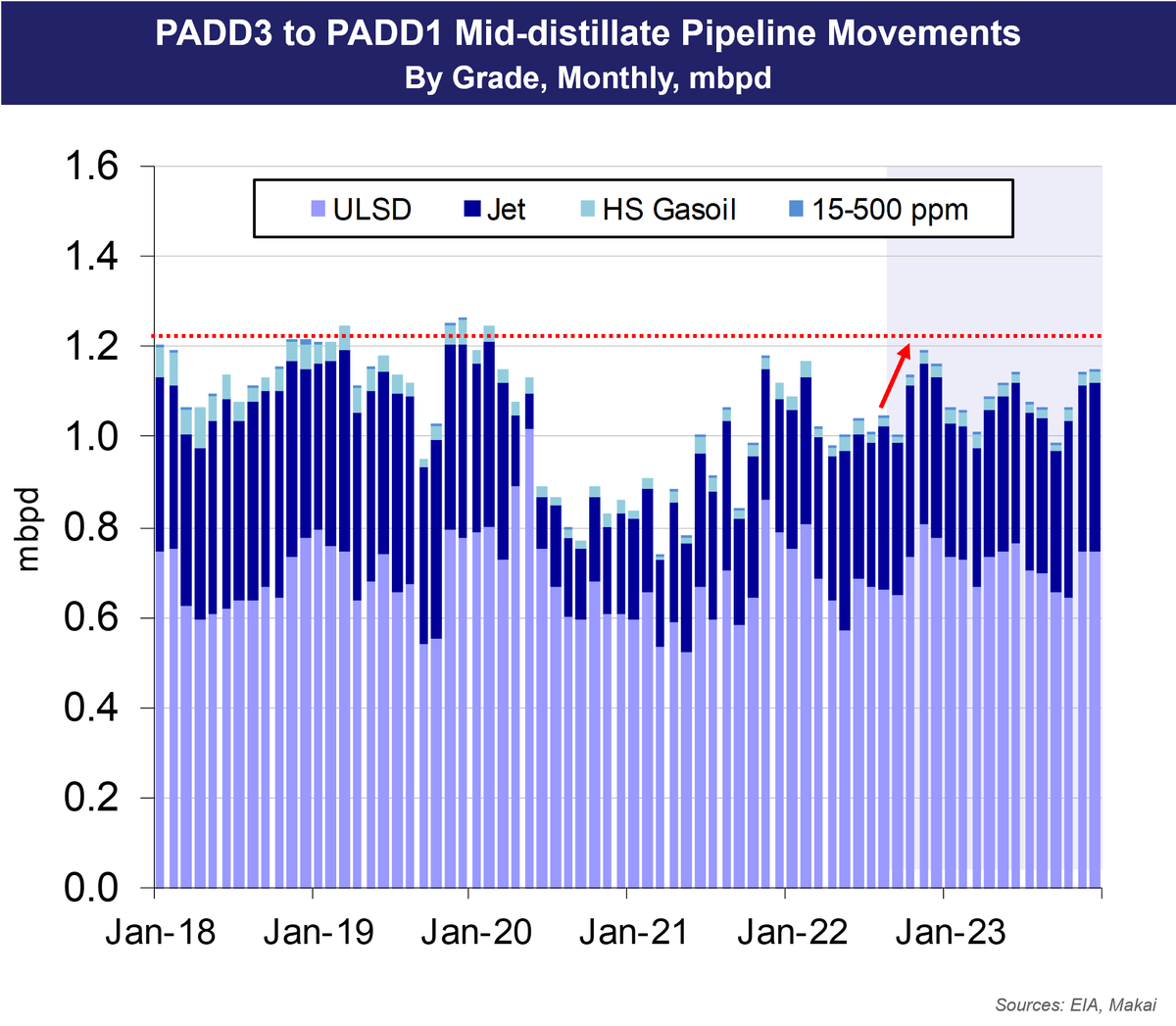

Updated our PADD1/PADD3 mass balances for the quiet hurricane season so far & for scheduled maintenance. Medium-term drop in USG exports from P3 demand, net capacity reductions & more sustainable utilisations & yields, but also from critical PADD1 requirements. #tankers #oott

The trade press loves running apocalyptic headlines on the low gasoil inventories in PADD1 and elsewhere, but the market needs to adjust to lower stocks and just get over their 5-yr averages. Still, just to keep stocks stable in PADD1 this Autumn & Winter…

PADD1 will need to draw higher pipeline flows of mid-distillate from PADD3, amidst a tighter seaborne export market. Note the 200 kbpd jump from Summer levels.

PADD3 refineries have been running at extraordinary utilisations this summer, but 600-800 kbpd of seasonal maintenance beckons. Forecast utilisations reflect this maintenance, but only a median hurricane season.

Lower output, higher regional demand and PADD3 stock building would trim potential outflows from PADD3, with higher PADD1 needs cutting into export availability. This excludes any near-term outflow impact from Whiting shutdown or US oil policy errors.

• • •

Missing some Tweet in this thread? You can try to

force a refresh