Salford City’s 2020/21 financial results covered a season that the club described as “unique” with the COVID pandemic leading to “extreme challenges”. Nevertheless, The Ammies’ 8th place in League Two was the best finish in their history #WeAreSalford

Salford City have been high-profile ever since the club was bought in 2014 by five of the #MUFC Class of ’92, namely Gary Neville, Ryan Giggs, Nicky Butt, Phil Neville and Paul Scholes. Singapore businessman (and Valencia owner) Peter Lim purchased a 50% stake in September 2014.

When they acquired Salford, the club was playing in the 8th tier of English football (the Northern Premier League Division One North), but they have secured four promotions since then, reaching the Football League for the first time in 2019.

When the Class of ’92 arrived, Giggs said that the owners’ ambition was EFL Championship football in 15 years. Progress has been impressive, though it has somewhat stalled in League Two. They have had three finishes in the top half, but they have not yet reached the play-offs.

Even though the owners played under one of the game’s longest serving managers, Sir Alex Ferguson, Salford have had a veritable managerial merry-go-round in their time with Phil Power, Anthony Johnson/Bernard Morley, Graham Alexander, Richie Wellens, Gary Bowyer & now Neil Wood.

Salford have also faced some criticism over their high spending and have been accused of buying their success, having reported a series of large losses as they made their way up the football pyramid.

In 2020/21 Salford posted a huge pre-tax loss of £4.9m, up from £3.8m, as revenue fell £0.2m (7%) to £3.2m, though this was offset by profit on player sales rising £0.2m. Operating expenses were flat at £7.0m, but there was a £1.1m exceptional charge (fixed assets impairment).

The main driver for Salford’s revenue reduction was match day, down £0.4m (66%) from £0.6m to £0.2m, as games were played behind closed doors, though this was partially offset by commercial increasing £0.2m (7%) from £2.8m to £3.0m.

Salford’s squad costs increased, as the wage bill rose £0.4m (10%) from £4.1m to £4.5m and player amortisation was up 24% from £251k to £312k. However, other expenses were cut 17% to £2.2m, partly due to the lower cost of staging games without fans.

Salford’s £4.8m post-tax loss was comfortably the worst in League Two, almost twice as much as the next highest club, Colchester United £2.6m. Only two other clubs lost more than £1m: Bolton Wanderers £1.5m and Harrogate Town £1.0m.

In fairness, Salford’s loss was exacerbated by their £1.1m exceptional impairment charge, while the financial results of a few other clubs were helped by once-off loan write-offs, namely Scunthorpe United £5.8m, Bolton Wanderers £2.8m and Leyton Orient £2.0m.

In addition, Salford only made £163k from player sales, while other clubs were boosted by significant profits from player trading, especially Exeter City £4.9m, Carlisle United £1.0m and Bradford City £0.5m.

Since the Class of ’92 arrived, Salford have lost £15.1m in 7 years, including £14.2m in the last 4 years alone. As the club has progressed up the leagues, the losses have grown, though Gary Neville explained, “It is a lot of money to lose, but we’ve come up from step eight.”

Neville also pointed out, “The club is yet to enjoy a full season in the EFL without restrictions, meaning we have not yet managed to maximise potential revenue opportunities against the increase in operational costs & administrative expenses associated with running an EFL club.”

That is undoubtedly true, though it is striking that Salford have made the highest losses in each of the last four seasons: £4.8m in 2020/21 (League Two), £3.8m in 2019/20 (League Two), £3.6m in 2018/19 (National League) and £2.0m in 2017/18 (National League North).

Salford’s revenue has nearly tripled from £1.2m in 2018 to £3.2m in 2021, which is pretty good going, especially as “the global pandemic caused a significant loss in revenue opportunities”. Note: the club’s accounts did not disclose revenue details before 2018.

Following the decrease, Salford’s £3.2m revenue was below quite a few of their rivals in League Two. Six of the clubs that published details had revenue above £4m, namely #BWFC £6.2m, Forest Green Rovers £5.8m, #TRFC £4.9m, #BCAFC £4.5m, #LOFC £4.3m and Walsall £4.2m.

Salford’s match day revenue fell by two-thirds from £0.6m to £0.2m, as COVID meant that games were played behind closed doors, though this was partially mitigated by streaming revenue.

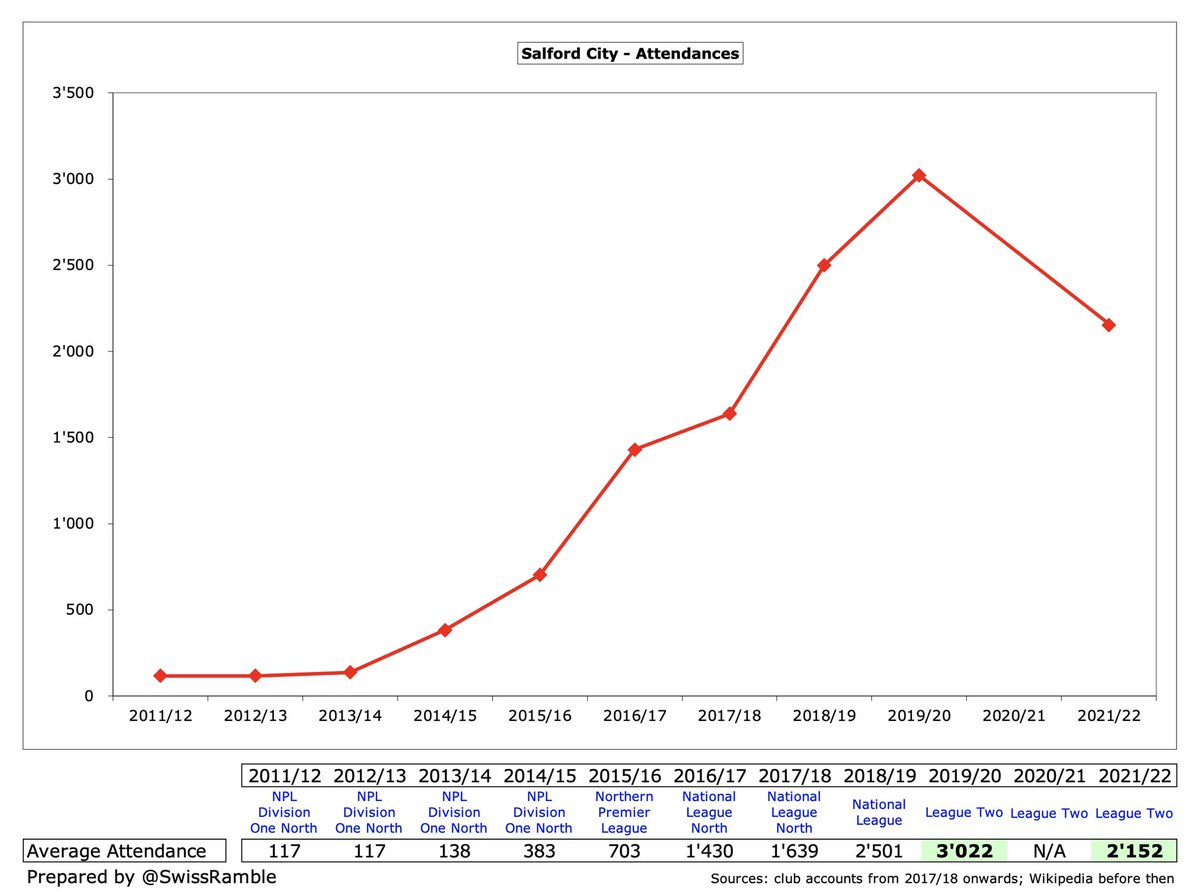

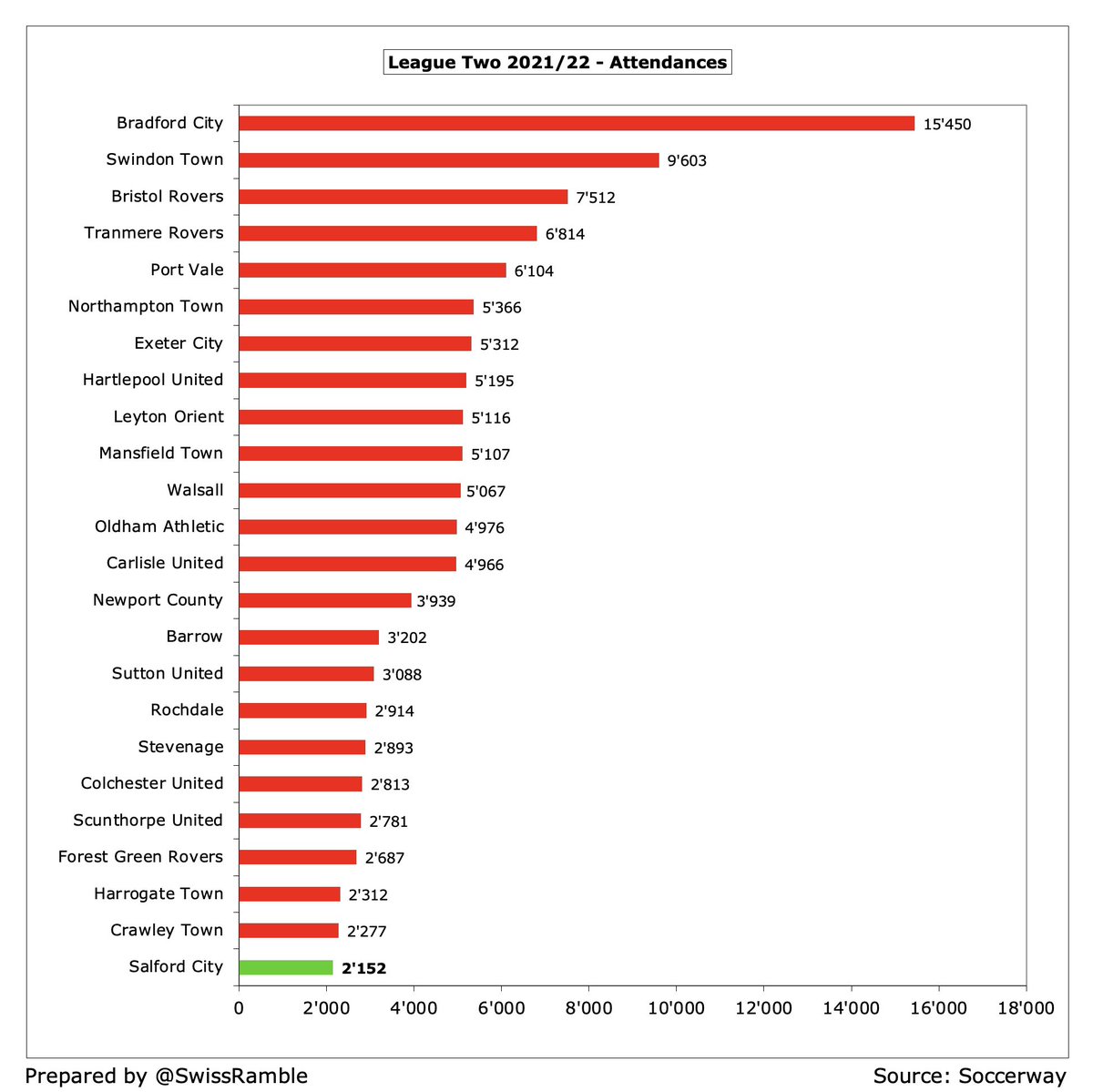

Salford’s average attendance steadily rose from 117 in the NPL Division One North in 2013 to 3,022 in 2020 (pre-pandemic), though it fell nearly 30% to 2,152 in 2022, the lowest in League Two. The club’s potential was shown by the record 4,518 crowd for an EFL Cup tie in 2019.

Salford’s owners have invested a lot of money to develop the Moor Lane ground, putting in four new stands and increasing capacity from 2,163 to 5,108. In October 2017 it was renamed the Peninsula Stadium in a 5-year sponsorship deal.

Salford’s commercial revenue (including broadcasting income) has nearly tripled in the last two years from £1.1m in 2018 to £3.0m in 2021. Their shirt sponsorship is with Talk Talk until 2023/24, while Castore replaced Kappa as kit supplier from 2022/23.

Salford booked £8k government grants in other operating income, though other clubs included much more here, especially Bolton Wanderers £2.5m (government grant £0.9m), Morecambe £1.6m (government grant £0.4m) and Exeter City £1.5m (grants £1.1m, job retention scheme £313k).

Despite the revenue reduction, Salford’s wages rose £0.4m (10%) from £4.1m to £4.5m, which means that wages have increased by nearly 70% since promotion to League Two (up from £2.7m in 2018).

Not all League Two clubs disclose wages in their accounts, but Salford’s £4.5m was third highest of those that do, only surpassed by Bolton Wanderers £6.9m and Leyton Orient £4.8m.

Salford’s wages to turnover ratio increased from 121% to 143%, which was by far the highest (worst) in League Two, ahead of Bolton Wanderers 112%, Leyton Orient 111% and Scunthorpe United 106%. That said, it was better than the 164% in the National League two years ago.

Salford’s player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose 24% from £251k to £312k, which was the highest reported in League Two, as the club continued to invest in the squad with the objective of gaining another promotion.

Salford spent £156k on player purchases in 2020/21, only below Port Vale £180k and Bolton Wanderers £179k. This actually represented a reduction on the prior year’s £281k gross spend, which was second highest in League Two, only surpassed by Mansfield £294k.

Salford’s gross financial debt has shot up under Project 92 Ltd, rising again in 2021 by 20% from £13.0m to £15.6m. Most (£13.2m) is owed to their owners: shareholder loan £12.9m (presumably Peter Lim) and Class of 92 Ltd £245k. There is also a £2.4m bank loan.

As a result of the growth, Salford’s £15.6m gross debt was the second highest in League Two, though a long way below Colchester United’s £29.2m. That said, it was more than three times as much as the next highest club, Mansfield Town £4.5m.

In the last 3 years Salford’s had £10.2m negative operating cash flow, having adjusted for non-cash items. They then spent £0.7m on players (purchases £0.9m, sales £0.2m), £1.6m on infrastructure (new stadium) and paid £0.4m interest. Funded by £12.7m loans from the owners.

Salford have clearly benefited a lot from these significant cash injections, but Gary Neville justified this approach: “We’ve invested enormous amounts of money in the last seven or eight years. But it’s all myself, David, Ryan, Paul, Nicky, Phil and Peter.”

Neville continued, “Peter owns 50 per cent, we own 50 per cent. We’ve put lots of money in ourselves. We’ve chosen to do that. I’m not against owner funding. We put it in at the start of the season. The club is obviously robust in that sense.”

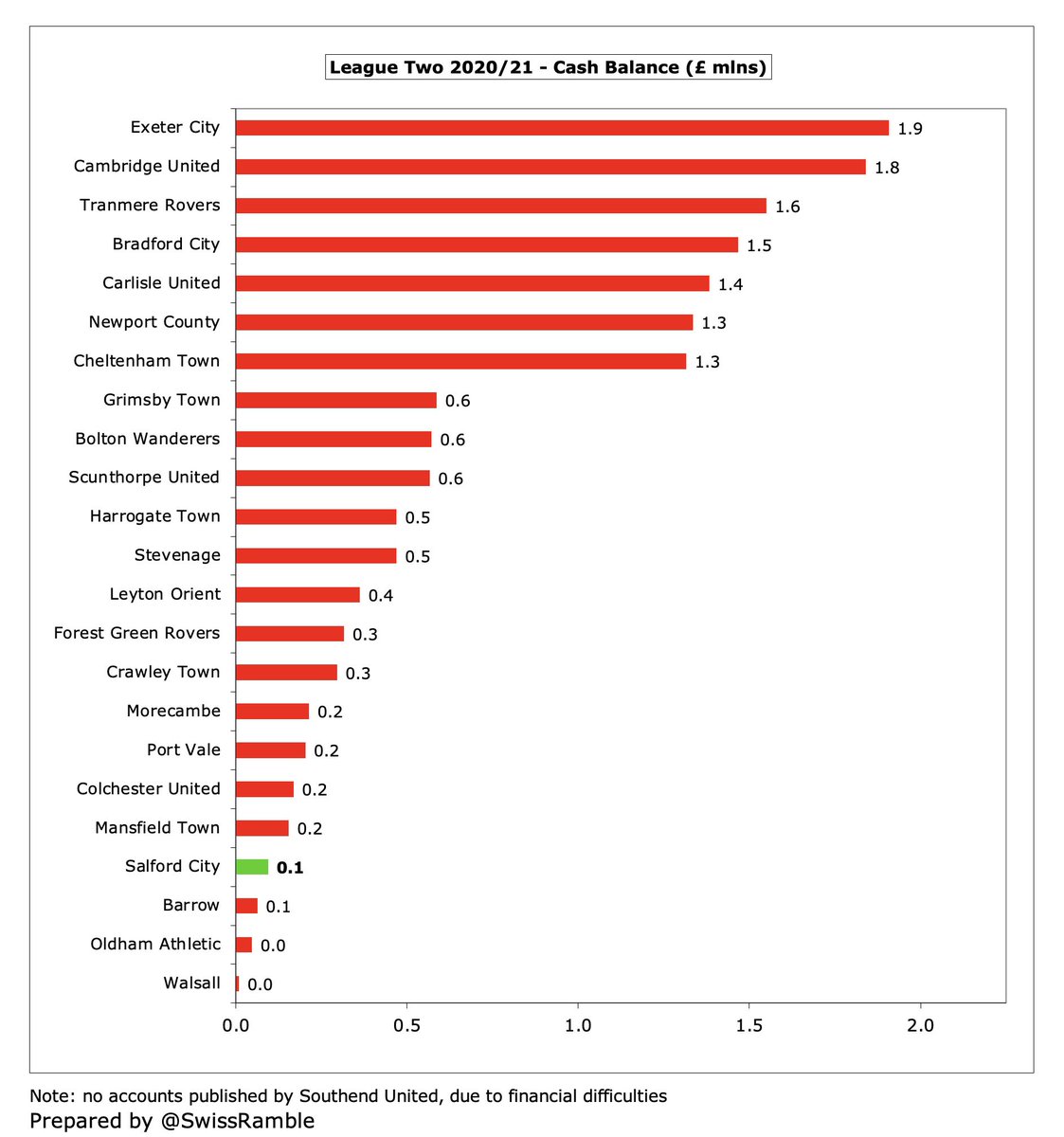

Salford’s cash balance as at 30th June 2021 was only £94k, far below the likes of Exeter City £1.9m, Cambridge United £1.8m and Tranmere Rovers £1.6m, but there is nothing to worry about, so long as their generous owners are prepared to put their hands in their pockets.

After Simon Jordan questioned whether Salford had complied with financial fair play rules, Neville emphasised that the owners put cash in upfront, in line with the League Two Salary Cost Management Protocol (SCMP) guidelines.

These state that player-related expenditure should be no more than 50% of revenue plus 100% of the “football fortune”, which includes transfer income, donations and cash/equity injections.

Salford encapsulate some of the governance challenges in football. On the one hand, the club should be applauded for its amazing climb up the leagues. As @GNev2 explained, “We’re trying to build a fanbase in a city that’s not had a Football League club ever.”

On the other hand, Salford’s big spending has given them a clear advantage over their rivals. Accrington Stanley owner @AndyhHolt provided the counter argument “All they do is raise the bar for the rest. Their largess damages those clubs that are trying to operate sustainably.”

Let’s leave the last word to Gary Neville: “The money that we put in is manageable between the seven of us. We're comfortable with our position. There's no financial pressure (to get promoted), but there is sporting disappointment.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh