How to Avoid Big Losses In trading ?

1. Avoid Stocks Below 200 ema

2. Sell Stocks in Stage 4 Down Trend

3. Dont Trade Stocks that are moving in Circuits

4. Avoid News based Trading

A thread With examples🔖

Retweet to Educate Your Trading Friends !

1. Avoid Stocks Below 200 ema

2. Sell Stocks in Stage 4 Down Trend

3. Dont Trade Stocks that are moving in Circuits

4. Avoid News based Trading

A thread With examples🔖

Retweet to Educate Your Trading Friends !

A Study Shows that 90% of the winning Stocks stay above 200 ema before a big Advancing Phase

1. Simply Not Holding or Buying Stocks below 200 ema Saves a lot of time and Money.

2. You can looses opportunity Cost if you buy stocks below 200 ema.

3. TimeFrame: Daily 200 ema

2/n

1. Simply Not Holding or Buying Stocks below 200 ema Saves a lot of time and Money.

2. You can looses opportunity Cost if you buy stocks below 200 ema.

3. TimeFrame: Daily 200 ema

2/n

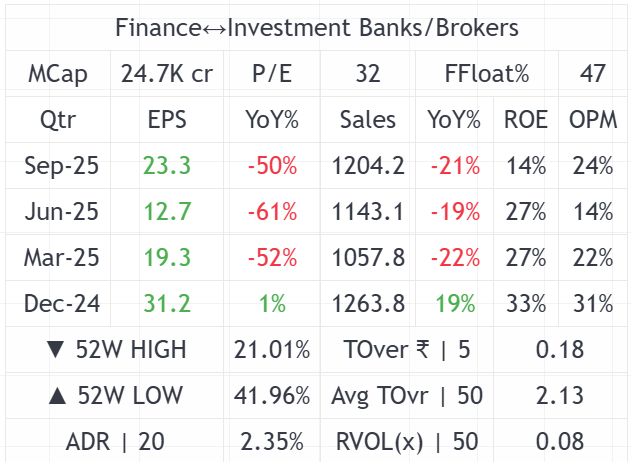

B. Sell Stocks in Stage 4 Down Trend

1. Stocks Exhibiting this are in complete Bear Grip

2. The 30 week ema acts as reference for stage analysis

3. These Stocks can be short sold on pullback to 30wema

4. Happens after Topping Phase

5. TimeFrame : Weekly , 30 Week Ema

3/n

1. Stocks Exhibiting this are in complete Bear Grip

2. The 30 week ema acts as reference for stage analysis

3. These Stocks can be short sold on pullback to 30wema

4. Happens after Topping Phase

5. TimeFrame : Weekly , 30 Week Ema

3/n

C. Dont Trade Stocks that are moving in Circuits

1. Mostly these stocks are Speculatve and Operator Driven.

2. You never know what is the top of the trend and may get Stuck with Huge Losses

Example : TTML , Alok , Ruchi etc

This is Pyramid Structure and news driven also

4/n

1. Mostly these stocks are Speculatve and Operator Driven.

2. You never know what is the top of the trend and may get Stuck with Huge Losses

Example : TTML , Alok , Ruchi etc

This is Pyramid Structure and news driven also

4/n

D. Avoid News based Trading

1. Whenever a postive News comes in Market People Jump in Buying the Stocks without thinking .

2. Most of the the times the news is factored in or gets factored after heavy buying

3. Good News can also be bad

Example : PnbBousing , AdaniPower

5/n

1. Whenever a postive News comes in Market People Jump in Buying the Stocks without thinking .

2. Most of the the times the news is factored in or gets factored after heavy buying

3. Good News can also be bad

Example : PnbBousing , AdaniPower

5/n

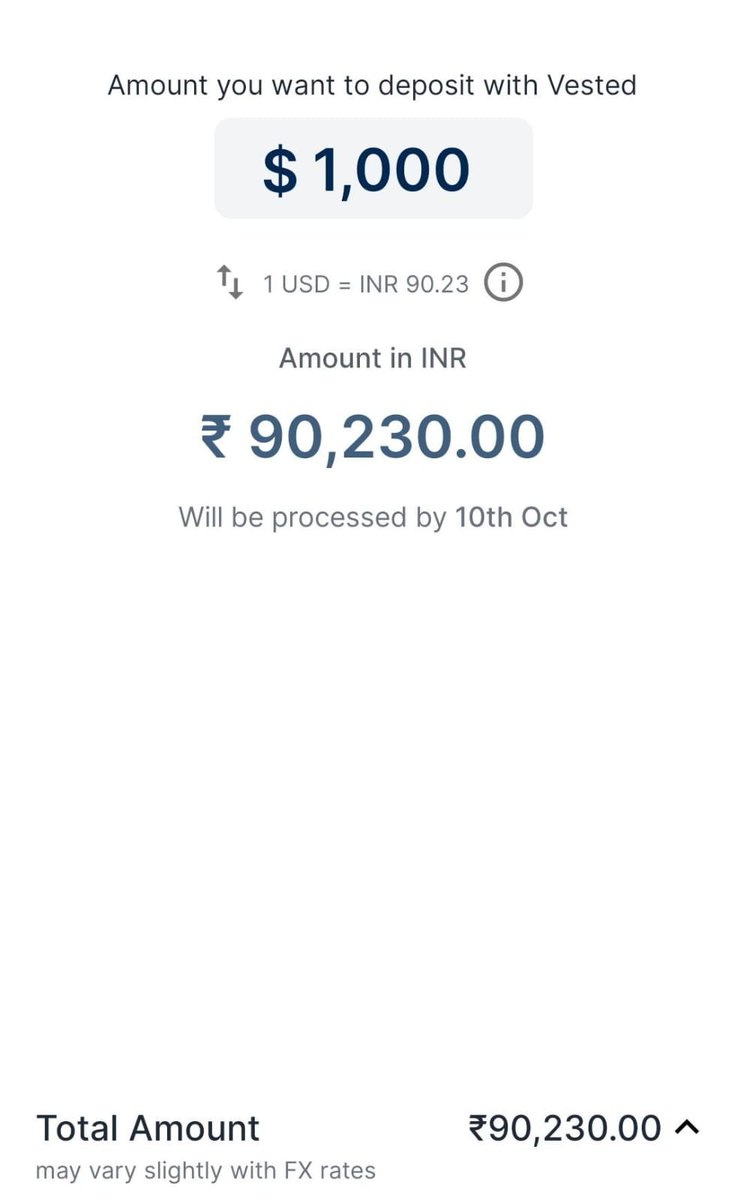

𝗠𝗲𝗻𝘁𝗼𝗿𝘀𝗵𝗶𝗽 𝗣𝗿𝗼𝗴𝗿𝗮𝗺 :

Starting on 4th September on Weekends Only

Total 5 Sessions of 2-3 Hours

𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗟𝗶𝗻𝗸 : rigipay.com/g/0rCnyCyib8

Use code "𝗦𝗘𝗣𝗧𝟭𝟬" for 10% Offer valid for 2 days

Starting on 4th September on Weekends Only

Total 5 Sessions of 2-3 Hours

𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗟𝗶𝗻𝗸 : rigipay.com/g/0rCnyCyib8

Use code "𝗦𝗘𝗣𝗧𝟭𝟬" for 10% Offer valid for 2 days

What Mentees have to say :

#Feedback

LINK FOR ENQUIRY:

wa.link/si4jn4

𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗟𝗶𝗻𝗸 : rigipay.com/g/0rCnyCyib8

Use code "𝗦𝗘𝗣𝗧𝟭𝟬" for 10% Offer valid for 2 days

#Feedback

LINK FOR ENQUIRY:

wa.link/si4jn4

𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗟𝗶𝗻𝗸 : rigipay.com/g/0rCnyCyib8

Use code "𝗦𝗘𝗣𝗧𝟭𝟬" for 10% Offer valid for 2 days

Telegram Link : t.me/Techno_charts

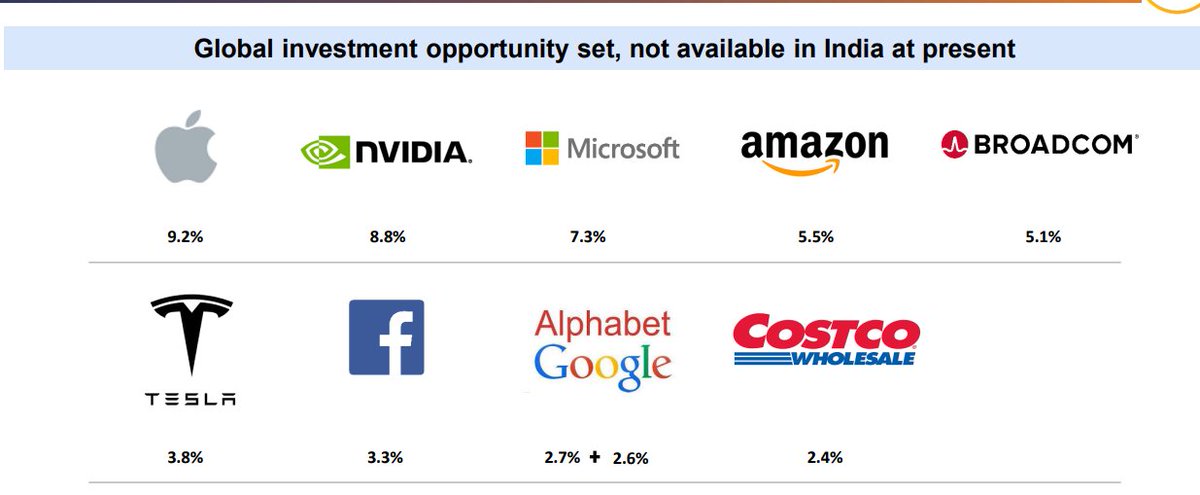

Follow 𝗠𝘆 𝗜𝗣𝗢 𝗠𝗢𝗠𝗘𝗡𝗧𝗨𝗠 𝗣𝗢𝗥𝗧𝗙𝗢𝗟𝗜𝗢 which has given 15% in a month

Join me now trin.kr/TechnoCharts

END

Follow 𝗠𝘆 𝗜𝗣𝗢 𝗠𝗢𝗠𝗘𝗡𝗧𝗨𝗠 𝗣𝗢𝗥𝗧𝗙𝗢𝗟𝗜𝗢 which has given 15% in a month

Join me now trin.kr/TechnoCharts

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh