I know you guys missed me, so here is a short mini series of threads about #volatility. Let's dive right in 😎 #OptionsTrading #trading

1- Let’s start by defining what volatility is. It’s simply how often something moves up/down and how big these moves are. If something moves up/down a lot, it means volatility = high. Something that doesn’t move that much, it means volatility = low.

2- The best two candidates I found for this example are $GME to $WBA (since they are very close in price). Can you tell which one is more volatile?

3- I think you guessed it right, $GME is more volatile (what a chart!). Now let’s look at the options chain to see how volatility can make a big difference in the options prices.

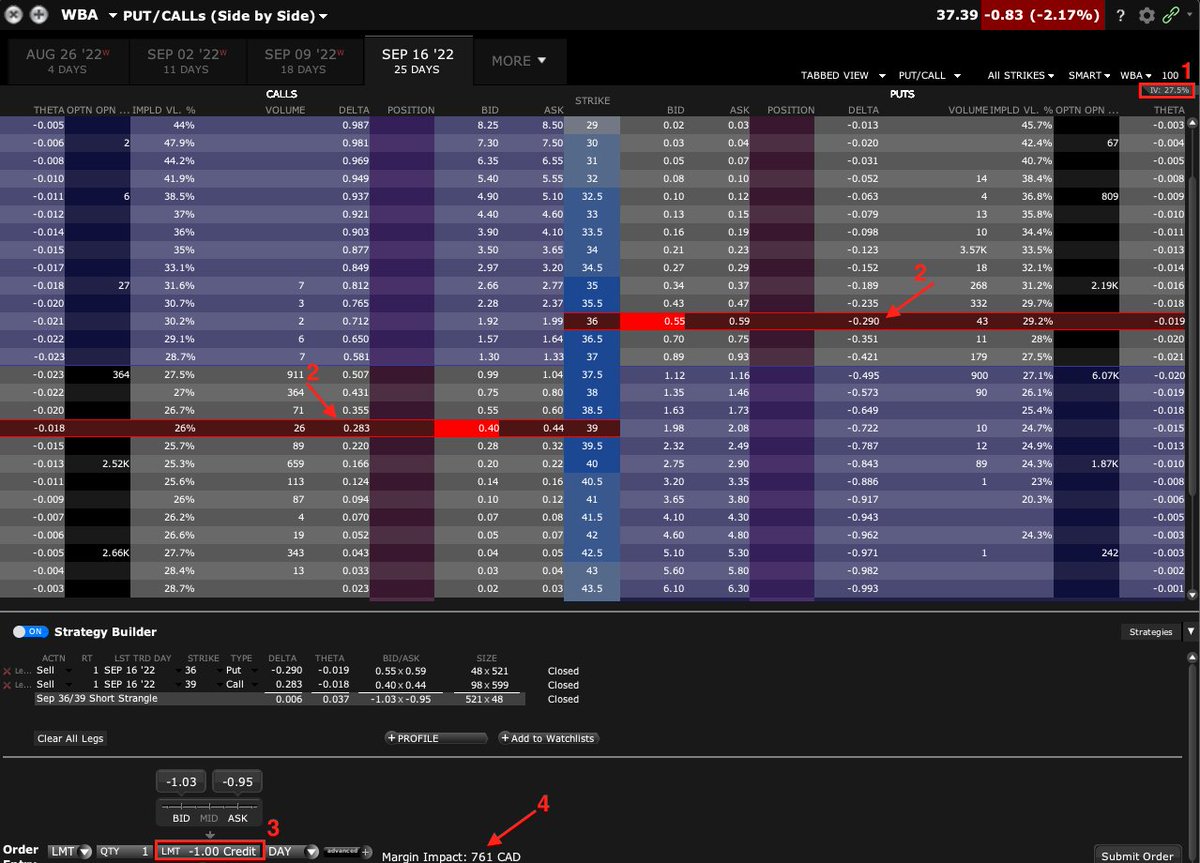

4- This is a screenshot of the options chain of $WBA. We can see that:

-1: IV is 27.5% in the SEP 16 cycle (25DTE)

-2-3: ~29 Delta Short Strangle is going for $1 credit

-4: Margin requirement is CAD$ 761

-1: IV is 27.5% in the SEP 16 cycle (25DTE)

-2-3: ~29 Delta Short Strangle is going for $1 credit

-4: Margin requirement is CAD$ 761

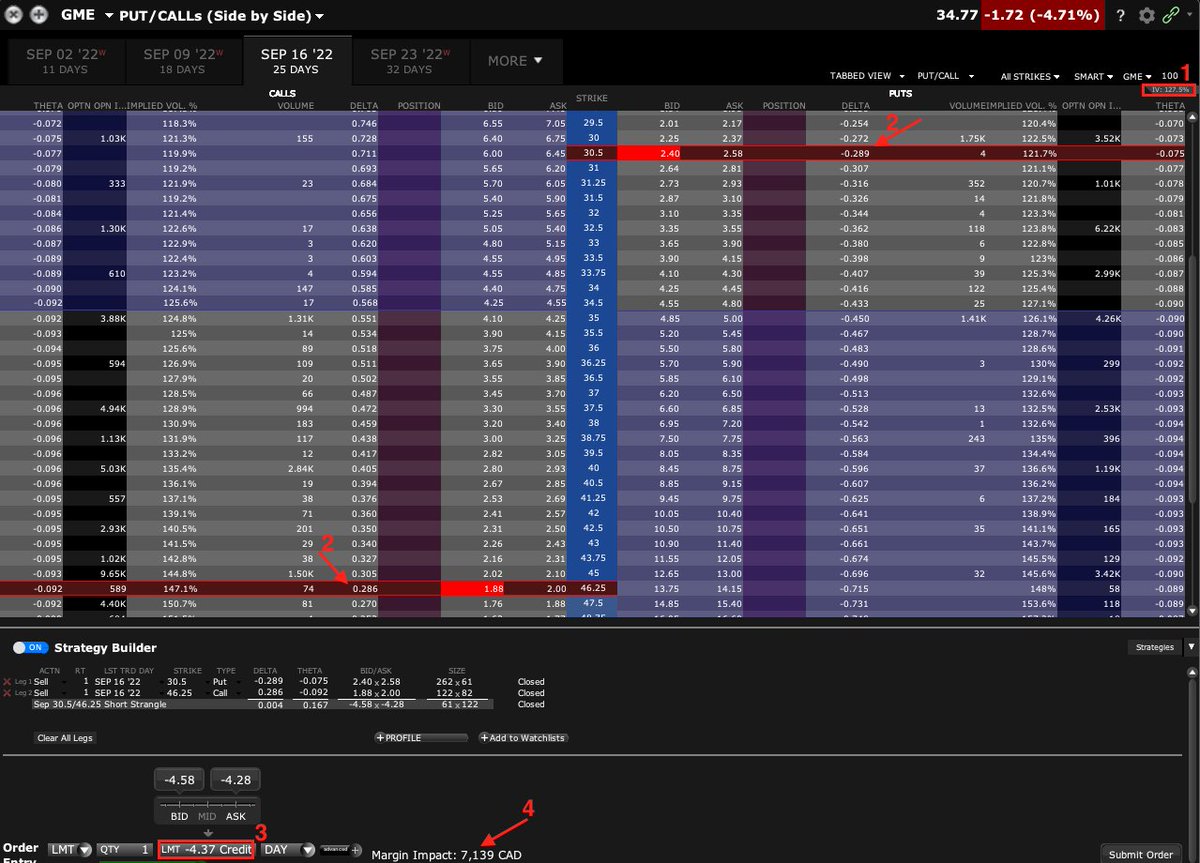

5- Now let’s look at the $GME options chain.

We can see that:

-1: IV is 127.5% in the SEP 16 cycle (25DTE)

-2-3: ~29 Delta Short Strangle is going for $4.37 credit

-4: Margin requirement is CAD$ 7,139

We can see that:

-1: IV is 127.5% in the SEP 16 cycle (25DTE)

-2-3: ~29 Delta Short Strangle is going for $4.37 credit

-4: Margin requirement is CAD$ 7,139

6- Since $GME is much more volatile than $WBA, its options will be priced more expensively. Now look at the margin requirements. $GME is almost 10 times more than $WBA! Simply because it’s more volatile which means more risk.

7- Stay tuned for Part 2!

• • •

Missing some Tweet in this thread? You can try to

force a refresh