Delta neutral protocols might be the next big thing in DeFi.

Everyone is already going crazy about the cashflow assets (e.g., $JOE, $GMX, $SNX), so Δ-neutrality makes sense as the next step.

Everyone is already going crazy about the cashflow assets (e.g., $JOE, $GMX, $SNX), so Δ-neutrality makes sense as the next step.

But first, what exactly is the delta (Δ) neutral position?

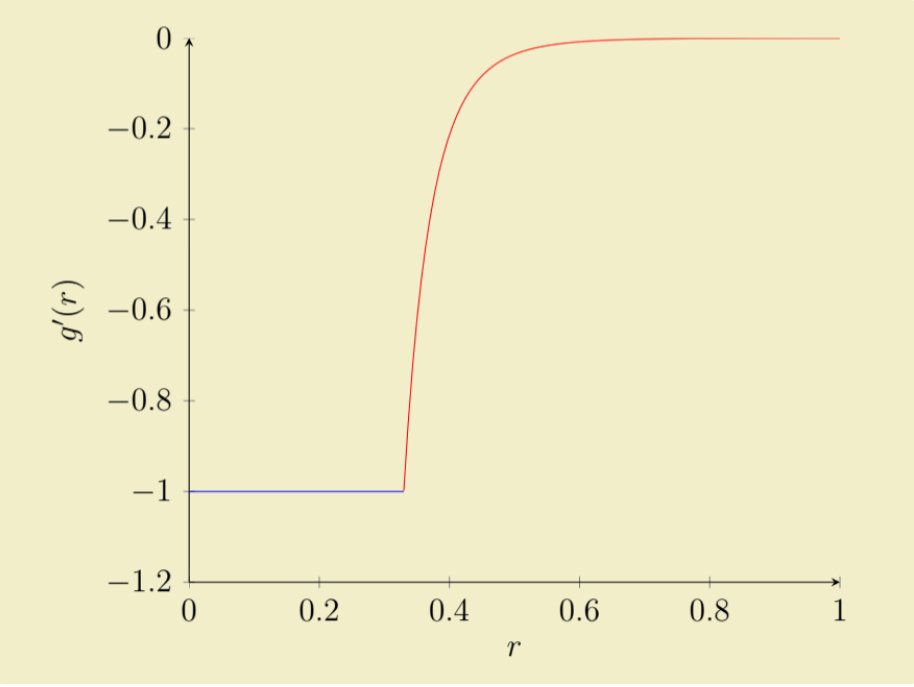

In simple terms, it is a strategy that combines multiple long and short positions so that the net change of its value is zero in all market conditions inside a certain range.

In simple terms, it is a strategy that combines multiple long and short positions so that the net change of its value is zero in all market conditions inside a certain range.

Let's say Alice holds $100 worth of $AVAX. If the price of AVAX increases by 5%, Alice makes $5. If it decreases by 10% - Alice loses $10.

To hedge against price decreases, Alice can short $100 worth of $AVAX through the perpetual exchange.

To hedge against price decreases, Alice can short $100 worth of $AVAX through the perpetual exchange.

Now, assuming her position doesn't get liquidated and no other fees are involved (i.e., funding rates), her position value will be stable at $100.

But what's so cool about portfolios that don't change in value and how people are supposed to make money with them?

But what's so cool about portfolios that don't change in value and how people are supposed to make money with them?

That's the most beautiful part. Imagine that instead of just holding spot $AVAX, Alice stakes it for $sAVAX to get 7.2% APR.

Because of the delta neutrality, she can receive this yield without worrying about the price of $AVAX decreasing.

Because of the delta neutrality, she can receive this yield without worrying about the price of $AVAX decreasing.

In exchange, she gives up exposure to $AVAX going up, so these strategies are better suited for people looking for sustainable yield rather than a quick 10x.

One of the projects that already offer such yields is @UmamiFinance.

One of the projects that already offer such yields is @UmamiFinance.

They hold $ETH and $BTC through the $GLP while earning yield from @GMX_IO fees and hedge downside risk through @TracerDAO's liquidation-free leveraged tokens.

Here is a good primer on Umami if you want a closer look:

Here is a good primer on Umami if you want a closer look:

https://twitter.com/BarryFried1/status/1534951513772244995

But yield is not everything delta-neutrality is good for.

One of the biggest problems for most current stablecoins is capital inefficiency.

Essentially, users need to deposit >$1 worth of assets to mint $1 worth of stables, so excessive capital is locked away doing nothing.

One of the biggest problems for most current stablecoins is capital inefficiency.

Essentially, users need to deposit >$1 worth of assets to mint $1 worth of stables, so excessive capital is locked away doing nothing.

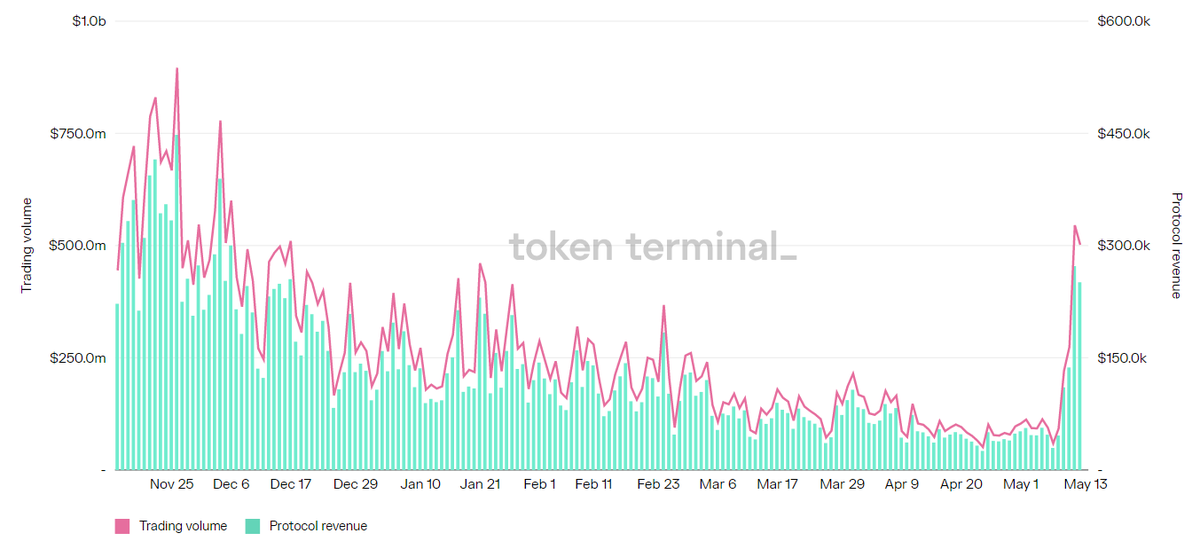

Solana's @UXDProtocol solves this problem by backing their $UXD stablecoin with delta-neutral positions on @mangomarkets.

When a user deposits $1 worth of $SOL, 1 UXD is minted in return. This $SOL is then deposited into a perpetual exchange and used to open a short.

When a user deposits $1 worth of $SOL, 1 UXD is minted in return. This $SOL is then deposited into a perpetual exchange and used to open a short.

This simple but effective design allows $UXD to keep 1:1 backing in a capital-efficient manner and generate non-dilutive revenue for the protocol from funding rates.

UXD have great docs: docs.uxd.fi/uxdprotocol/

and this @MessariCrypto article is also gud: messari.io/report/uxd-tac…

UXD have great docs: docs.uxd.fi/uxdprotocol/

and this @MessariCrypto article is also gud: messari.io/report/uxd-tac…

On the #Avalanche side, @YetiFinance have been teasing some delta neutral strategies for a while.

You can theoretically construct those yourself right now, but I wouldn't be surprised if automated solutions start popping up.

You can theoretically construct those yourself right now, but I wouldn't be surprised if automated solutions start popping up.

Right now, some pieces are still missing, but with @HubbleExchange's multi-collateralisation and @ArrowMarkets being (hopefully) closer to mainnet, there should be more than enough tools available for strategy buildooors.

• • •

Missing some Tweet in this thread? You can try to

force a refresh