First, 𝐰𝐡𝐚𝐭 𝐢𝐬 𝐁𝐞𝐧𝐝𝐃𝐀𝐎?

@BendDAO is a NFT-collateralized crypto loans supporting #NFT holders to borrow $ETH through the lending pool using NFTs as collateral instantly (40% of the floor price), while depositors provide $ETH liquidity to earn interest.

@BendDAO is a NFT-collateralized crypto loans supporting #NFT holders to borrow $ETH through the lending pool using NFTs as collateral instantly (40% of the floor price), while depositors provide $ETH liquidity to earn interest.

@BendDAO 𝐓𝐡𝐞 𝐫𝐞𝐚𝐬𝐨𝐧 𝐰𝐡𝐲 𝐁𝐞𝐧𝐝𝐃𝐀𝐎 𝐟𝐯𝐜𝐤𝐞𝐝 𝐮𝐩

The Health Factor (𝐇𝐅) is the factor used to determine the risk of collateral in Bend

𝐇𝐅 = (OpenSea Floor Price * Liquidation Threshold) / Debt with Interests

(Liquidation Threshold = 𝟎.𝟗)

The Health Factor (𝐇𝐅) is the factor used to determine the risk of collateral in Bend

𝐇𝐅 = (OpenSea Floor Price * Liquidation Threshold) / Debt with Interests

(Liquidation Threshold = 𝟎.𝟗)

@BendDAO 𝟏.𝟎 < = HF < = 𝟏.𝟓 => Risky => 𝐌𝐔𝐒𝐓 repay the debt

HF < 𝟏.𝟎 + 𝐅𝐀𝐈𝐋 to repay the loan within 48 hours => Liquidation will be triggered, goodbye to your mortgaged NFTs

HF < 𝟏.𝟎 + 𝐅𝐀𝐈𝐋 to repay the loan within 48 hours => Liquidation will be triggered, goodbye to your mortgaged NFTs

@BendDAO But I wonder if the Bend team thought about this when the beraaaa market came?

If the floor price drops sharply, then HF will also decrease => More ppl get liquidated => More NFTs will be auctioned to recover the debt.

But…

If the floor price drops sharply, then HF will also decrease => More ppl get liquidated => More NFTs will be auctioned to recover the debt.

But…

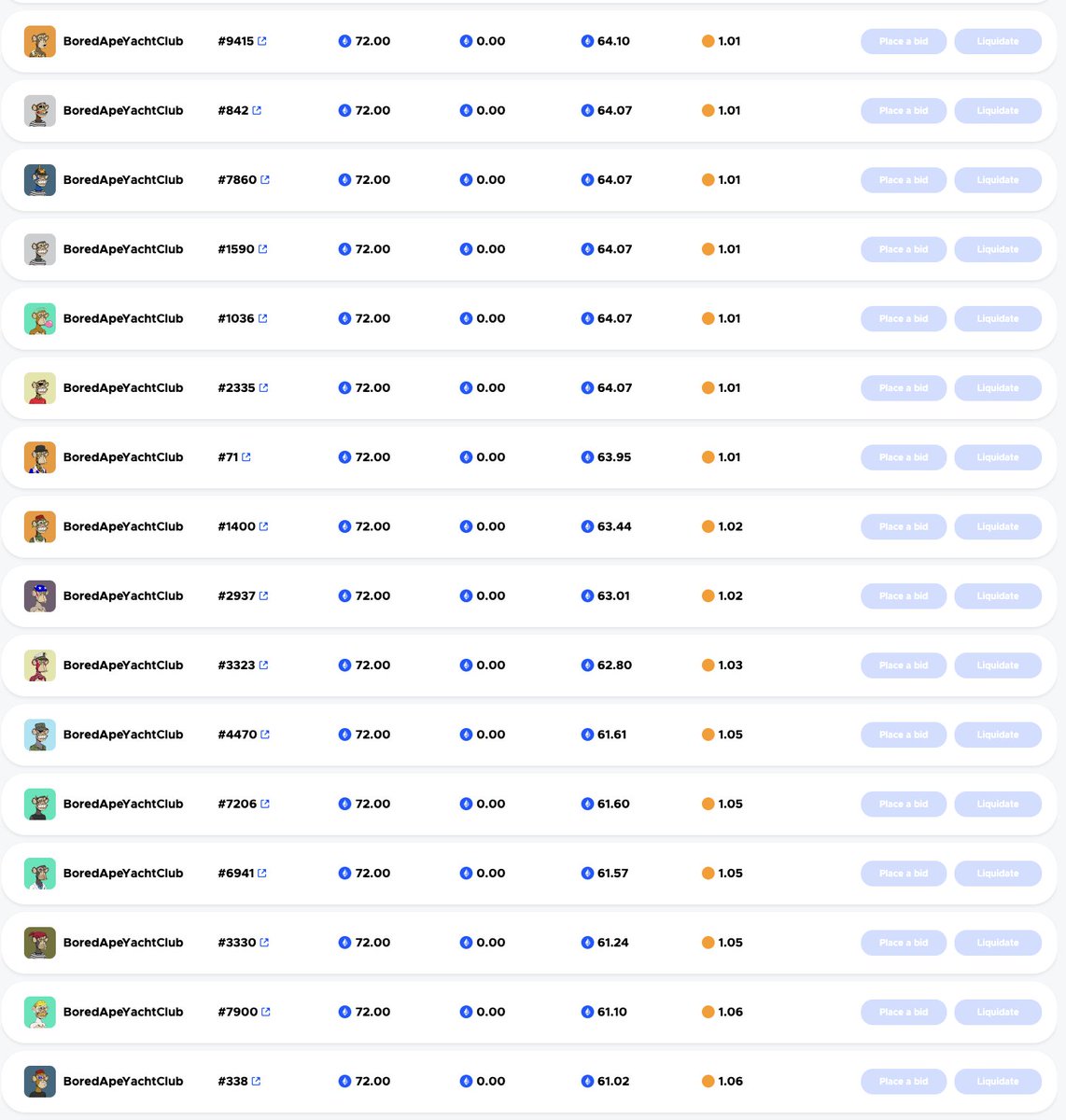

@BendDAO ...𝐇𝐨𝐰 𝐚𝐛𝐨𝐮𝐭 𝐧𝐨 𝐨𝐧𝐞 𝐛𝐢𝐝𝐝𝐢𝐧𝐠 𝐨𝐧 𝐭𝐡𝐨𝐬𝐞 #𝐍𝐅𝐓𝐬?

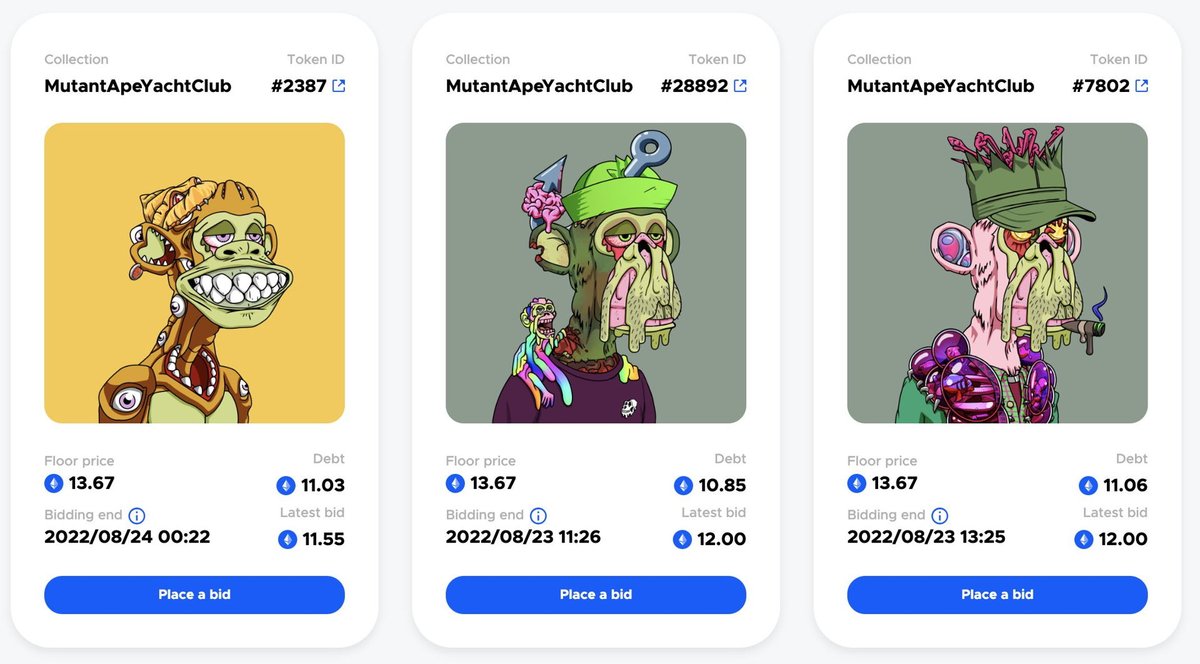

At first glance, it looks like we will have a super sale NFTs party - an extremely rare opportunity to accumulate blue chips at lower prices compared to OpenSea floors.

At first glance, it looks like we will have a super sale NFTs party - an extremely rare opportunity to accumulate blue chips at lower prices compared to OpenSea floors.

@BendDAO 𝐓𝐡𝐞 𝐩𝐫𝐨𝐛𝐥𝐞𝐦 𝐢𝐬 𝐁𝐞𝐧𝐝’𝐬 𝐛𝐢𝐝𝐝𝐢𝐧𝐠 𝐫𝐮𝐥𝐞𝐬.

Bidders must follow 3 conditions:

- Bids > current debt

- Bids > 95% of current OpenSea floors

- Lock $ETH for 48 hours

This leads to more problems:

Bidders must follow 3 conditions:

- Bids > current debt

- Bids > 95% of current OpenSea floors

- Lock $ETH for 48 hours

This leads to more problems:

@BendDAO - When Debt > Floor, as a bidder, why do you have to bid? You can buy another one on OpenSea at floor price (unless you love this #NFT soooo much and this is a chance for you to get it in the easiest and cheapest way, maybe) and if floor keeps dropping, no incentive for u to bid

@BendDAO - Because the movement of floors in 48 hours has a high probability of falling further, especially when we are in a bear market like this, bidders wouldn't dare take such a big risk to lock their $ETH for too long for fear of buying at a higher price.

@BendDAO - Big fishes want Bend to die, so they are waiting for the mass liquidation.

𝐖𝐡𝐚𝐭 𝐞𝐥𝐬𝐞?

- #NFT Volume is at yearly lows => not enough liquidity in the market to absorb

𝐖𝐡𝐚𝐭 𝐞𝐥𝐬𝐞?

- #NFT Volume is at yearly lows => not enough liquidity in the market to absorb

@BendDAO - If Debt (loan + very high interest) > Floor, as a borrower, why do you have to pay your debt? You just simply hold $ETH and buy back your NFTs when the floor continues to drop, or just let them be liquidated and buy another Ape on @opensea

@BendDAO @opensea => Mortgaged NFTs are illiquid + Huge amount of $ETH borrowed (15,000 $ETH) may not be repaid

=> BendDAO ends up holding these NFTs as bad debt.

=> BendDAO ends up holding these NFTs as bad debt.

@BendDAO @opensea => Fearing that the protocol would crash and users wouldn't be able to withdraw their funds,, lenders pulled $ETH out of the lending pools => Bank rrrrrrrun

@BendDAO @opensea Consequence?

To Bend: its wallet had no $ETH left. There was just 12.5 WETH in the contract.

=> Liquidity in lending pool = 0

=> Utilization ratio > 100%, borrowers must pay > 100% interest rates

=> Borrowers have more reason not to repay the loan with that crazy interest rates

To Bend: its wallet had no $ETH left. There was just 12.5 WETH in the contract.

=> Liquidity in lending pool = 0

=> Utilization ratio > 100%, borrowers must pay > 100% interest rates

=> Borrowers have more reason not to repay the loan with that crazy interest rates

@BendDAO @opensea To the NFT market: 272 #BAYCs and 309 #MAYCs were in the BendDAO wallet. Those NFTs account for 82.8% of the total collateral value.

=> The people buying the apes in the auction will get them super cheap, giving them plenty of margin to undercut the floor

=> The people buying the apes in the auction will get them super cheap, giving them plenty of margin to undercut the floor

@BendDAO @opensea => Massive dump in price could happen

=> BAYC leads the NFT market like Bitcoin because of its huge cap, so it will greatly affect other collections when its floor price is deeply reduced.

=> A liquidation spiral will happen

=> BAYC leads the NFT market like Bitcoin because of its huge cap, so it will greatly affect other collections when its floor price is deeply reduced.

=> A liquidation spiral will happen

@BendDAO @opensea - Liquidation Threshold: 𝟓% weekly decrease from 𝟗𝟎% to 𝟕𝟎%

=> This is the most important change. By lowering the liquidation threshold, they can be assured that under-collateralized #NFTs will be auctioned off before the floor drops enough to enter bad debt territory.

=> This is the most important change. By lowering the liquidation threshold, they can be assured that under-collateralized #NFTs will be auctioned off before the floor drops enough to enter bad debt territory.

@BendDAO @opensea - Auction Period: Reduced from 𝟒𝟖 𝐡𝐫𝐬 to 𝟒 𝐡𝐫𝐬

=> Limiting the risk of floor price fluctuations, while increasing the advantage for bidders

=> Attracting more liquidity

=> Limiting the risk of floor price fluctuations, while increasing the advantage for bidders

=> Attracting more liquidity

@BendDAO @opensea - Base Interest Rate: Adjust to 20%

𝐂𝐨𝐦𝐦𝐞𝐧𝐭 𝐨𝐧 𝐭𝐡𝐞 𝐞𝐟𝐟𝐞𝐜𝐭𝐢𝐯𝐞𝐧𝐞𝐬𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐫𝐨𝐩𝐨𝐬𝐚𝐥: Good for lenders, but there will be more supply to hit the market. It will be tough for any floors to go up in the near future.

𝐂𝐨𝐦𝐦𝐞𝐧𝐭 𝐨𝐧 𝐭𝐡𝐞 𝐞𝐟𝐟𝐞𝐜𝐭𝐢𝐯𝐞𝐧𝐞𝐬𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐫𝐨𝐩𝐨𝐬𝐚𝐥: Good for lenders, but there will be more supply to hit the market. It will be tough for any floors to go up in the near future.

@BendDAO @opensea What happened then?

Things are getting better

- Strong buying demand for Clones/Azuki/MAYC/BAYC at floor prices

- Count of NFTs for auction has gone down due to the increase in floor prices of some blue chips, so now Bend owns low percentage of any collection supply

Things are getting better

- Strong buying demand for Clones/Azuki/MAYC/BAYC at floor prices

- Count of NFTs for auction has gone down due to the increase in floor prices of some blue chips, so now Bend owns low percentage of any collection supply

@BendDAO @opensea - Majority of the NFTs are getting bids

- More $ETH has come into the contract: The BendDAO wallet currently has 31,613.33 $ETH, with 18,901 available, which has sent interest rates on borrowed NFTs lower to 4% APR

=> 𝐓𝐡𝐞 𝐜𝐫𝐢𝐬𝐢𝐬 𝐢𝐬 𝐨𝐯𝐞𝐫

- More $ETH has come into the contract: The BendDAO wallet currently has 31,613.33 $ETH, with 18,901 available, which has sent interest rates on borrowed NFTs lower to 4% APR

=> 𝐓𝐡𝐞 𝐜𝐫𝐢𝐬𝐢𝐬 𝐢𝐬 𝐨𝐯𝐞𝐫

@BendDAO @opensea 𝐒𝐨𝐦𝐞 𝐭𝐡𝐨𝐮𝐠𝐡𝐭𝐬?

- This event occurred not because #NFT should never be used as collateral. The main reason is poorly designed thresholds of #BendDAO

- This is the first example of "NFT x DeFi" having a big impact on top #NFT collections.

- This event occurred not because #NFT should never be used as collateral. The main reason is poorly designed thresholds of #BendDAO

- This is the first example of "NFT x DeFi" having a big impact on top #NFT collections.

@BendDAO @opensea - Everything in the #NFT market in particular and #crypto in general is closely linked, so if one link breaks, there will be a domino effect. Human psychology is the catalyst that makes the effect happen faster.

@BendDAO @opensea - Still don't understand why the heads of #BendDAO lock the barn door after the horse is gone. Admittedly they were excellent at making the right and timely corrections to make the situation better,...

@BendDAO @opensea ...but they certainly knew this was going to happen sooner or later and had a solution in place. So why not make the change sooner when the bear market has lasted more than half a year? Did @BendDAO take advantage of this "sure-to-happen" incident to promote itself?

• • •

Missing some Tweet in this thread? You can try to

force a refresh