1/12. I've tweeted a # of times on grain markets in recent wks: to me, they show case a fascinating battle between input prices (farm costs) & output prices (farm revenue). Farm return forecasts just out from University of Illinois illustrate this dance.

farmdocdaily.illinois.edu/2022/08/2023-c…

farmdocdaily.illinois.edu/2022/08/2023-c…

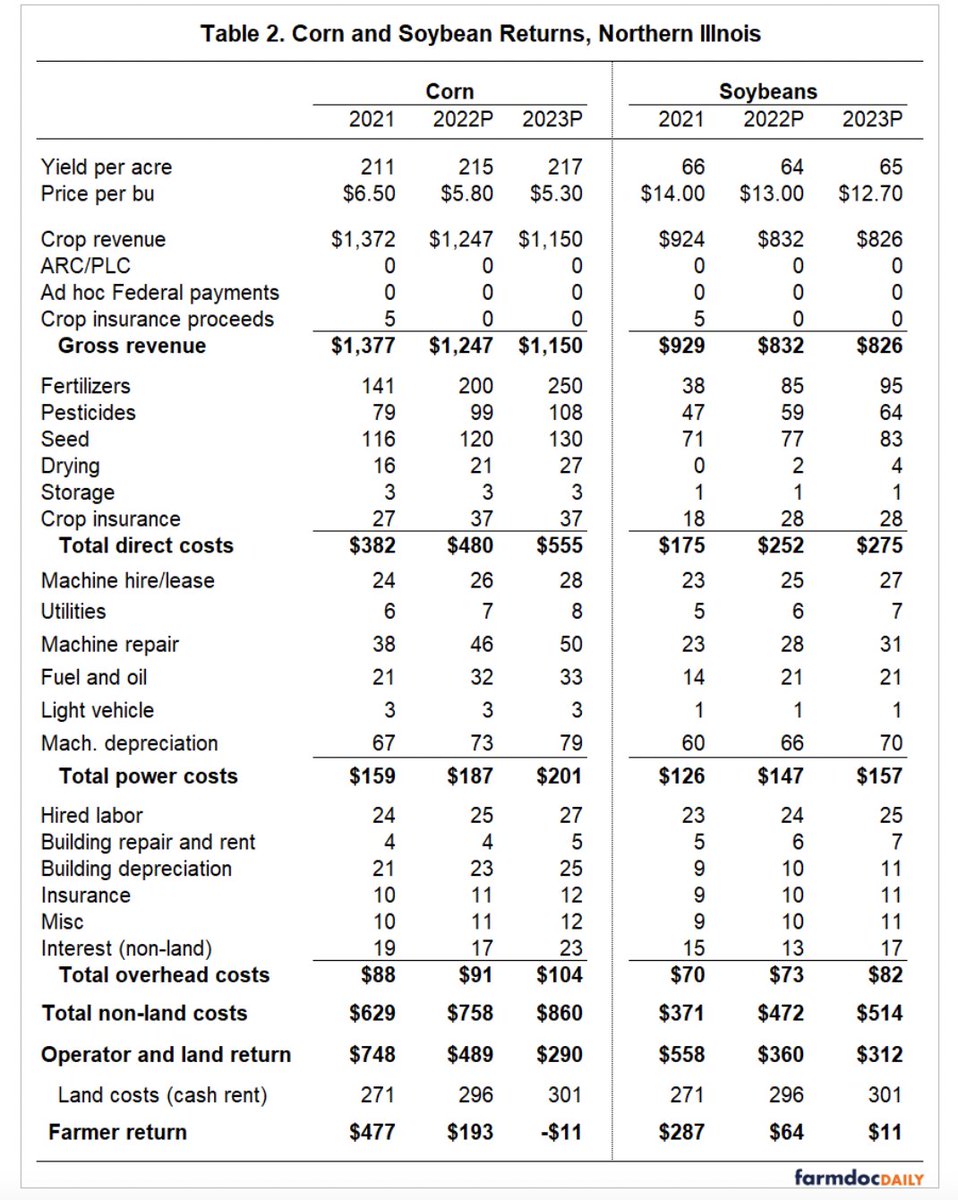

2/12. You can see that the farm sector got to party like everyone else through to this year. But things are going to get a bit more sticky next year. Basically, costs are forecast to go 'to the moon' but prices aren't.

3/12. The detailed table below gives you an idea of where the damage is being done. Taking 2023 over the bumper profit year of 2021, fertilizer is projected to be up 77%, pesticide 37%, fuel 57%. Overheads, which include labor, are slated to be up 18%.

4/12. As a result, farmer returns are set to collapse in 2023. It's also worth noting that certain costs get locked in up front. Fertilizer needs to be applied in August & September before planting.

5/12. Farmers appear to be hanging back on purchasing in the hope that prices will fall back down. But the critically important nitrogen-based fertilizers are really priced off natural gas, and, anything, that could rise in price through September.

6/12. The only parts of this analysis I would question are the relatively conservative price forecasts. Soybean and corn are traded globally. And they also move around based on substitutes like wheat.

7/12. If you think US farmers have it tough, spare a thought for those in Europe. France is the largest grower and exporter of wheat. It's farmers are having to contend with far large input cost rises than the US and a drought.

8/12. Meanwhile, over in Ukraine & Russia, most attention has been focussed on the transport of existing stocks out of Black Sea ports. But, for me, the real story there is the 2022/23 growing season.

9/12. Farmers in Ukraine are having to cope with sky high fuel & fertilizer cost spikes as well; that is, if they can get hold of supplies. Traditionally, these inputs mostly came from Russia and Belarus.

10/12. Further, Ukrainian farmer supply chains will have to compete with the war effort, and a large percentage of Ukrainian men are now in uniform.

11/12. Going back to the US, the predicament there can be thought of as a microcosm for the broader economy (albeit an extreme one). If grain prices don't rise, farmer operating margins will collapse. If they do rise, this will help reignite food inflation.

12/12. Market has reacted positively to the below-consensus CPI number out today. But I don't believe in Goldilocks. Price rises either top out and operating margins fall; or margins hold up and price rises remain annoyingly sticky (so the Fed hikes more). Hashtag: #NoFreeLunch.

CORRECTION: in the comments it was rightly picked up that fertilizer isn't being applied in August/September since crops are still in the ground. I should have said purchase decisions ahead of fall planting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh