Family First | Data & Market Enthusiast | 2x CS Grad @Uofillinois | Retail Investor & Educator | Tech & AI | Options Flow Hunting @unusual_whales

How to get URL link on X (Twitter) App

$GME Top contracts by highest volume on Tuesday - those 5,000 blocks that were seen were part of a larger multi-leg transaction involving 11/28 and 12/5 expiries with slightly out-of-the money call selling - note the time stamp and the MLAT code as multi-leg transactions. Trader sold the $21.5c 12/5, $23c 12/5, $21.50c 11/28 and bought the $20.5c 11/28 in one transaction. Basically the sells finance the buys in an attempt to capture premium from the volatility, short-dated expiry and a close below their OTM strikes

$GME Top contracts by highest volume on Tuesday - those 5,000 blocks that were seen were part of a larger multi-leg transaction involving 11/28 and 12/5 expiries with slightly out-of-the money call selling - note the time stamp and the MLAT code as multi-leg transactions. Trader sold the $21.5c 12/5, $23c 12/5, $21.50c 11/28 and bought the $20.5c 11/28 in one transaction. Basically the sells finance the buys in an attempt to capture premium from the volatility, short-dated expiry and a close below their OTM strikes

$GME top contracts on Friday by volume (typical to see most of the volume centered around the weekly contracts) - saw some of those call spreads coming in too where traders were selling the $21, $22 and $22.50 calls for this week's expiry and last week

$GME top contracts on Friday by volume (typical to see most of the volume centered around the weekly contracts) - saw some of those call spreads coming in too where traders were selling the $21, $22 and $22.50 calls for this week's expiry and last week

$ASST call activity kicked up during the late afternoon once the news of @mikealfred investment into #ASST as shown in the previous graph. While there was a lot of volume on those January calls, let's dig in a little bit deeper and look at individual strikes.

$ASST call activity kicked up during the late afternoon once the news of @mikealfred investment into #ASST as shown in the previous graph. While there was a lot of volume on those January calls, let's dig in a little bit deeper and look at individual strikes.

$DJT total daily premium $44.34M

$DJT total daily premium $44.34M

$GME saw net call premium spike on Friday while GameStop was still trading under $20 before closing at $21.85 — we talked about Friday’s flow during Monday’s option flow report.

$GME saw net call premium spike on Friday while GameStop was still trading under $20 before closing at $21.85 — we talked about Friday’s flow during Monday’s option flow report.

$GME #GME Compare the call volume on Friday to the historical data — Friday was a big day for calls, call volume and net call premium. 316,169 call volume. 54,770 put volume on Friday. Implied volatility (IV) increased to over 100% on Friday as this call option activity increased ahead of GameStop earnings on Tuesday September 10 after the market closes. Net call premium begin ticking up on Thursday ahead of the Labor Day holiday. The last time IV was over 100% was back on August 5

$GME #GME Compare the call volume on Friday to the historical data — Friday was a big day for calls, call volume and net call premium. 316,169 call volume. 54,770 put volume on Friday. Implied volatility (IV) increased to over 100% on Friday as this call option activity increased ahead of GameStop earnings on Tuesday September 10 after the market closes. Net call premium begin ticking up on Thursday ahead of the Labor Day holiday. The last time IV was over 100% was back on August 5

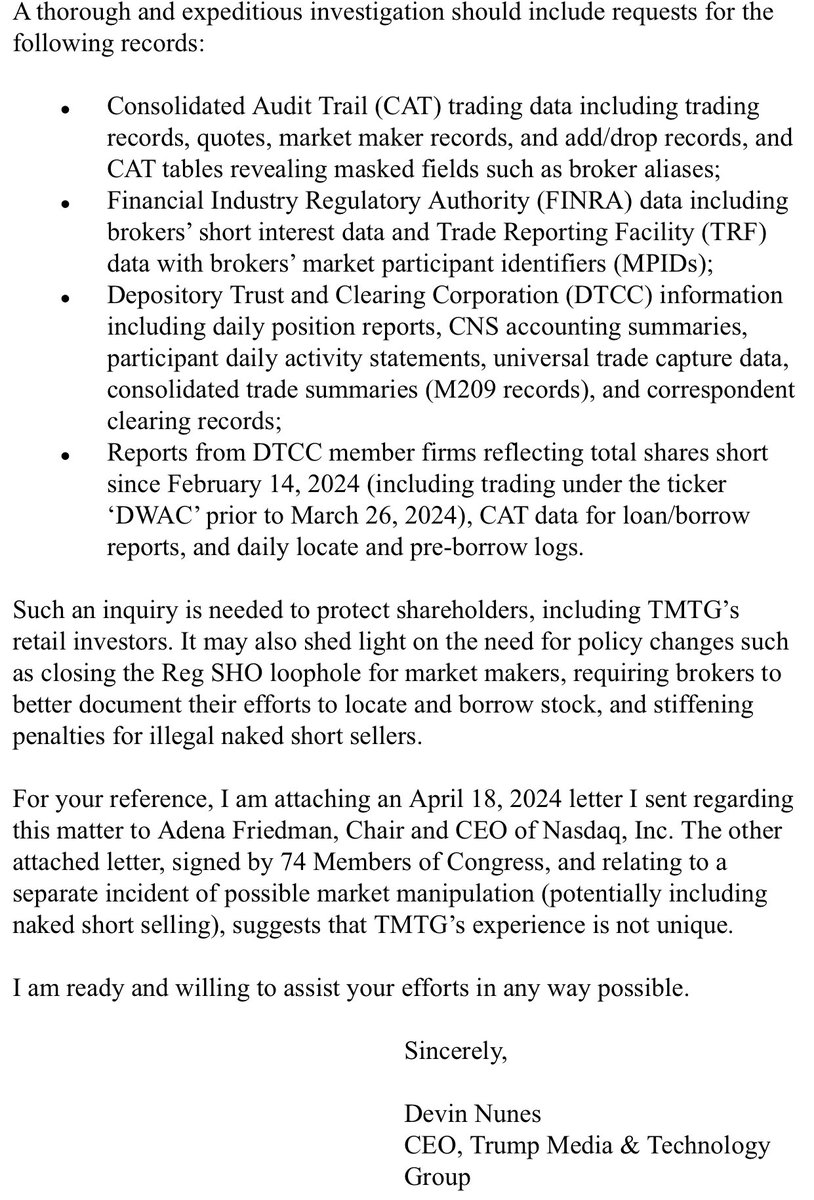

New 8-K filed this morning $DJT #DJT

New 8-K filed this morning $DJT #DJT

Enhances liquidity by raising more than $162 million of equity capital since the inception of the APE At-The-Market program.

Enhances liquidity by raising more than $162 million of equity capital since the inception of the APE At-The-Market program.

https://twitter.com/ryan__rigg/status/1552391273721511938Nearing lunch time we start to see the broader market lift and by the afternoon an upward trend was happening. $AAPL & $AMZN beat last night in AH helped set up the $SPY to reach $409.69 in AH — closed at $406.07 and currently $407.73 in PM

https://twitter.com/ryan__rigg/status/1552391252917854209‼️Mentioned GDP report in my summary

https://twitter.com/cvpayne/status/1552633489111105536

https://twitter.com/ryan__rigg/status/1552348311109210114

$AMC low of day $13.82 —

$AMC low of day $13.82 —

Full report here financialservices.house.gov/uploadedfiles/…

Full report here financialservices.house.gov/uploadedfiles/…

Dish antennas attached to towers are crucial to making this work and enabling firms to keep pace with rivals. That’s because the antennas beam buy and sell orders to other financial markets in Chicago, the U.S. East Coast and elsewhere around the globe.

Dish antennas attached to towers are crucial to making this work and enabling firms to keep pace with rivals. That’s because the antennas beam buy and sell orders to other financial markets in Chicago, the U.S. East Coast and elsewhere around the globe.