Owning energy stocks into a recession is usually a bad idea.

Here are 6 charts that changed my mind..

#COM #EFT #OOTT

Here are 6 charts that changed my mind..

#COM #EFT #OOTT

The world isn't spending nearly enough on drilling for oil & gas. 70-80% of cashflow is typical.

We are at 35%, way too little to meet demand

We are at 35%, way too little to meet demand

Spending isn't increasing that quickly looking forward either, even with mountains of free-cashflow to reinvest.

The increase in US rigs has basically stalled in July showing producers are still worried about the economy and not in a hurry to ramp up production.

The increase in US rigs has basically stalled in July showing producers are still worried about the economy and not in a hurry to ramp up production.

Drilled but uncompleted wells (DUCs) are way below normal. DUCs per active rig are 40% below normal.

Even if budgets explode, labor issues and a lack of DUCs mean we are 9-12 months from seeing the supply response. Shale isn't bailing out the world anytime soon.

Even if budgets explode, labor issues and a lack of DUCs mean we are 9-12 months from seeing the supply response. Shale isn't bailing out the world anytime soon.

Global oil & gas in storage has been falling all year and is very low across the globe.

Low tanks mean even if a recession kills demand for 12 months, tanks may not refill enough to provide the buffer we need to deal with supply shortages that are likely to continue afterward.

Low tanks mean even if a recession kills demand for 12 months, tanks may not refill enough to provide the buffer we need to deal with supply shortages that are likely to continue afterward.

The recent selloff has energy indexes off just as much as they were in Sept of 08'. You are not buying at all-time highs.

Most intriguing is what happened next if you bought at these levels in 2008...

Most intriguing is what happened next if you bought at these levels in 2008...

Even though oil stocks kept crashing in 08' and early 09' energy investors who bought after the first selloff kept pace with the S&P the entire time!

And the supply situation and storage levels are even worse now!

And the supply situation and storage levels are even worse now!

After seeing these 6 charts, I now believe energy stocks will see a faster recovery than 2008 during a recession and will outperform the market even if you buy them today.

For much more, check out this post: grizzleoil.substack.com/p/energy-inves…

For much more, check out this post: grizzleoil.substack.com/p/energy-inves…

I write threads like this all the time over at my Substack.

Save yourself some time and let me tell you what really matters when investing in energy.

grizzleoil.substack.com/p/introducing-…

Save yourself some time and let me tell you what really matters when investing in energy.

grizzleoil.substack.com/p/introducing-…

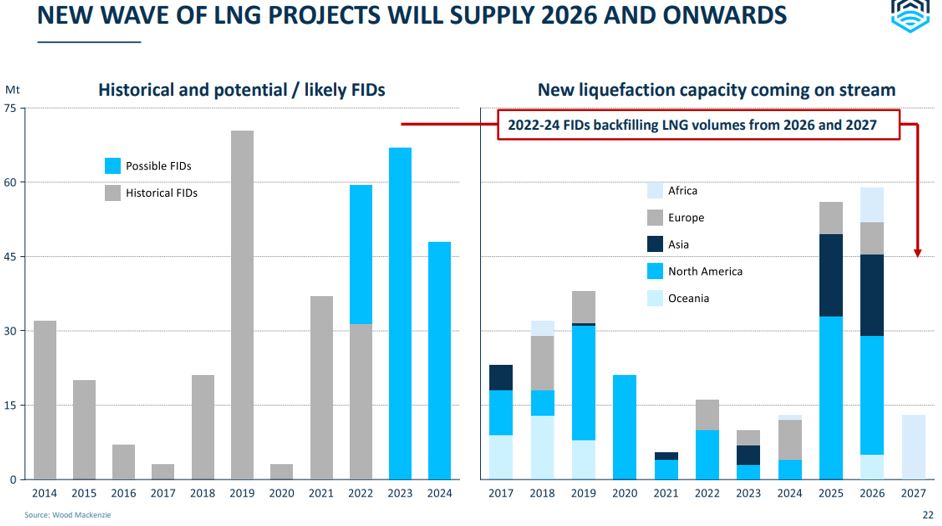

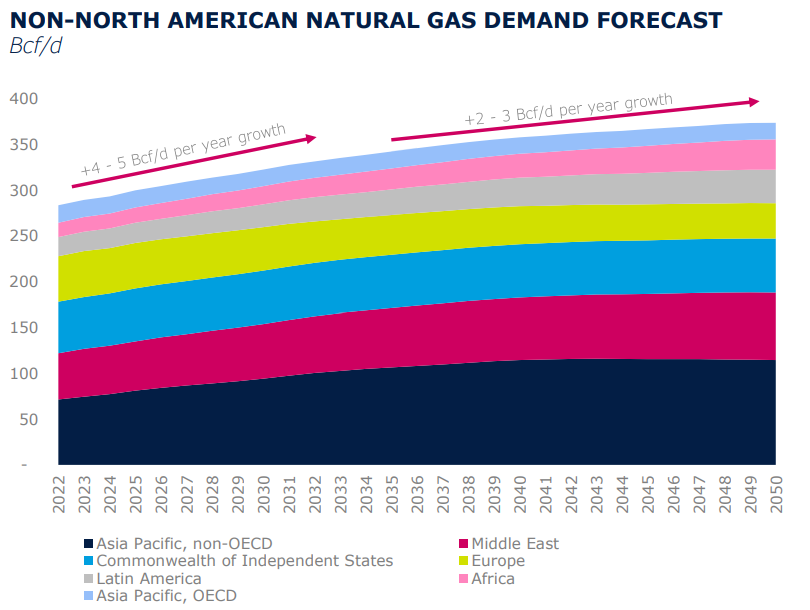

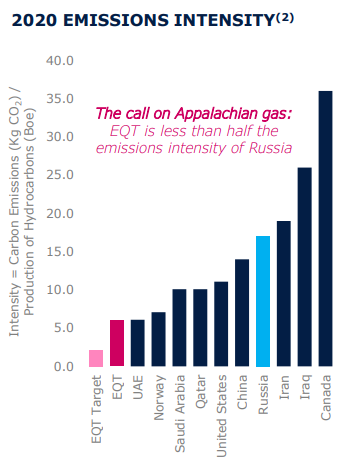

Check out my first post which is about my favorite energy investing theme of the next 10 years. LNG

https://twitter.com/ScottW_Grizzle/status/1506628397572759554?s=20&t=3MA6tkpNL6VO2x3_F2F9QA

• • •

Missing some Tweet in this thread? You can try to

force a refresh