Staking has taken center stage over the past two years after @ethereum allowed locking up ETH since the lately 2020 for ETH 2.0

Since then we have a new category in the #Defi world named Staking as a Service with the leader being LIDO Finance

Since then we have a new category in the #Defi world named Staking as a Service with the leader being LIDO Finance

@ethereum 1/

👉Key Insights

Instead of depending on computational power like POW, under POS, validators lock (stake) a certain amount of the network’s native crypto-asset as collateral to create new blocks.

In return, they earn inflationary rewards and transaction fees

👉Key Insights

Instead of depending on computational power like POW, under POS, validators lock (stake) a certain amount of the network’s native crypto-asset as collateral to create new blocks.

In return, they earn inflationary rewards and transaction fees

@ethereum 2/

Though, participation in staking has some big tackles for a standard holder:

- Node operation knowledge is hard to learn for non-tech

- Token amount requirement is very high for majors

- Staked token liquidation is too low

Though, participation in staking has some big tackles for a standard holder:

- Node operation knowledge is hard to learn for non-tech

- Token amount requirement is very high for majors

- Staked token liquidation is too low

@ethereum 3/

Those are reasons why we have @LidoFinance the first non-custodial, liquid staking Protocol was born just a week after the announcement of ETH 2.0 locking

And now it is ranked second by TVL and top 10 by revenue

Those are reasons why we have @LidoFinance the first non-custodial, liquid staking Protocol was born just a week after the announcement of ETH 2.0 locking

And now it is ranked second by TVL and top 10 by revenue

@ethereum @LidoFinance 4/

Lido allows you to participate in staking with any amount of token and no tech knowledge requirement.

Furthermore, you will receive tokenized derivatives (stAssets) claimed for your staked asset that can be traded or collateralized on #Defi easily.

Lido allows you to participate in staking with any amount of token and no tech knowledge requirement.

Furthermore, you will receive tokenized derivatives (stAssets) claimed for your staked asset that can be traded or collateralized on #Defi easily.

@ethereum @LidoFinance 5/

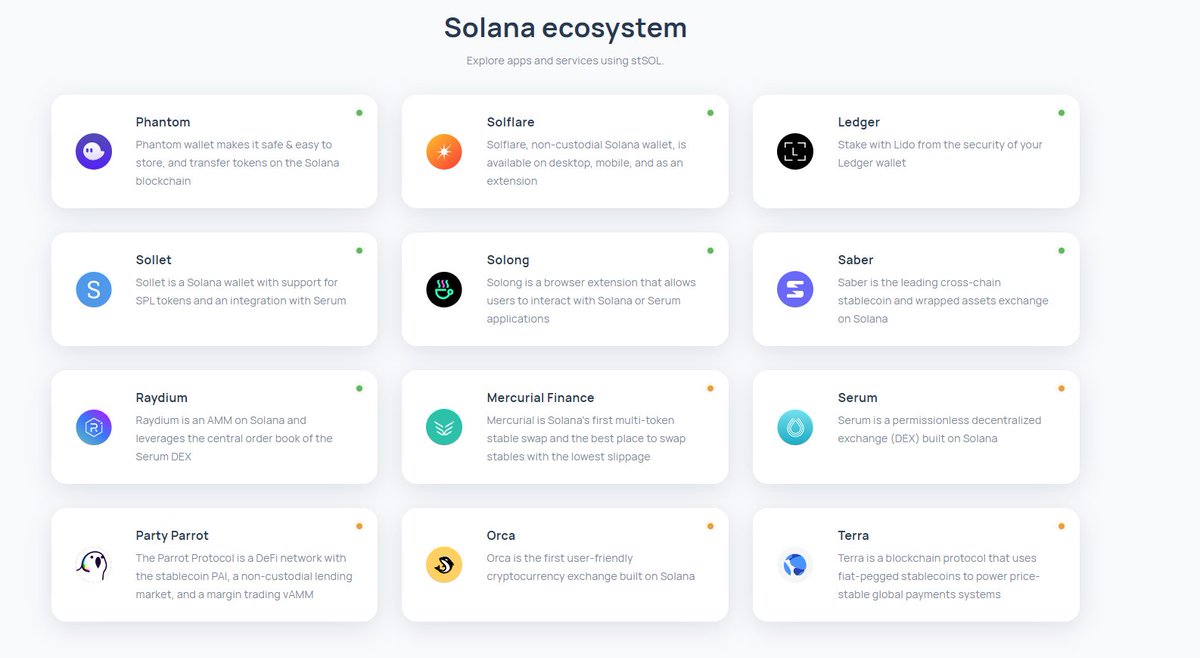

After nearly 2 years under development, @LidoFinance now has supported 5 chains: @ethereum , @0xPolygon , @solana , @kusamanetwork and @Polkadot

(Rumors said the next one will be @cosmos after the launching of @Neutron_org)

After nearly 2 years under development, @LidoFinance now has supported 5 chains: @ethereum , @0xPolygon , @solana , @kusamanetwork and @Polkadot

(Rumors said the next one will be @cosmos after the launching of @Neutron_org)

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org 6/

👉 How Lido work

Even working in 5 chains with different designs, the general mechanics are similar. We can see the pic below

- Parties: Users (stakers) & node operators

- Protocol components: Smart contracts, stAssest, and external Defi Dapps

(Src: @Leo_Glisic)

👉 How Lido work

Even working in 5 chains with different designs, the general mechanics are similar. We can see the pic below

- Parties: Users (stakers) & node operators

- Protocol components: Smart contracts, stAssest, and external Defi Dapps

(Src: @Leo_Glisic)

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic 7/

Staking Pool (Smart Contract) is the heart of this billion-dollar machine

- Users deposit/withdraw the Asset to/from Staking Pool and this pool is responsible for minting/burning derivative assets (stAssets)

Staking Pool (Smart Contract) is the heart of this billion-dollar machine

- Users deposit/withdraw the Asset to/from Staking Pool and this pool is responsible for minting/burning derivative assets (stAssets)

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic 8/

- Node Operators receive the amount of delegated ETH from users via Staking Pool and also received a portion of fees from that contract

- Lido DAO Treasury acquire fees from Staking Pool

- Node Operators receive the amount of delegated ETH from users via Staking Pool and also received a portion of fees from that contract

- Lido DAO Treasury acquire fees from Staking Pool

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic 9/

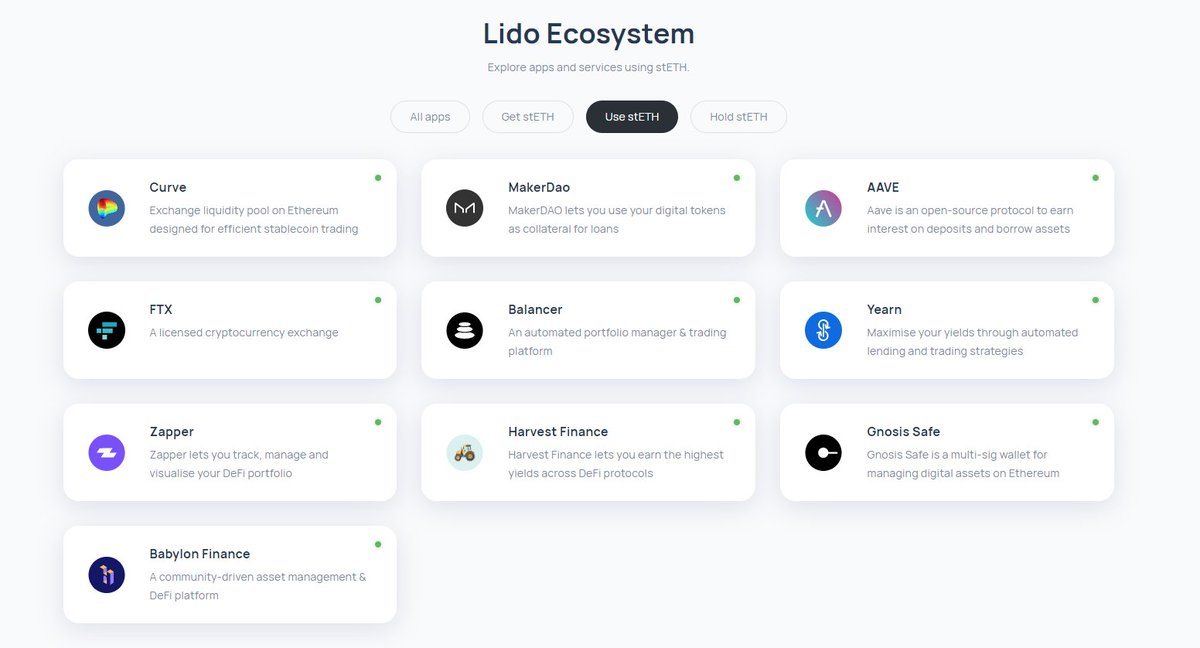

The last and most important component is external Defi integrations that will help stAssets become more liquid or make staking become so attractive to holders

The last and most important component is external Defi integrations that will help stAssets become more liquid or make staking become so attractive to holders

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic 10/

Indeed, in a dynamic market like #Crypto, investors usually hesitate to lock up their assets for a long time

Besides, they also want to leverage their investment via staking yield and #Defi dapps.

Indeed, in a dynamic market like #Crypto, investors usually hesitate to lock up their assets for a long time

Besides, they also want to leverage their investment via staking yield and #Defi dapps.

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic 11/

Lido DAO has built a steady Defi Ecosystem to support its own stAsset

It collaborated with top AMMs & DEXs - @CurveFinance @Uniswap @Saber_HQ @BalancerLabs to launch stAsset:Asset pool with fresh $LDO incentives to attract Liquidity Providers (maintain stAsset price)

Lido DAO has built a steady Defi Ecosystem to support its own stAsset

It collaborated with top AMMs & DEXs - @CurveFinance @Uniswap @Saber_HQ @BalancerLabs to launch stAsset:Asset pool with fresh $LDO incentives to attract Liquidity Providers (maintain stAsset price)

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs 12/

Moreover, integration with lend/borrow protocols like @AaveAave brings back more use cases to stAsset such as collateral, and leverage than just a liquid asset

To increase the yield of stETH check below

Moreover, integration with lend/borrow protocols like @AaveAave brings back more use cases to stAsset such as collateral, and leverage than just a liquid asset

To increase the yield of stETH check below

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave 13/

👉LDO Token

Even Lido is leader in liquid staking sector and far away from the second one @Rocket_Pool, though many still wonder about investing in $LDO

👉LDO Token

Even Lido is leader in liquid staking sector and far away from the second one @Rocket_Pool, though many still wonder about investing in $LDO

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave @Rocket_Pool 14/

As we can see, an amount of LDO, 64% token of the total supply, has been locked for 1 year. That means these tokens will fully vest by December 17, 2022

The remaining token 36.2% of the total supply, belongs to the Lido DAO treasury and will be used for protocol government

As we can see, an amount of LDO, 64% token of the total supply, has been locked for 1 year. That means these tokens will fully vest by December 17, 2022

The remaining token 36.2% of the total supply, belongs to the Lido DAO treasury and will be used for protocol government

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave @Rocket_Pool 15/

Some uses so far have been liquidity incentives, advisory, VC sales, and funding of the Ethereum Protocol Guild.

Hence, $LDO holders can just use it for voting in DAO. There are no other benefits for them.

Some uses so far have been liquidity incentives, advisory, VC sales, and funding of the Ethereum Protocol Guild.

Hence, $LDO holders can just use it for voting in DAO. There are no other benefits for them.

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave @Rocket_Pool 16/

Maybe worrying about the unlocking token event and the ability to accrue value of LDO, recently multiple tiers 1 VCs which include @AlamedaResearch, @paraficapital sold a large amount of $LDO

That my friend @theData_Nerd has just caught it as below

Maybe worrying about the unlocking token event and the ability to accrue value of LDO, recently multiple tiers 1 VCs which include @AlamedaResearch, @paraficapital sold a large amount of $LDO

That my friend @theData_Nerd has just caught it as below

https://twitter.com/1558634109890875392/status/1562062693774766080

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave @Rocket_Pool @AlamedaResearch @paraficapital @theData_Nerd 17/

In contrast, a few VCs are optimistic about this token future. They maybe expect #theMerge to bring $LDO up.

blog.lido.fi/lido-and-the-m…

In contrast, a few VCs are optimistic about this token future. They maybe expect #theMerge to bring $LDO up.

blog.lido.fi/lido-and-the-m…

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave @Rocket_Pool @AlamedaResearch @paraficapital @theData_Nerd 18/

All in all, Lido is the first and best liquid staking project for now. However, investing in $LDO should be considered carefully, especially at this moment because of the bear market, the uncertainty of #theMerge, and the unlocking token event.

All in all, Lido is the first and best liquid staking project for now. However, investing in $LDO should be considered carefully, especially at this moment because of the bear market, the uncertainty of #theMerge, and the unlocking token event.

@ethereum @LidoFinance @0xPolygon @solana @kusamanetwork @Polkadot @cosmos @Neutron_org @Leo_Glisic @CurveFinance @Uniswap @Saber_HQ @BalancerLabs @AaveAave @Rocket_Pool @AlamedaResearch @paraficapital @theData_Nerd That's a wrap!

If you enjoyed this thread:

1. Follow me @HakAnalytics for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @HakAnalytics for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1508999172996829190/status/1562281335099912192

• • •

Missing some Tweet in this thread? You can try to

force a refresh