so I have been following @SarangSood tweets around closing premiums of #banknifty straddles and was wondering, did the premiums reflect changes in margin requirement around Q2/Q3 2020?

it seems they did, here is a #THREAD #algotrading

it seems they did, here is a #THREAD #algotrading

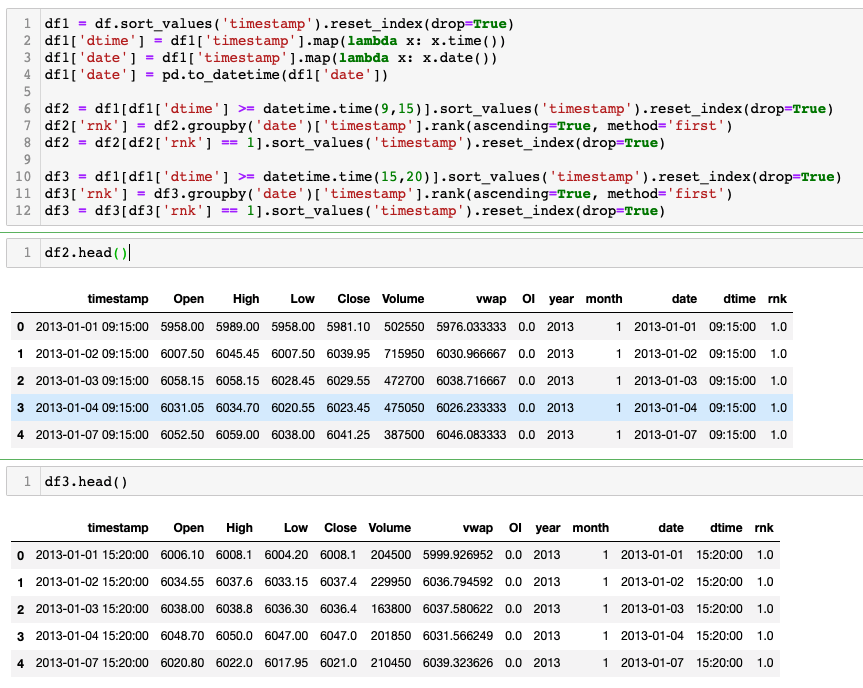

For this, we essentially look at the future price at 9.20 am and fetch premiums for 1st OTM call and put. since lotsize has changed over time, we would like to adjust the combined premium as per today’s lotsize (25) so that there is only one moving part which is margin-required

combined_premium_adj = (combined_prem * lotsize at the time) / 25

ok, so quarter wise box plot looks nice and it does contains a lot of information, but something simple needs to be done.

line charts are great but a bit noisy,

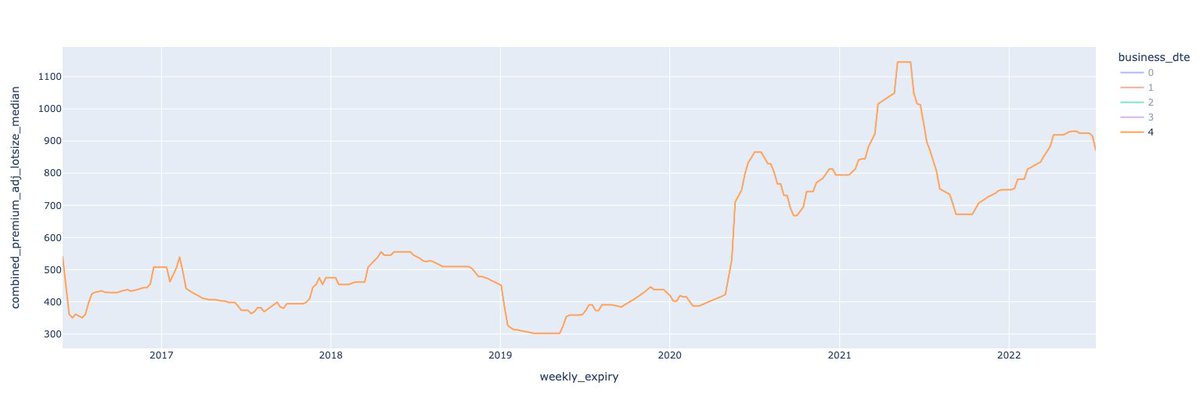

let's take a 12 week rolling median

ok, so quarter wise box plot looks nice and it does contains a lot of information, but something simple needs to be done.

line charts are great but a bit noisy,

let's take a 12 week rolling median

pretty neat !!

y-scale seems to be creating a bit of hindrance. let’s breakup the chart by each dte.

notice the shift in premiums around Q2/Q3 2020 which happens to be also the starting phase of change in margin requirements.

y-scale seems to be creating a bit of hindrance. let’s breakup the chart by each dte.

notice the shift in premiums around Q2/Q3 2020 which happens to be also the starting phase of change in margin requirements.

and here is our favourite expiry day chart

average of second regime is roughly 2x of first regime for all the charts

average of second regime is roughly 2x of first regime for all the charts

Lot of people may also attribute these data points to vix which peaked in Mar 2020 but then vix has gone through its ups and downs in last 2 years, so it’s up to you how you want to interpret the data.

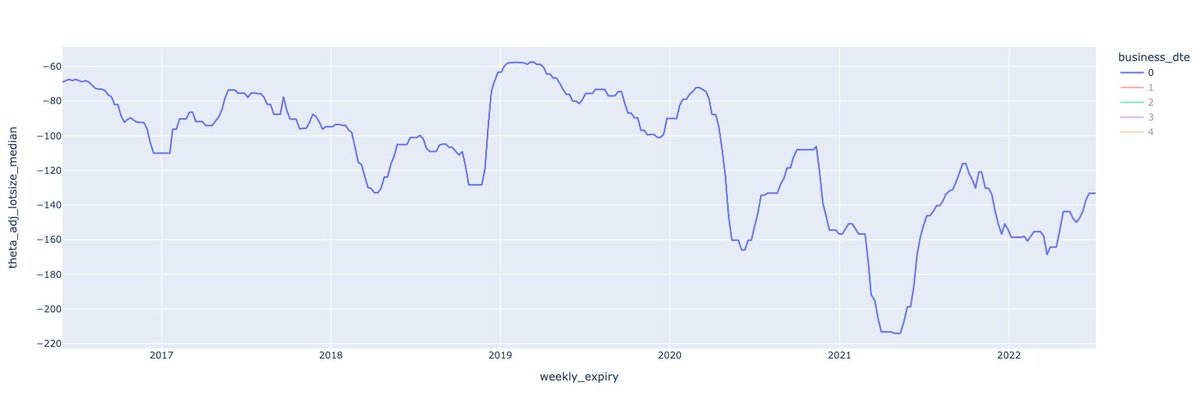

Combined Theta for OTM 1 strangle

Looking at theta is probably going to show the same picture as option premium over long time

For this, we essentially look at the future price at 9.20 am and fetch theta values for 1st OTM call and put.

Looking at theta is probably going to show the same picture as option premium over long time

For this, we essentially look at the future price at 9.20 am and fetch theta values for 1st OTM call and put.

Also since lotsize has changed over time, we would like to adjust the combined theta as per today’s lotsize (25) so that there is only one moving part which is margin requirement.

combined_theta_adj = (combined_theta * lotsize at the time) / 25

combined_theta_adj = (combined_theta * lotsize at the time) / 25

and finally expiry day theta chart

I think, all charts are essentially showing a regime change post 2020 Q2 and I don’t think the second regime is entirely due to high vix during 2020. It seems to be compensating for higher margin requirements

I think, all charts are essentially showing a regime change post 2020 Q2 and I don’t think the second regime is entirely due to high vix during 2020. It seems to be compensating for higher margin requirements

if you read this far, here is the blog article with more charts and details about the analysis

medium.com/@niuhi/option-…

medium.com/@niuhi/option-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh