A quick refresher on why investing in US natural gas looks like a home run right now.

#COM #OOTT #EFT

#COM #OOTT #EFT

The US produces about 100 Bcfe/d of gas.

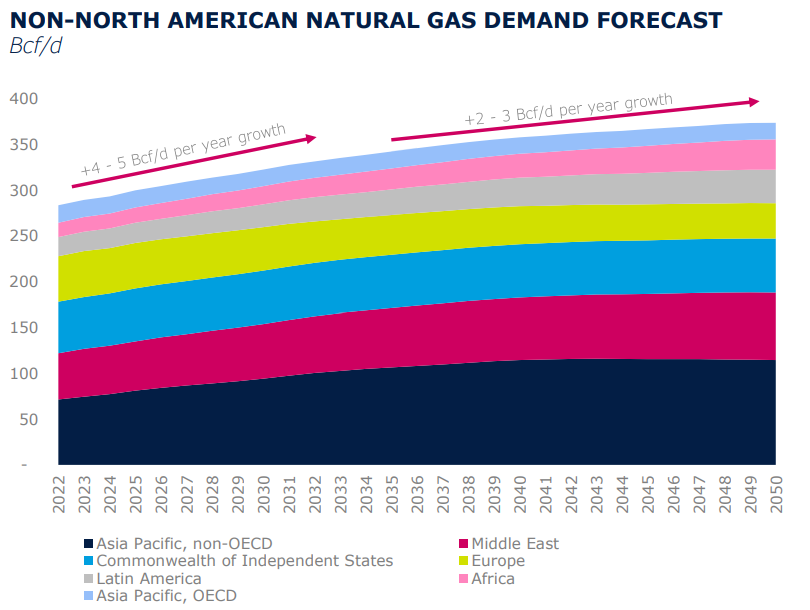

Outside America, the world consumes 280 Bcfe/d for a total of 380Bcfe/d of global demand.

Outside America, the world consumes 280 Bcfe/d for a total of 380Bcfe/d of global demand.

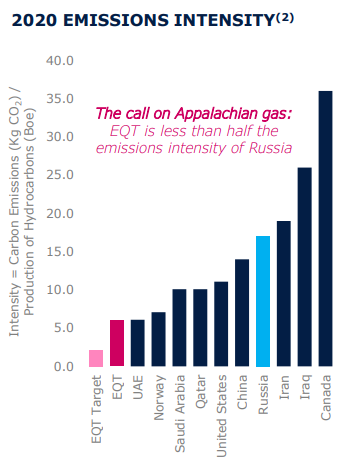

Gas is much greener than coal or oil.

Gas gives off far fewer emissions than both coal and oil (see "EQT" bar on the left)

Gas gives off far fewer emissions than both coal and oil (see "EQT" bar on the left)

The world burns enough coal to equal 430 Bcfe/d, more than all the gas consumed in a year.

40% of that coal is ripe for switching to gas and would equal 50% more demand for gas globally.

40% of that coal is ripe for switching to gas and would equal 50% more demand for gas globally.

That's a lot of new gas demand. Where would it come from?

Well, considering US gas (Henry Hub) costs $8 while gas in Europe + Asia (TTF,JKM) goes for $30-$40 it's a safe bet US gas is the answer.

Well, considering US gas (Henry Hub) costs $8 while gas in Europe + Asia (TTF,JKM) goes for $30-$40 it's a safe bet US gas is the answer.

And coal to gas switching isn't the only opportunity...

Europe's desperate need for a replacement to Russian gas would be ~14% of all US gas supplied. Not to mention Asia which would love to buy US gas for 70% off.

Europe's desperate need for a replacement to Russian gas would be ~14% of all US gas supplied. Not to mention Asia which would love to buy US gas for 70% off.

The demand environment for US gas has never been stronger.

Gas is the pragmatic way to meet global emissions targets while providing power as the world transitions off fossil fuels to clean renewable energy.

Gas is the pragmatic way to meet global emissions targets while providing power as the world transitions off fossil fuels to clean renewable energy.

For all the TLDR people out there this is all you need to know..

US gas = $8

Europe gas = $30

Asia gas= $25

Whose gas do you think will be most in demand? The future is bright for anyone producing gas in the USA.

US gas = $8

Europe gas = $30

Asia gas= $25

Whose gas do you think will be most in demand? The future is bright for anyone producing gas in the USA.

I write threads like this all the time over at my Substack.

Save yourself some time and let me tell you what really matters when investing in energy.

grizzleoil.substack.com/p/introducing-…

Save yourself some time and let me tell you what really matters when investing in energy.

grizzleoil.substack.com/p/introducing-…

Also, check out this post which is about my favorite energy investing theme of the next 10 years. LNG

https://twitter.com/ScottW_Grizzle/status/1506628397572759554

• • •

Missing some Tweet in this thread? You can try to

force a refresh