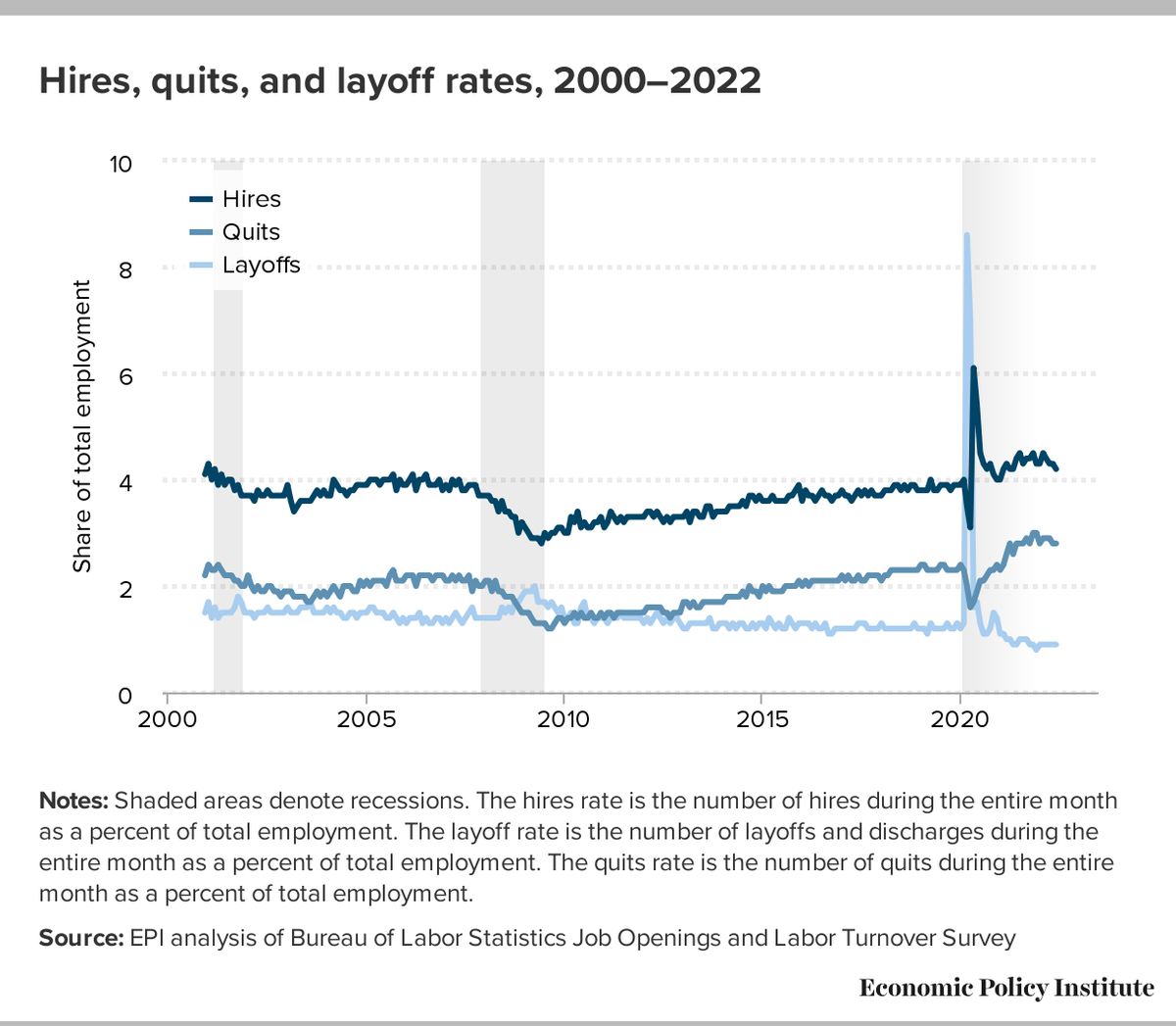

June 2022 #JOLTS data is out. Job openings fell sharply, now four months of declines, and yet, job openings are still higher than a year ago and significantly higher than pre-pandemic. Hires and separation rates both ticked down slightly while quits and layoffs were unchanged.

Slight correction. Job openings are down each month since March's series high. That's three months in a row of declines. Please pardon the error in counting months when it's now August and the data are for June.

Mild reductions in hires, layoffs, and quits levels reported in June as the hires rate ticks down slightly and layoffs and quits rates hold steady. Layoffs continue to be low in historical terms and high levels of quits signal workers seeking (and finding) better opportunities.

Hiring continues to outpace quits in every major sector as workers seek and find new jobs. Churn remains highest in low-wage accommodation and food services. Wage growth in that sector suggests workers are finding better jobs when they quit.

The hires rate in accommodation and food services ticked up for two months in a row even as the quits rate remains the highest across all sectors. Every month, workers continue to quit their jobs and find new and likely better opportunities within accommodation and food services.

• • •

Missing some Tweet in this thread? You can try to

force a refresh