1. Recommended Reading for the Day: This really is a "wow" article. In 10 minutes or reading you can learn alot here about organic vs. conventional farming returns. Thanks Mike Langemeier! #boilerup

https://twitter.com/FarmPolicy/status/1556599199235457024

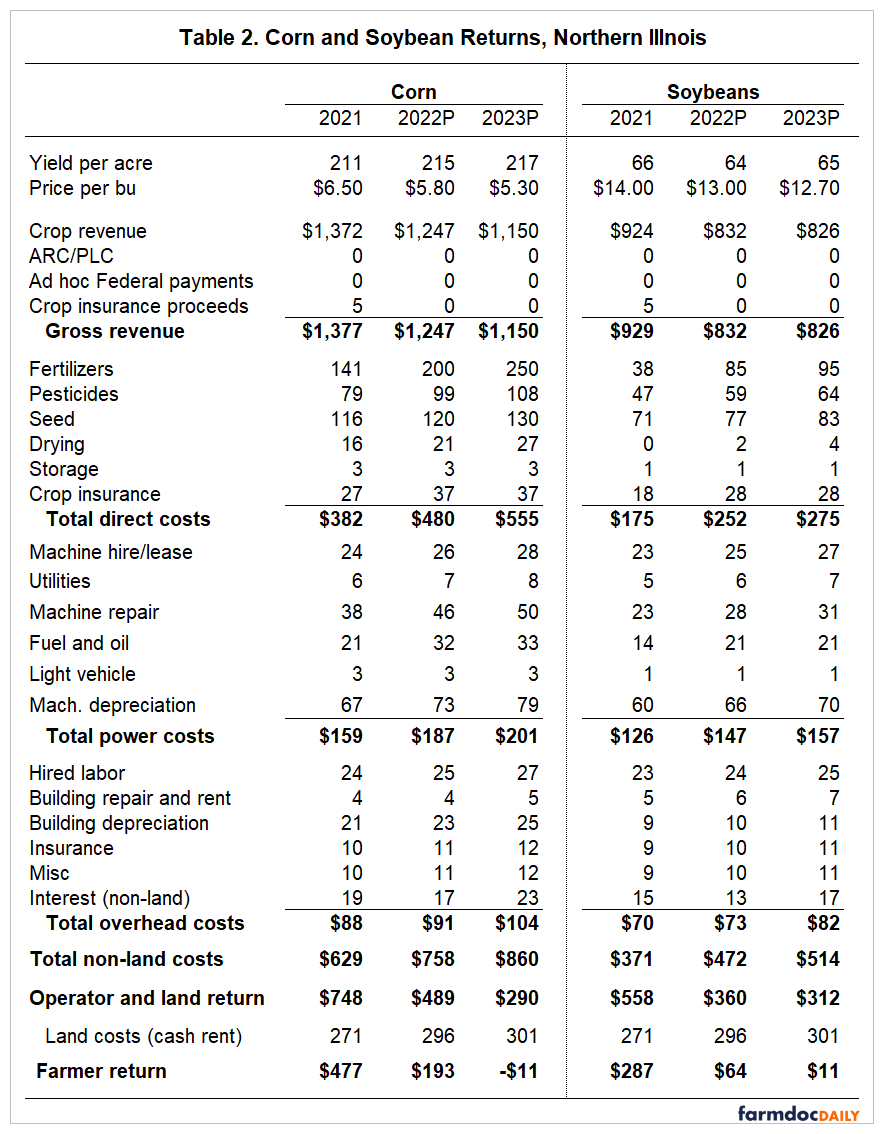

2. An awfully lot of opinion out there about organic vs. conventional crop returns. Mike has assembled invaluable comparisons from the same FINBIN database. Here are five-year average yields. Hits to organic yields are obvious and big for corn and soybeans.

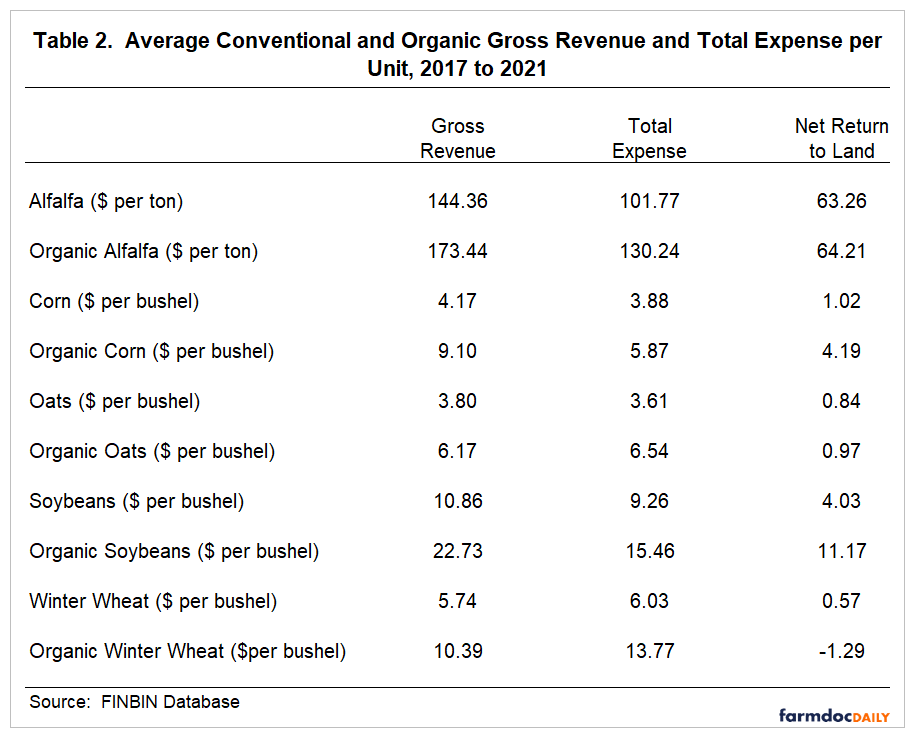

3. Now lets turn to gross revenue per unit, or price. Some eye-popping organic premiums here across the board. Remember these are not theoretical. Based on actual farm return data. Organic corn premium was almost $5 per bushel!

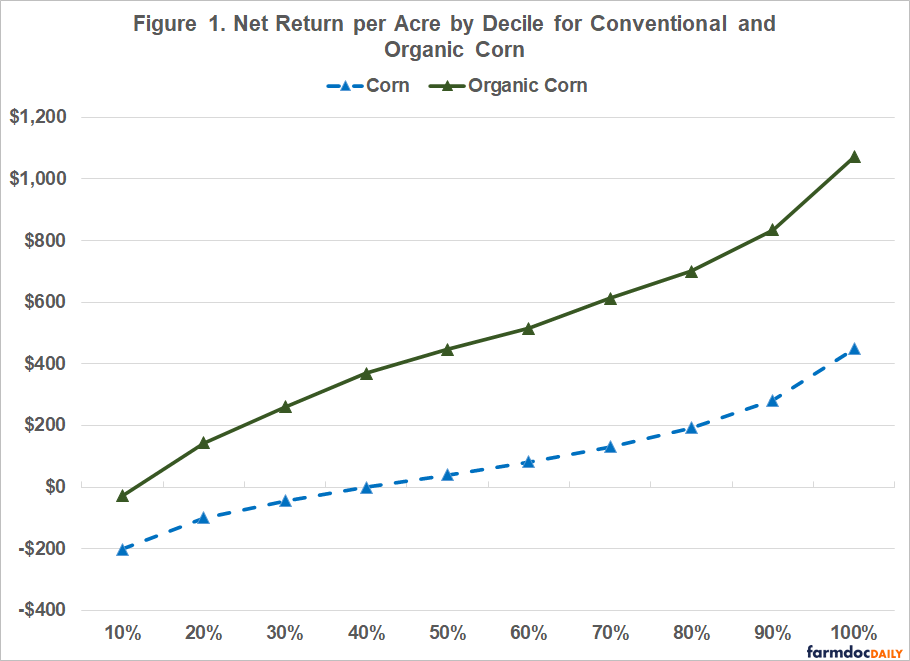

4. So now, what wins out in organic vs. conventional: lower yields or higher prices? What about costs? Here are the net returns per acre by decile of returns for conventional vs. organic. At least in this data, organic appears to win hands down.

5. So which is it, organic or conventional? Which has the higher returns? Alas, we still do not completely know the answer even with this great analysis. First, organic rotations are more complex than 50/50 rotations. Have to include small grains, cover crops, etc.

6. Second, for full analysis you have to account for the cost of transitioning from conventional to organic. This is very much not inconsequential. Still, I was impressed with the price premiums for organic and increase in organic enterprise returns for most crops.

7. Not lets talk some simple economics on conventional vs. organic crop returns. The article indicates that only 2% of US cropland is organic. Even if growing that is a tiny slice of the pie. Economics suggests that the reason is that costs of switching to organic are high.

8. If organics were just straight up much more profitable than conventional crops there would be a stampede by farmers in that direction. Since there is not, basic economics suggests that net returns after considering all costs cannot be that different.

9. Realize that my economic argument is very simple. Lots of caveats could be added. But I think it is a reasonable way to begin the discussion at least in economic terms. Again, great work by my #boilerup friend Mike Langemeier!

10. Finally, gives me the chance to toot the FDD horn. Where else in the world can you find the breadth and depth of agricultural economic analysis found here? Yes, I am extremely proud of the work we do here!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh