/1 @redactedcartel is the next project that will generate #RealYield for its token holders!

Here's why you should pay attention to Redacted🧵👇

Here's why you should pay attention to Redacted🧵👇

/2 Overview

The project mission is to build different products that empower on-chain liquidity, governance, and cash flow for DeFi protocols.

A part of the generated revenue will be sent to @redactedcartel token holders in the form of ETH rewards.

The project mission is to build different products that empower on-chain liquidity, governance, and cash flow for DeFi protocols.

A part of the generated revenue will be sent to @redactedcartel token holders in the form of ETH rewards.

/3 Where is the project revenue coming from?🤔

The project launched 2 products:

-Hidden Hand

-Pirex

50% of the Hidden Hand's fees and 42.5% of Pirex's fees will be sent to $BTRFLY holders.

Also, 15% of treasury earnings are shared with token holders.

BTRFLY-Redacted token

The project launched 2 products:

-Hidden Hand

-Pirex

50% of the Hidden Hand's fees and 42.5% of Pirex's fees will be sent to $BTRFLY holders.

Also, 15% of treasury earnings are shared with token holders.

BTRFLY-Redacted token

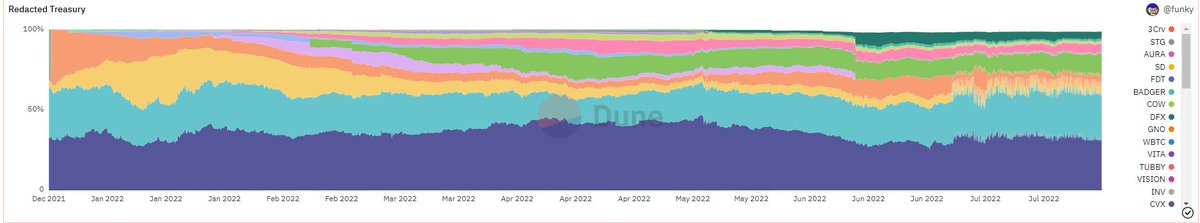

/4 Treasury

There are nearly $25M in the Redacted treasury.

Considering that the $BTRFLY market cap is $42M atm, we can say that each 1$ of $BTRFLY tokens controls nearly 0.6$ of the treasury funds🤩

These funds are generating revenue through yield farming, bribes, etc.

There are nearly $25M in the Redacted treasury.

Considering that the $BTRFLY market cap is $42M atm, we can say that each 1$ of $BTRFLY tokens controls nearly 0.6$ of the treasury funds🤩

These funds are generating revenue through yield farming, bribes, etc.

/5 You can even track how these funds are used through the Redacted Metrics dashboard: dune.com/queries/436963…

The treasury generated ~$2.8 million in income in Q2 2022.

The treasury generated ~$2.8 million in income in Q2 2022.

/6 Hidden Hand

Hidden Hand is a Bribe Marketplace.

Protocols can leverage Hidden Hand to bribe the token holders of different projects for voting for emmissions on their vaults/LPs etc.

veToken holders of 6 different projects can use this product to earn extra yield atm.

Hidden Hand is a Bribe Marketplace.

Protocols can leverage Hidden Hand to bribe the token holders of different projects for voting for emmissions on their vaults/LPs etc.

veToken holders of 6 different projects can use this product to earn extra yield atm.

/7 4% of all bribes coming into the Hidden Hand are collected as a fee by Redacted🤩

Balancer has seen massive success through Hidden Hand.

If veTokenomics popularity will continue to increase, Hidden Hand will likely generate a lot of fees for $BTRFLY holders.

Balancer has seen massive success through Hidden Hand.

If veTokenomics popularity will continue to increase, Hidden Hand will likely generate a lot of fees for $BTRFLY holders.

/8 Pirex

Pirex makes possible the creation of liquid wrappers that allow for auto-compounding and the tokenization of future yield.

It might sound tricky, but I'll try to explain how pxCVX(the first Pirex liquid wrapper) works:

CVX can be deposited in Pirex for pxCVX.

Pirex makes possible the creation of liquid wrappers that allow for auto-compounding and the tokenization of future yield.

It might sound tricky, but I'll try to explain how pxCVX(the first Pirex liquid wrapper) works:

CVX can be deposited in Pirex for pxCVX.

/9 Once deposited, the protocol will lock this CVX for vlCVX(locked Convex).

Pirex uses the CVX voting power to get bribes for pxCVX holders using Votium.

Votium-a bribe marketplace for veCRV and vlCVX holders

But that's not all!

Pirex uses the CVX voting power to get bribes for pxCVX holders using Votium.

Votium-a bribe marketplace for veCRV and vlCVX holders

But that's not all!

/10 pxCVX can be exchanged for uCVX. pxCVX holders should do this if they don't want to collect the rewards very often.

The number of pxCVX per uCVX increases over time as more bribes are claimed.

How do $BTRFLY holders benefit from this?

4% of vlCVX bribes are taken as a fee.

The number of pxCVX per uCVX increases over time as more bribes are claimed.

How do $BTRFLY holders benefit from this?

4% of vlCVX bribes are taken as a fee.

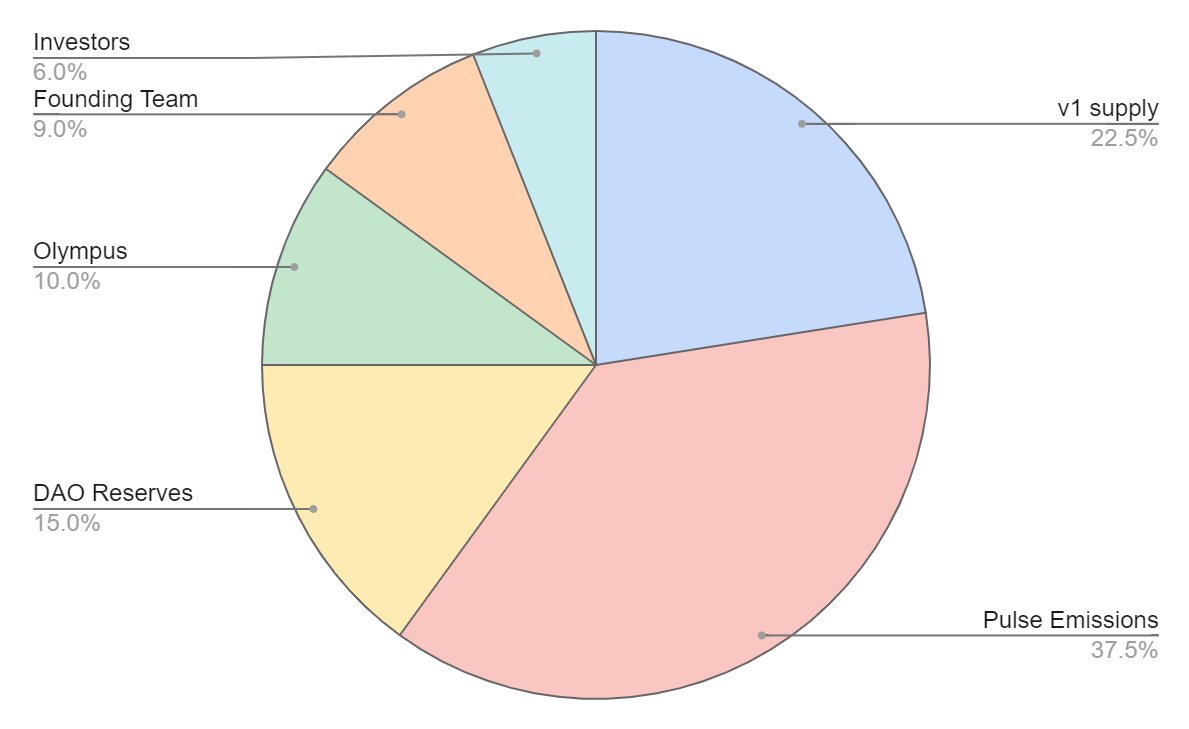

/11 Roadmap

The team recently announced the launch of a new $BTRFLY token.

This one will have a limited supply and holders will be able to lock it for rlBTRFLY to earn sustainable rewards in $ETH.🤑

The rewards will depend on how much time each holder locks his rewards.

The team recently announced the launch of a new $BTRFLY token.

This one will have a limited supply and holders will be able to lock it for rlBTRFLY to earn sustainable rewards in $ETH.🤑

The rewards will depend on how much time each holder locks his rewards.

/12 Other things that are worth mentioning:

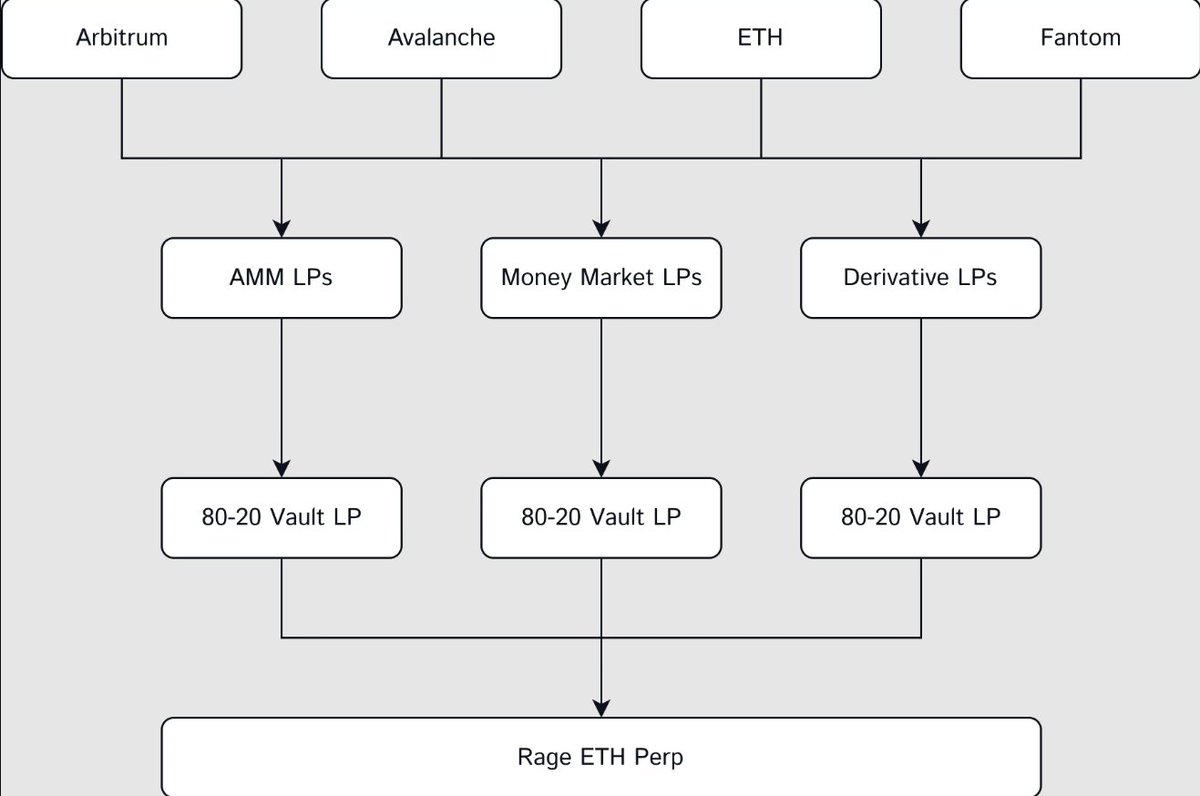

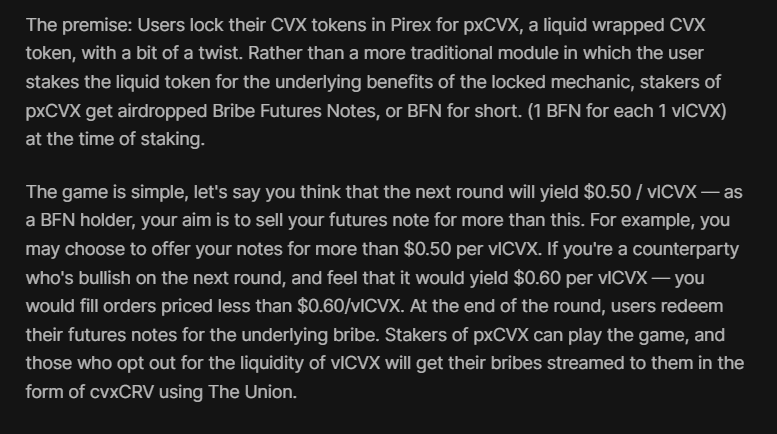

Pirex will allow the pxCVX holders to tokenize their future pxCVX yield/vote events in the near future.

So you'll essentially be able to bet on the prices of the future bribes. See in the image down below how this is going to work:

Pirex will allow the pxCVX holders to tokenize their future pxCVX yield/vote events in the near future.

So you'll essentially be able to bet on the prices of the future bribes. See in the image down below how this is going to work:

/13 That's all!

@Subli_Defi is one of the first chads who wrote about Redacted before the recent pump of BTRFLY price. I recommend you to also check his 🧵:

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

@Subli_Defi is one of the first chads who wrote about Redacted before the recent pump of BTRFLY price. I recommend you to also check his 🧵:

https://twitter.com/Subli_Defi/status/1555669085064683522

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

/14 @JAI_BHAVNANI

@CurveCap

@0xDamien

@DegenSensei

@YJN58

@rektdiomedes

@OmarOnChain

@0xKolten

@0xSami_

@0xMattyb

@___magnus___

@cryptouf

@mcasto_

@0xAlunara

@JRossTreacher

@CurveCap

@0xDamien

@DegenSensei

@YJN58

@rektdiomedes

@OmarOnChain

@0xKolten

@0xSami_

@0xMattyb

@___magnus___

@cryptouf

@mcasto_

@0xAlunara

@JRossTreacher

• • •

Missing some Tweet in this thread? You can try to

force a refresh