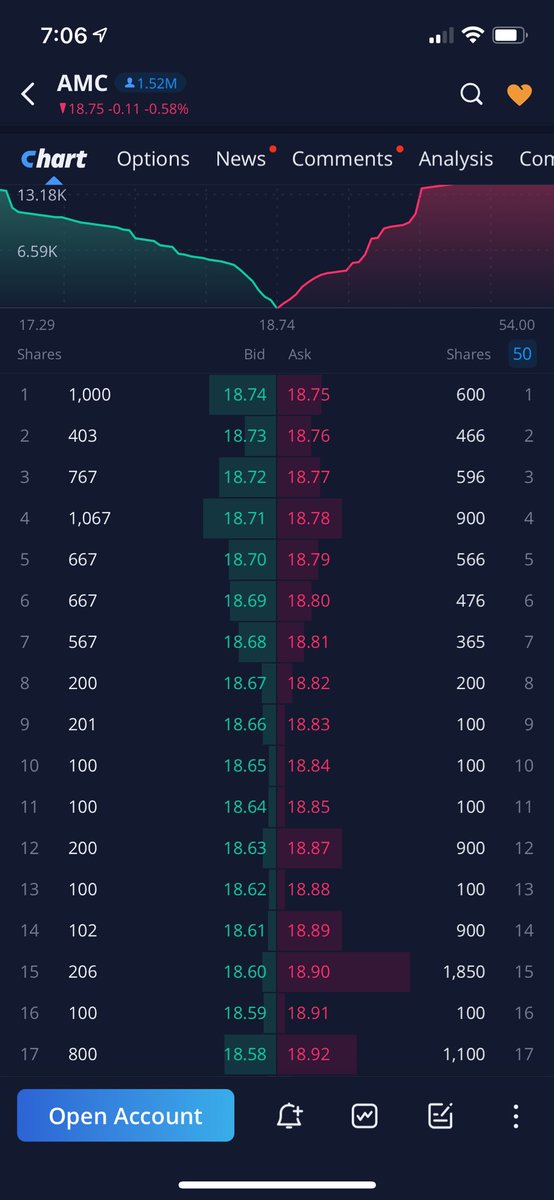

re: glitches... So I said a couple days ago I had a working hypothesis. I've seen it line up like 5 times in a row now. Basically take the biggest volume from a day, then on t+1 you'll see the glitch match the candles from that. I think it might mean... $amc #amc #atAMC ...

...that they're parking orders then internally settling them and sending them to the tape a day later. Why else would the price keep matching a day late but perfectly match the biggest volume of trades (like 5 times in a row). Examples follow...

I have more examples. It's highly illegal if this is happening and I should say I'm making up the hypothesis, but what other logical reason is there, that our glitches keep matching t-1 biggest volume candles?? $amc #amc #atAMC #apesnotleaving

• • •

Missing some Tweet in this thread? You can try to

force a refresh