Are the stock markets really going to crash now? I am not sure. A thread:

1. The Inidzes went into sell off Friday. it was already pretty strong. At first glance it looks almost crashy. But there is one thing that really bothers me about it. When I look across my Twitter TL,

1. The Inidzes went into sell off Friday. it was already pretty strong. At first glance it looks almost crashy. But there is one thing that really bothers me about it. When I look across my Twitter TL,

2. I see charts + analyses everywhere that point to parallels with t. past + now expect a huge slide. But hardly any analysis of an alternative variant that could point to new highs.And I follow quite a few big US Twitter accounts here. Have you also looked at the AAII sentiment?

3. @axelroark was one of the few accounts that was able to express what I was thinking after the close. that seems too easy. Certainly - if panic should really set in now, it can also go straight into the sell off. But I see possibilities in the charts that still point to

https://twitter.com/axelroark/status/1563344008096907265

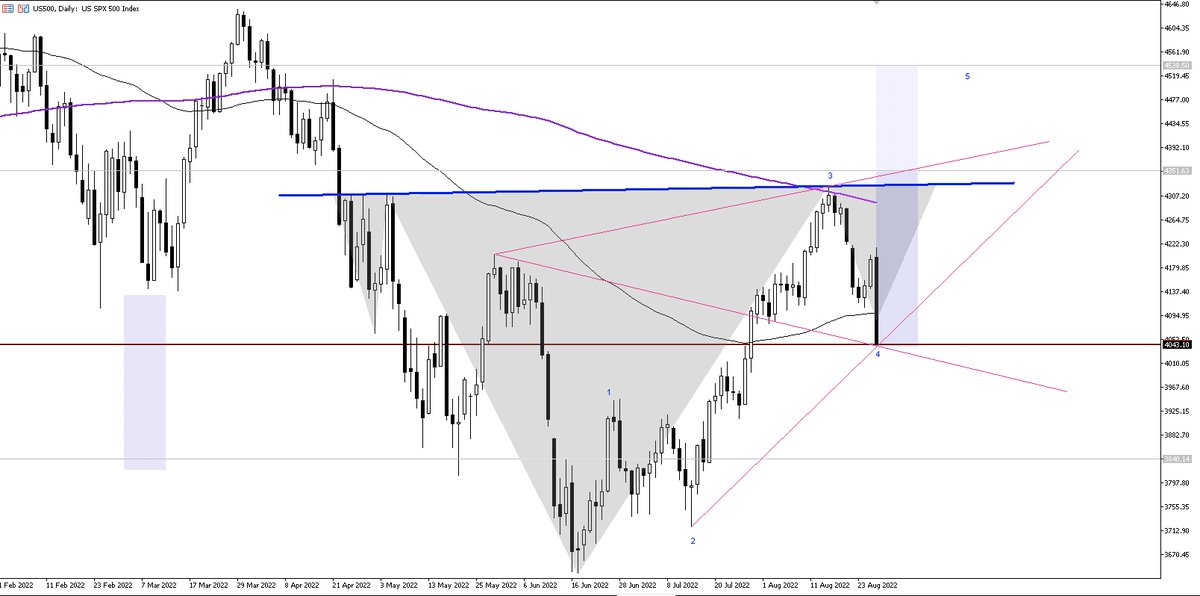

4. another high. Both #SPX and #NASDAQ and #DowJones could have completed an ABC movement here. But what if they are all running in a sharp W4 right now? As long as the highs of the suspected W1 do not cross, this possibility remains. Besides the possible waves, I am also

5. looking at few formations like Descending Broadening Wedges or Wolfe Waves. Those formations that are often recognised by the market. Interestingly, in addition to the US indices, Dax also activated a bullish Wolfe Wave with the selloff in each case, which can lead to a W5

6. in the US indices. #Dax is to be viewed differently here, as it has cut the high of the suspected W1. But an ABC movement would be possible here.

7. Here I show you what I mean using H4 charts of the 3 US indices $SPX, $NDX and $DOW. All 3 have an active bullish WW in blue. They all still have room to move downwards. As long as the 1 is not cut, a W5 can still follow. The blue Wolfe waves could be the triggers for this.

8. Should this happen, a W5 can start, which can later activate a larger Wolfe (green). for the $SPX I even have an addition of a possible iSHS

9. $Dax has also activated a bullish Wolfe Wave here, which can ignite at any time if #Dax turns. Here in the chart is a possible count of an ABC since the high. The first thrust was 5-wave, the B ran in an ABC and the C is currently still in motion. If a small countermovement

10. starts on Sunday night/Monday, a W4 and W5 can be assumed, which can bring the C to a close. The question will then be, will it be a shortened C or will it play out 100%?

To be noted: Dax is much weaker than the US Inidzes and is already much closer to the last lows.

To be noted: Dax is much weaker than the US Inidzes and is already much closer to the last lows.

11. However, as long as it does not fall below the last low, I still think it is possible that the 14,500 zone will be reached.

• • •

Missing some Tweet in this thread? You can try to

force a refresh