How to get URL link on X (Twitter) App

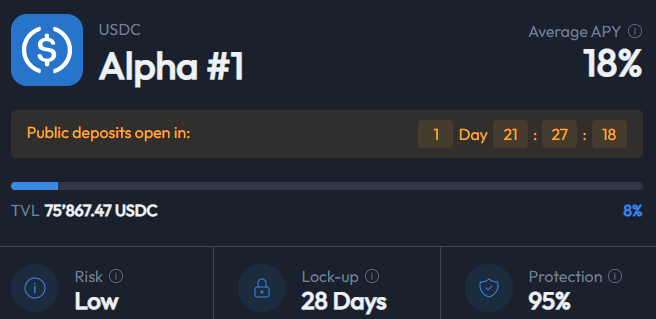

In short, the vault takes users' deposits in $USDC, locks them up for an epoch's duration (28 days) and uses them to generate yield.

In short, the vault takes users' deposits in $USDC, locks them up for an epoch's duration (28 days) and uses them to generate yield.

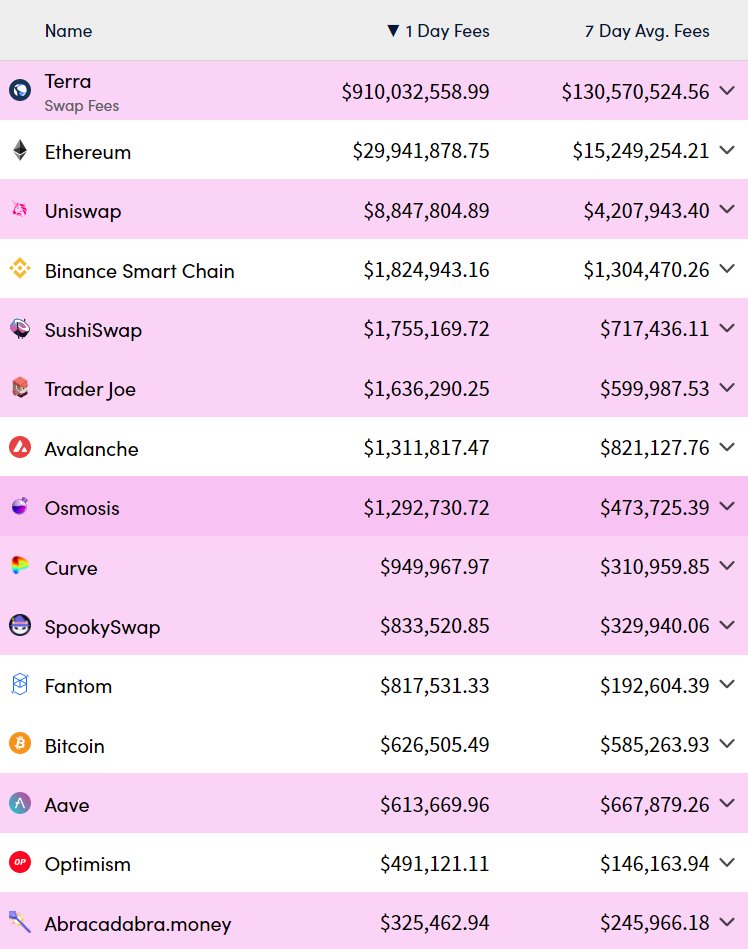

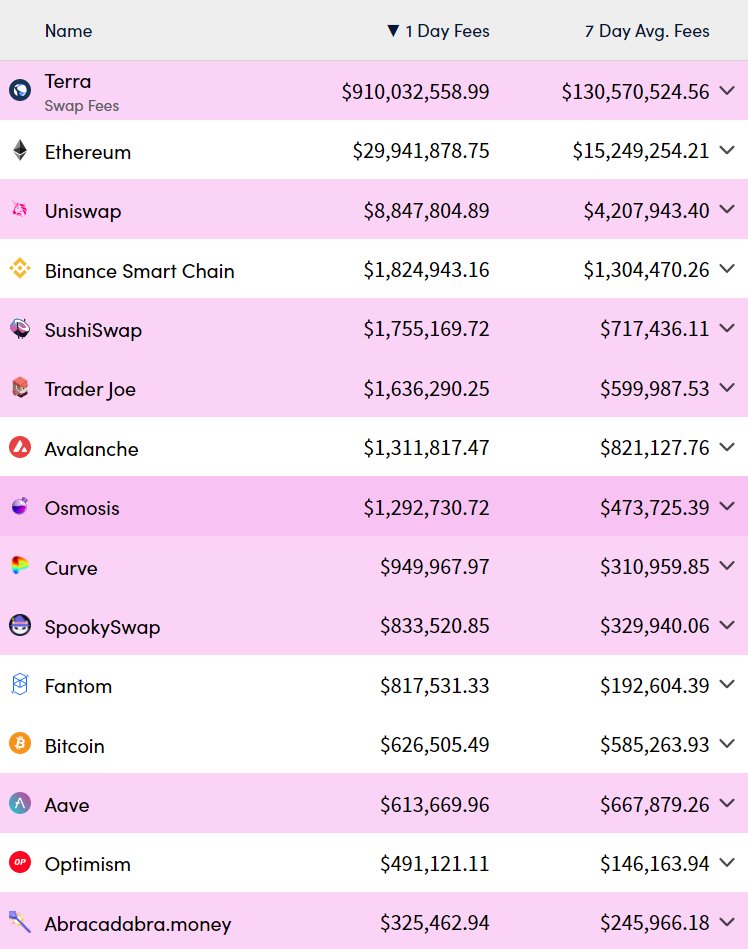

1. Rise of the "cashflow tokens" narrative.

1. Rise of the "cashflow tokens" narrative.

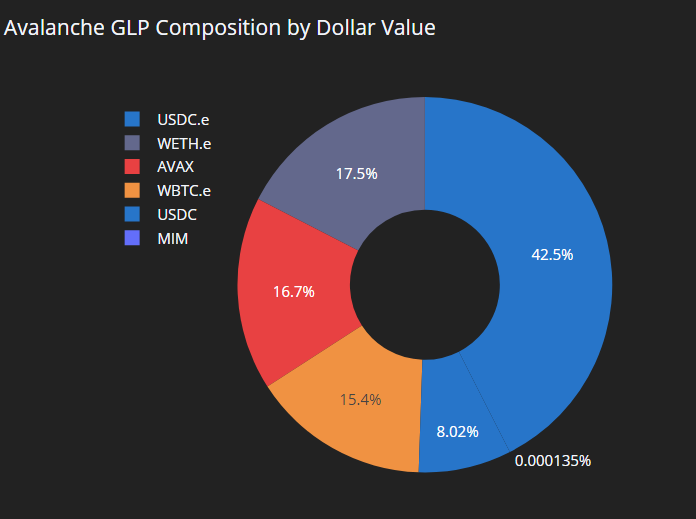

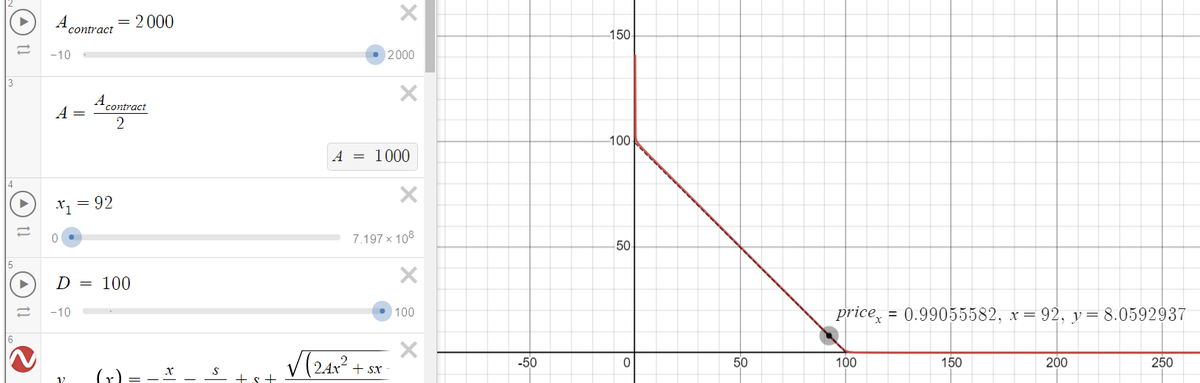

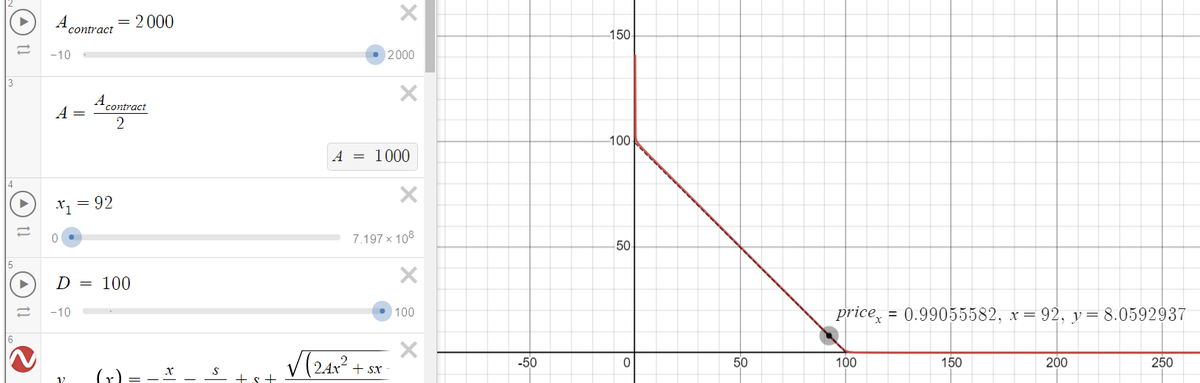

At the first glance, it is just another DEX just like TraderJoe or Uniswap: there is a pool with crypto assets and you can trade with it instead of relying on always having a 2nd party on the opposite side of a trade as you would in a traditional order book exchange.

At the first glance, it is just another DEX just like TraderJoe or Uniswap: there is a pool with crypto assets and you can trade with it instead of relying on always having a 2nd party on the opposite side of a trade as you would in a traditional order book exchange.

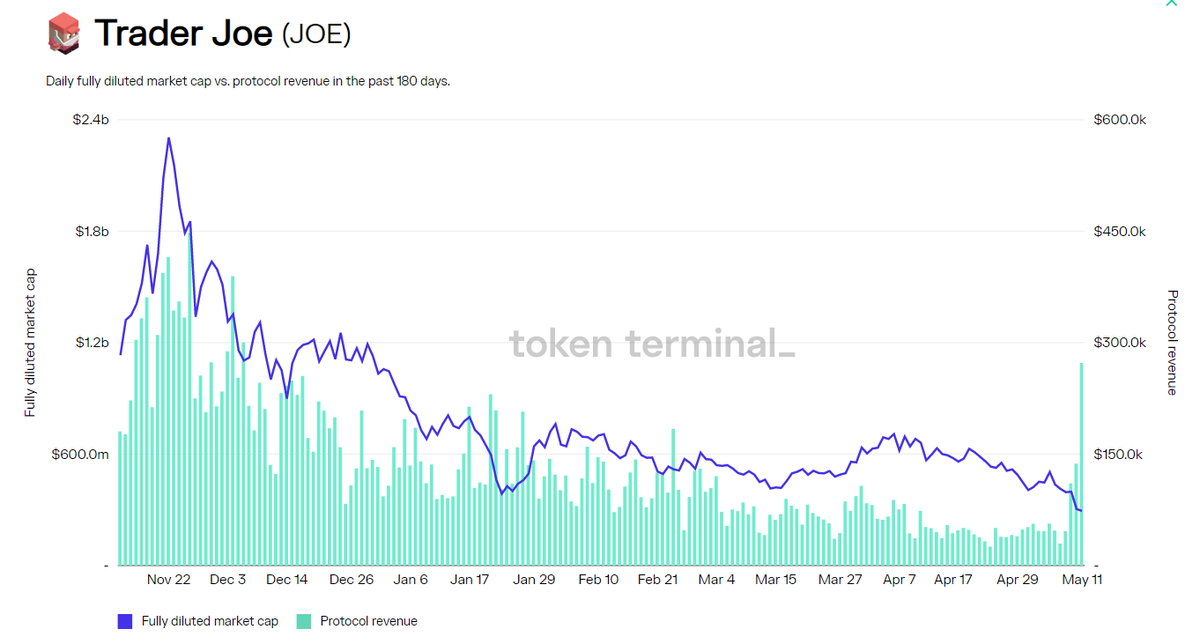

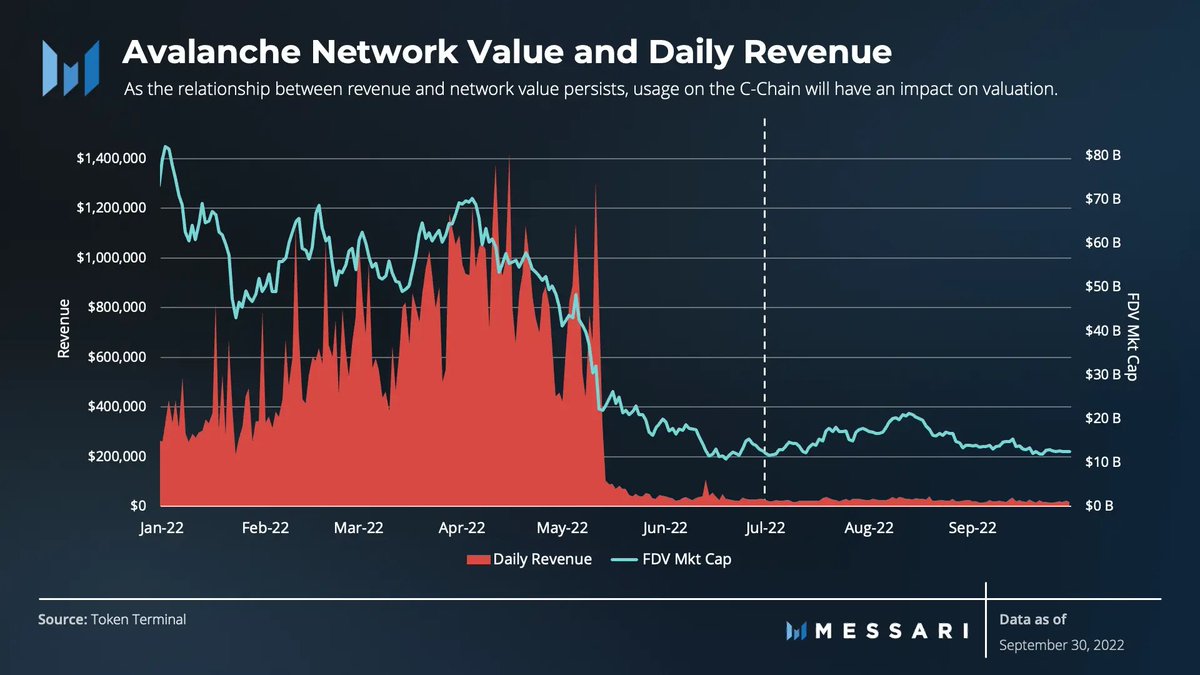

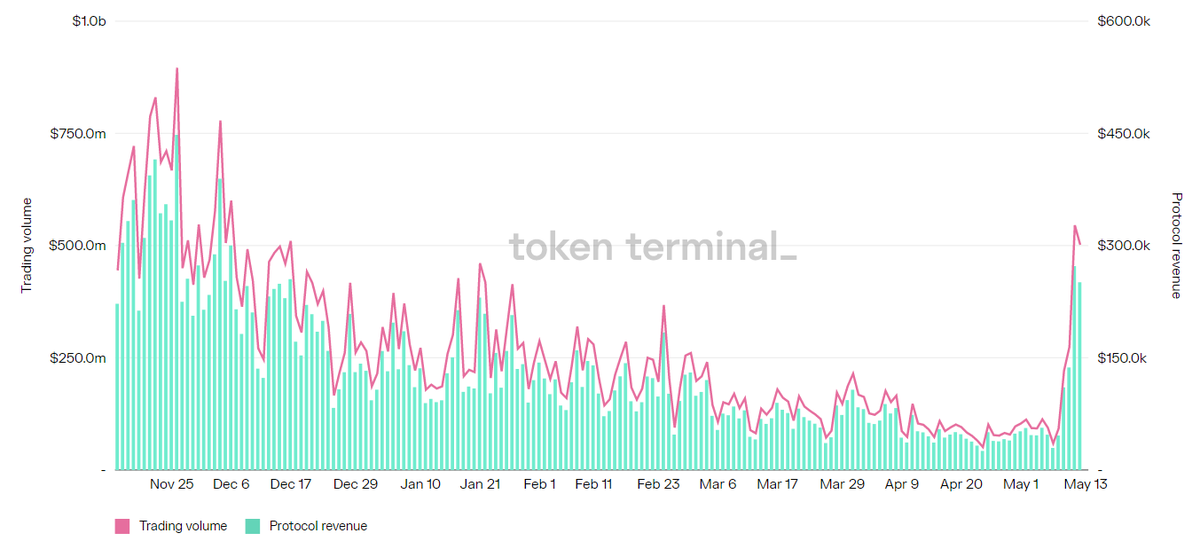

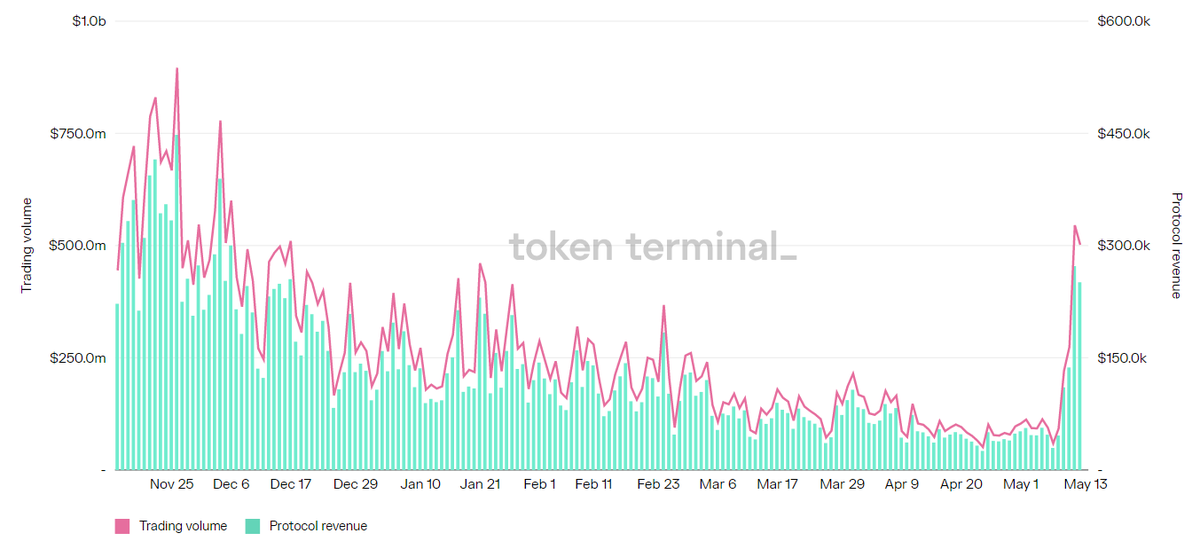

Market cap down 📉, revenue for LP and sJOE holders up 📈.

Market cap down 📉, revenue for LP and sJOE holders up 📈.