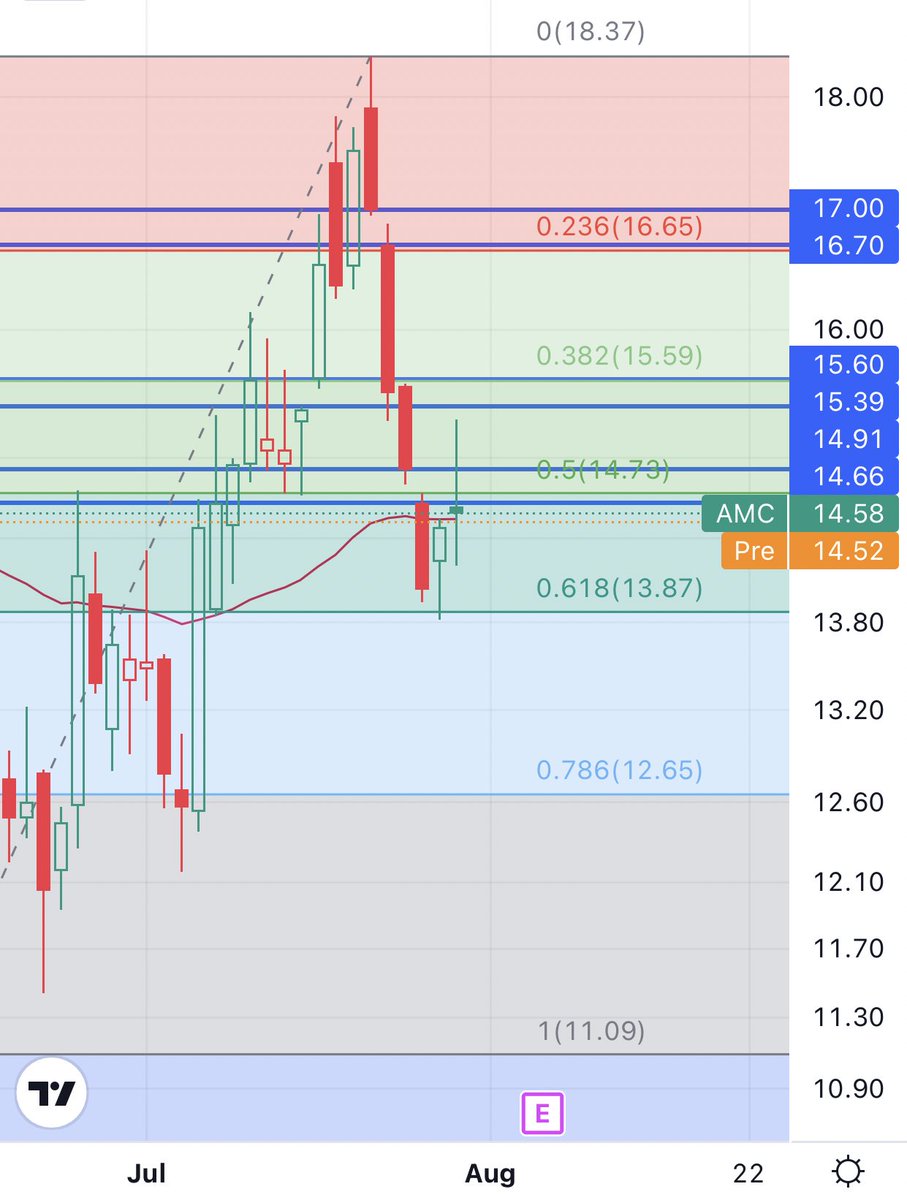

$AMC saw some of these levels yesterday play out as we quickly saw the gap above get filled and hit the $15.05 fib level with a high of $15.29 (low of day $14.20) — markets then slumped quickly after the bell as reaction to the GDP report and from the FOMC pump on Wednesday.

https://twitter.com/ryan__rigg/status/1552391273721511938

Nearing lunch time we start to see the broader market lift and by the afternoon an upward trend was happening. $AAPL & $AMZN beat last night in AH helped set up the $SPY to reach $409.69 in AH — closed at $406.07 and currently $407.73 in PM

$AMC closed Thursday right above its 50DEMA of $14.54 at $14.58. After the initial run and sell off in the morning, $AMC tried testing that $14.73 level a couple times in the afternoon and nearing close.

$AMC retraced to the .618 on Wed created from the $18.37 high last week, prints a bullish hammer which set it up yesterday’s price action. Gaps remain.

Watching $15.59 if above $15.29

Gap at $14.73 if above $14.54

$13.87 if below $14.20

$12.65 if below $13.82

50DEMA $14.54

Watching $15.59 if above $15.29

Gap at $14.73 if above $14.54

$13.87 if below $14.20

$12.65 if below $13.82

50DEMA $14.54

Max Pain currently at $14.50. $AMC will either accept the $14.54DEMA and respect it or it’ll be the point of resistance.

Watching $16.65 if above $15.60 would be extremely bullish as there is a gap to be filled (most unlikely)

Earnings next Thursday 8/4 after the bell #AMC

Watching $16.65 if above $15.60 would be extremely bullish as there is a gap to be filled (most unlikely)

Earnings next Thursday 8/4 after the bell #AMC

Watching into the close $AMC #AMC

$AMC As expected, around the 50DEMA. Closed down $.02 from yesterday! Super low volume today — last time $AMC had sub 20M volume was back on Nov 26. Earnings next week. Enjoy your weekend and I’ll put out a fresh analysis & summary for next week on Sunday night or Monday PM🍿👊🏻😎

• • •

Missing some Tweet in this thread? You can try to

force a refresh