Q1 is a quieter quarter for Verde also and so March (just like with HMI) is likely the far busier month sales-wise. But still, what this demonstrates is that prices were rising in Q1 2022 even before the Russian invasion of Ukraine.

Again, Q1 is a quieter quarter for Verde also and so March (just like with HMI) is likely the far busier month sales-wise. But still, what this demonstrates is that prices were rising in Q1 2022 even before the Russian invasion of Ukraine.

15/

Now whilst the Minas Gerais price chart isn't easy to come by here is the Brazil Potassium Chloride Monthly Price in BRL.

Note the consistent nature of Q2 meaning prices throughout that period will fully benefit from what March contributed to Q1.

Now whilst the Minas Gerais price chart isn't easy to come by here is the Brazil Potassium Chloride Monthly Price in BRL.

Note the consistent nature of Q2 meaning prices throughout that period will fully benefit from what March contributed to Q1.

16/

This means we should higher average achieved prices again which will be further supported by (in HMI's case) an AUD/BRL exchange that has further weakened in Q2.

Note this is not about absolute accuracy but the trend.

This means we should higher average achieved prices again which will be further supported by (in HMI's case) an AUD/BRL exchange that has further weakened in Q2.

Note this is not about absolute accuracy but the trend.

17/

Where the competition goes HMI is at the very least able to follow.

That Brazil potassium chloride prices drive that competition and their average is up substantially in Q2 2022 and supported by a weaker exchange rate. Meaning more AUD in the bank.

Where the competition goes HMI is at the very least able to follow.

That Brazil potassium chloride prices drive that competition and their average is up substantially in Q2 2022 and supported by a weaker exchange rate. Meaning more AUD in the bank.

18/

There's much more to share on this which helps back up things like HMI's reporting and cash flows + their expectations on sales in Q3 but that's for another thread.

There's much more to share on this which helps back up things like HMI's reporting and cash flows + their expectations on sales in Q3 but that's for another thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh