#FinolexPipes Q1 23 Concall Highlights

Like and Retweet for better reach !

1. Total revenue registered a y-o-y growth of 23% to Rs. 1,190 Cr from Rs. 965 Cr, but down

25% q-o-q from 1595 cr.

Like and Retweet for better reach !

1. Total revenue registered a y-o-y growth of 23% to Rs. 1,190 Cr from Rs. 965 Cr, but down

25% q-o-q from 1595 cr.

2. Degrowth in EBITDA was 40% to 126cr in Q1 23 from 210 cr in Q1 22. Margins also dropped

to 11% from 22%. Reasons for fall in EBITDA were because of Weak agri demand and

inventory losses due to fall in PVC prices.

to 11% from 22%. Reasons for fall in EBITDA were because of Weak agri demand and

inventory losses due to fall in PVC prices.

3. PVC Pipes & Fittings volume grew 29% y-o-y to 71,960 MT and for PVC Resin volume registered a y-o-y growth of 25% to 62,746 MT. Volume for CPVC was 3600 MT with revenue of about 150 crores.

4. PVC Pipes & Fittings segment grew by 34% y-o-y to 1132.01 whereas PVC resin grew by 25.1% to 784.58 cr. PVC Pipes & fittings EBITDA stood at Rs 125.91 Cr for Q1FY23 – down 39.9% against Rs 209.51 Cr for Q1FY22. PVC resin EBIT dropped 54% to 72.9 cr from 157.8 cr.

5. Agri demand has been lower for the past two years post covid because of budget constraints

for farmers and High PVC prices. Demand in the segment to remain low in the current

quarter because of Monsoon.

for farmers and High PVC prices. Demand in the segment to remain low in the current

quarter because of Monsoon.

With corrections in PVC prices it is expected that the demand will rise in next quarter.

6. PVC prices have seen a sharp drop from 1450$ per tonnes to 1050 $. Also EDC and VCM

prices have dropped from 670$ to 520$ and from 1170$ to 880$.

6. PVC prices have seen a sharp drop from 1450$ per tonnes to 1050 $. Also EDC and VCM

prices have dropped from 670$ to 520$ and from 1170$ to 880$.

Reduction in PVC prises is mainly in Asian market because of construction slowdown in china, lockdowns and also lower demand in domestic market.

7. Fall in PVC prices have led to inventory losses for the company, leading to margin contraction.

7. Fall in PVC prices have led to inventory losses for the company, leading to margin contraction.

Company expects to continue incurring such losses in coming quarter. Inventory losses is more for Finolex compared to others as they are the only company with backward integration.

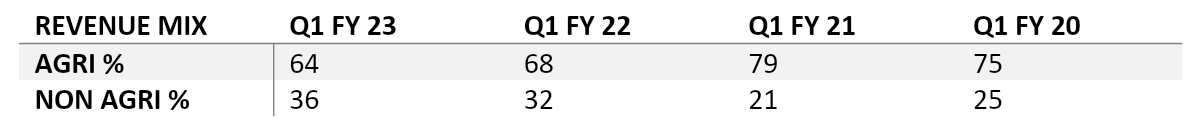

8. Agri Non-Agri Mix improved to 64:36 from 68:32. Non agri Segment is up 20% from pre covid

Levels. Agri demand is yet to pick up.

Levels. Agri demand is yet to pick up.

9. Capex for the year will be 250 crores. 50 cr of which will be spent on maintenance Capex.

Remaining will be spent on mouldings, extruders and majorly on Fittings. Company is planning to give more focus on plumbing and sanitation.

Remaining will be spent on mouldings, extruders and majorly on Fittings. Company is planning to give more focus on plumbing and sanitation.

10. PVC resin industry has seen not seen any expansion for the past decade. Now many

companies are expanding their capacities and also some new entrants are entering the industry. Company also have some sizeable expansion plans.

companies are expanding their capacities and also some new entrants are entering the industry. Company also have some sizeable expansion plans.

11. The company continue to have strong balance sheet with a net cash surplus of 1300 crores.

12. Company’s other expenses were significantly higher for the quarter. This rise was due to

forex losses which company incurred with currency depreciation against dollar.

12. Company’s other expenses were significantly higher for the quarter. This rise was due to

forex losses which company incurred with currency depreciation against dollar.

Another reason was increasing fuel cost. Coal prices have gone up to 110$ from 45-55$ range.

Register to model portfolio to watch detailed analysis of various businesses

Link : valueeducator.com/advisory/

Register to model portfolio to watch detailed analysis of various businesses

Link : valueeducator.com/advisory/

• • •

Missing some Tweet in this thread? You can try to

force a refresh