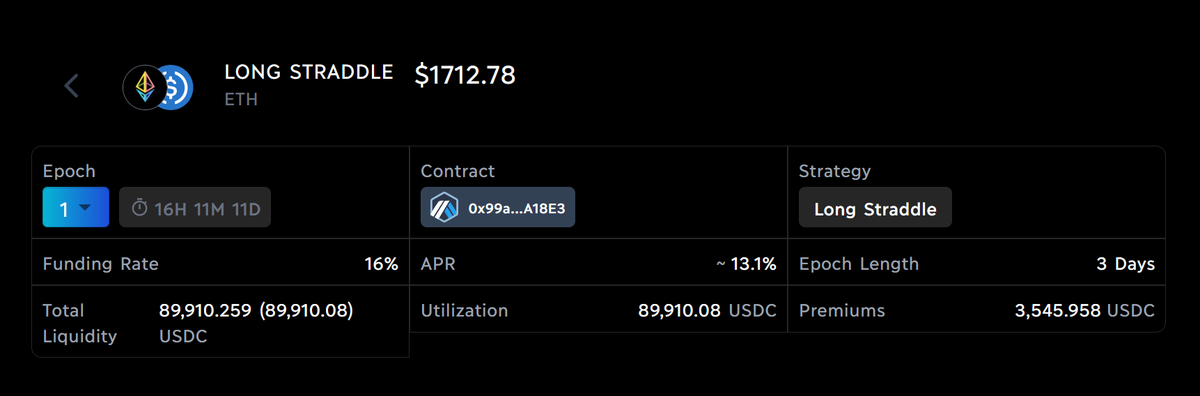

Dopex just released Atlantic Straddles which gives users another venue to earn yield on stables.

This is the first simplified options strategy on the protocol that is done in one click.

Let’s start from the basics to understand how to use them.

blog.dopex.io/articles/dopex…

This is the first simplified options strategy on the protocol that is done in one click.

Let’s start from the basics to understand how to use them.

blog.dopex.io/articles/dopex…

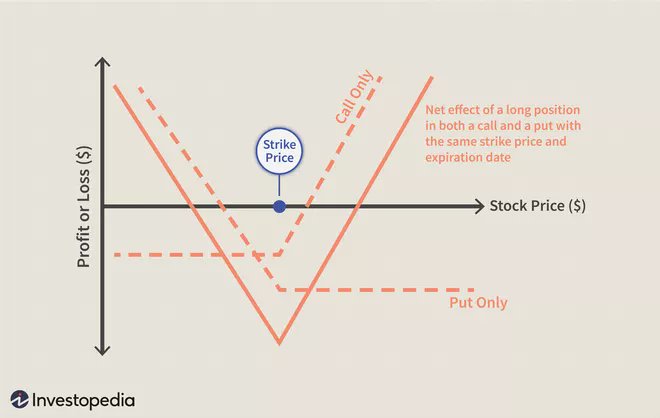

Straddle

This is an option strategy where a put and call of the same strike price and expiration date are purchased.

The strategy available today is a Long Straddle which requires the purchase of an ATM call and ATM put allowing the buyer to profit off volatility.

This is an option strategy where a put and call of the same strike price and expiration date are purchased.

The strategy available today is a Long Straddle which requires the purchase of an ATM call and ATM put allowing the buyer to profit off volatility.

Catalysts such as a CPI print or the merge are situations where one would want to purchase a long straddle.

If you’re expecting the ticker to trade sideways, you’ll want to sell a straddle.

If one is expecting volatility, you’ll want to buy a straddle.

If you’re expecting the ticker to trade sideways, you’ll want to sell a straddle.

If one is expecting volatility, you’ll want to buy a straddle.

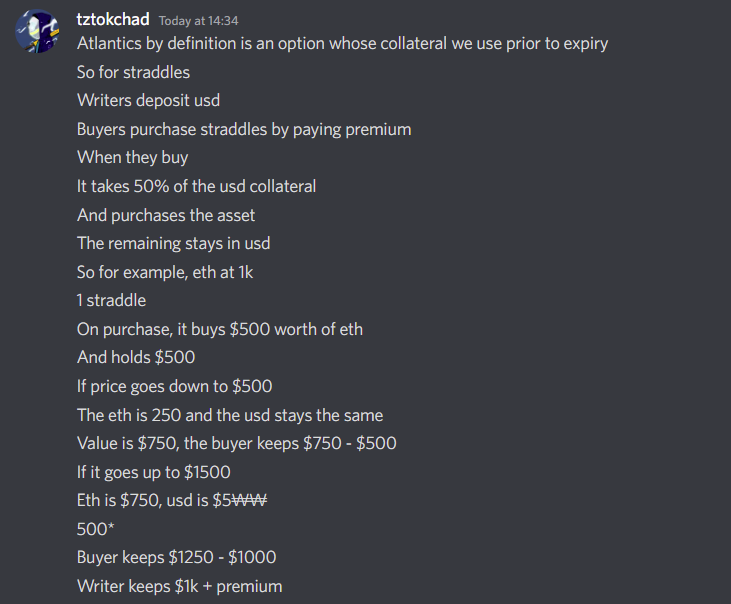

The defining characteristic of Atlantic options is that the collateral in the option is unlockable.

There have been many threads explaining how they work, but I’m going to link mine in case you need a refresher.

There have been many threads explaining how they work, but I’m going to link mine in case you need a refresher.

https://twitter.com/dLuxGMI/status/1516030461058994178

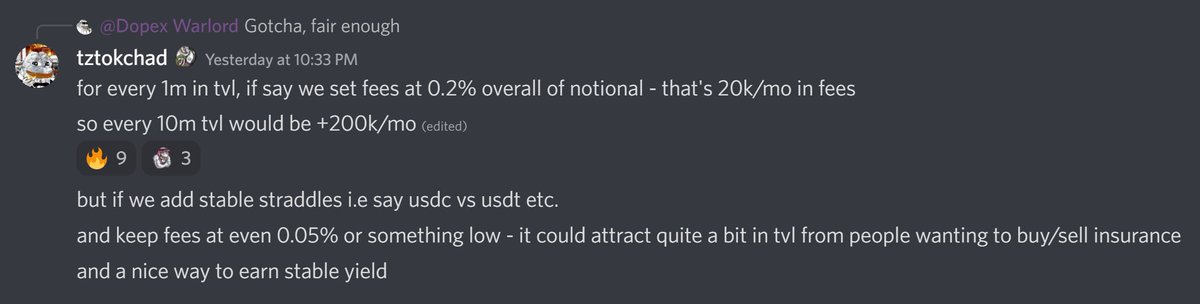

Here @tztokchad explains exactly how Atlantic Straddles work.

Writer keeps initial + premium + funding rate.

Trader needs volatility to profit.

Writer keeps initial + premium + funding rate.

Trader needs volatility to profit.

There is a funding rate attached to the cost because half of the option's collateral is used to purchase the asset, in this case $ETH.

As of right now, epochs will last 3 days and writers can simply rollover between epochs.

As of right now, epochs will last 3 days and writers can simply rollover between epochs.

Profit

Here’s how you define your breakeven point as a trader: Premium / Strike Price = x%

The ticker in question must move greater than x% to realize a profit. Let’s use a more finite example.

Here’s how you define your breakeven point as a trader: Premium / Strike Price = x%

The ticker in question must move greater than x% to realize a profit. Let’s use a more finite example.

The premium is $10 and the strike price is $150.

$10 / $120 = 0.083 = 8.3%

The ticker must move greater than 8.3% for the trader to make a profit.

$10 / $120 = 0.083 = 8.3%

The ticker must move greater than 8.3% for the trader to make a profit.

How to Use

The UI can be intimidating if you're not certain of what you're doing.

Thankfully the @dopex_io team wrote a detailed walkthrough on their blog that will detail how navigate the UI.

blog.dopex.io/articles/intro…

The UI can be intimidating if you're not certain of what you're doing.

Thankfully the @dopex_io team wrote a detailed walkthrough on their blog that will detail how navigate the UI.

blog.dopex.io/articles/intro…

The first writers earned themselves 480% APR in the first epoch, but this won't last for long.

The team has crafted another tool for yield farming that is very much in the #RealYield conversation.

The team has crafted another tool for yield farming that is very much in the #RealYield conversation.

https://twitter.com/tztokchad/status/1557185517879529472

Summary

Atlantic Straddles provide another venue for earning stable yield and gives traders a simplified one click experience to speculate.

In time, one can expect greater and greater fees to accrue towards $DPX and $plsDPX as TVL increases and more strategies are released.

Atlantic Straddles provide another venue for earning stable yield and gives traders a simplified one click experience to speculate.

In time, one can expect greater and greater fees to accrue towards $DPX and $plsDPX as TVL increases and more strategies are released.

Did you find this helpful?

1. Follow me: @dLuxGMI

2. Favorite/RT the first tweet!

1. Follow me: @dLuxGMI

2. Favorite/RT the first tweet!

https://twitter.com/dLuxGMI/status/1557346018265530368

• • •

Missing some Tweet in this thread? You can try to

force a refresh