Lots of talk today about #Bitcoin and #Crypto being regulated, and even Bitcoiners calling for regulations on other cryptocurrencies

I do not like and even reject the framing:

"Regulations Will Help Adoption"

4 basic reasons why, a short 🧵👇

I do not like and even reject the framing:

"Regulations Will Help Adoption"

4 basic reasons why, a short 🧵👇

1/ #Bitcoin is already one of the heaviest regulated assets there are, every agency chimes in

IRS, CFTC, FinCen, SEC, have all weighed in with their regulations, and today US Senate bill working to give regulation power back to CFTC

More regulation is NEVER the answer

IRS, CFTC, FinCen, SEC, have all weighed in with their regulations, and today US Senate bill working to give regulation power back to CFTC

More regulation is NEVER the answer

2/ #Bitcoin is already perfectly legal to buy it right now, both personally and for institutions and corporations.

There is nothing holding it back, look at:

@Saylor and $MSTR + Fidelity + Coinbase + Blackrock, etc, I could go on...

There is nothing holding it back, look at:

@Saylor and $MSTR + Fidelity + Coinbase + Blackrock, etc, I could go on...

3/ In USA, we don’t ask for permission because we are FREE

Laws tell us what we "Can't" do, they take away freedom. They DO NOT tell us what we can do, they don’t us give permission

I REJECT:

"If only govs regulate us / give us permission, permission, more people will use it"

Laws tell us what we "Can't" do, they take away freedom. They DO NOT tell us what we can do, they don’t us give permission

I REJECT:

"If only govs regulate us / give us permission, permission, more people will use it"

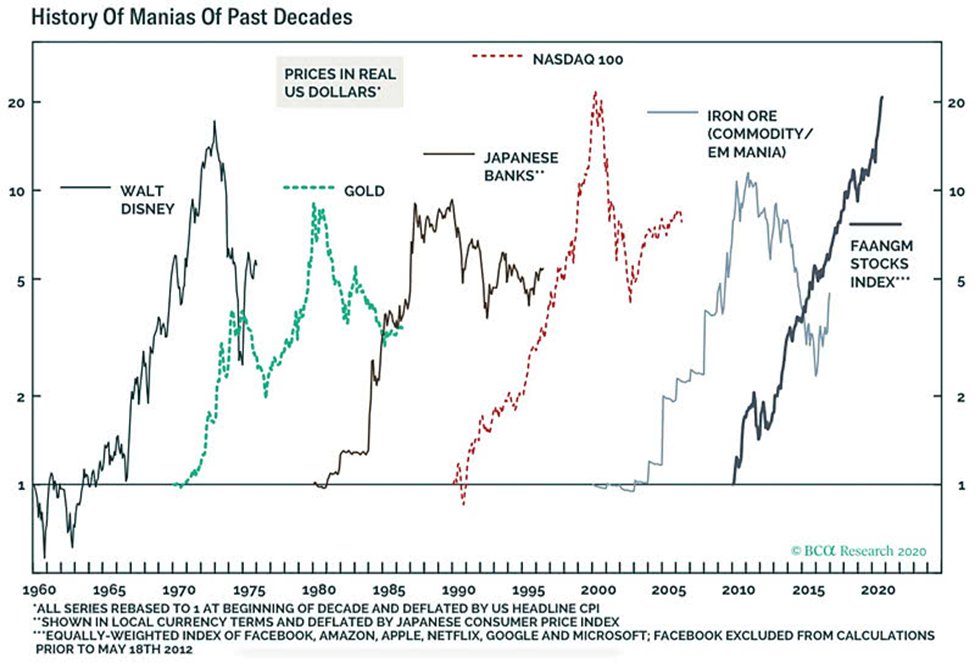

4/ We DO NOT need to push for mainstream adoption, no one had to push for mainstream adoption of the Internet, the masses will come.

Read This 👇corporatefinanceinstitute.com/resources/know…

Understand the “Diffusion Of Innovation” theory, read up on it to understand the diagram for why...

Read This 👇corporatefinanceinstitute.com/resources/know…

Understand the “Diffusion Of Innovation” theory, read up on it to understand the diagram for why...

5/ 3 good books to read, simple, 1hr max reads that would really help this...

1. Murray Rothbard: Anatomy Of the State

2. Frederick Bastiat: The Law

3. The Uncommunist Manifesto (my plug 😉)

These books can be read in less than 1 hour each, HIGHLY RECCOMEND you check them out

1. Murray Rothbard: Anatomy Of the State

2. Frederick Bastiat: The Law

3. The Uncommunist Manifesto (my plug 😉)

These books can be read in less than 1 hour each, HIGHLY RECCOMEND you check them out

• • •

Missing some Tweet in this thread? You can try to

force a refresh