One confusing thing about #econtwitter is there are always two valid debates happening simultaneously that often bleed into each other. But once you realize they're different it's a lot easier.

One is a more political debate and the other is a more economic one.

One is a more political debate and the other is a more economic one.

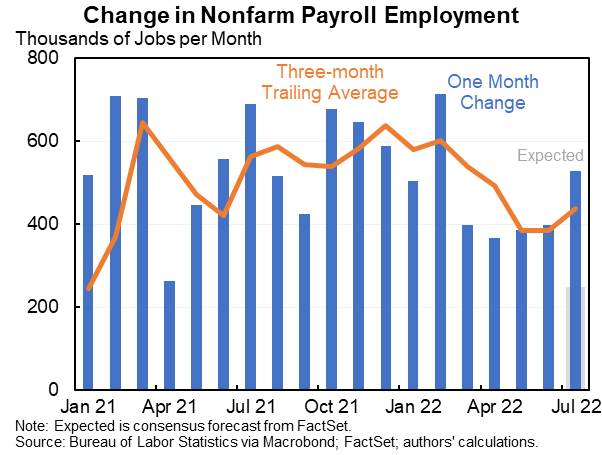

From the Democratic side of the political debate today's jobs number was 100% great news. It will probably help in the midterm elections etc.

From the economic perspective the jobs number was more mixed. Could make a credible great economic news case but more debatable.

From the economic perspective the jobs number was more mixed. Could make a credible great economic news case but more debatable.

We'll see the same w/ next week's CPI. The headline will be low because of falling gas price. That matters to rebut silly GOP arguments about rising gas prices. It does matter for the midterm elections. And it matters for well being. People *should* make all those points.

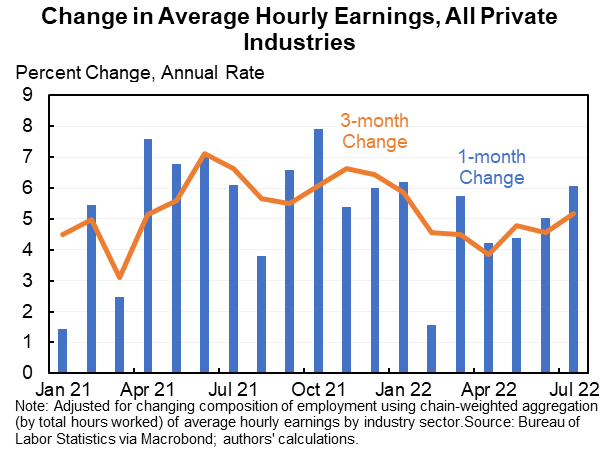

But next week I'll be doing what I've done every time I've ever talked about the CPI--which is to focus on the core measure (or other underlying measures like trimmed mean or median). These are more relevant for predicting future inflation, what the Fed will/should do, etc.

Note @paulkrugman has made this point too, distinguishing between his gas price commentary which was engaged in the political debate (w/ Paul's commentary being in good faith and rebutting people in bad faith) from the economic debate re the Fed.

https://twitter.com/paulkrugman/status/1554119740309766147?s=20&t=mx9KwBjDWVHMLWmbED3pOg

• • •

Missing some Tweet in this thread? You can try to

force a refresh