/1 @traderjoe_xyz just launched the whitepaper of their brand new AMM!

The AMM is called "Liquity Book", and aims to solve the problems encountered by Uniswap V3.

Here's everything you need to know about it🧵👇

The AMM is called "Liquity Book", and aims to solve the problems encountered by Uniswap V3.

Here's everything you need to know about it🧵👇

/2 Liquidity Book

The whitepaper is a little too technical, but I'll try to simplify it and present the essential parts of their new AMM.

Liquidity Book(LB) arranges the liquidity of an asset pair into price bins.

The whitepaper is a little too technical, but I'll try to simplify it and present the essential parts of their new AMM.

Liquidity Book(LB) arranges the liquidity of an asset pair into price bins.

/3 When swaps are performed, the funds available in a liquidity bin are exchanged at a constant price.

If a swap requires more liquidity than is available in the current bin, it will move to the next bin.

LPs can concentrate liquidity around a price range delimited by 2 bins.

If a swap requires more liquidity than is available in the current bin, it will move to the next bin.

LPs can concentrate liquidity around a price range delimited by 2 bins.

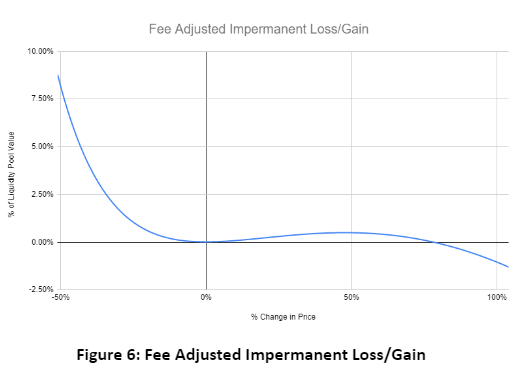

/4 Impermanent Loss

One of the most critical issues of Uniswap V3 is that impermanent loss often exceeds swap fees.

A study effectuated by the @Bancor team showed that 50% of Uniswap V3 LPs lose money.

Liquidity Book solves this problem by introducing variable swap fees.

One of the most critical issues of Uniswap V3 is that impermanent loss often exceeds swap fees.

A study effectuated by the @Bancor team showed that 50% of Uniswap V3 LPs lose money.

Liquidity Book solves this problem by introducing variable swap fees.

/5 Swap fees will have 2 components:

-base fee

-variable fee

The variable fee will depend on the volatility of the assets in each pair.

It is designed to compensate LPs for instantaneous volatility, encouraging them to manage their liquidity around the moving price.

-base fee

-variable fee

The variable fee will depend on the volatility of the assets in each pair.

It is designed to compensate LPs for instantaneous volatility, encouraging them to manage their liquidity around the moving price.

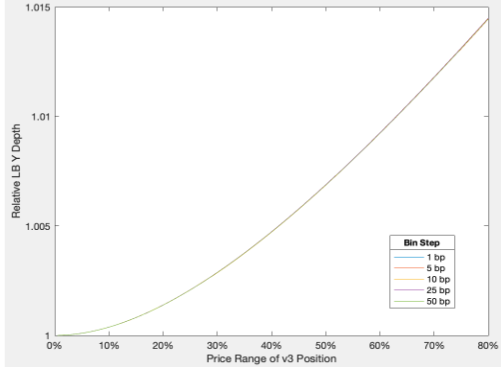

/6 Market Depth

As you might already know, a larger amount of liquidity deposited to a pair results in lower slippage for trades.

Market Depth measures how much of an asset can be traded for another asset at a given price level.

A higher market depth -> lower slippage

As you might already know, a larger amount of liquidity deposited to a pair results in lower slippage for trades.

Market Depth measures how much of an asset can be traded for another asset at a given price level.

A higher market depth -> lower slippage

/7 By incentivizing LPs to actively manage the price range of their liquidity through variable swap fees, LB market depth is likely to increase.

As shown below, the market depth of Liquidity Book is within 1% of Uniswap V3 for positions that span up to 60% of the price range.

As shown below, the market depth of Liquidity Book is within 1% of Uniswap V3 for positions that span up to 60% of the price range.

/8 Other things that are worth mentioning

∘ Trade Routing - swaps will be routed through legacy AMM pairs when better pricing is found(this shouldn't happen often though)

∘ Protocol fees - a portion of swap fees will be retained for the protocol

∘ Trade Routing - swaps will be routed through legacy AMM pairs when better pricing is found(this shouldn't happen often though)

∘ Protocol fees - a portion of swap fees will be retained for the protocol

/9 The whitepaper shows that the Liquidity Book AMM will solve 2 main problems:

-Impermanent loss (unless there's a massive change in price, the swap fees will exceed impermanent loss)

-slippage (due to the arrangement of liquidity in price bins)

-Impermanent loss (unless there's a massive change in price, the swap fees will exceed impermanent loss)

-slippage (due to the arrangement of liquidity in price bins)

/10 That's it!

I'm excited to see that #Avalanche projects are starting to innovate again.

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

I'm excited to see that #Avalanche projects are starting to innovate again.

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

/11 Follow them more alpha about Trader Joe and Avalanche Ecosystem:

@demirelo

@rektdiomedes

@0xSindermann

@traderjoeintern

@AvalancheIntern

@AvaxGems

@cryptofishx

@DavideFi_

@luigidemeo

@tezukaTez

@demirelo

@rektdiomedes

@0xSindermann

@traderjoeintern

@AvalancheIntern

@AvaxGems

@cryptofishx

@DavideFi_

@luigidemeo

@tezukaTez

• • •

Missing some Tweet in this thread? You can try to

force a refresh